The gold price stair-stepped its way broadly higher at an ever-decreasing rate until the collusive commercial short stepped in five minutes before the 8:20 a.m. COMEX open New York...the moment it broke above $4,400 spot...setting its engineered low tick about fifteen minutes after the 1:30 p.m. COMEX close. It was allowed to crawl a bit higher from that point until trading ended at 5:00 p.m. EST.

The high and low ticks in gold, both of which were set in New York, were reported as $4,414.80 and $4,319.70 in the February contract...and intraday move of $95.10 an ounce. The February/April price spread differential in gold at the close in New York was recorded by the CME Group as $32.30...April/ June was $32.60...June/August was $32.90 -- and August/October was $28.10 an ounce.

Gold was closed in New York on Friday afternoon at $4,330.30 spot...up $13.90 on the day. Net volume was definitely on the quieter side at about 136,500 contracts -- and there were a bit under 19,000 contracts worth of roll-over/over/switch volume on top of that.

I saw that 589 gold, plus 602 silver contracts were traded in January yesterday and, as is always the case, it remains to be seen just how much of these amounts show up in tonight's Daily Delivery and Preliminary Reports further down in today's column.

![]()

Silver's price was managed by 'da boyz' in a mostly similar fashion as gold's ...except for the fact that they really began to lean on the price starting at the 9:30 opens of the equity markets in New York on Friday -- and then set its low tick around 1:10 p.m. EST. It then wandered/chopped higher and under obvious close supervision until the market closed at 5:00 p.m.

The high and low ticks in silver were reported by the CME Group as $74.21 and $70.515 in the March contract...and intraday move of $3.695 an ounce. The March/ May price spread differential in silver at the close in New York yesterday was 55.3 cents...July/September was 48.0 cents -- and September/ December was 53.3 cents an ounce.

Silver was closed on Friday afternoon in New York at $72.771 spot...up $1.28/ 1.72% on the day. Net volume was very heavy at a bit under 89,000 contracts -- and there were around 13,300 contracts worth of roll-over/switch volume in this precious metal.

![]()

Platinum's broad, quiet and somewhat uneven stair-step rally ran into 'grief' at the 10 a.m. EST afternoon gold fix in London. It then had a broad, quiet, uneven and slightly descending down/up move that lasted until the market closed at 5:00 p.m. EST. Platinum was closed at $2,144 spot...up 78 dollars from Wednesday.

![]()

