December 2023

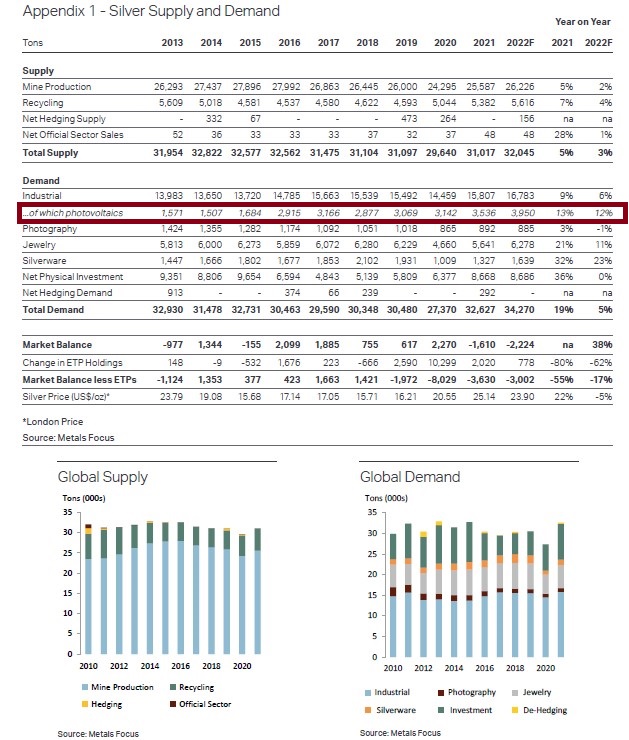

2023 saw another year of the huge supply-demand deficit in silver, despite heavy investment selling. The most significant demand increase came from solar panels. In 2021, the Silver Institute and Metal Focus group were looking at PV (solar panel) using 110 million oz, growing at 12-13% per year. But in November 2023, the Silver Institute and Metal Focus group revised the 2023 estimate to about 200 million oz! In other words, in the past two years, over 100 million oz of silver was taken by the PV industry “unexpectedly”!

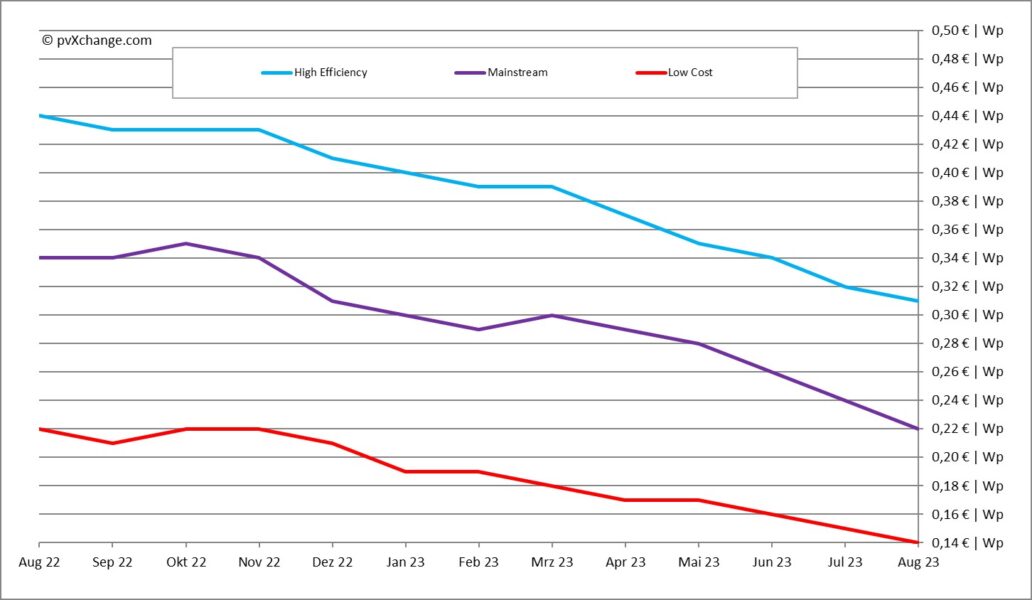

2023 is also another year that we saw rapid progress in the solar panel industry. We saw huge drops in solar panel prices while the technology advanced. The drop in solar panel prices is making solar panels very affordable. In addition, the drop in the lithium and lithium battery price is making PV the cheapest energy in human history.

