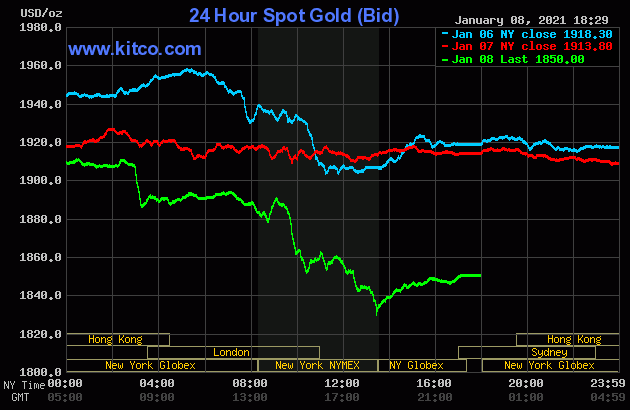

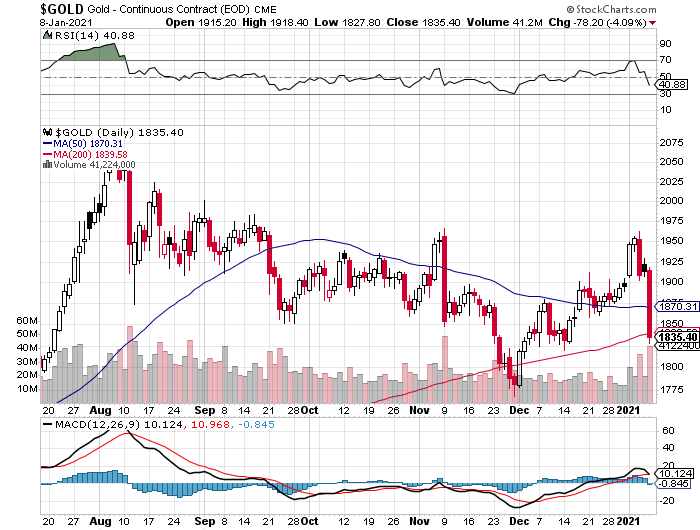

The gold price drifted quietly lower until shortly before 1 p.m. China Standard Time on their Friday morning -- and then traded sideways until the London open. The bids got pulled -- and gold was back below $1,900 spot and down twenty bucks in a very few minutes. From that juncture it crept a bit higher until the noon GMT silver fix -- and then was sold lower anew. The Big 8 shorts appeared in force once again at the 9:30 a.m. low tick in the dollar index -- and the equity market opens in New York. Gold's low tick was set a minute or so before the 1:30 p.m. COMEX close -- and from that point it drifted quietly higher until around 3:45 p.m. in after-hours trading. I didn't do much after that.

The high and low ticks in gold were recorded by the CME Group as $1,918.40 and $1,827.80 in the February contract. The February/April price spread differential in gold at the close yesterday was a mere $1.90...April/June was $3.00 -- and June/August was $2.70. These numbers certainly encouraged traders to roll out of February and into future months, which they did in droves yesterday.

Gold was closed in New York on Friday afternoon at $1,850.00...down $63.80 from Thursday -- and about 22 bucks off its Kitco-recorded low tick of the day. Net volume was enormous for sure, but not quite as enormous as one might expect on such price action, at a bit under 369,500 contracts -- and there was a huge 85,000 contracts worth of roll-over/switch volume out of February and into future months...mostly April and June. I'll have more on this in The Wrap.

|

|

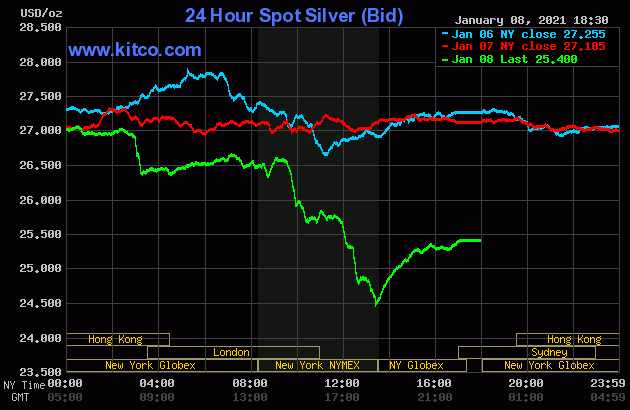

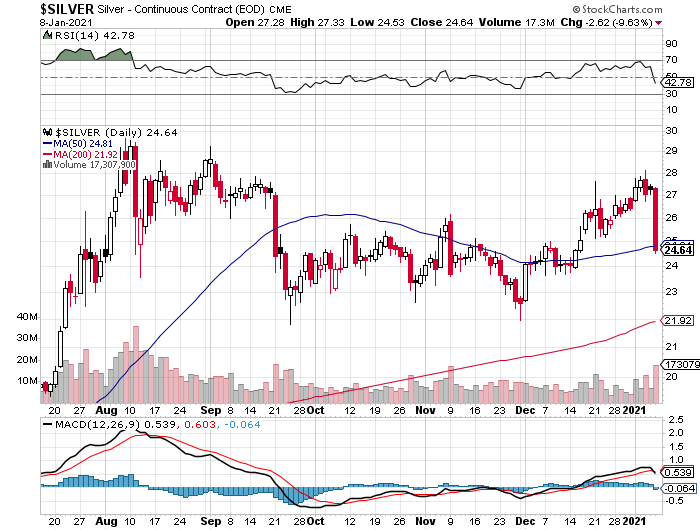

The Big 8 shorts handled the silver price in an identical manner as they did in gold, including all the major price inflection points, so I'll spare you the gory play-by-play in this precious metal.

The high and low ticks were reported as $27.335 and $24.53 in the March contract...an intraday move of $2.805 cents. The March/May price spread differential in silver at the close yesterday was only 6.2 cents...May/July was 7.4 cents -- and July/September was 7.2 cents.

Silver was closed on Friday afternoon in New York at $25.40 spot, down $1.705 on the day -- and about a dollar off its Kitco-recorded low tick. Net volume was ginormous at a bit under 181,000 contracts -- and there was a hair over 8,000 contracts worth of roll-over/switch volume in this precious metal...mostly into May and July.

|

|

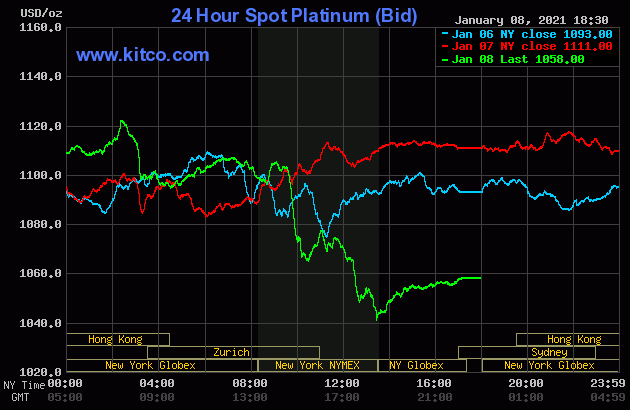

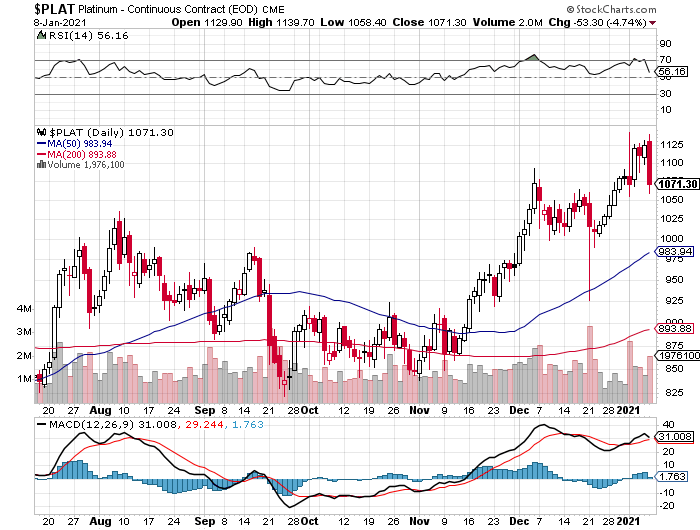

The platinum price was engineered lower in a similar fashion as both silver and gold -- and the major price inflection points were the same as well. It was closed at $1,058 spot, down 53 bucks on the day -- and 17 dollars off its Kitco-recorded low tick.

|

|

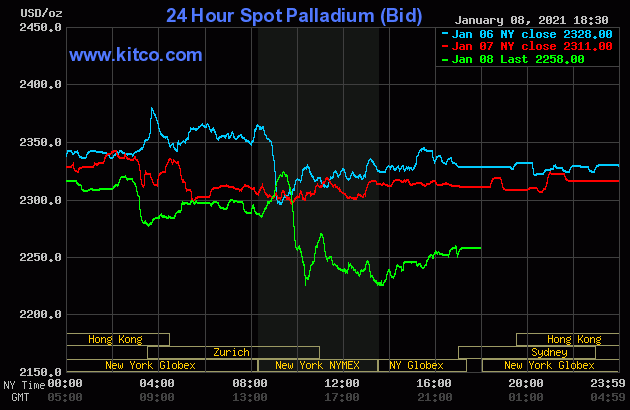

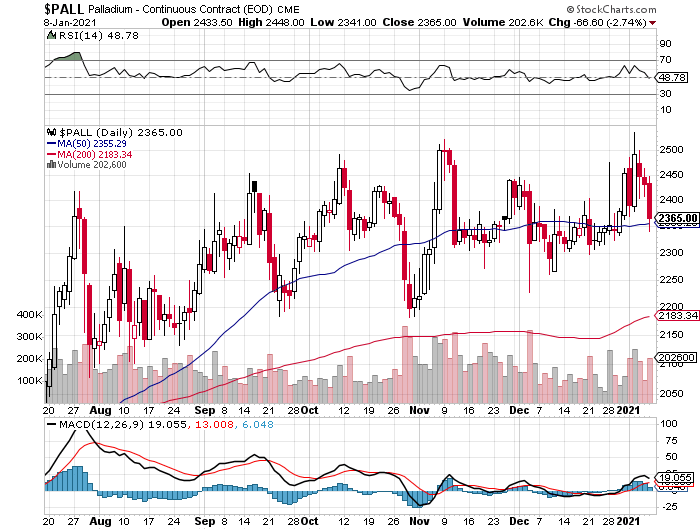

The price action in palladium was a bit of a variation on what happened in the other three precious metals, but at the end of the day the results were the same, as the Big 8 shorts et al. closed it down 53 dollars on the day as well, at $2,258 spot.

|

|

Total palladium volume was only 2,340 COMEX contracts...2,331 of them in March, the current front month -- and the other 9 contracts were in June.

