Silver, like gold, has returned to the spotlight this year with the precious metal recently trading at its highest in a year at just under $26 an ounce.

In the past month, silver prices have gone up nearly 20%, eclipsing the S&P 500’s approximate 5% gain over the same period, as well as outpacing other precious metals, including gold (9%), platinum (10%) and palladium (12%).

The boost to silver comes as the value of the US dollar, an alternative safe-haven asset, has struggled, falling about 2% over the past month and more than 9% since a 20-year peak last September.

Assuming the US Federal Reserve proceeds to cut interest rates, silver could continue on the current trajectory at least until the end of year as the opportunity cost of holding metals gets lower.

Some are already claiming this is “the year” for silver as it latches onto an inflation-fueled rally to eventually surpass the $30-an-ounce mark that was last seen nine years ago.

Such projection is not unwarranted; there is plenty of historical evidence to suggest that silver usually outperforms gold in years of high inflation. Furthering silver’s investment appeal is the general expectation that a recession could soon befall.

But that’s not all. Behind the bullish outlook is a massive imbalance existing in silver’s market fundamentals that is supporting higher prices.

Largest Supply Deficit

Analysts have long been pointing to a “severe shortage” of silver due to the relentless growth in demand for the metal, which is used in many industrial applications such as automotive and electronics.

