While there is little we can do to prevent climate change — the Earth is going to continue to warm until it isn’t — we can do our part in cleaning up the atmosphere by reducing fossil fuel usage.

The modernization and electrification of the global transportation system will require a change hitherto unprecedented in the history of civilization. The fossil-fuel-based transportation system needs to be electrified, and the switch must be made from oil, gas and coal-powered power plants to those which run on solar, wind and nuclear energy. If we have any hope of cleaning up the planet, before the point of no return, a massive decarbonization needs to take place.

On top of surging demand for metals needed to feed so-called “green infrastructure” programs being rolled out in the United States, Europe and China, we have emerging structural deficits for several metals, that will keep prices buoyant for the foreseeable future.

New emissions targets being set by countries like Canada, the US, Britain, China and Japan, will mean large-scale deployment of electric vehicles, renewable power and electrical transmission, all of which will require copious metal content.

A brand-new report from Bloomberg NEF states that the transition from fossil fuels to clean energy could require as much as $173 trillion in energy supply and infrastructure investment over the next three decades.

The report identifies four key components of the energy transition — solar panels, wind turbines, lithium-ion batteries and EV charging units — that show the complexity of the supply chains needed to quit fossil fuels, and how the demand for certain crucial metals will push prices higher.

We believe we need to add a fifth: electrical transmission lines, including smart grids.

These five components will require high volumes of so-called battery metals and industrial metals. According to BNEF, the use of cobalt is expected to jump about 70% by 2030, while consumption of lithium and nickel for the battery sector will be at least five times higher. Other major beneficiaries of the green transition shift include copper, graphite, iron ore and steel. We discuss each component in turn.

Solar panels

According to BloombergNEF estimates, solar panels with the power capacity of 1 gigawatt of electricity will need about 18.5 tons of silver, 3,380 tons of polysilicon and 10,252 tons of aluminum.

Copper is also a key component of photovoltaic cells. A solar power plant contains approximately 5.5 tons of copper per megawatt of power generation. A single 660-kW turbine is estimated to contain some 800 pounds of copper.

Renewable power systems are at least five times more copper-intensive than conventional power.

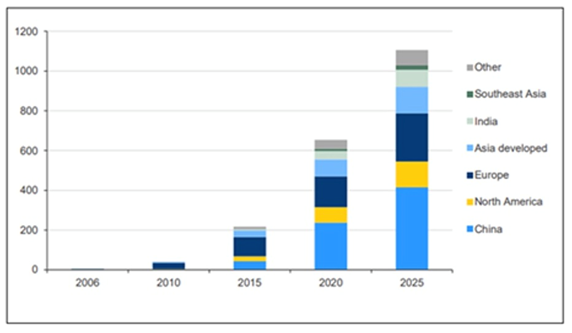

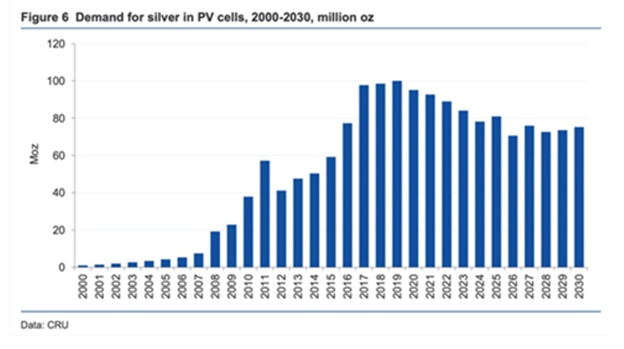

More and more silver is being demanded for use in PV cells, as countries move towards adopting renewable energy sources.

As the metal with the highest electrical and thermal conductivity, silver is ideally suited to solar panels. Silver paste within the solar cells ensure the electrons move into storage or towards consumption, depending on the need. It is estimated that about 100 million ounces of silver are consumed per year for this purpose alone.

This figure is expected to rise in the coming years, with continued growth of electricity demand and renewable energy aspirations all pointing to rising solar power penetration.

Historical and forecast solar capacity by region, 2006-2025. Source: The Silver Institute & CRU Consulting

Historical and forecast solar capacity by region, 2006-2025. Source: The Silver Institute & CRU Consulting

One projection has annual silver consumption by the solar industry growing 85% to about 185 million ounces within a decade, according to a report by BMO Capital Markets.