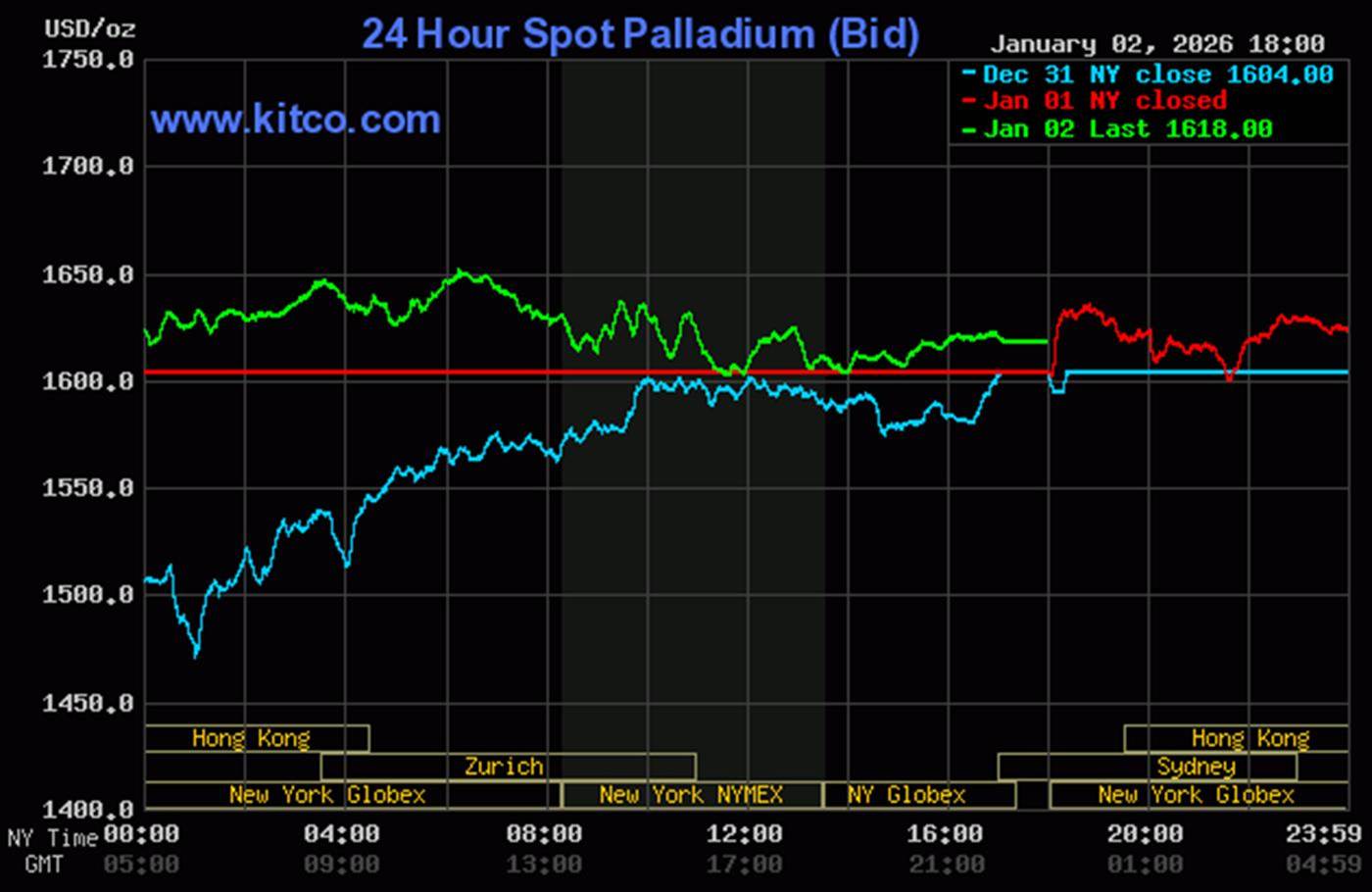

Palladium jumped higher at the 6:00 p.m. Globex open in New York on Thursday evening -- and was then sold lower until around 9:40 a.m. in Shanghai on their Friday. It then had a broad and quiet up/down move centered around 12:15 p.m. in Zurich -- and ending around 11:40 a.m. in COMEX trading in New York. It then crept a few uneven dollars higher until the market closed at 5:00 p.m. EST. Palladium was closed at $1,618 spot...up 14 bucks on the day.

Based on the kitco.com spot closing prices in silver and gold posted above... the gold/silver ratio worked out to 59.5 to 1 on Friday...compared to 60.4 to 1 on Wednesday.

Here's the 1-year Gold/Silver Ratio chart from Nick -- and updated with this past week's data. Click to enlarge.

![]()