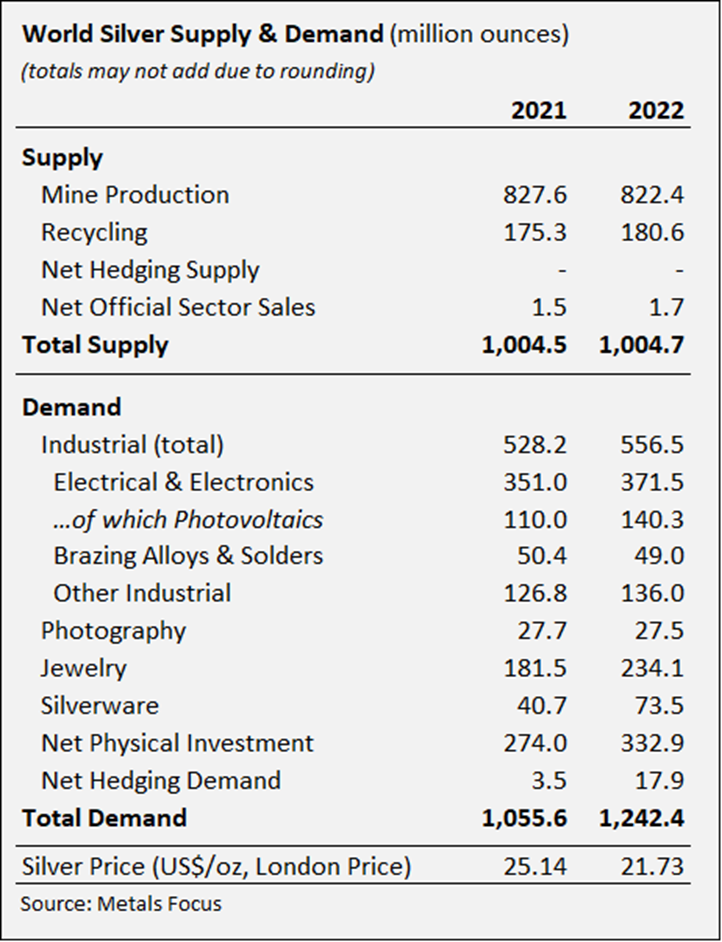

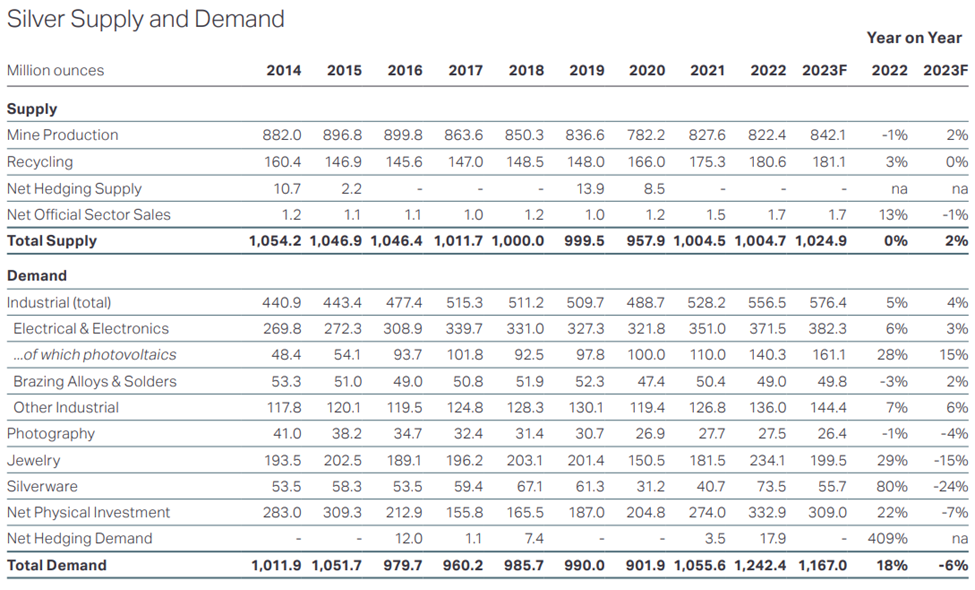

The new industry figures help to paint a clearer picture. Data from the Silver Institute shows that global silver demand has increased by 38% since 2020 as world economies continue to recover from the Covid-19 pandemic.

Last year, demand for silver surged by 18% to a record high 1.24 billion ounces against a stagnant supply, stretching the market deficit to a second straight year, the Silver Institute said in its latest publication.

According to the 2023 World Silver Survey, the global silver market was undersupplied by 237.7 million ounces in 2022, which the Institute says is “possibly the most significant deficit on record.”

What’s more unsettling is that it took just two years of undersupply — the 2022 deficit and the 51.1Moz shortfall from 2021 — to wipe out the cumulative surpluses from the previous decade, and this demand-supply gap is likely to remain for the foreseeable future.

Source: Metals Focus

Source: Metals Focus

“We are moving into a different paradigm for the market, one of ongoing deficits,” said Philip Newman at Metals Focus, the research firm that prepared the Silver Institute’s data.

“Silver demand was unprecedented in 2022, and we don’t say that to try and be sensational, that is the only way to describe the market,” Newman stated in an interview with Kitco News this week.