Coming off a record year despite the pandemic, the US solar industry will likely be one of the leading drivers of silver demand. Installations grew 43% year over year in 2020, reaching a record 19.2 gigawatts of new capacity. By 2030, solar installations are expected to quadruple from current levels, according to a report from the Solar Energy Industries Association and Wood Mackenzie.

As most solar panels used in the US come from Asia, the recent Biden administration ban on solar panels from China, over forced labor concerns, places the US solar industry in a bind, potentially sparking a surge in domestic silver exploration.

Wind turbines

Wind turbines and infrastructure with the power capacity of a gigawatt (1GW = 1,000 megawatts) need about 387 tons of aluminum, 2,866 tons of copper and 154,352 tons of steel, according to BloombergNEF estimates. Permanent magnets made of rare-earth metals like neodymium are commonly used in the generators found in offshore wind turbines.

A single 2-megawatt wind turbine weighing 1,688 tons comprises 1,300 tons of concrete, 295 tons of steel, 48 tons iron ore, 24 tons of fiberglass, 4 tons each of copper and neodymium and .065 tons of dysprosium.

The Manhattan Institute estimates that building a 100MW wind farm would require 30,000 tons of iron ore and 50,000 tons of concrete, along with 900 tons of non-recyclable plastics for the large blades. The organization says that for solar hardware, the tonnage in cement, steel and glass is 150% greater than for wind, to get the same energy output.

According to The Institute for Sustainable Futures at the University of Technology Sydney, Australia analyzed 14 metals essential to building clean tech machines, concluding that the supply of elements such as nickel, dysprosium, and tellurium will need to increase 200–600%. Read more on the challenges of transitioning to solar and wind

Lithium-ion batteries

For lithium-ion batteries to be able to store 1GW of energy, BloombergNEF estimates they will require about 729 tons of lithium, 1,202 tons of aluminum and 1,731 tons of copper.

The continued move towards electric vehicles is a huge copper driver. In EVs, copper is a major component used in the electric motor, batteries, inverters, wiring and in charging stations.

A recent Silver Institute report says battery electric vehicles contain up to twice as much silver as ICE-powered vehicles, with autonomous vehicles requiring even more due to their complexity.

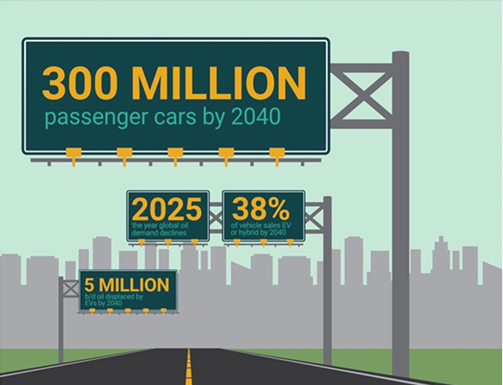

The Silver Institute anticipates that, due to the evolution of hybrid and battery electric vehicles, the auto industry is expected to absorb 90 million ounces of silver by 2025, rivaling silver consumption in photovoltaics, currently the largest application of global industrial silver demand.

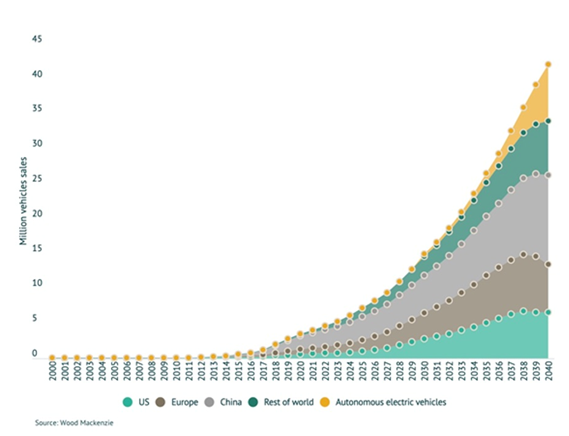

In its electric car forecast to 2040, Wood Mackenzie finds EV sales are expected to reach 45 million units per year in the next two decades, with a total global EV stock of 323 million.