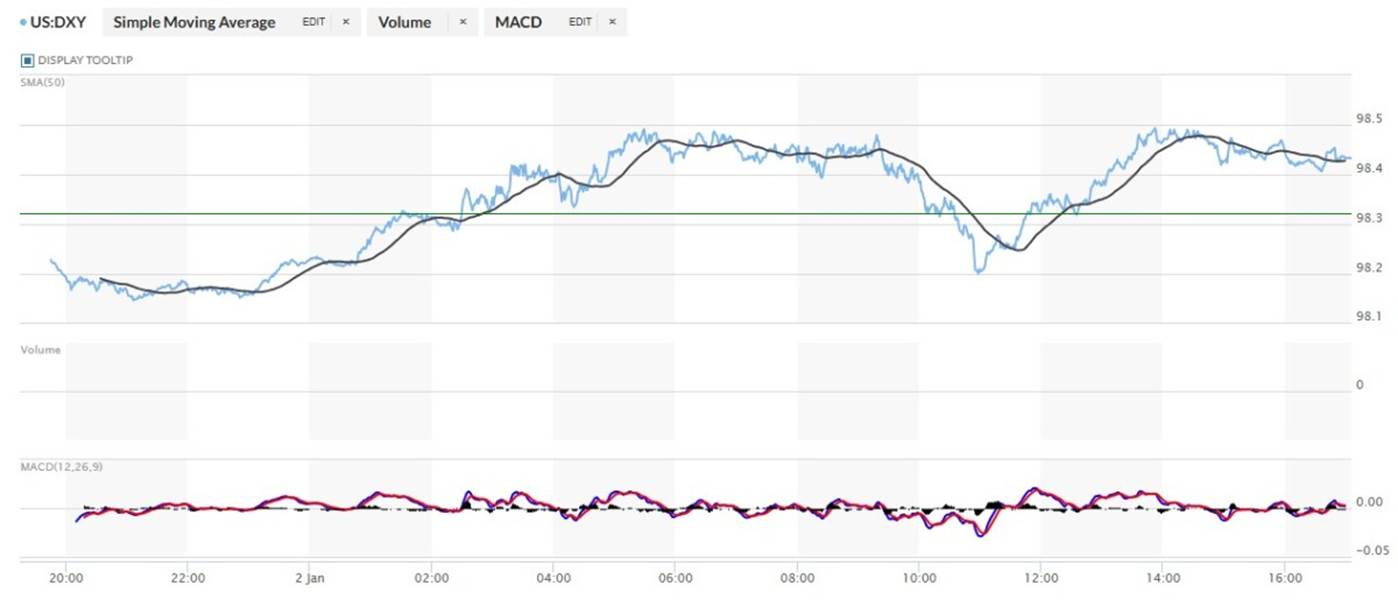

The dollar index closed very late on Thursday afternoon in New York at 98.32 -- and then opened lower by 9 basis points once trading commenced at 7:45 p.m. EST on Thursday evening...which was 8:45 a.m. China Standard Time on their Friday morning. It then sagged a bit until 10:08 a.m. CST -- and then began to stair-step its way higher until it topped out at the 10:28 a.m. morning gold fix in London. It didn't do much from that juncture until it began to head lower starting at 9:18 a.m. in New York -- and it looked like the usual 'gentle hands' saved it around 10:55 a.m. EST. Its ensuing 'rally' topped out around 1:50 p.m. -- and from that point it chopped quietly lower until shortly before trading ended at 5:00 p.m. EST.

The dollar index finished the Friday trading session in New York at 98.43...up 11 basis points from its close on Thursday.

Here's the DXY chart for Friday...thanks to marketwatch.com as usual. Click to enlarge.

![]()

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...98.44...and the close on DXY chart above, was 1 basis point above that. Click to enlarge.

![]()

It was yet another day where the currencies played no part in what was happening on the precious metals stage.

U.S. 10-year Treasury: 4.1870%...up 0.0240/(+0.5765%)...as of the 1:59:53 p.m. CST close.

For the holiday-shortened week, the ten-year closed higher by 5.1 basis points...despite the interventions by the Fed.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

As I keep pointing out in this spot every Saturday, the 10-year hasn't been allowed to trade above its 4.92% high tick set back on October 15, 2023...but I still suspect that we've seen the 3.9482% low for this cycle...which was set back on October 22, 2025. QT came to an end a month ago -- and more rate cuts in 2026 are expected...as is the return of QE.