Solar panel innovation, meanwhile, has reached an inflection point. In order to increase efficiency, 25-150% more silver is needed for the future generation of solar panels.

Tunnel oxide passivated contact (TOPCon) technology took off in 2023, increasing silver loading in solar panels by at least 25%. In 2024, more than 50% of solar panels are expected to be based on TOPCon.

Another development in the solar industry, heterojunction technology (HJT), is projected to require double the silver load in solar panels in 2025 and beyond.

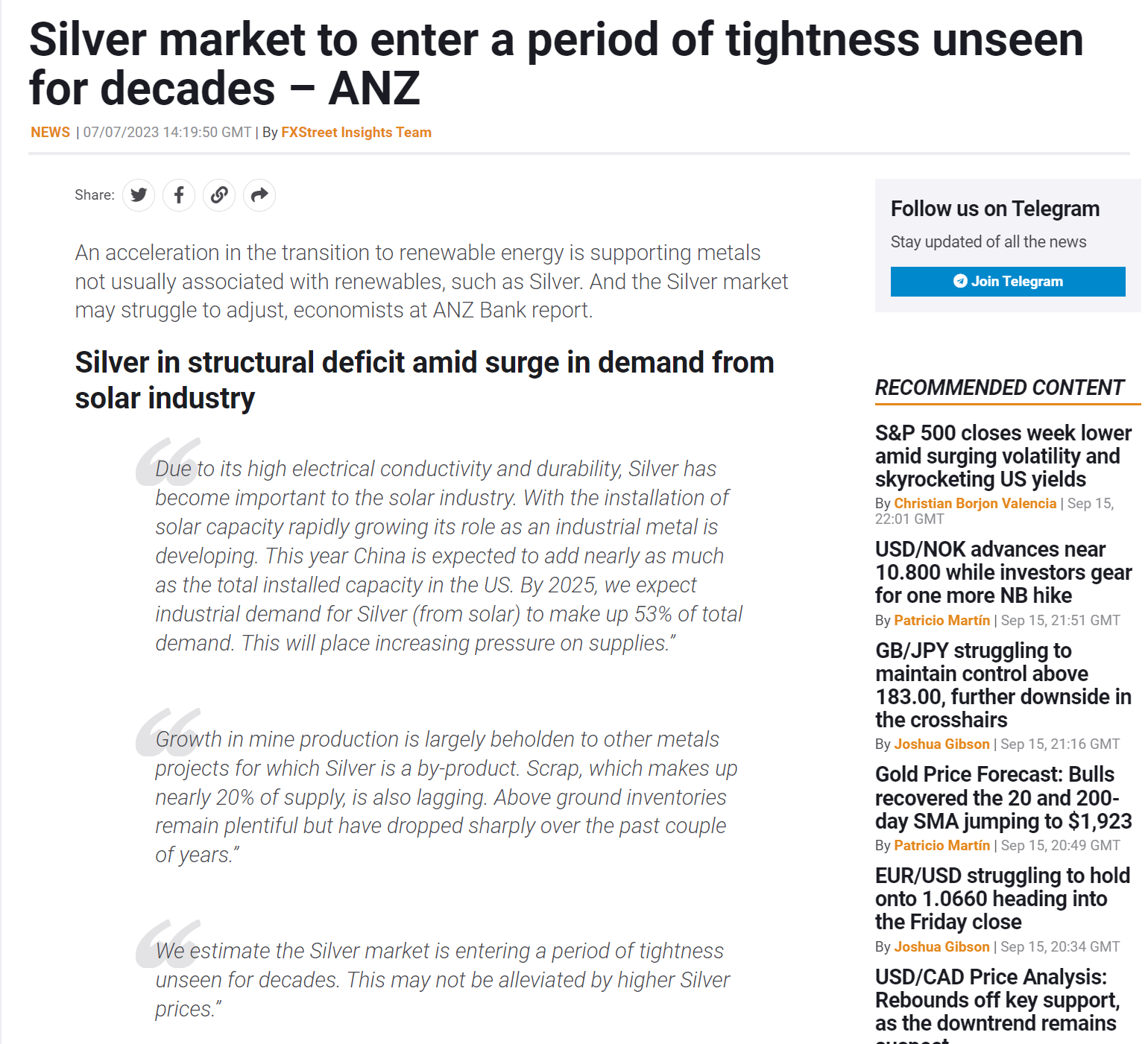

As a result, most people are very optimistic about the growth of solar panels in the next few years. ANZ is expecting PV to take more than 50% of the industry’s silver demands by 2025, a huge jump from 20% in 2021.