Based on the spot closes provided by kitco.com posted above, the gold/silver ratio closed at 72.8 to 1 on Friday, compared to 70.6 to 1 on Thursday.

Here's Nick Laird's 1-year Gold/Silver Ratio chart, updated with all of the previous week's data. Click to enlarge.

|

|

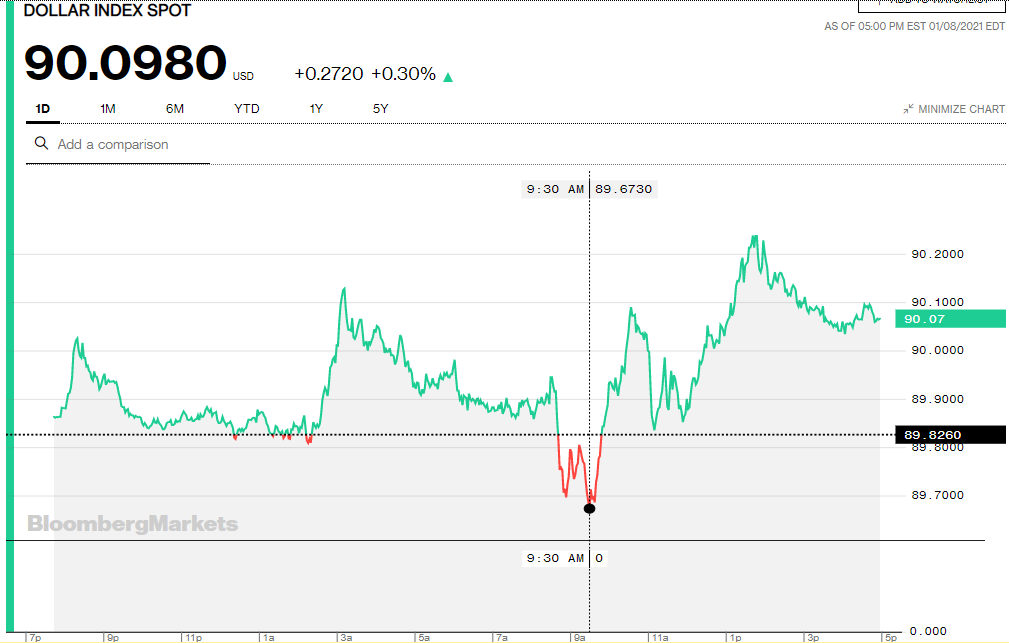

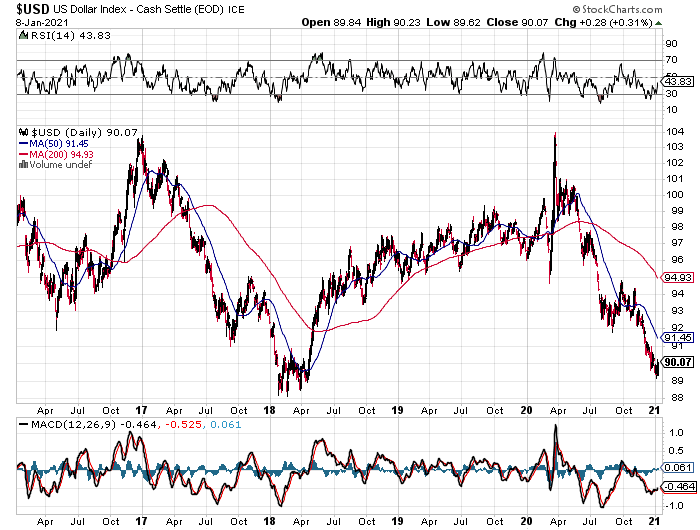

The dollar index finished the Friday trading session in New York at 90.098...up 27 basis points from its close on Thursday.

Here's the DXY chart for Friday, courtesy of Bloomberg as always. Click to enlarge.

|

|

|

|

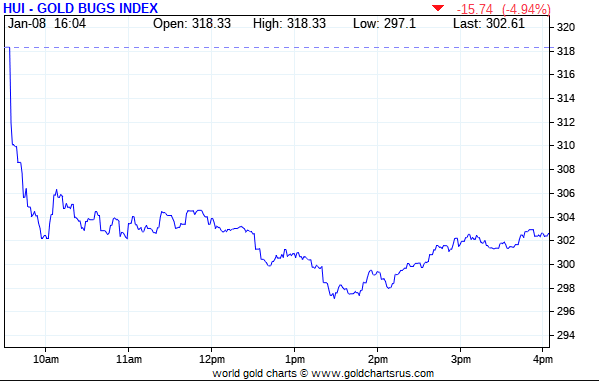

The gold shares got smoked yesterday. But, having said that, they recovered off their 1:30 p.m. lows rather nicely -- and the HUI closed down 'only' 4.94 percent. It could have been far worse.

|

|

And it was worse in silver, but that should come as no surprises as the 'long knives' were really out for that precious metal on Friday. There was no recovery for them at silver's low tick of the day...the 1:30 p.m. COMEX close...as Nick Laird's Intraday Silver Sentiment/Silver 7 Index closed lower by an eye-watering 8.08 percent. Click to enlarge if necessary.

|

|

Computed manually, the above index closed down 7.97 percent.

And here's Nick's 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday's candle -- and it's an ugly one. Click to enlarge as well.

|

|

They were all dogs yesterday, but the two biggest pooches were Coeur and Hecla Mining, down 12.82 and 10.98 percent respectively. The puppy with the fewest fleas was Wheaton Precious Metals, as it closed lower by 'only' 4.41 percent.

But in spite of the carnage, one must keep in mind that there was a buyer for every share sold in a panic yesterday -- and it's a safe bet that most of the stocks sold yesterday were being held on margin. The new owners are certainly much stronger hands than that.

And in the interests of full disclosure, I was one of those 'strong hands' buyers yesterday, as I picked up a position in a new silver company that I'd never owned shares in before...New Pacific Metals Corp. I was lucky enough to buy it just off its low tick of the day -- and by the close, my position was already in the green by a few hundred dollars. I certainly won't be selling them any time soon.

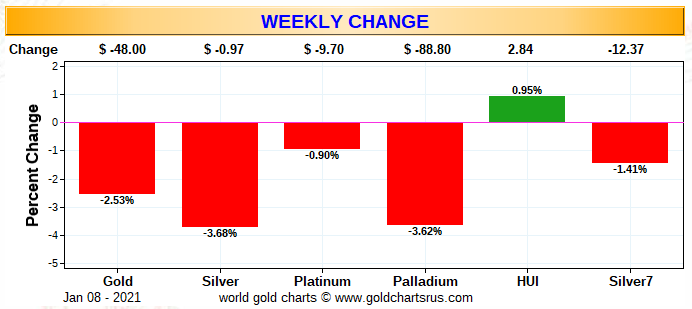

Here is one of the usual three charts that shows up in every Saturday missive. It shows the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York - along with the changes in the HUI and the Silver 7 Index.

Since the month and year are so young, only 5 business days old, I'm only posting the weekly chart...as the month-to-date and year-to-date charts obviously show the same data.

Here's the weekly chart -- and as ugly as it was in the precious metals this week, their associated equities held up rather well, with the gold stocks actually closing up on the week. So take heart, dear reader! Click to enlarge.

|

|

And as Ted Butler has pointed out on many occasions, the Big 8 short positions are the sole reason that prices aren't at the moon already, as just about every other group of traders in the COMEX futures market is net long against them in all four precious metals.

Of course they've been hard at work since the Tuesday cut-off, but using the past as prologue as I always do, I doubt they've been able to accomplish much, despite their huffing and puffing. Of course that won't be know for sure until next Friday's COT Report.

The CME Daily Delivery Report showed that 351 gold and zero silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, there were three short/issuers in total -- and the only one that really mattered was Morgan Stanley, as they issued 322 contracts out of their house account. They were followed by Dutch bank ABN Amro, with 25 contracts out of their client account. The biggest long/stopper was JPMorgan, picking up 116 contracts in total...83 for their own account, plus another 33 for their clients. In second place was Standard Chartered, as they stopped 56 contracts for their own account. Morgan Stanley came in third, with 53 contracts for their client account.

In platinum, there were another 23 contracts issued and stopped.

The link to yesterday's Issuers and Stoppers Report is here.

So far in January there have been 1,452 gold contracts issued/reissued and stopped -- and that number in silver is 611 contracts. In platinum there have been 1,701 COMEX contracts issued/reissued and stopped as well.

The CME Preliminary Report for the Friday trading session showed that gold open interest in January fell by 17 contracts, leaving 474 still around, minus the 351 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 41 gold contracts are actually posted for delivery on Monday, so that means that 41-17=24 more gold contracts just got added to January deliveries. Silver o.i. in January rose by 1 contract, leaving 370 still open -- and zero silver contracts were posted for delivery on Monday...so obviously 1 silver contract was added to January.