For perspective, global EV sales in 2019 were only 2.1 million, with a stock of 7.2 million EVs, according to Global EV Outlook 2020.

And this just in: Adamas Intelligence reports that new global registrations of passenger vehicles increased 109% year on year during the first six months of 2021. In a new report, Adamas analysts found 4.16 million new units were registered in H1 versus just 1.99 million units during H1 2020.

Major automakers have set their sights on being climate neutral by 2050 and they view battery electric vehicles (BEVs) as the best way of achieving that target. Change is being driven, pun intended, by stricter vehicle emissions regulations.

While some may scoff at the wild predictions, progress is being made, according to Woodmac, on the obstacles to higher EV penetration.

“The projected price of battery packs keeps dropping. We expect the US$100/KWh threshold to be breached by 2024, one year earlier than our previous projections,” says Ram Chandrasekaran, Wood Mackenzie principal analyst.

Electric vehicle sales, 2000-2040. Source: Wood Mackenzie

Electric vehicle sales, 2000-2040. Source: Wood Mackenzie

Source: Wood Mackenzie

Source: Wood Mackenzie

Source: Wood Mackenzie

Source: Wood Mackenzie

In Europe, EVs are taking showrooms by storm. Last year for the first time, Europe sold more battery-electric and plug-in-hybrid EVs than China, with Germany and France leading the way.

The jump in electric vehicle registrations during the second half of 2020 meant a 175% increase in the watt-hours of batteries deployed, according to Adamas.

Globally, the amount of lithium deployed in newly sold vehicles jumped 96%, to 57,300 tonnes of lithium carbonate equivalent, over the same period. Nickel and cobalt deployed in world battery production during H2 2020 climbed 69% and 85% respectively, according to Adamas.

In 20 years BloombergNEF says copper miners need to double the amount of global copper production, just to meet the demand for a 30% penetration rate of electric vehicles. That means an extra million tonnes a year, over and above what we mine now, every year for the next 20 years!

As we have written, the combination of structural deficits, pent-up demand, and infrastructure build-outs, are the perfect storm for nickel and graphite.

NEF predicts demand for Class 1 “battery-grade” nickel is expected to out-run supply within five years, fueled by rising consumption by lithium-ion electric vehicle battery suppliers. Nickel’s inroads are due mainly to an industry shift towards NMC 811 batteries which require eight times the other metals in the battery. (first version NMC 111 batteries have one part each nickel, cobalt, and manganese).

Lithium-ion batteries contain 10 to 15 times more graphite than lithium. An average hybrid vehicle carries up to 10 kg of graphite and a plug-in EV has around 70 kg. Every million EVs require in the order of 75,000 tonnes of natural graphite. This represents a 10% increase in flake graphite demand.

The need for lithium batteries not only for EVs, but energy storage, handheld tools like drills, and an array of consumer electronics like cell phones and laptops, is almost certain to outstrip supply. Roskill expects total graphite demand over the next 10 years to grow around 5 to 6% per annum.

Charging stations

A fast, public electric vehicle charger typically needs 25 kilograms of copper, while a smaller residential charger needs about 2 kg, according to BloombergNEF estimates. Quoting from the above-mentioned piece:

Installations of public chargers—along highways, in grocery store parking lots or at fleet depots—jumped more than a third last year to bring the global total to 1.36 million nozzles. Today’s cost pressures pale in comparison to what might happen later this decade, with copper demand for chargers predicted by BNEF to surge.

Charger installations are set to increase rapidly to reach 309 million connectors by 2040, when the sector’s annual investment will top $590 billion.

Along with copper, charging points and charging stations are also expected to demand a lot more silver.

According to the Silver Institute, silver’s use in the automotive market will see a strong rebound in 2021, to just over 60Moz. It estimates the sector’s demand for silver will rise to 88Moz in five years as the transition from traditional cars and trucks to EVs accelerates. Others estimate that by 2040, electric vehicles could demand nearly half of annual silver supply.