Source: The Silver Institute

Source: The Silver Institute

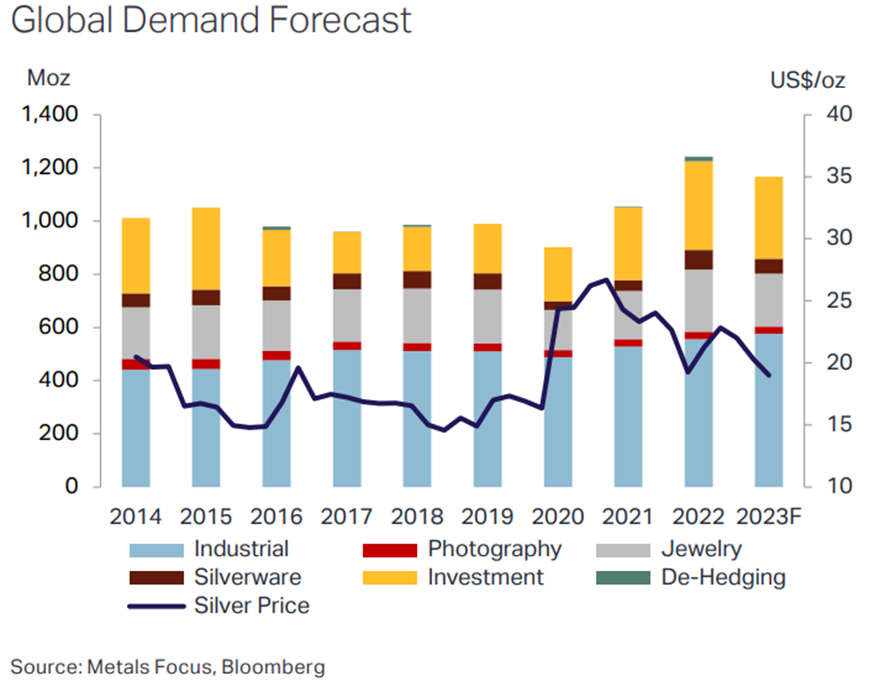

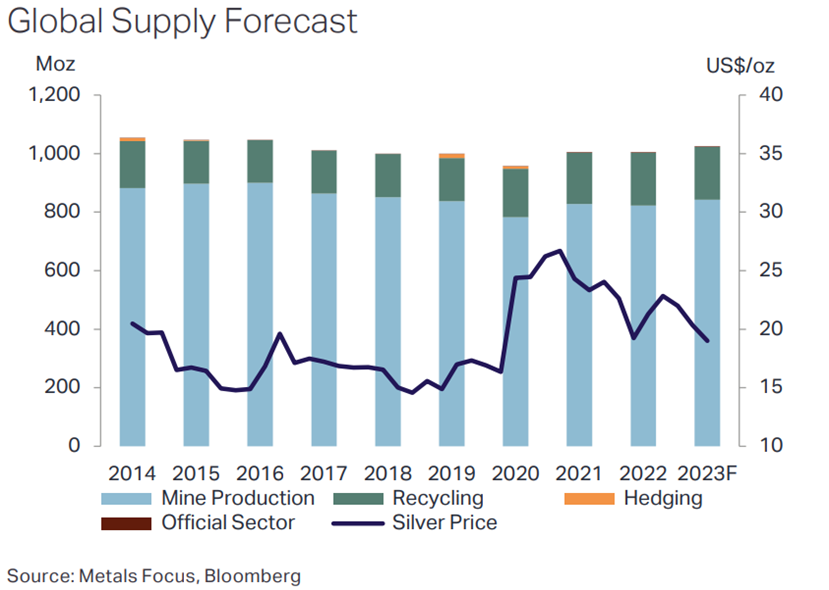

In 2023, we are most likely going to see a repeat of last year, with solid demand and a slight increase (2%) in mine production.

The Silver Institute is forecasting another 1.17 billion ounces being demanded this year, against a projected supply of 1.02 billion ounces. While this would close the gap to 142.1 million ounces, it would still be the second-largest deficit in over two decades.

“Even if some of the markets are not as strong compared to last year, demand is still expected to be very robust,” Newton told Kitco News.

Source: The Silver Institute

Source: The Silver Institute

Record Industrial Demand

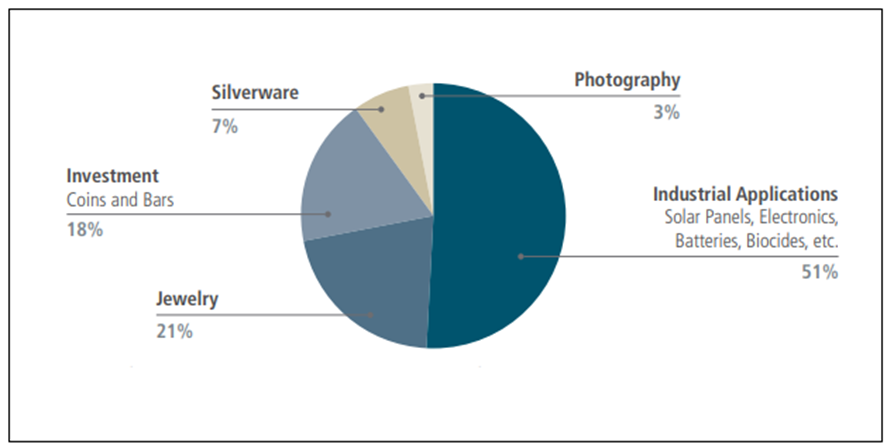

Of all the major demand categories, arguably the biggest driving force is silver’s industrial importance.