Total gold open interest at the close yesterday fell by 12,339 COMEX contracts -- and total silver o.i. at the close on Friday dropped by only 6,299 contracts. I suspect that Ted will have something to say about these numbers in his weekly review to his paying subscribers later this afternoon.

I must admit that I was somewhat surprised to see that their were no reported changes in either GLD or SLV on Friday. But I suspect that we'll certainly see some on Monday.

I should point out that trading volume in GLD yesterday was very heavy at around 24 million shares...about 2.5 time normal. But in SLV, the volume was over the moon at about 107 million shares, about five times the average volume. That will certainly have an effect on their respective inventory levels at some point. But the short report changes on this won't be published until January 27.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD & SLV inventories, there was a net 194,245 troy ounces of gold added -- and a net 433,711 troy ounces of silver was added as well.

There was another sales report from the U.S. Mint, the second of the New Year. They reported selling another 15,000 troy ounces of gold eagles -- 5,500 one-ounce 24K gold buffaloes -- and 100,000 silver eagles.

Month/year-to-date the mint has sold 63,500 troy ounces of gold eagles -- 20,500 one-ounce 24K gold buffaloes -- and 2,800,000 silver eagles.

There was a bit of activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday, with all of it occurring at Manfra, Tordella & Brookes, Inc. They reported receiving 16,075.500 troy ounces/500 kilobars [SGE kilobar weight] -- and shipped out 803.775 troy ounces/25 kilobars [SGE kilobar weight]. The link to that is here.

There was more activity in silver, as 449,182 troy ounces was received -- and 422,821 troy ounces was shipped out. The largest 'in' amount was 296,709 troy ounces that arrived at Manfra, Tordella & Brookes, Inc. -- and the remaining 152,473 troy ounces ended up at Brink's, Inc. There were five depositories involved in the 'out' activity -- and the two biggest were Canada's Scotiabank, as they shipped out 262,195 troy ounces -- and they were followed by the 101,450 troy ounces that departed Brink's, Inc. There was some paper activity as well, but they were inventory adjustments, not transfers. The link to all this, plus a bit more, is here.

There was a bit of activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. There were 234 kilobars received at Loomis International -- and 51 kilobars were shipped out of Brink's, Inc. The link to that, in troy ounces, is here.

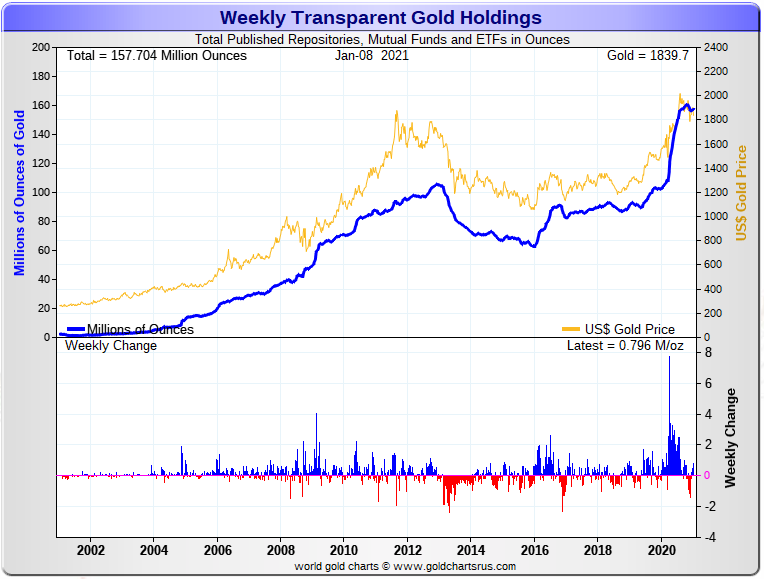

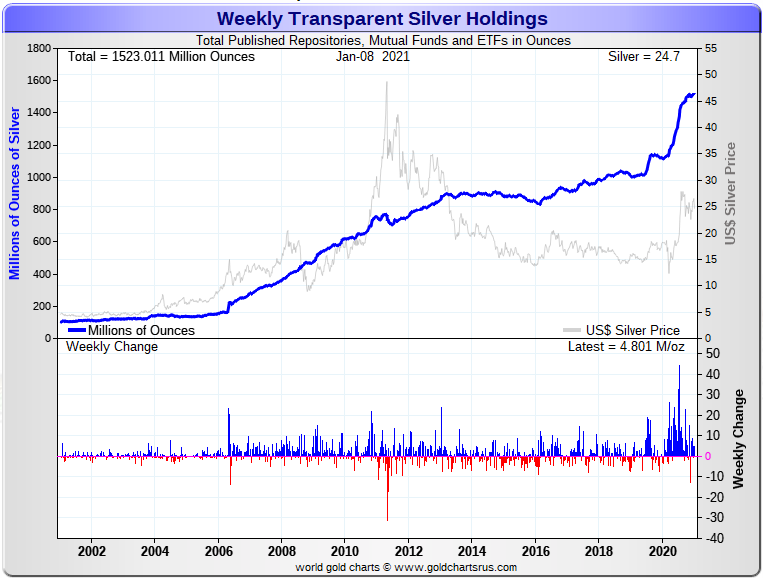

Here are the usual two 20-year charts from Nick Laird that appear in this spot in every Saturday column. They show the total amount of gold and silver held in all known depositories, ETFs and mutual funds as of the close of trading on Friday.

For the week that was, there was a net 796,000 troy ounces of gold added -- and a net 4,801,000 troy ounces of silver was added as well...most of which went into SLV once again. Click to enlarge for both.

|

|

|

|

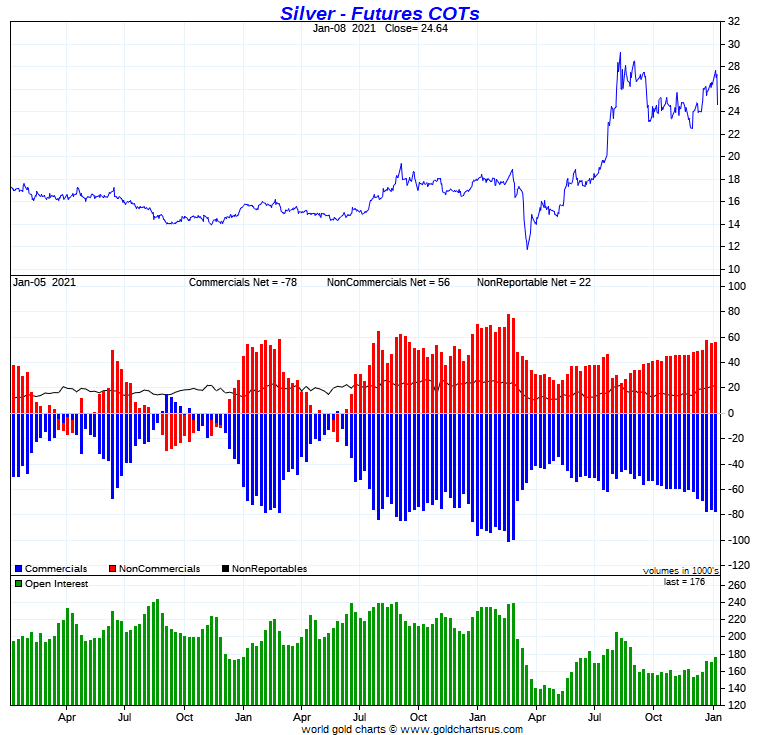

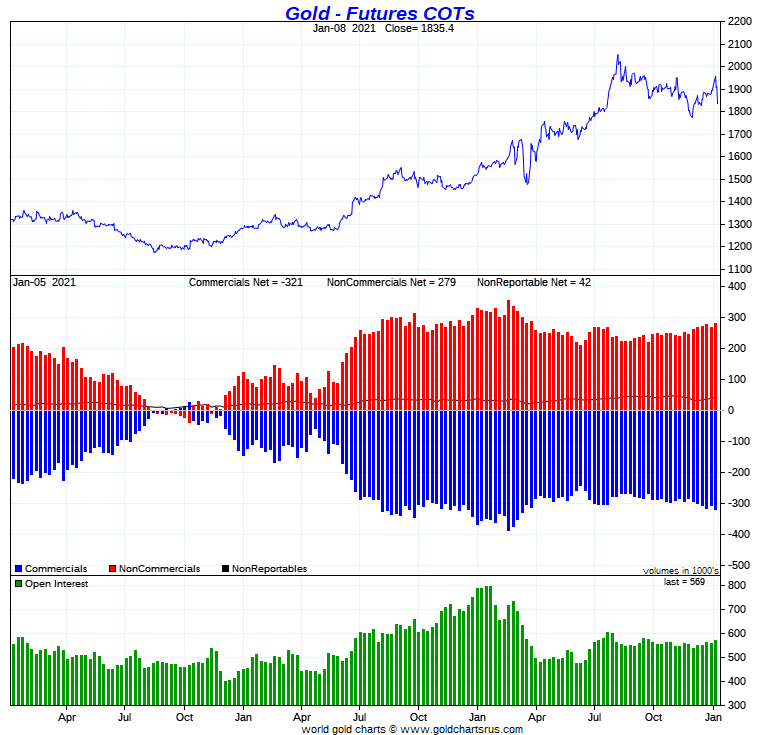

The Commitment of Traders Report for positions held a the close of COMEX trading on Tuesday is already ancient history -- and not worth the paper its printed on, but I'm going to go through the motions anyway, as I'll need the numbers to compare to the massive improvements we're going to see in next Friday's Report.

There was a smallish increase in the Commercial net short position in silver -- and a fairly hefty increase in the commercial net short position in gold.

In silver, the Commercial net short position rose by only 1,688 contracts, or 8.4 million troy ounces.

They arrived at that number by increasing their long position by 581 contracts, but also increased their short position by 2,269 contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, the Managed Money traders didn't do anything, as their net long position only decreased by a piddling 116 contracts. But the other two categories, the Other Reportables and Nonreportable/small traders increased their net long positions...the former by 888 contracts -- and the latter by 916 contracts.