Electricity transmission

An important part of the shift away from fossil fuels and the aging electricity grids they feed into, is the “smart grid”. Smart grids use technology that make energy integration easier and allow for a higher penetration of renewable energy. They are deemed essential for accelerating the use of fully electric vehicles and plug-in hybrids, and for storing energy from wind and solar installations.

The adoption of smart grid technology in developed and developing countries will boost demand for copper strips used in switchgear, devices that protect equipment and circuits from power spikes. Copper is the conductor material used in transformer windings, strips and busbars. Both power and distribution transformers use copper strips. Copper is the preferred conductor material for underground transmission lines operating at high voltages, while aluminum is preferable for wiring in residences, buildings, aircraft and appliances.

Looking ahead, 5G cellular technology is set to emerge as another major driver of metals demand.

A nationwide buildout of the 5G network will require a massive amount of investment in infrastructure upgrades, placing silver in a unique position to benefit. Semiconductor ICs/chips, both within smartphones and vehicles, are used to process the frequencies 5G requires, and as electronics continue to get smaller, this will require denser packaging technologies.

Copper is also a key component of the global 5G buildout. Even though 5G is wireless, its deployment involves a lot more fiber and copper cable to connect equipment.

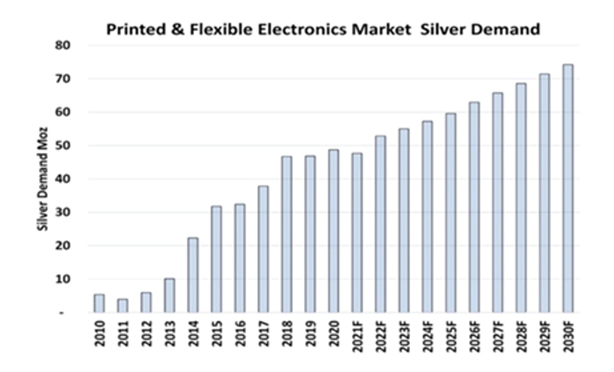

Finally, silver demand for “printed and flexible electronics” is forecast to increase 54% over the next nine years, rising from 48Moz in 2021 to 74Moz in 2030, meaning a consumption of 615Moz during this time frame.

A recent Silver Institute news release describes them as “mainstays” in a variety of electronic products, including sensors that measure everything from temperature, pressure and motion, to moisture, relative humidity and carbon monoxide. They are also used in medical devices, mobile phones, appliance displays and consumer electronics.

Printed and flexible electronics market silver demand. Source: Precious Metals Commodity Management LLC

Printed and flexible electronics market silver demand. Source: Precious Metals Commodity Management LLC

Political and market factors

Biden’s clean energy plans

Cleaning up the planet will not be possible without major reductions in carbon emissions from the two largest economies, the US and China.

President Biden is pushing forward on climate-oriented programs that distance himself from his predecessor and are a nod to the Democratic left that supported his bid for president.

Pro-environment actions so far include re-joining the Paris climate agreement; canceling the Keystone XL pipeline from Alberta to US Gulf Coast refineries; suspending new oil and gas leases on federal lands; and Biden’s commitment to the Leaders Climate Summit: cutting in half US emissions below 2005 levels by 2030.

Biden’s $1.2 trillion infrastructure package, passed by the Senate but not yet by the House of Representatives, includes transitioning the US transportation system to battery-powered vehicles and supporting renewable wind and solar energies over carbon-based sources like coal and natural gas.

The legislation includes rebuilding traditional infrastructure like highways, bridges and rail lines, and investing in technologies to reduce greenhouse gases. The latter includes installing thousands of EV charging stations, providing incentives to encourage Americans to buy more electric vehicles, and constructing new electric power lines that provide renewable energy and expand electricity storage.

The Biden administration is aiming for carbon-free power generation by 2035 and net-zero emissions by 2050.

The bill proposes nearly $550 billion in new spending over five years, setting aside $110 billion for “blacktop” infrastructure such as roads & bridges; $55 billion to replace lead pipes and ensure access to clean drinking water; $66B for upgrading passenger and freight rail; $65 billion for broadband; and $73 billion for clean energy.