Unlike gold, which is mainly bought as an investment or for jewelry, silver is more of an industrial metal. It is estimated that approximately 60% of today’s silver is used for industrial purposes such as electronics, solar cells, automotive and soldering, with the remaining 40% available for investment.

Source: Source: GFMS Definitive, Metals Focus, The Silver Institute, UBS

Source: Source: GFMS Definitive, Metals Focus, The Silver Institute, UBS

As such, silver’s value is primarily driven by demand from the industrial sectors, which the Silver Institute projects to reach an all-time high this year at 576.4 million ounces, a 4% rise over 2022 after a 5% increase the year before.

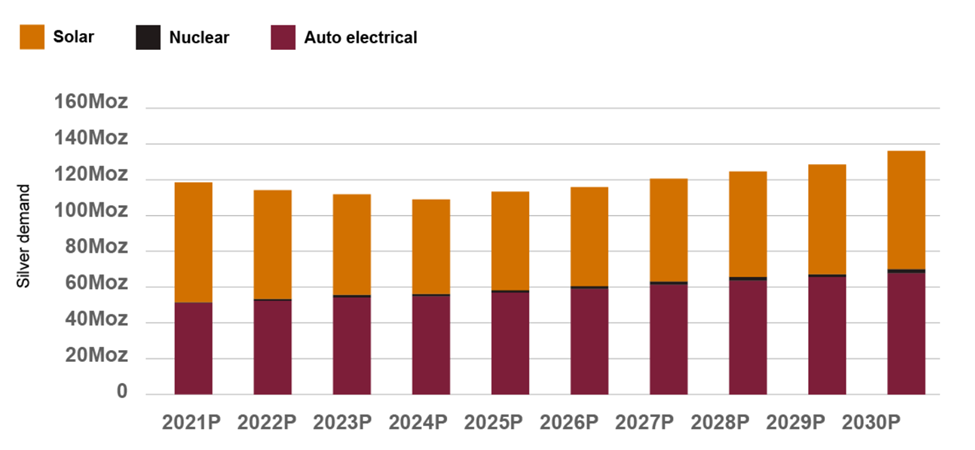

What’s more, demand for silver in the next few years is expected to hold “broadly steady” even with downward swings from the investment and jewelry categories, the Silver Institute says, as the global shift to clean energy means more of the metal will be needed for solar photovoltaic (PV) cells and electric vehicles on top of the conventional industrial needs.

This structural change in silver demand also builds on promising cyclical factors such as GDP growth, and specifics such as gains for consumer electronics, a further rise in vehicle output and growth for the construction industry.

“Some new (or newer) uses (such as PV) will see further thrifting and/or substitution in silver use but thrifting overall is expected to remain slight as, for most applications, silver use is already running at the bare minimum,” the Silver Institute wrote in its report.

“All this explains why we expect industrial demand to outpace overall GDP growth, marking a turnaround from the last decade’s situation,” it added.

Looking into the next decade, the Silver Institute expects considerable interest in silver as the global transition to renewable energy intensifies.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. A 2020 Saxo Bank report stated that “potential substitute metals cannot match silver in terms of energy output per solar panel.

Using silver as conductive ink, photovoltaic cells transform sunlight into electricity. Silver paste within the solar cells ensures the electrons move into storage or towards consumption, depending on the need. It is estimated that approximately 100 million ounces of silver are consumed per year for this purpose alone.

Analysis by BMO Capital Markets has annual silver consumption by the solar industry growing even higher at 85% to about 185 million ounces within a decade.

The role of silver in the green energy revolution. Source: Bloomberg

The role of silver in the green energy revolution. Source: Bloomberg

In the Silver Institute’s report, demand from photovoltaics climbed 15% last year to 140.3 million ounces, and is expected to surge another 28% to 161.1 million ounces in 2023, by which demand would’ve been about three times that of 2015.

Longer term, demand from the solar market is expected to keep up this pace. The institute, which references a World Bank projection for the energy technology segment as a basis for its predictions, forecasts that consumption could eventually hit 500 million ounces by 2050.