![]()

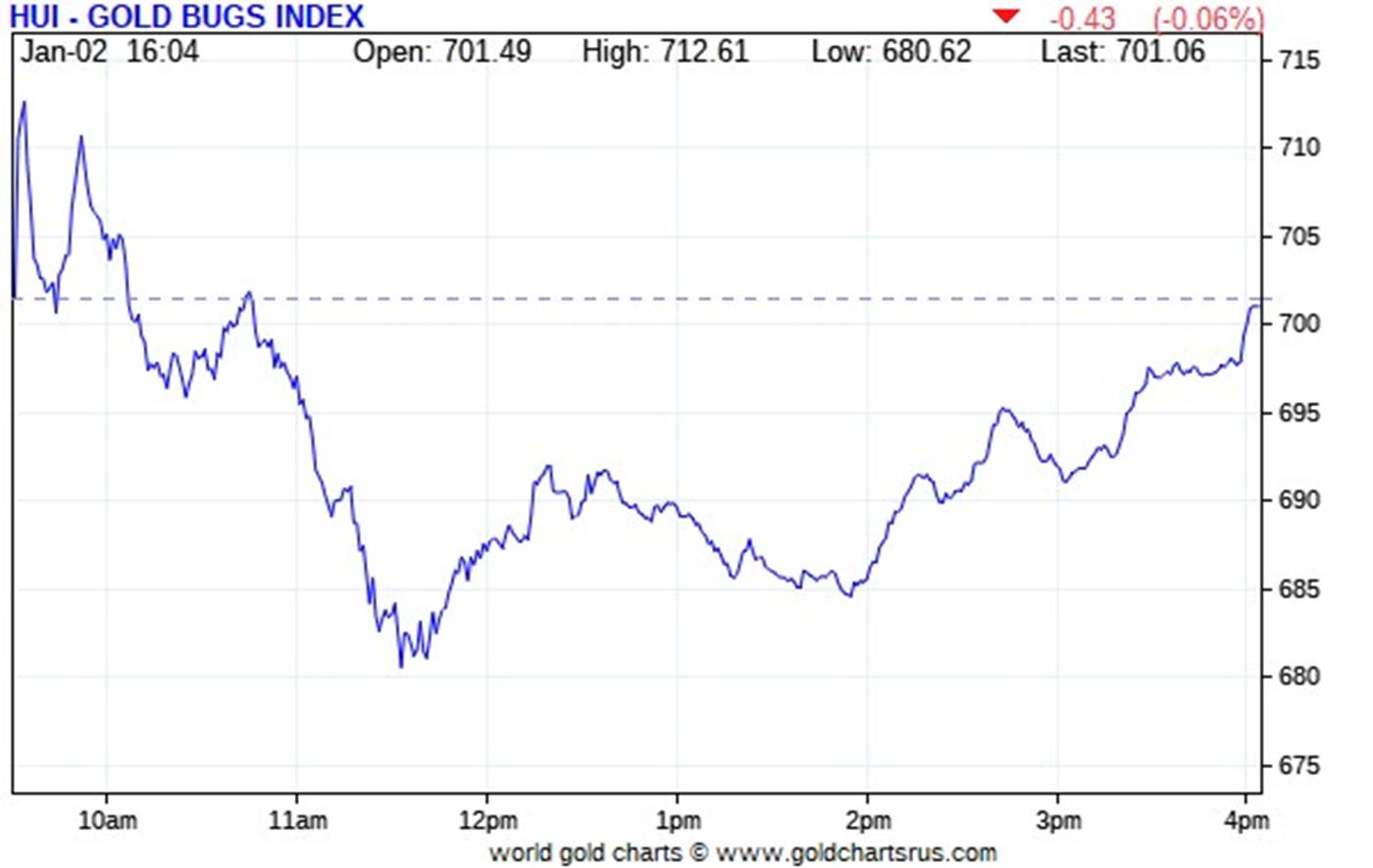

The gold shares rally attempts in early trading in New York on Friday morning were both met with resolute selling -- and they bottomed out shortly after 11:30 a.m. EST. They then proceeded to wander quietly higher until the markets closed at 4:00 p.m. Despite the fact that 'da boyz' ensured that gold closed well down on the day, the HUI only closed lower by 0.06 percent.