Doing the math: 916 plus 888 minus 116 equals 1,688 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver now stands at 387.6 million troy ounces...up from the 379.1 million troy ounces they were short in Monday's COT Report.

In yesterday's COT Report the Big 8 were short 403.9 million troy ounces -- and in Monday's COT Report they were short 404.7 million troy ounces...so they reduced their short position by an insignificant amount during the reporting week.

And as of the cut-off on Tuesday, the Big 8 were short 104 percent of the Commercial net short position.

Looking at the Producer/Merchant category in yesterday's report, Ted didn't think that JPMorgan did anything during the reporting week -- and were still short 1-2,000 COMEX contracts in silver. I'm sure that has been covered by now -- and they may be net long.

Here's Nick's 3-year COT chart for silver, updated with yesterday's data -- and there's not a lot to see. Click to enlarge.

|

|

However, they certainly decreased their current mark-to-market margin losses...but that's not the same as reducing their short position.

In gold, the commercial net short position rose by a rather chunky 13,669 COMEX contracts, or 1.37 million troy ounces.

They arrived at that number by reducing their long position by 3,878 contracts -- and increased their short position by 9,791 contracts. It's the sum of those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, all three categories were buyers during the reporting week. The Managed Money traders increased their net long position by 7,574 contracts...the Other Reportables by 2,872 contracts -- and the Nonreportable/small traders by 3,223 contracts.

Doing the math here: 7,574 plus 2,872 plus 3,223 equals 13,669 COMEX contracts, the change in the commercial net short position.

The commercial net short position in gold as of the close of COMEX trading on Tuesday stood at 32.09 million troy ounces, up from the 30.73 million troy ounces in Monday's COT Report.

The Big 8 are short 27.99 million troy ounces of gold, which is up a fair amount from 27.15 million troy ounces that they were short in Monday's COT Report. As of the Tuesday cut-off they were short 87 percent of the commercial net short position.

It was Ted's opinion that JPMorgan didn't do anything in gold during the reporting week just past -- and remain market neutral from a COMEX futures market perspective.

Here's the 3-year COT chart for gold from Nick, updated with Friday's data -- and the increase should be noted. Click to enlarge.

|

|

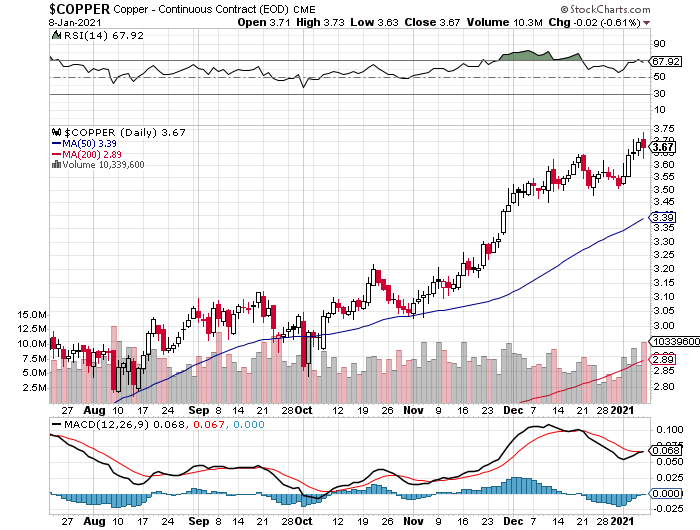

In the other metals, the Managed Money traders in palladium increased their net long position by a very hefty 797 COMEX contracts during the last reporting week -- and are now net long the palladium market by 4,079 COMEX contracts...around 42 percent of the total open interest...up around 6 percentage points from last week. The COMEX futures market in palladium continues to be a market in name only. In platinum, the Managed Money traders increased their net long position by another 2,433 contracts during the reporting week -- and they are now net long the platinum market by 20,637 COMEX contracts...about 34 percent of total open interest -- and up about 3 percentage points from last week. In copper, the Managed Money traders decreased their net long position by a further 1,349 contracts -- and are net long copper to the tune of 80,508 COMEX contracts...about 2.01 billion pounds of the stuff -- and about 31 percent of total open interest...down about 2 percentage points from last week.

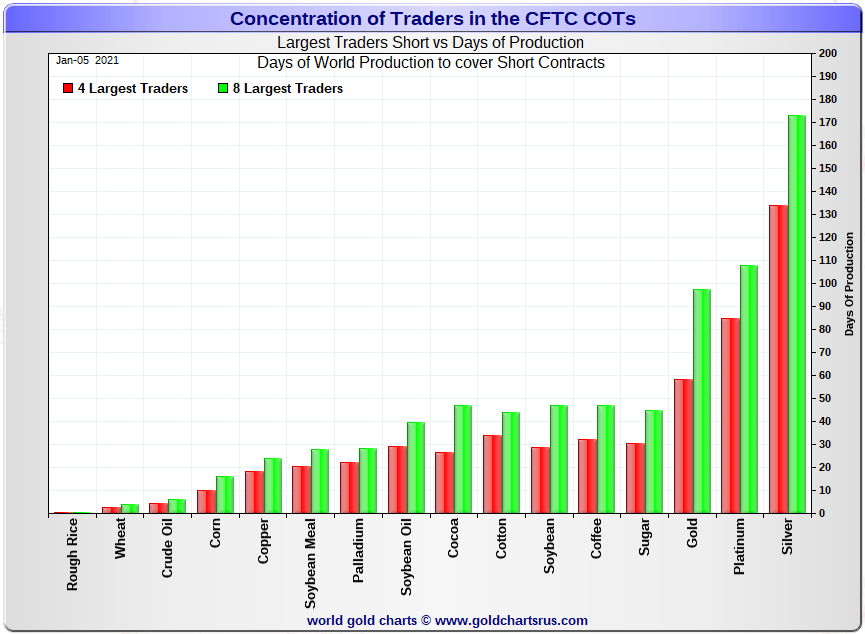

Here's Nick Laird's "Days to Cover" chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, January 5. It shows the days of world production that it would take to cover the short positions of the Big 4 - and Big '5 through 8' traders in each physically traded commodity on the COMEX. Click to enlarge.

|

|

In the COT Report above, the Commercial net short position in silver was reported by the CME Group at about 387 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 8 traders is around 403 million troy ounces. So the short position of the Big 8 traders is larger than the total Commercial net short position by about 403-387=16 million troy ounces...down 8 million troy ounces from the 24 million troy ounces in the prior week's report.

The reason for the difference in those numbers...as it always is...is that Ted's raptors, the 28-odd small commercial traders other than the Big 8, are net long that amount. But not by much for the third week in a row -- and as Ted mentioned on the phone yesterday, they're holding their smallest net long position in ages. He was also of the opinion that they were most likely aggressively adding to their long positions since the Tuesday cut-off.

Another way of stating this [as I say every week in this spot] is that if you remove the Big 8 commercial traders from that category, the remaining traders in the commercial category are net long the COMEX silver market. It's the Big 8 against everyone else...a situation that has existed for over four decades in both silver and gold -- and in platinum and palladium as well.

As per the first paragraph above, the Big 4 traders in silver are short around 134 days of world silver production in total. That's around 33.5 days of world silver production each, on average...unchanged from the December 29 COT Report. The four big traders in the '5 through 8' category are short 39 days of world silver production in total, which is a bit under 10 days of world silver production each, on average...also unchanged from the prior week's report.

The Big 8 commercial traders are short 45.9 percent of the entire open interest in silver in the COMEX futures market, which is down a bit from 47.6 percent they were short in last week's COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would be a bit under the 55 percent mark. In gold, it's 49.2 percent of the total COMEX open interest that the Big 8 are short, which is up a tiny amount from the 48.8 percent they were short in the prior week's COT Report -- and a bit over 55 percent once the market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 58 days of world gold production, unchanged from Monday's COT Report. The '5 through 8' are short another 39 days of world production, up 3 days from last week's report...for a total of 97 days of world gold production held short by the Big 8...obviously up 3 days from Monday's COT Report. Based on these numbers, the Big 4 in gold hold about 60 percent of the total short position held by the Big 8...down about 2 percentage points from last week's report.

According to Ted, JPMorgan didn't do anything in silver during the past reporting week...still net short about 1-2,000 COMEX contracts. And in gold they remained at market neutral.

One would suspect that these numbers will certainly be different in next week's COT Report.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 77, 79 and 79 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is unchanged from last week's COT Report...platinum is also unchanged from a week ago -- and palladium is down about two percentage points week-over-week.

As you already know, but I keep repeating nonetheless, the Big 8 shorts are still hugely exposed in all four precious metal in the COMEX futures market -- and that's despite their engineered price declines since the Tuesday cut-off. They did decrease their short positions in silver by a tiny bit -- and increased their short position in gold during this reporting week -- and I will be very surprised if they were able to improve these positions by much in next week's COT Report.

This current situation regarding the Big 8 shorts is still beyond obscene and grotesque -- and as Ted correctly points out, its resolution will be the sole determinant of precious metal prices going forward.

