March 18, 2024 – Outcrop Silver & Gold Corporation (TSXV:OCG, OTCQX:OCGSF, DE:MRG) (“Outcrop Silver”) is pleased to announce the 2024 drilling program at the 100% owned Santa Ana highgrade silver project in Colombia is expected to commence in April 2024. The program, is designed to not only expand resources in areas previously identified for their potential but also to drill new targets along the 18.5 kilometres of strike that has been drill permitted.

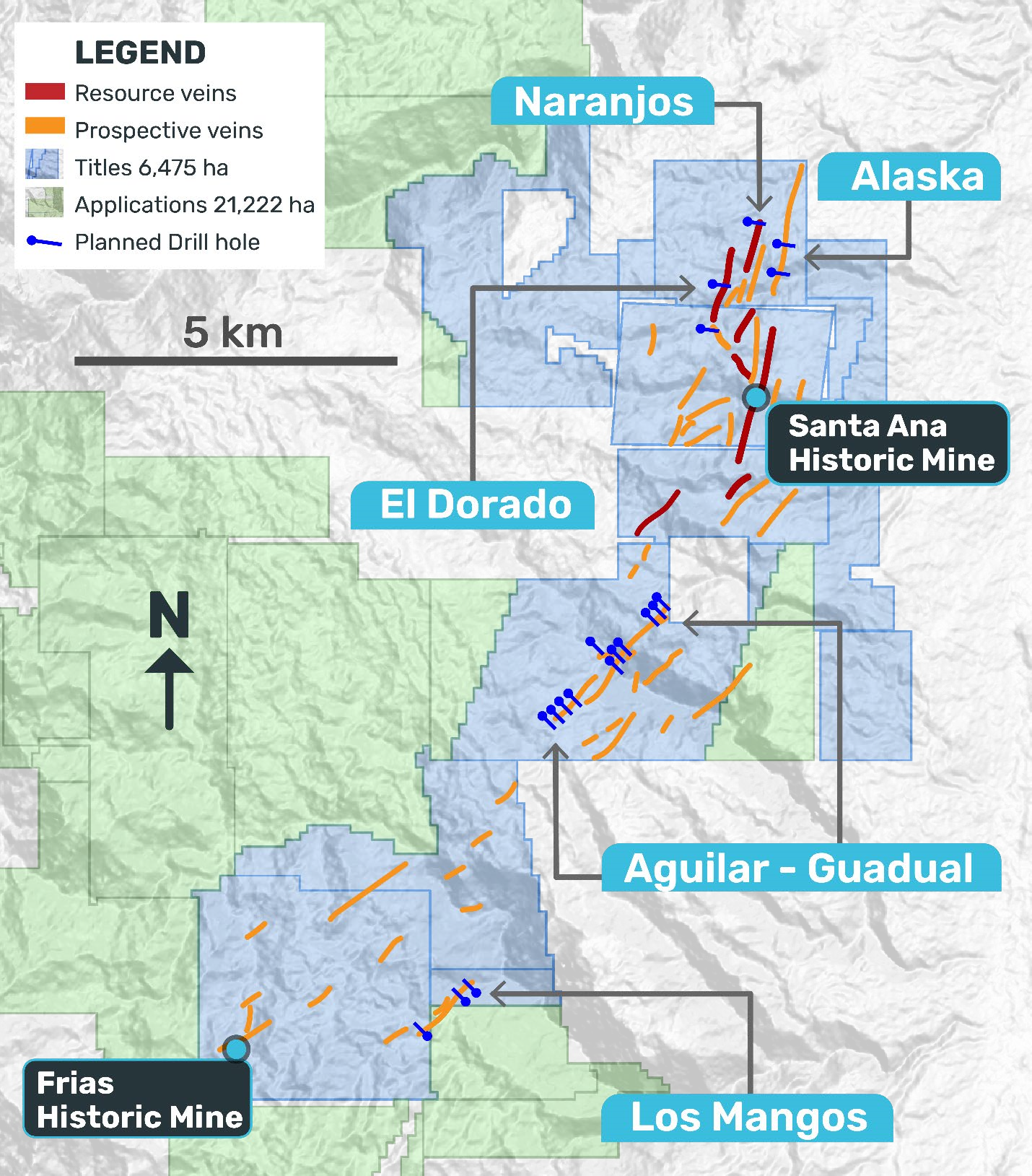

The program will focus on extending mineralization along strike and down dip at El Dorado, including veins not previously included in the 2023 maiden resource due to insufficient drill density. Additionally, we will explore untested veins, such as the promising Aguilar-Guadual target, and Los Mangos area to the southwest, identified by numerous high-grade channel samples. This comprehensive approach aims to underscore the scalability of the Santa Ana project and its potential for substantial resource growth.

"2024 is a watershed year for Outcrop Silver as we launch an extensive drilling program to unlock the full potential of the Santa Ana project,”

comments Ian Harris, President and CEO.

“By strategically shifting our drilling contractors and focusing our exploration efforts, we aim to establish a robust roadmap for expanding our resource base across both established and new targets within our extensive land holdings.”