An even larger $3.5 trillion spending package is also under consideration by the House. It includes:

- $198 billion in direct payments to utilities for hitting clean energy goals, providing consumers with rebates to make homes more energy-efficient, and financing for domestic manufacturing of clean energy and auto supply chain technologies;

- $67 billion to fund climate-friendly technologies and impose fees on emitters of methane, to reduce carbon emissions;

- $37B to electrify the federal vehicle fleet.

President Biden is showing himself to be far more adept than Trump when it comes to stick-handling large pieces of legislation through Congress. The veteran senator managed to achieve rare bipartisan support for his $1.2T infrastructure bill, despite initial widespread GOP opposition to it. As CNBC reported, The vote was the culmination of months of intense work by the White House and a bipartisan group of 10 senators, who negotiated a dizzying series of compromises that maneuvered the bill through a deeply divided Senate.

On Wednesday Biden launched “intensive in-person engagement at the White House”, according to CNN, with plans to meet with Democrats regularly in the days ahead including House Speaker Nancy Polosi and Senate Majority Leader Chuck Schumer. The Democrats aim to pass the infrastructure bill, a key piece of his domestic agenda, through the House this fall, followed by the $3.5T spending package.

And while Biden and his Commerce Department have yet to lift Trump-era sanctions on hundreds of billions worth of tariffs mostly directed at China, he is pursuing a conciliatory approach to America’s allies that many feel is necessary to rebuild relations following Trump’s brusque foreign-policy style.

In his first address to the United Nations this week, Biden urged global cooperation and said the US “is ready to work with any nation that steps up and pursues peaceful resolution to shared challenges, even if we have intense disagreements in other areas”.

In a nod to China, the president stressed the US is “not seeking a new Cold War or a world divided into rigid blocks”, and he signaled that the US is prepared to re-join the Iran nuclear deal.

Also in his address, President Biden said the US will increase funding to developing countries to $11.4 billion by 2024, and he finished his speech with a promise, in stark contrast to Trump, that America will lead “with our allies.”

Getting back to electrification metals, the more diplomatic tone Biden is setting domestically and globally bodes well for the large volume of metals expected to be needed to complete the kinds of large-scale infrastructure build-outs being contemplated not only in the US but in China, Europe and beyond.

At the Clean Energy Week Policy Makers Symposium, Sept. 20-24, veteran Alaska Senator Lisa Murkowsi said critical minerals are important to US national security and prosperity. She noted the country has the resources to mine them domestically, and singled out Alaska as having deposits of 30 of 35 critical minerals that have been identified by the US Geological Survey.

At present, the US is 100% reliant on imports of 13 critical minerals, including graphite, the second-largest battery component in electric vehicles by weight.

A White House report on critical supply chains showed that graphite demand for clean energy applications will require 25 times more graphite by 2040 than was produced worldwide in 2020.

Earlier this year, the Federal Permitting Improvement Steering Committee (FPISC) granted High-Priority Infrastructure Project (HPIP) status to Graphite One (TSXV:GPH), which is aiming to develop America’s first high-grade producer of coated spherical graphite (CSG), integrated with a domestic graphite resource at Graphite Creek, Alaska.

During her keynote address, Sen. Murkowski said “If they, Graphite One, were able to open tomorrow the US could go from being fully reliant on foreign countries for our graphite to Graphite One being able to supply nearly all our graphite demand.”

China

Along with the US, China is also moving forward rapidly on its plans to electrify and decarbonize. The country is the world leader in electric vehicles and battery production.

President Xi Jinping last fall announced the country is aiming for carbon neutrality by 2060. (carbon neutral means emitting the same amount of carbon dioxide into the atmosphere as is offset by other means)

With China being the world’s biggest source of carbon dioxide, responsible for around 28% of global emissions, Xi’s pledge was a significant step in fighting global climate change.

However, meeting its carbon-neutral goal and replacing fossil fuels will mean a 75% increase in electricity demand, and equates to a $6.4 trillion investment in new power generation capacity, according to a report from Wood Mackenzie quoted by South China Morning Post.

Growth will primarily come from solar, wind and energy storage, all of which will require copious metals.