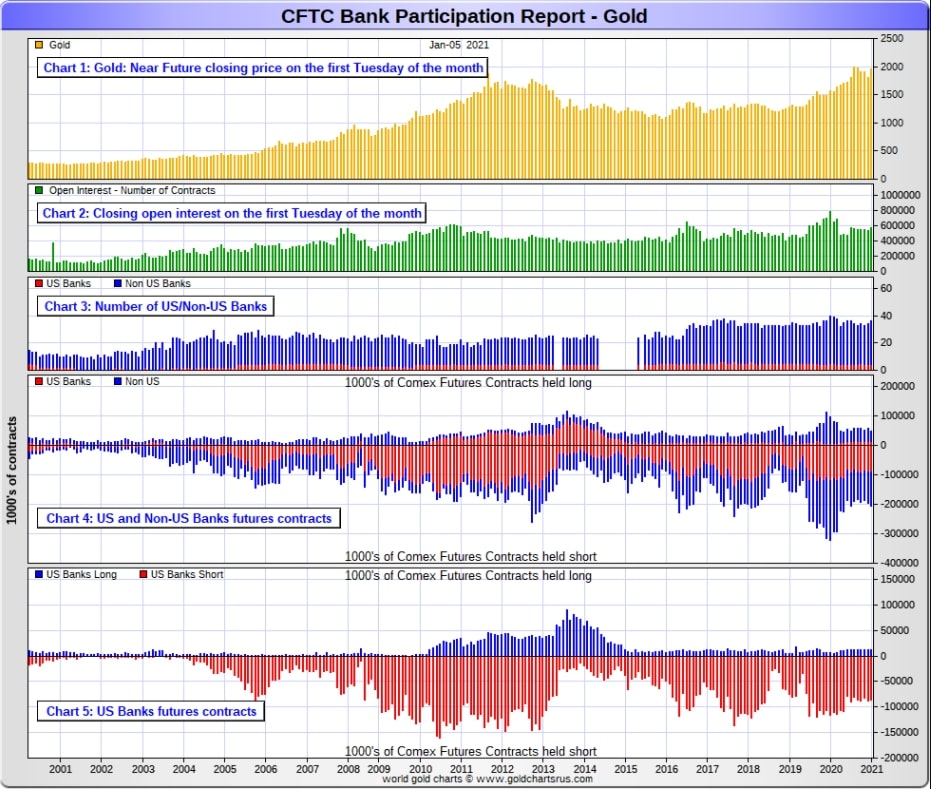

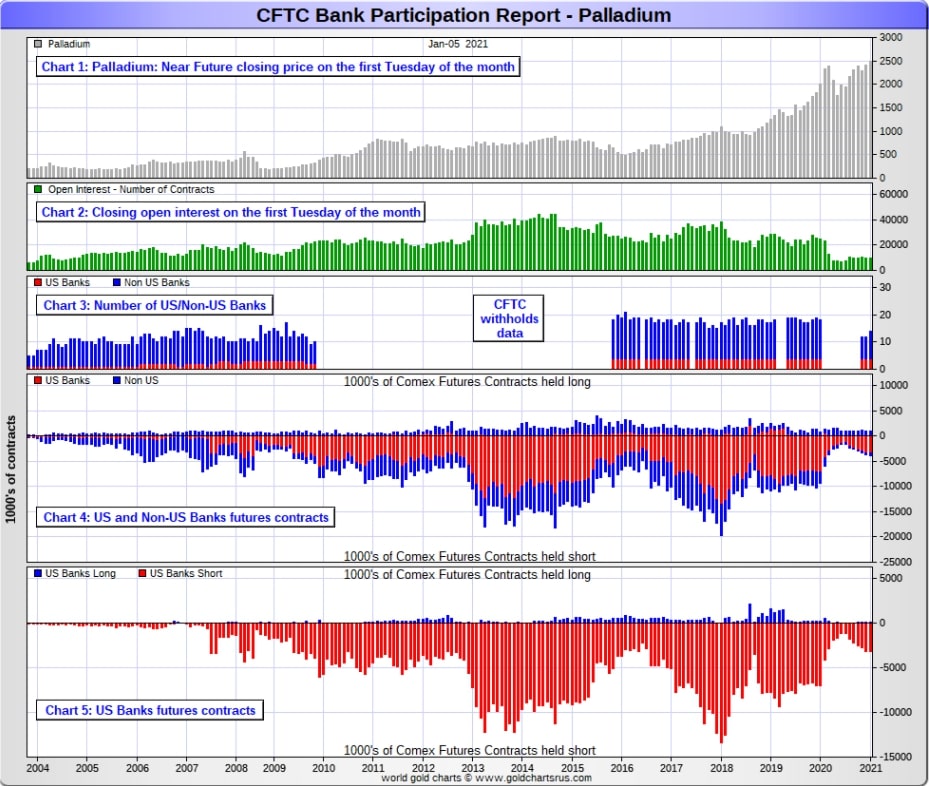

The January Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday's cut-off in all COMEX-traded products. For this one day a month we get to see what the world's banks are up to in the precious metals -and they're usually up to quite a bit.

[The January Bank Participation Report covers the time period from December 1 to January 5 inclusive.]

In gold, 4 U.S. banks are net short 75,790 COMEX contracts in the January BPR. In December's Bank Participation Report [BPR] these same banks were net short 76,215 contracts, so there was a tiny decrease of 425 COMEX contracts from four weeks ago, which is an immaterial change.

Citigroup, HSBC USA, Goldman Sachs and possibly Morgan Stanley would most likely be the U.S. banks that are short this amount of gold...however, one should presume that it's their clients that are short. I'm also starting to harbour some suspicions about the Exchange Stabilization Fund as well, although they may be just backstopping the shorts -- and not actually short in the COMEX futures market themselves.

Also in gold, 32 non-U.S. banks are net short 81,732 COMEX gold contracts. In December's BPR, 30 non-U.S. banks were net short 61,943 COMEX contracts...so the month-over-month change shows a huge increase of 19,789 COMEX contracts...so they did all the shorting last month.

At the low back in the August 2018 BPR...these non-U.S. banks held a net short position in gold of only 1,960 contacts -- and they've been back on the short side in a big way ever since.

I suspect that there's at least two large non-U.S. bank in this group, one of which would be Scotiabank/Scotia Capital...plus HSBC most likely. And I have my suspicions about Barclays, Dutch Bank ABN Amro, plus Australia's Macquarie as well. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are mostly immaterial and, like in silver, always have been so.

As of this Bank Participation Report, 36 banks [both U.S. and foreign] are net short 27.7 percent of the entire open interest in gold in the COMEX futures market, which is up a bit from the 25.7 percent 34 banks were short in the December BPR.

Here's Nick's BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank's COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

|

|

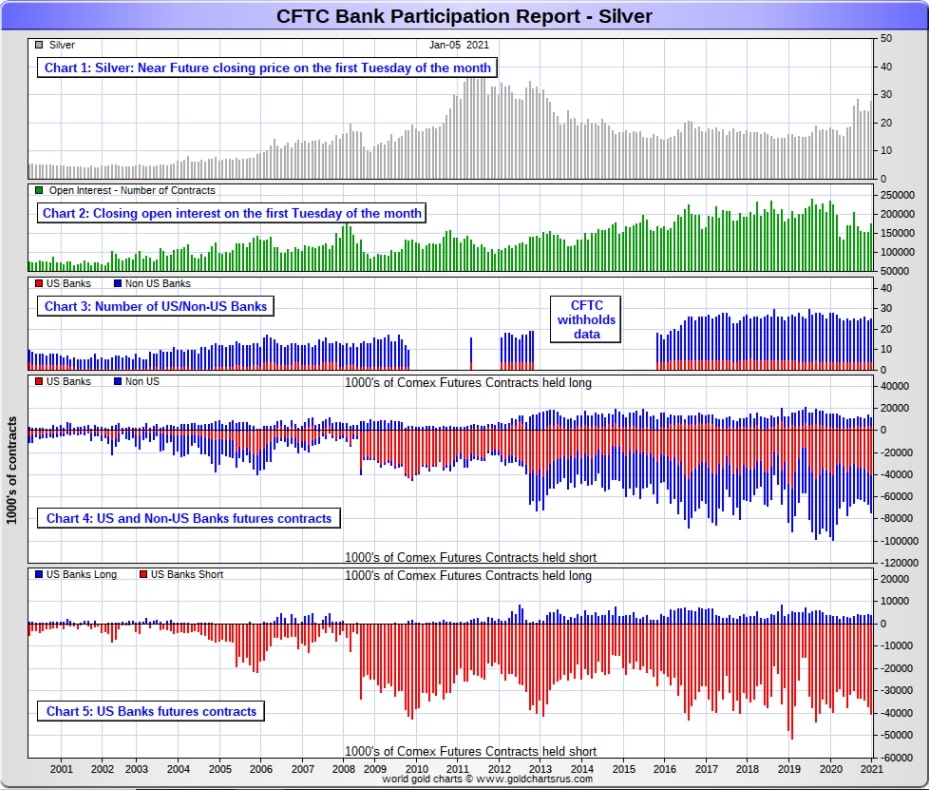

In silver, 4 U.S. banks are net short 36,515 COMEX contracts in January's BPR. In December's BPR, the net short position of these same 4 U.S. banks was 32,785 contracts, so the short position of the U.S. banks has increased by 3,730 contracts month-over-month.

As in gold, the three biggest short holders in silver of the four U.S. banks in total, would be Citigroup, HSBC USA -- and Goldman or maybe Morgan Stanley in No. 3 and 4 spots. And, like in gold, I'm starting to have my suspicions about the Exchange Stabilization Fund's role in all this.

Also in silver, 21 non-U.S. banks are net short 27,008 COMEX contracts in the January BPR...which is up 7,205 contracts from the 19,803 contracts that 20 non-U.S. banks were short in the December BPR. I would suspect that Canada's Scotiabank/Scotia Capital holds a goodly chunk of the short position of these non-U.S. banks. I also suspect that a number of the remaining 20 non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren't, the remaining short positions divided up between these other 20 non-U.S. banks are immaterial - and have always been so.

As of January's Bank Participation Report, 25 banks [both U.S. and foreign] are net short 36.1 percent of the entire open interest in the COMEX futures market in silver-up a bit from the 34.5 percent that 26 banks were net short in the December BPR. And much, much more than the lion's share of that is held by Citigroup, HSBC USA, Goldman, Scotiabank -- and maybe one other non-U.S. bank...the Big 8 shorts.