All these are pointing to a structural silver shortage for decades to come. Silver is mainly a primary metal by-product. In order for silver production to catch up with demand, many new primary silver mines need to be built and the silver price needs to be high for an extended period of time.

Over one week ago, gold broke the $2,100-per-ounce barrier for the first time and silver jumped to near $26, followed by both metals pulling back, is a pattern that I have seen in the past.

The rally was a reaction to a series of developments:

• Depreciating U.S. dollar

• Falling bond yields

• Safe-haven demand

• Dovish tone from central banks of the world, signaling a halt to the recent cycle of interest rate increases

My take is that the precious metals run was partially driven by a group of funds squeezing the shorts in a thinly traded market. This happens in a bull market and usually marks the short-term top of gold.

I have seen this many times. The most famous one was the financial crisis of 2008 when Bear Stearns went under. There was a Sunday night pop in gold, and I took advantage of it. This kind of topping pattern is manufactured, and a lot of pundits will surely proclaim, “This is the top of gold!”

However, such a sequence is usually a foreshadowing of higher gold and silver prices, and it is a buying opportunity on any significant pullback – like the one we saw this week.

Historically, silver tends to do well in the later stage of a gold rally and usually hits a new high. That means silver will likely test the 50-dollar mark and is likely to exceed it.

While precious metals equities have rallied overall in recent weeks, most stocks are close to their 52-week low as the market remains risk-off with investors in a holding pattern. Investors looking to invest in precious metals can take advantage of the pullback and historically low stock prices.

You may know that I am neither a “gold bug” nor a “silver bug”. I invest in a variety of sectors, and it is always about value and timing.

When it comes to precious metals, I pick my spots.

During the chaos of late 2008, I bet big on gold miners and was rewarded very nicely.

In 2012, taking a hard look at the fundamentals, I exited gold and silver stocks.

In March 2020, with silver at $12 and a pandemic on the way, I pounded the table. The gains were tremendous.

Well, I have a strong “buy” feeling once again. These are my top two picks recently published on the Streetwise interview: (For more details and updates, subscribe Chen's letter at https://chenpicks.com/)

Silvercorp Metals (TSX:SVM; NYSE:SVM) – a Canadian pure-play silver mining company operating several low-cost and long-life mines in China. The company has US$189 million in cash, no debt, and is buying back shares and paying dividends. Silvercorp’s strong balance sheet is funding a plethora of growth projects at its operations and strategic M&A for increased diversification. Mining entrepreneur Dr. Rui Feng is the founder, chairman, and chief executive officer of the company.

Cerro de Pasco Resources (CNSX:CDPR; OTCMKTS:GPPRF) – focused on the development of the El Metalurgista mining concession in Peru and the exploration of the Quiulacocha Tailings Project at the site. They are very close to getting the presidential easement, the 5th in the Peruvian history, to access the largest above ground silver resource in the world.

References:

- https://www.kitco.com/news/2023-12-04/Gold-price-powers-to-record-high-backs-off.html

- https://www.fxstreet.com/news/silver-price-analysis-xag-usd-faces-downward-rally-after-reachingm-multi-month-highs-rising-yields-202312041624

- https://www.benzinga.com/analyst-ratings/analyst-color/23/12/36058685/peter-schiff-says-gold-stocks-show-extreme-bearishness-despite-yellow-metals-record

- https://www.benzinga.com/analyst-ratings/analyst-color/23/12/36058685/peter-schiff-says-gold-stocks-show-extreme-bearishness-despite-yellow-metals-record

- Silver Looks Like a Real Bargain Right Now | SchiffGold

- Global Silver Industrial Demand Forecast to Achieve New High in 2023 | (silverinstitute.org)

- https://thesilverindustry.substack.com/p/silver-use-surges-as-solar-skyrockets

- https://chenpicks.com/