China will continue to demand a high volume of mineral commodities needed for construction projects. China spends three times more on infrastructure than the US, claiming a million bridges including most of the world’s highest. Of the world’s 100 tallest skyscrapers, 49 are in China. The Wall Street Journal reported in April that in 2014, China used more cement in the previous three years than the US did during the entire 20th century. The country also produces more than half the world’s steel, 1ast year 14 times more than the US, according to the World Steel Association. China’s 23,000 miles of high-speed rail could link New York and Los Angeles more than eight times and Beijing plans to add 30% more track by 2025.

Of course we can’t forget President Xi’s Belt and Road Initiative. 2,600 infrastructure projects costing $3.7 trillion are linked to BRI, as of mid-2020. Think about how much metal that would entail.

Research commissioned by the International Copper Association, quoted by Mining Technology, found that Belt and Road projects in over 60 Eurasian countries will push the demand for copper to 6.5 million tonnes by 2027, a 22% increase over 2017 levels.

That much copper equates to nearly a third of the 20Mt of copper produced in 2020 — new copper supply that would need to be either mined from existing operations or discovered.

Europe

As mentioned Europe last year sold more battery-electric and plug-in-hybrid EVs than China. EU member states have reportedly begun submitting plans under the €750 billion ‘Next Gen’ deal. The four largest EU economies, Germany, France, Italy and Spain, account for almost half the budget of the program, which focuses on climate change and digital infrastructure.

Italy is especially vulnerable to climate-related change from rising sea levels, heat waves, drought and landslides, and will therefore spend the most, €205B, on mitigation measures. The Spanish government is earmarking €70B in EU grants, focusing on renewable energy and rail mobility (also healthcare and telecommunications), France’s ‘Next Gen’ spending targets green hydrogen, lowering carbon emissions, retrofitting the energy network and modernizing railways, and Germany will spend 40% of its €28B funding package on climate policy and energy transition spending, including hydrogen infrastructure.

Evergrande

Recently the global push to electrify and decarbonize was thrown a curveball in the form of the Evergrande crisis in China. As one of the country’s largest real estate developers, investors not only in Asia but worldwide are worried about “Asian contagion” should the company not receive a bailout from the Chinese government and become insolvent.

A meltdown in the Chinese property market could have widespread repercussions, potentially impacting the demand for construction commodities including copper, iron ore and steel.

It’s estimated around 1.5 million people could lose the deposits on their homes if Evergrande goes under. Then there are the companies that Evergrande does business with, like construction and design firms. They could potentially go bust if their deposits aren’t repaid. The effect on the country’s financial system could also be far-reaching; Evergrande reportedly owes money to around 171 domestic banks and 121 other financial firms.

However according to Bloomberg, Global markets were offered a reprieve from Evergrande contagion fears on Wednesday, as China’s central bank boosted liquidity and investors mulled a vaguely-worded statement from the troubled developer about an interest payment.

Despite all the “Chicken Little” headlines, I personally don’t believe Evergrande is another Lehman Brothers. A deal will be done to stabilize Evergrande’s debt and restructure bonds and loans by selling most of its assets; some investors will be repaid with real estate.

The health of the Chinese steel industry is good reason to think the markets are over-reacting to Evergrande. Take a look at rebar.

The Washington Post notes that, for all the government’s promises of [steel] output curbs, usage as of July this year was running nearly 10% higher still.

The price of the reinforcement bar used on construction sites is at almost the same elevated level it was two months ago, before its key ingredient — iron ore — starting falling and Monday drifted below $100 a tonne for the first time in over a year.

That suggests that end-use demand is still pretty much where it was before this panic started, which should deliver mill owners handsome profits, WaPo adds, concluding that, we’ve not yet seen the reckoning with its steel addiction that China, and the world, ultimately needs. Until that happens, don’t assume this market is dead.

The World Steel Association forecasts global steel demand to grow 5.8% this year to exceed pre-pandemic levels, followed by another 2.7% increase the year after. The association expects China’s steel consumption, about half of the global total, will keep growing from record levels.

Cement

Beyond China, the cement market is another sign that major infrastructure projects will be rolled out this year and over the short to medium term.

Despite covid-related construction slowdowns in 2020, global cement production was consistent with 2019 output. The biggest cement consumers last year were Vietnam, Indonesia, India and China.

According to IndexBox, between 2020 and 2030, the global cement market is set to expand at an average annual rate of 1.8% CAGR, reaching 5B tonnes by 2030.