Here's the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns-the red bars. It's very noticeable in Chart #4-and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

|

|

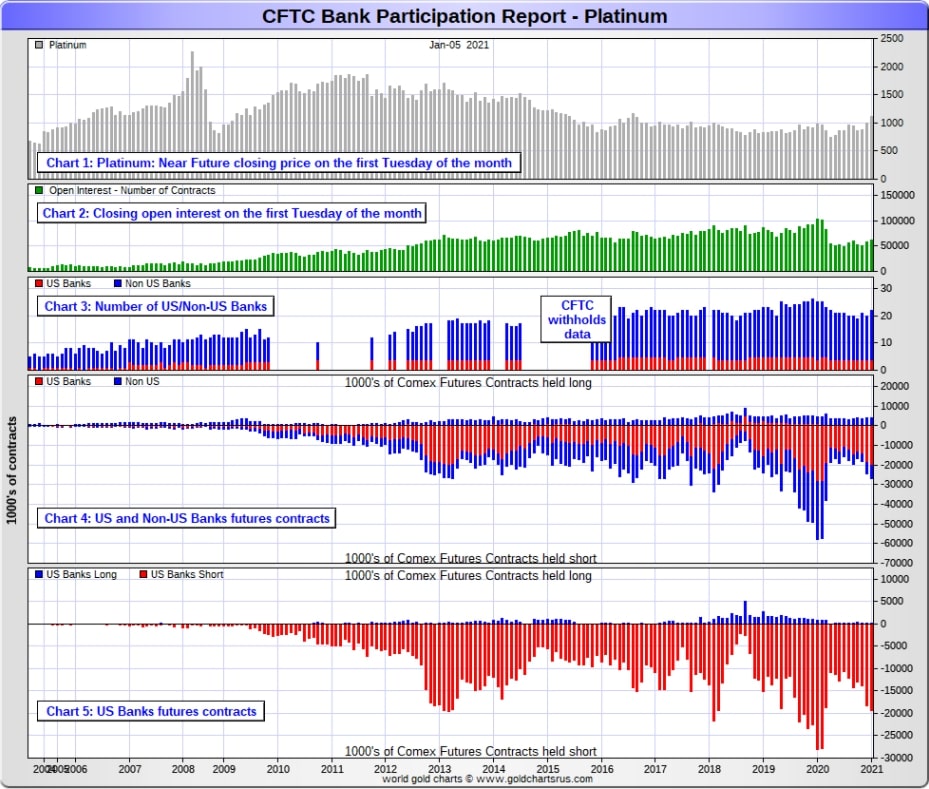

[At the 'low' back in July of 2018, these same U.S. banks were actually net long the platinum market by 2,573 contracts]

Also in platinum, 18 non-U.S. banks are net short 3,475 COMEX contracts in the January BPR, which is up only 706 COMEX contracts from the 2,769 COMEX contracts that 16 non-U.S. banks were net short in the December BPR. These aren't big changes, either.

[Note: Back at the July 2018 low, these same non-U.S. banks were net short 1,192 COMEX contracts.]

And as of January's Bank Participation Report, 22 banks [both U.S. and foreign] are net short 37.1 percent of platinum's total open interest in the COMEX futures market, which is up from the 35.9 percent that 20 banks were net short in December's BPR. But it's the U.S. banks, or most likely their clients, that are on the short hook big time. They have little chance of delivering into their short positions, although a very large number of platinum contracts have already been delivered in during the last four months. But that fact, like in both silver and gold, has made no difference whatsoever to their short positions held. They're still very short in the COMEX futures market in this precious metal as well.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

|

|

Also in palladium, 10 non-U.S. banks are net long 199 COMEX contracts-down a piddling 23 contracts from the 222 COMEX contracts that 8 non-U.S. banks were net long in the December BPR.

And as I've been commenting for almost forever now, the COMEX futures market in palladium is a market in name only, because it so illiquid and thinly-traded. Total open interest at Tuesday's cut-off was only 9,676 contracts.

As of this Bank Participation Report, 14 banks [both U.S. and foreign] are net short 30.5 percent of the entire COMEX open interest in palladium...up a bit from the 28.8 percent of total open interest that 12 banks were net short in December.

And because of the small numbers of contracts involved, along with a tiny open interest, these numbers are pretty much meaningless. So, for the tenth month in a row, the world's banks are no longer involved in the palladium market in a material way -- and if they are, I suspect that it's their clients that are on the hook, not the banks themselves.

Here's the palladium BPR chart. And as I point out every month, you should note that the U.S. banks were almost nowhere to be seen in the COMEX futures market in this precious metal until the middle of 2007-and they became the predominant and controlling factor by the end of Q1 of 2013. They have imploded into insignificance over the last nine Bank Participation Reports, although their short position has been sneaking higher for the last six months. It remains to be seen if they return as big short sellers again at some point like they've done in the past. Click to enlarge.

|

|

The short or long positions in silver and gold that JPMorgan may or may not hold, are immaterial -- and have been since March. It's the remaining Big 8 shorts that are on the hook in everything precious metals-related -- and they've been sticking their respective heads further into the lion's mouth since the price tops of early August...although that has certainly changed somewhat since the cut-off on January 5th.

But as has been the case for over a year now, the short positions held by the Big traders/banks is the only thing that matters -- and how it is ultimately resolved [as I said earlier] will be the sole determinant of precious metal prices going forward.

I don't have all that much in the way of stories, articles or videos for you today.

CRITICAL READS

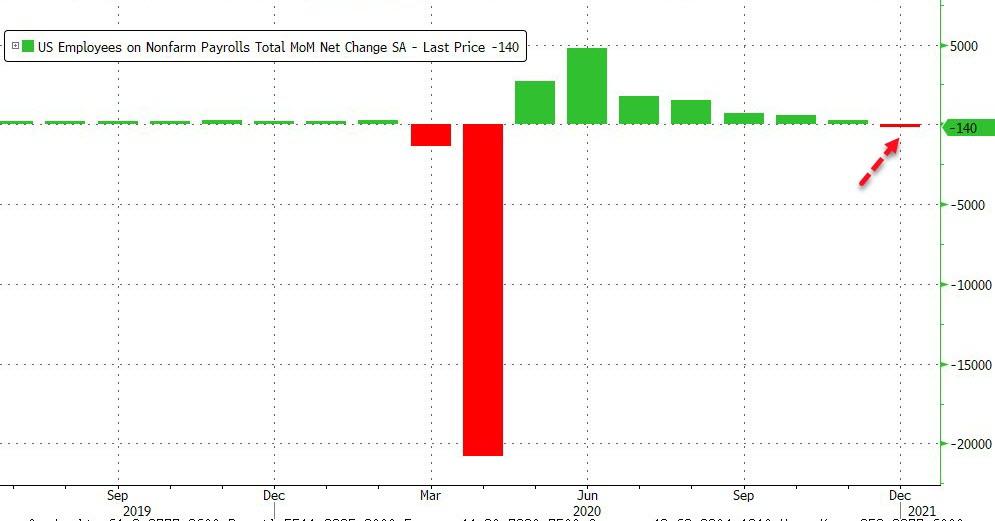

Huge December Payrolls Miss: 140,000 Jobs Lost, Worst Month Since April

As previewed earlier when we said "December Payrolls Preview: Brace For a Very Ugly Number", as a result of the second wave of covid shutdowns economists expected a sharp slowdown in December job growth in the U.S., with more than a quarter of those surveyed - including Goldman - predicting a negative print. Yet as Bloomberg notes, while the data is "almost certain to show an ongoing loss of labor-market momentum -- indeed, it could reveal outright job losses -- one could argue that it's already outdated." After all, a fresh stimulus package was passed towards the end of last month, and there is every chance of a further one in the months to come. Moreover, the prospect of vaccine-related normalization still hovers in the future, even if the current reality of the pandemic looks fairly grim. Finally, with this the last payroll month under the Trump admin, it is hardly a secret that the BLS would look to have a kitchen sink month where the upward "government massaged data" over the past 4 years catches down to reality.

With all that in mind, it was still a surprise just how ugly the December print was, with the BLS reporting that a whopping 140K jobs were lost last month, the first monthly job loss since April's record drop...Click to enlarge.

|

|

Employment declines were concentrated in leisure and hospitality, private education, and government were partially offset by gains in professional and business services, retail trade, construction, and transportation and warehousing. Also due to the harsh weather in December, workers unable to work due to bad weather was 111K.

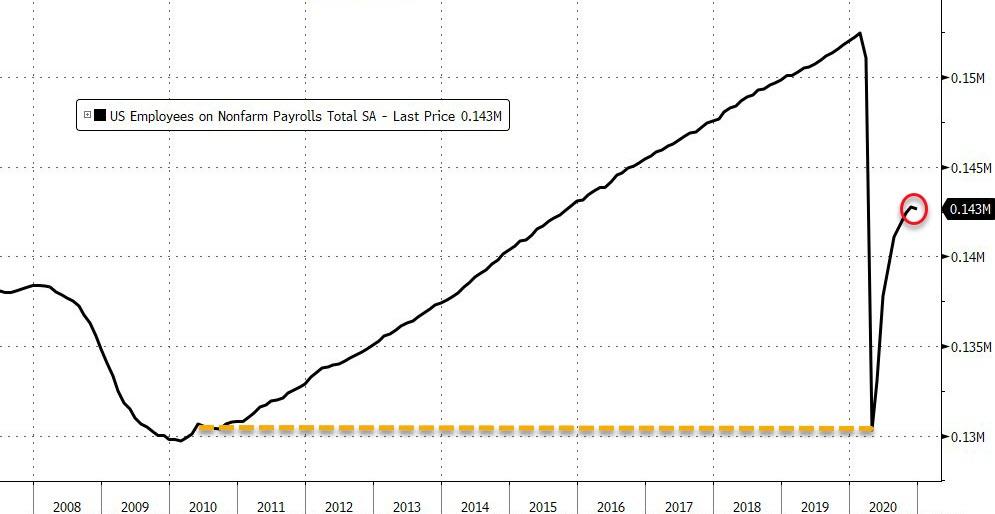

It appears that the post-covid recovery is stalling about halfway on the way up to the pre-covid record highs. Click to enlarge.

|

|

And once again for the cheap seats, in case it is still unclear why this dismal number is ugly: as Bloomberg concludes, "for any economists who haven't yet made a forecast for the size of the Covid-19 relief package that's expected after the Biden administration takes office, this is likely to expand their estimate." So... $3 trillion... or $5 trillion... or $10 trillion... and will Bitcoin be $1 million next?