And without a sudden, large injection of supply, it won’t be surprising to see the current silver deficit extend beyond the end of this decade while setting new records along the way.

Positive Outlook

While there can be no such thing as “safe bets” when it comes to commodities, silver is probably the closest thing thanks to its solid fundamentals, acting as a support for the metal’s long-term pricing.

Over the past three months, it has even outperformed gold “primarily due to real or perceived future demand for silver due to industrial usage factors,” says Michael Cuggino, president and portfolio manager of the Permanent Portfolio Family of Funds.

As Metals Focus points out, the global silver market is entering a new era where sizable deficits could be the common theme year to year, fueling a positive outlook for silver.

Nicky Shiels, head of metals strategy at precious metals company MKS PAMP, predicts that silver is expected to post deficits of more than 100 million ounces over the next five years, with industrial demand spurring the tight supply.

That demand, according to Shiels, is expected to grow more than 15% over that period, hinging on accelerated industrial demand from automotive and electronics applications.

“The largest segment of silver demand is industrial, [which equates] to almost 50% of total demand,” she told CNBC earlier this year, calling for a base case of silver prices to climb to $28, with a bullish case of $30 or more.

With the right mix of factors, silver could go a lot higher, “easily into the $30s,” Cuggino seconded.

Back in February 2022, David Morgan of the Morgan Report told Investing News there was potential for silver to hit US$50 in the short term, as “high levels of stock market volatility could make the white metal more attractive to investors.”

Silver mining executives, too, are optimistic. Randy Smallwood of Wheaton Precious Metals said that “I’m very bullish on gold, but I’m even more bullish on silver.”

“We hit peak silver supply back about five, six years ago. Silver production on a worldwide basis has actually been dropping, and we’re not seeing as much silver produced from the mines,” he stated in a CNBC interview.

The case for peak gold, silver and copper

Keith Neumeyer of First Majestic Silver even believes that the metal’s price could hit triple digits, in part because the current market cycle can be compared to the year 2000, when investors were sailing high on the dot-com bubble and the mining sector was down.

“It’s only a matter of time before the market corrects, like it did in 2001 and 2002, and commodities see a big rebound in pricing,” he stated in an interview with Wall Street Silver in August.

Possible Headwinds

Still, some analysts prefer to be cautious about silver’s outlook in the short-term, as the price has already broken the key $20 per ounce level and interest rates are rising.

The World Bank’s October 2022 Commodity Markets Outlook saw the silver price averaging $21 throughout the year, and then staying constant at the same level throughout 2024.

In its annual survey, the Silver Institute says prices should average $21.30 an ounce this year, which is 2% lower than last year’s average of $21.73, owing to a decline in investment demand.

“We think that institutional investment will eventually run out of steam, as we believe that the current market consensus that the Fed will be forced to cut rates in H2 will be proven wrong,” the institute said.

Furthermore, recession fears could lead to softer industrial demand, which may cause silver prices to drop as low as $18 per ounce, according to MKS PAMP. The Silver Institute also sees silver prices falling to this level before year-end.

The biggest risk to silver prices is if inflation falls away faster than expected, Janie Simpson, managing director at ABC Bullion, elaborated.

“If the Fed continues to tighten, and if inflation falls away more rapidly than the market expects, that will be a headwind for silver,” she explained, “especially if the economy heads into a recession, given the large share of silver demand tied to industrial output.”

Five reasons gold and silver could rally soon

Conclusion

Long story short, silver’s short-term outlook is down to a matter of the impacts of a recession on industrial demand weighing against its “safe haven” status during uncertain times. But over a longer horizon, there are reasons to be bullish.

A closer look at the silver price dynamics over the last five years indicates that a bullish trend has been established since around mid-2020. The main hurdle to a breakout was the Fed’s interest rate hikes, which in turn strengthened the US dollar, but a new business cycle of lower rates and weaker dollar would remove that.

And then there’s the energy transition, which presents an ideal condition for silver prices to rise.

As Wells Fargo described previously: “Commodities have been in a supercycle since 2020, with silver looking to play a special role, especially considering how cheap it is relative to other commodities.”

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.