Uranium

The global drive for increasing the amount of renewable energy and replacing fossil-fuel sources like coal and natural gas, continues to be limited due to the “intermittency” factor. Solar and wind power can only be generated when the wind blows and the sun shines, and grid-scale battery storage technology is still in its infancy.

Also, the additional megawatts of power needed to fill all of those lithium-ion batteries going into electric vehicles, along with a much higher level of grid-scale battery storage expected for renewable energy, implies a major increase in generative capacity. We know from previous articles that the mining industry will be challenged to meet the supply of copper in coming years, with shortages expected as early as 2025 without new copper mines coming onstream.

For these reasons, we need a form of electricity that bridges carbonized and decarbonized power, and the candidate is nuclear.

The global capacity for nuclear power is expected to grow by 27% between 2015 and 2030. Nuclear consultant UxC estimates annual uranium demand will spike by nearly 60%, from the current 190 million pounds of U3O8 to 300 million pounds by 2030.

The uranium market has been oversupplied for the past several years, which has weighed on the price, but recently it spiked to the highest level since 2015, due to a large investment from Sprott Inc. The asset management firm earlier this year launched its Physical Uranium Trust, and on Sept. 7 the trust hit $1 billion in assets. The company has reportedly amassed 24 million pounds of uranium, sometimes buying more than half a million pounds a day. In comparison, total spot volume for 2020 was 92.2 million pounds.

The spot price for U3O8, the technical name for the nuclear fuel, moved above $30 per pound in March for the first time since 2016, and it currently sits at $32.15/lb.

Source: YCharts

Source: YCharts

Conclusion

The United States is back in the fold of countries pledging to reduce greenhouse gas emissions, and that is helping to drive demand for an assemblage of metals that a global push to decarbonize and electrify is expected to require.

The new “green economy” rejects dirty sources of energy and transportation, namely coal, oil, and natural gas. Instead, it relies on carbon-friendly modes of transport and energy production, including electric vehicles, renewable power, and energy storage, as well as mobile technology (5G) and rapid adoption of artificial intelligence (AI) technologies needing increased computing power.

Transportation makes up 29% of global emissions, so transitioning from gas-powered cars and trucks to plug-in vehicles, as well as high-speed rail, is an important part of the plan to wean ourselves off fossil fuels.

However, to accomplish all of the above will require a colossal boost in the production of mined materials, including copper, silver, graphite, zinc, iron ore and steel.

Among the demand drivers of these “future-facing metals” are solar panels, wind turbines, lithium-ion batteries, charging stations and electricity transmission.

The Biden administration is gung-ho to advance major funding for clean and green energy programs which are included within the $1.2 trillion and $3.5 trillion spending packages that have passed the Senate and are currently before the US House of Representatives.

China and the European Union have grand plans of their own to decarbonize and electrify their economies, putting even more pressure on the mining industry to provide the necessary metals.

We also have to think about the developing world and its voracious demand for commodities. India for one, and Africa. According to the Center for International Policy, in 2035 the number of working-age people in Africa will exceed the rest of the world combined, and by 2050 one in four humans will be African. At 2100, 40% of the world’s population will hold a passport from an African country. Its citizens want what we as North Americans have. The World Bank estimates that Africa will need up to $170 billion in investment a year for 10 years to meet its infrastructure requirements.

As investors we need to be correctly positioned in the companies and sectors we choose. At AOTH we don’t get distracted by headlines like Evergrande and the US Federal Reserve increasing interest rates (it can’t, and won’t). We remain focused on the long game, of stable and buoyant demand for commodities. The next commodities supercycle is being driven primarily by “green” infrastructure investments but also traditional asset replacement including aging roads, bridges and water/ wastewater system. All of this requires millions of extra tonnes of copper, iron ore, steel, cement, etc.

We must acknowledge the demand curve going forward is not a straight line. There may be hiccups along the way but the overall trend is intact. Global demand for electrification metals and industrial metals are not going away. If anything they are increasing. We therefore remain focused on identifying and investing in junior mining companies that provide the best leverage to rising commodity prices.

Richard (Rick) Mills

aheadoftheherd.com

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.