This longish and chart-filled story was posted on the Zero Hedge website at 8:33 a.m. EST on Friday morning -- and it comes to us courtesy of Brad Robertson. Another link to it is here. There was a follow-up ZH story to this headlined "Who's Hiring and Who's Firing: 372,000 Waiters and Bartenders Lost Their Jobs in December" -- and that comes courtesy of Brad as well.

Biden assembling multi-trillion-dollar stimulus plan with checks, unemployment aid

President-elect Joe Biden said Friday he is assembling a multi-trillion-dollar relief package that would boost stimulus payments for Americans to $2,000, extend unemployment insurance and send billions of dollars in aid to city and state governments, moving swiftly to address the nation's deteriorating economic condition and the rampaging pandemic.

The package will also include billions of dollars to improve vaccine distribution and tens of millions of dollars for schools, as well as rent forbearance and assistance to small businesses, especially those in low-income communities, Biden said at a news conference in Wilmington, Del.

"We need to provide more immediate relief for families and businesses now," Biden said.

"The price tag will be high," he said, adding, "The overwhelming consensus among leading economists left, right and center is that in order to keep the economy from collapsing this year, getting much, much worse, we should be investing significant amounts of money right now."

Biden said he would lay out the package in more detail next week. It would build on some $4 trillion in economic assistance Congress has already devoted to battling the devastating pandemic, including a $900 billion package President Trump signed into law last month.

Why am I not surprised, dear reader. This news item showed up on the washingtonpost.com Internet site at 12:44 p.m. on Friday afternoon EST -- and I found it embedded in a GATA dispatch. Another link to it is here. The Zero Hedge spin on this is headlined ""The Price Will Be High": Biden Calls For "Trillions" In Fiscal Stimulus" -- and that is linked here.

We have become convinced that the allocation of $454 billion under the CARES Act stimulus legislation to cover any losses incurred in the Fed's emergency bailout programs was a dog and pony show created by U.S. Treasury Secretary Steve Mnuchin (who has testified to Congress that he helped write the legislation) in order to provide Mnuchin with a slush fund to trade in markets.

Our suspicions are heightened by the fact that the Fed ran very similar emergency bailout programs from 2007 to 2010 and did not require any funds from the Treasury to backstop losses. The Fed simply relied on collateral from the Wall Street firms borrowing from the Fed. If those firms don't have the collateral today, then they're likely insolvent and not legally allowed to borrow from the Fed.

We have carefully reviewed the CARES Act. There is not one word in the legislation that directs Mnuchin to place that $454 billion into the Exchange Stabilization Fund (ESF). But that's where Mnuchin placed that money. We know this because the ESF's financial statement says Mnuchin placed not only the $454 billion into the ESF but he also initially placed the additional $46 billion that he was allocated under the CARES Act to help airlines and businesses important to national security (for a total of $500 billion).

Mnuchin has successfully gotten mainstream media to report that the bulk of the $454 billion went to the Fed for its emergency lending facilities but went mostly unused. In reality, the Fed only received $114 billion from Mnuchin.

This rather brief commentary from Pam and Russ Martens put in an appearance on the wallstreetonparade.com Internet site on Friday sometime -- and I thank Brad Robertson for sending that along as well. Another link to it is here.

Biden Will Face New Depression -- Jim Rickards

Economic growth or decline is the result of factors that are larger than any one administration or any one set of policies. Of course, specific policies such as tax changes or regulatory initiatives can help or hurt the economy depending on how they are designed, but they will generally not change the macro-momentum.

A tax increase may be a headwind for growth, but it will not stop a strong economy in its tracks. Likewise, a tax cut or extended unemployment benefits may be a boost for a weak economy, but they will not end a recession single-handedly.

Growth and recession are driven by larger events such as demographics, globalization, war, inflation, deflation and, yes, pandemic. Large changes in fiscal or monetary policy are the only policies that may or may not move the needle.

The recession that began in February 2020 most likely ended in July. There has been no official declaration to that effect from the National Bureau of Economic Research (NBER), the private but widely recognized arbiter of business cycles.

Still, given third quarter GDP estimates of 33.1% growth, it is almost certain that the recession is over. While the recession may be over, the new depression is not.

This commentary from Jim was posted on the dailyreckoning.com Internet site on Friday sometime -- and another link to it is here. I thank Brad Robertson for this as well. Gregory Mannarino's longish post market close rant for Friday is linked here.

Fragility. Last year exposed myriad fragilities. The U.S. stock market went from all-time highs to an emergency FOMC meeting in ten sessions. The S&P500 lost more than a third of its value in just 21 trading days. Q2 GDP collapsed at a 31% annualized rate. Financial conditions tightened dramatically, with illiquidity and dislocation erupting throughout the markets - equities and fixed income. The year demonstrated the fragility of social stability. Frail confidence in our institutions was similarly revealed.

A historic rally saw stock prices end 2020 at record highs. Financial conditions loosened spectacularly, with the year seeing record investment-grade and high-yield bond issuance. Record IPOs and SPACs. It was a year of surging trading volumes for both equities and options. The Fed's balance sheet expanded almost $3.2 TN in 43 weeks.

Financial fragilities were exposed - and then seemingly resolved at the generous hands of the Federal Reserve (and the global central bank community).

For years now, my beginning of the year "Issues" pieces have featured a key Credit Bubble maxim: "The Bubble either further inflates or bursts." While easier to dismiss than ever, this dynamic has never been as germane. The Fed-induced Bubble is raging out of control. Monetary Disorder is acute and highly destabilizing. Sustainability must be questioned.

The system to begin 2021 in the throes of historic late-cycle "Terminal Phase Excess." One cannot overstate the potential damage this ongoing epic Monetary Disorder can inflict upon financial, economic, social and political stability.

Doug's weekly commentary is definitely worth reading. It was posted on his website in the wee hours of Saturday morning EST -- and another link to it is here.

The Real Revolution is Still Ahead -- Bill Bonner

The media is having a field day - showing, over and over again, the cockeyed videos. A crowd of yahoos gets hotted up. They make a break for the Capitol... bust through the windows and doors...

And there they are. One man sits at Nancy Pelosi's desk and puts his feet up. Another - with horns on his head... and tattoos on his naked torso - stands on the dais of the Senate.

And all over, they wander... aimlessly... pointlessly strewing papers and asking themselves...

..."What the Hell are we doing here?"

Myth Versus Reality

An "insurrection!" screamed the papers. An "invasion" said the commentators. A "revolution," said the analysts. "Pearl Harbor," opined Senator Chuck Schumer, surely losing his mind. "Domestic terrorists," insisted Joe Biden. "A coup d'état," said some other clown.

And onto the news channel came Michelle Obama, who let out that it was a "desecration" of the Capitol.

Yes... there... she had managed to find the right nail and give it a whack. For the only significant damage was there - to the myth...

This very interesting commentary from Bill appeared on the rogueeconomics.com Internet site on Friday sometime -- and another link to it is here.

Danes Get 20-Year 0% Mortgages

The country with the longest history of negative central bank rates is offering homeowners 20-year loans at a fixed interest rate of zero.

Customers at the Danish home-finance unit of Nordea Bank Abp can, as of Tuesday, get the mortgages, which will carry a lower coupon than benchmark U.S. 10-year Treasuries. At least two other banks have since said they'll do the same.

Denmark stands out in a global context as the country to have lived with negative central bank rates longer than any other. Back in 2012, policy makers drove their main rate below zero to defend the krone's peg to the euro. Since then, Danish homeowners have enjoyed continuous slides in borrowing costs.

The once unthinkable notion of borrowing for two decades without paying interest comes as central bankers across the globe shy away from rate hikes. No major western central bank is likely to raise rates this year, according to Bloomberg's quarterly review of monetary policy.

"Denmark has a so-called pass-through system in which mortgages are directly tied to the covered bonds used to fund the loans. Lenders act as brokers between borrowers and investors, generating income from fees, not interest rates. Borrowers get the coupon rate, though the effective cost is generally a bit higher because bonds rarely sell at par."

As rates have continued to sink, other banks in Denmark -- home to the world's biggest mortgage-backed covered-bond market -- are joining Nordea.

This rather brief Bloomberg article appeared on their website early on Tuesday morning -- and I thank Swedish reader Patrik Ekdahl for pointing it out. Another link to it is here.

Deutsche Bank to pay nearly $125 million to resolve U.S. bribery, metals charges

Deutsche Bank AG will pay nearly $125 million to avoid U.S. prosecution on charges it engaged in foreign bribery schemes and manipulated precious metals markets, the latest blow for the bank as it tries to rebound from a series of scandals.

Germany's largest lender agreed to the payout as it entered a three-year deferred prosecution agreement with the U.S. Department of Justice, and a related civil settlement with the U.S. Securities and Exchange Commission.

Almost all of the payout relates to charges Deutsche Bank violated the federal Foreign Corrupt Practices Act (FCPA) over its dealings in Saudi Arabia, Abu Dhabi, China and Italy, court papers show. Nearly two-thirds of the payout is a criminal fine.

The settlements were made public on Friday at a hearing in the federal court in Brooklyn, New York.