Our 2024 drill campaign will focus solely on high-potential targets with proven mineralization, significant resource expansion potential, and strategic locations within a highly prospective mineralized corridor. These targets have exhibited significant mineralization through surface samples, initial drilling, and geological mapping, indicating an excellent potential for resource expansion. They are located along a prolific mineralized corridor that offers a linear path for systematic exploration and resource delineation across a vast area. This presents an unparalleled opportunity for expanding known mineral resources and discovering new zones of mineralization.

2024 Drill Targets

El Dorado

El Dorado target offers an opportunity to step out along strike to discover new high-grade shoots and to expand known high-grade shoots, like Las Abejas, along the dip. This potential for both lateral and vertical extension makes it a prime candidate for increasing the mineral resource. The previous successful intersection of high-grade mineralization in drill hole DH317 (3.05 metres true width @ 16.08 g/t Au and 2,719 g/t Ag, (see News Release from January 30, 2023) suggests that targeting around the 750 metres absolute elevation could be a highly effective exploration strategy along this vein system.

Aguilar-Guadual

The Aguilar-Guadual target area stands out for its historical significance, high-grade silver potential, and strategic importance for resource expansion, being a more than 1,800 metre long vein system. The results from initial exploration have provided a highly prospective drill-ready target that needs to be tested to unlock its full potential. Channel samples from old underground workings and from surface have returned assays as high as 5,572 and 7,220 g/t AgEq, respectively (see News Release from January 03, 2023 and April 26, 2023).

Los Naranjos

Los Naranjos remains open along strike after drilling included in the Mineral Resource. The apparent continuity of mineralization along strike indicates a clear opportunity to expand the resource by extending the known mineralized zones. The presence of high-grade silver in quartz veins and associated shear zones, underscores the target’s potential for contributing significantly to the project’s overall resource. High-grade drill intercepts previously reported are hole DH270 (5.82 metres true width @ 4.27 g/t Au and 1,770 g/t Ag) or DH272 (1.09 metres true width @ 4.1 g/t Au and 712 g/t Ag) (see News Release from July 27, 2022).

Alaska

Alaska represents the northernmost extension of the Santa Ana vein system. Drilling Alaska will provide critical data to understand the full scope of the mineralized system, potentially leading to the discovery of new zones of mineralization within the same structural trend. Despite previous drilling success, the drill density at Alaska was insufficient to include the area in the Mineral Resource. Additional drilling is required to increase the drill density to a level where it can contribute to the resources, converting known mineralization into categorized resources. Channel samples have returned high-grade assays up to 13.78 g/t Au and 3,415 g/t Ag and drill intercept with 1.07 meters true width @ 561 g/t AgEq (see News Release from April 26, 2023).

Los Mangos

Los Mangos has demonstrated some of the highest grades in surface samples along with very consistent and wide vein occurrences, suggesting the presence of a robust mineralized system. Located along strike to the southwest, Los Mangos supports the strategic goal of generating mineral resources across the entire length of the 20 kilometre mineralized corridor, enhancing the project’s scalability and economic value.

The high-grade assays from both historic mine dumps and in-situ quartz veins, coupled with the continuity of vein outcrop over 650 metres, underscore the area's potential. Samples from quartz veins from historic workings returned up to 4,545 g/t Ag. Vein material from historic mine dumps shows assays of 27.71 g/t Au and 9,738 g/t Ag (see News Release from August 23, 2022).

Map 1. 2024 Drilling campaign targets and drill hole locations.

ATM Program

Further to an at-the-market offering of common shares made pursuant to a prospectus supplement dated September 6, 2023, Outcrop Silver issued 5,970,500 common shares and raised gross proceeds of $1,247,639 pursuant to such offering from October 1, 2023 to December 31, 2023. Fees of 2.5% of the gross proceeds of the at-the-market offering were paid to Research Capital Corporation, being $31,190.

Clarification

Further to the news release dated February 9, 2024, the effective date of the Consulting Agreement with Triomphe Holdings Ltd. was February 15, 2024, rather than February 12, 2024 and the fee of $60,000 was paid in advance.

ICP Securities Inc. Engaged for Automated Market Making Services

Outcrop Silver has engaged the services of ICP Securities Inc. ("ICP") to provide automated market making services, including use of its proprietary algorithm, ICP Premium™, in compliance with the policies and guidelines of the TSX Venture Exchange and other applicable legislation. ICP will receive a fee of C$7,500 plus applicable taxes per month, payable monthly in advance. The agreement between Outcrop Silver and ICP is for an Initial Term of four (4) months and shall be automatically renewed for subsequent one (1) month terms (each month called an "Additional Term") unless either party provides at least thirty (30) days written notice prior to the end of the Initial Term or an Additional Term, as applicable. There are no performance factors contained in the agreement and no stock options or other compensation are being granted in connection with the engagement. ICP and its clients may acquire an interest in the securities of Outcrop Silver in the future.

ICP is an arm's length party to Outcrop Silver. ICP's market making activity will be primarily to correct temporary imbalances in the supply and demand of Outcrop Silver’s shares. ICP will be responsible for the costs it incurs in buying and selling Outcrop Silver’s shares, and no third party will be providing funds or securities for the market making activities.

