On the heels of the highest BLS inflation figure since the 1980's, Patrick Yip, a OneGold executive notes inflation is like rock-and-roll, it's here to stay. Judging by prior inflationary cycles, it's easy to see that policymakers are lagging far behind price increases (figure 1.1.).

Our guest notes insidious inflation will continue to erode not only purchasing power of dwindling incomes, but also retirement savings and investments, by more than 50%!

Until the current Fed Funds Rate (roughly 1%) comes back in natural alignment with the rate of inflation, as of today, 8.3%; officials will likely face an upward battle to contain the inflation genie.

Similar to the 1980's, producers and consumer's alike will bid up prices, particularly the inflation hedge of choice, gold and silver. Unfortunately, many investors will be caught flat footed, as the meme-stocks transform into "stonks", amid what could resemble the 2000's "lost-decade" for US equities, where gold soared 7 fold!

The risk-on-trade is finally returning to the investing dialogue in board rooms, instructional investment banks and even the retail investor crowd.

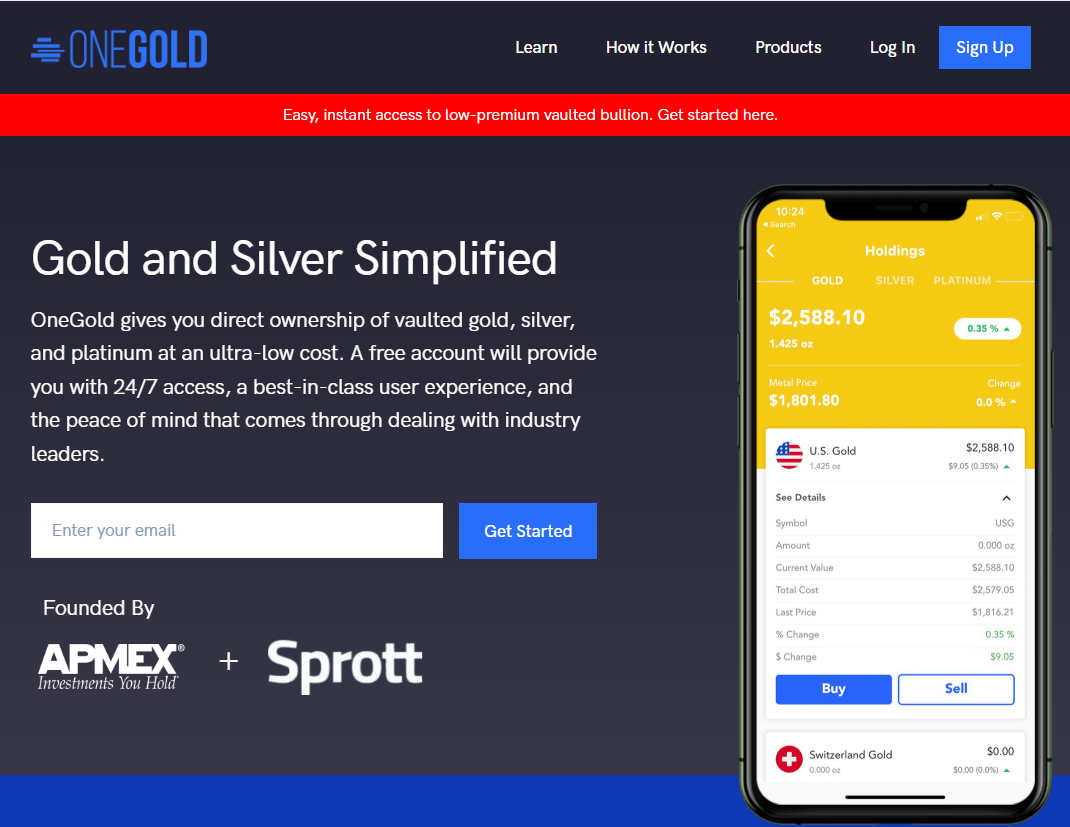

Our guest tackle's the important issue of gold premiums, noting several methods that OneGold facilitates the best interests of their clients by savvy navigation through the physical market, including the US Mint. Not only is our guest a satisfied user of OneGold, but also GoldSeek.com founder, Peter Spina is an avid user of OneGold and extremely pleased with several key aspects, such as vaulting in various International venues.

Investors are encouraged to make their focus the accumulation of precious metals ounces, avoiding high premiums in favor of securing the most "bank-for-their-buck." Plus Patrick Yip outlines key tax advantages available to OneGold clients, in particular, opportunities in retirement accounts such as IRA's.

Our guest and host concur, gold is likely to ascend at least to $5,000 per ounce in the next bull market phase, currently underway.