"Deutsche Bank engaged in a criminal scheme to conceal payments to so-called consultants worldwide who served as conduits for bribes to foreign officials and others," in order to win and retain "lucrative business projects," Acting U.S. Attorney Seth DuCharme in Brooklyn said in a statement.

In the metals case, prosecutors accused Deutsche Bank traders of placing fraudulent trades, known as spoofing, to induce other traders to buy and sell futures contracts at prices they otherwise would not have.

And nobody goes to jail. This Reuters story showed up on their Internet site at 11:09 a.m. EST on Friday morning -- and was updated about six hours later. I found it on the gata.org Internet site -- and another link to it is here.

Great Reset? No Thanks. -- Bryan Griffin

Remember in 2009 when then Secretary of State Hillary Clinton traveled to Russia with a big, red, plastic button that she thought said "Reset"? Well, she presented it to her counterpart in the Russian Foreign Ministry only to be informed that the button read "overload" and was more reminiscent of an industrial emergency stop button than any sort of reset.

That's what this new "great reset" is, too. It may be presented as something good, but it's a sham. In form and function, it would bring a dramatic stop to the progress of humanity over the last 200 years.

The "Great Reset" trended on Twitter just a few weeks ago. Time Magazine published a full-throated endorsement of the idea. The New York Times would have you believe it is a far-right conspiracy theory, but the World Economic Forum features "The Great Reset" as the most prominent sub-topic on its website.

|

|

There's a certain trend among many who are wealthy or who have tasted political power: they develop an affinity for telling the rest of the world what it should and shouldn't do.

The World Economic Forum is a vehicle for that jet-set past-time.

In May, the Forum announced its yearly conference would focus on the idea of a Great Reset. The Forum's founder, Klaus Schwab, wrote a book titled COVID-19: The Great Reset.

This interesting and worthwhile opinion piece was posted on the wamc.org Internet site back on November 25 of last year -- and it's even more relevant now than it was back then. I thank Ryan McCleery for sending it our way on Thursday -- and another link to it is here.

The only precious metal-related stories on the Internet yesterday was the usual main stream drivel that advanced various and sundry reasons why they were sold lower yesterday...but not one dared breath the real reason, if in fact they knew what it was.

The PHOTOS and the FUNNIES

Continuing eastward on B.C. Highway 3 towards Osoyoos on May 23...it was a picture postcard day as far as the weather and light conditions were concerned. All four of these photos were taken along the highway. The last three shots were all taken from the same spot...the first looking south across the Similkameen River -- and across the U.S. border in the distant background, the second looking west in the direction we'd just come -- and the fourth photo looking east down the Similkameen River valley. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The WRAP

Today's pop 'blast from the past' was released in the U.K. on 15 November 1963 -- and in the U.S. on December 27. This pop/rock group were part of the 'British Invasion' way back then -- and it was the first hit other than The Beatles to chart big on U.S. Billboard's Top 100 back in 1964...fifty-six years ago. And if one wishes to see how much society has changed over that period of time, this video will tell you all you need to know. The link is here.

Today's classical 'blast from the past' is something that I should have posted last month around the winter solstice...but the festive season got in the way -- and I forgot all about it, so I will make amends now.

Here's Vivaldi's Violin Concerto No. 4 in F minor, RV 297 "Winter" performed on original instruments with Cynthia Miller Freivogel as soloist -- along with the Early Music ensemble Voices of Music. It's an audio and video tour de force -- and has been viewed 18 million times. There are two token men in the ensemble...one on double bass -- and other playing the archlute. The link is here.

As Ted Butler pointed out on the phone yesterday, if one just looked around at the financial, economic and political news/chaos yesterday -- and for the whole week, without checking precious metal prices, one would naturally assume that they would have been substantially higher -- and maybe at new record highs for this move.

But, alas, the Big 8 shorts et al. had other plans -- and they made sure that the precious metals were not a safe haven this week.

In gold, they blew it down through its 100, 50 and 200-day moving averages all in one fell swoop...closing it below its 200-day moving average in the process. In silver, they closed it below both its 100 and 50-day moving averages. With platinum already well above any moving average that mattered, the bear raid in that precious metal didn't do much damage, but palladium traded below its 50-day moving average intraday for a short while on Friday. However, in such a thinly-traded and illiquid market, that probably didn't matter.

But there's a limit to what the Big 8 shorts can accomplish -- and the limiting factor as Ted has pointed out time and time again, is the fact that the Managed Money traders don't appear prepared to sell short big time like they have in the past. That seemed to be the case again yesterday, so there's no way that the Big 8 can ever cover. I'm sure that they did cover a bit, but as I mentioned in my COT commentary further up, it will most likely not be enough to make any material difference.

Of course that won't be known with any precision until next Friday's COT Report, but I'll be amazed if they covered more than about 5 percent of their current short position. Of course there are still two more trading days left in this reporting week, but if no traders in the Non-commercial category or the small traders aren't prepared to sell longs or go short a meaningful amount, the Big 8 can huff and puff all they want, but it will be to no avail.

They may improve their mark-to-market on their margin calls a bit more, but the bulk of their short positions in the COMEX still remain as the proverbial sword of Damocles.

And as Ted has also pointed out, the resolution of these grotesque and obscene short positions will be the sole determinant of precious metal prices going forward.

But as discouraging as these engineered bear raids are, the price trends in the precious metals are still firmly higher -- and as I say from time to time..."this too shall pass" -- and it will.

But what is really sad is the fact that the precious metal miners, who all know fully well what's going on, won't lift a finger or utter a word to help their industry, their own companies -- and us shareholders that own stock in them.

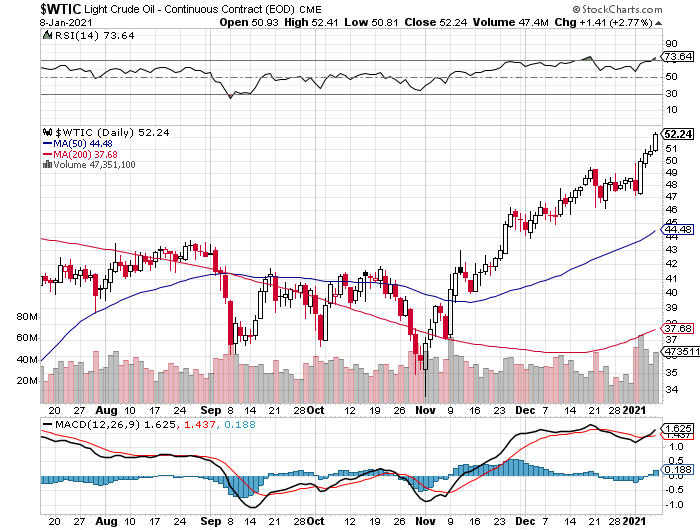

Here are the 6-month charts for the Big 6 commodities, courtesy of stockcharts.com as always. The damage in the precious metals has already been dissected and bisected above. Copper closed down 2 cents after being higher on the day -- and hugely overpriced WTIC added another $1.41 a barrel to that number yesterday.

And just as an aside...rhodium, which doesn't have a COMEX futures or options market attached to it...closed at $19,200 the ounce yesterday. That's what happens in a market that trades freely. That fact alone should give you some idea of just how massively underpriced the other four precious metals are, relatively speaking...silver in particular.

|

|

|

|

|

|

|

|

|

|

|

|

It was depressing, frightening -- and more than ominous to watch the chaos in the U.S. this week, not only the Georgia election process, but the storming of the Capitol Building in Washington. Regardless of whom was behind all this, I'm beginning to suspect that American Republic is now standing on mighty shaky ground.

And as I type these paragraphs, I can see the front cover of G. Edward Griffin's classic tome: "The Creature From Jekyll Island: A Second Look at the Federal Reserve" in my mind.

As Gregory Mannarino has pointed out more times that I can remember, it matters not who sits behind the Resolute desk, or Hayes desk as it's sometimes called, as the deep state/New World Order crowd will continue calling the shots from the behind the scenes.

He would be 100 percent correct about that.

The only difference in this day and age is that they are now fully out in the open if you care to examine what's happening in the world in general -- and the U.S. in particular, with an open and well-read mind.

The same story can be found in Carroll Quigley's monster missive "Tragedy & Hope: A History of the World in Our Time". Once you become aware of their presence, that knowledge can't be undone, as one can't unlearn what what has learned.

And what makes the situation even more depressing going forward is the fact that there's nothing that we can do about the process, as whatever they have planned for us is now baked in the cake. All we can do is sit back and observe, as events continue to unfold.

However, we are not entirely helpless, as we can still survive this with our wealth intact -- and that's despite the fact that 'da boyz' showed up this week.

Precious metals have been a store value of wealth throughout all of recorded history...remain that way today -- and will do the same in the future. All one has to do is look at the amount of money flowing into all the precious metal ETFs and mutual funds over the last number of years...particularly in 2020.

Some of it is John Q. Public money to be sure, but the vast majority of it is held by deep state insiders that know what's coming down the pipe -- and wish to be protected from those events just as much as we do.

I'm of the opinion that these Big 8 shorts are holding precious metal prices at these levels as best they can until they are ordered to stand back and let them rip to the upside. As to when that's going to happen -- and what concurrent events surround it, remains to be seen.

But with President-elect Joe Biden already promising many trillions in fiat currency the moment he's sworn in on the 20th, a possible crisis in the U.S. dollar looms large.

But regardless of whatever this event, or series of events turn out to be, the certain casualty will be the end of this price management scheme in silver and gold that has been ongoing for almost the last 50 years.

Of course this process is slow...too slow for us at times, but at this juncture one must be careful for what one wishes for. These deep state/new world order crowd types have their own agenda -- and won't be rushed.

Despite the temporary set-back this week, I'm still quite happy with my precious metals investments, which did well last year -- and will do even better in 2021.

I'm not only still "all in"...I'm even more "all in" than I was on Friday morning.

See you on Tuesday.

Ed