ICP is a Toronto based CIRO dealer-member that specializes in automated market making and liquidity provision, as well as having a proprietary market making algorithm, ICP Premium™, that enhances liquidity and quote health. Established in 2023, with a focus on market structure, execution, and trading, ICP has leveraged its own proprietary technology to deliver high quality liquidity provision and execution services to a broad array of public issuers and institutional investors.

Silver Equivalent

Metal prices used for equivalent calculations were US$1,800/oz for gold, and US$25/oz for silver. Metallurgical recoveries based on Outcrop Silver’s Metallurgical test work are 97% for gold and 93% for silver.

QA/QC

For exploration core drilling, the company applied its standard protocols for sampling and assay. HQ-NTW core is sawn with one-half shipped. Core samples were sent to either ALS, Actlabs or SGS in Medellin, Colombia, for preparation. Samples delivered to Actlabs were AA assayed on Au, Ag, Pb, and Zn at Medellin using 1A2Au, 1A3Au, Multielements AR (Ag Cu Pb Zn), and Code 8 methods. Then samples are sent to Actlabs Mexico for ICP-multi-elemental analysis with code 1E3. After preparation, the samples sent to ALS Colombia were shipped to ALS Lima for assaying using Au-ICP21, Au-GRA21, ME-MS41, Ag-GRA21, Ag-AA46, Pb-AA46, and Zn-AA46 methods. In line with QA/QC best practices, blanks, duplicates, and certified reference materials are inserted at approximately three control samples every twenty samples into the sample stream, monitoring laboratory performance. Comparison to control samples and their standard deviations indicates acceptable accuracy of the assays and no detectible contamination. The samples are analyzed for gold and silver using a standard fire assay on a 30-gram sample and with a gravimetric finish when surpassing over limits. Multi-element geochemistry was determined by ICP-MS using either aqua regia or four acid digestions. Crush rejects, pulps, and the remaining core are stored in a secured facility for future assay verification.

Qualified Person

Edwin Naranjo Sierra is the designated Qualified Person for this news release within the meaning of the National Instrument 43-101 (NI 43-101) and has reviewed and verified the technical information in this news release. Mr. Naranjo has anholds a M.Sc. in Earth Sciences, and is a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM) and the Society of Economic Geology.

About Santa Ana

The 100% owned Santa Ana project comprises 27,000 hectares, including titles and applications, 110 kilometres from Bogota, Colombia. Santa Ana consists of regional-scale parallel vein systems covering a majority of the Mariquita District. The Mariquita District is Colombia’s highest-grade primary silver district, where mining records date to at least 1585, with historic silver grades reported to being among the highest in Latin America from dozens of mines.

Santa Ana maiden resource estimate contains an estimated indicated resource of 24.2 million ounces silver equivalent at a grade of 614 grams per tonne silver equivalent and an inferred mineral resource of 13.5 million ounces silver equivalent at a grade of 435 grams per tonne silver equivalent, based on the NI 43101 Technical Report titled “Santa Ana Property Mineral Resource Estimate,” dated June 8, 2023, and prepared by AMC Mining Consultants. The resource is comprised of the seven vein systems (commonly containing multiple parallel veins and multiple ore shoots) discovered to date – Santa Ana (San Antonio, Roberto Tovar, San Juan shoots); La Porfia (La Ivana); El Dorado (El Dorado, La Abeja shoots); Paraiso (Megapozo); Las Maras; Los Naranjos and La Isabela.

Veins with similar high grade and thickness exist along strike toward the south, forming a high-grade silver enriched trend that extends for 30 kilometres. Outcrop Silver’s exploration team has identified numerous additional veins based on high-grade samples from outcrop and historical workings that have yet to be drilltested. Outcrop Silver remains focused on identifying and drilling new vein targets with high-grade potential, and adding substantially derisked mineralized silver-bearing veins that will increase the published maiden resource.

About Outcrop Silver

Outcrop Silver is advancing the Santa Ana high-grade silver deposit with exploration activities aiming to expand the current mineral resource. Santa Ana is being advanced by a highly disciplined and seasoned professional team with decades of experience in Colombia.

ON BEHALF OF THE BOARD OF DIRECTORS

Ian Harris

Chief Executive Officer +1 604 294 9039

harris@outcropsilverandgold.com www.outcropsilverandgold.com Kathy Li

Vice President of Investor Relations

+1 778 783 2818 li@outcropsilverandgold.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as such term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Certain information contained herein constitutes “forward-looking information” under Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as “potential,” “we believe,” or variations of such words and phrases or statements that certain actions, events or results “will” occur. Forwardlooking statements are based on the opinions and estimates of management as of the date such statements are made and they are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Outcrop to be materially different from those expressed or implied by such forward-looking statements or forward-looking information, including: the receipt of all necessary regulatory approvals, capital expenditures and other costs, financing and additional capital requirements, completion of due diligence, general economic, market and business conditions, new legislation, uncertainties resulting from potential delays or changes in plans, political uncertainties, and the state of the securities markets generally. Although management of Outcrop have attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forwardlooking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Outcrop will not update any forward-looking statements or forward-looking information that are incorporated by reference