![]()

Once again -- and despite the fact that silver vastly outperformed gold on Friday, the silver shares hugely underperformed their golden cousins, as Nick Laird's Silver Sentiment Index closed down 2.01 percent. Click to enlarge.

![]()

The two 'stars' were Wheaton Precious Metals and Silvercorp Metals, closing higher by 0.30 percent -- and unchanged on the day. The two biggest dogs were Avino Silver & Gold Mines -- and Peñoles -- closing down 4.15 and 4.67 percent respectively.

Not surprisingly, I didn't see any news on the thirteen silver stocks that make up the above Silver Sentiment Index.

In the interest of full disclosure, I just want you to know that I 'walk the walk' as well as 'talk the talk'. I always recommend that newbie investors not try to rifle shoot the silver equities sector by buying individual stocks...but buy SILJ if they live in the U.S...or NinePoint Silver Equities Fund if they live in Canada...as they both hold a broad basket of silver stocks. I invested another decent chunk of money in Ninepoint yesterday...as I've been a shareholder in it for years already.

The silver price premium in Shanghai over the U.S. spot price on Friday was 5.05 percent.

The reddit.com/Wallstreetsilver website, now under 'new' and somewhat improved management, is linked here. The link to two other silver forums are here -- and here.

Normally I would post the weekly, month-to-date and year-to-date charts in this space...but with the New Year only one day old, I've decided to pass on them. Besides which, I posted the month and year-to-date charts for all of 2025 in Thursday's year-end missive.

The CME Daily Delivery Report for Day 3 of January deliveries showed that 338 gold, plus 150 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the only short/issuer that mattered was Canada's BMO [Bank of Montreal] Capital, issuing 322 contracts out of its house account. The largest long/stopper by far was Wells Fargo Securities, picking up 227 contracts for their house account. The next three down the list were Canada's Scotia Capital/ Scotiabank, JPMorgan and Citigroup, stopping 40, 32 and 29 contracts ...JPMorgan for their client account.

In silver, the only short/issuer that mattered was StoneX Financial, issuing 119 contracts out of it client account. The largest long/stopper was Citigroup, picking up 54 contracts for clients -- and the next three down the list were JPMorgan, Morgan Stanley and StoneX Financial...stopping 31, 27 and 24 contracts respectively...JPMorgan for their client account.

In platinum, there were an astonishing 1,163 contracts issued and stopped -- and the only short/issuer that mattered was JPMorgan, issuing 1,142 contracts out of its client account. The list of long/stoppers was impressive!

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date, only three delivery days old, there have already been 4,249 gold, plus 3,596 silver contracts issued and stopped...424,900 troy ounces of gold -- and 17.980 million troy ounces of silver.

The CME Preliminary Report for the Friday trading session showed that gold open interest in January increased by 419 contracts, leaving 1,175 still open...minus the 338 contracts out for delivery on Tuesday as per the above Daily Delivery Report. Wednesday's Daily Delivery Report showed that 136 gold contracts were actually posted for delivery on Monday, so that means that 419+136=555 more gold contracts just got added to January deliveries. That's a lot!

Silver o.i. in January fell by 1,124 COMEX contracts, leaving 1,177 still around...minus the 150 contracts out for delivery on Tuesday that were mentioned a bunch of paragraphs ago. Wednesday's Daily Delivery Report showed that 1,168 silver contracts were actually posted for delivery on Monday, so that means that only 1,168-1,124=44 more silver contracts were added to January deliveries.

Total gold open interest in the Preliminary Report on Friday night increased by 6,339 COMEX contracts. Total silver o.i. dropped by 3,162 contracts...short covering perhaps...hopefully.

[I checked the final total open interest number for gold for Wednesday -- and it had barely moved...from -5,183 COMEX contracts, down to -5,395 COMEX contracts. Final total silver o.i. for Wednesday rose an immaterial amount...from -3,951 COMEX contracts...up to -3,819 contracts.]

Gold open interest inFebruary in the CME's Preliminary Report on Friday night increased by 3,387 contracts, leaving 331,055 COMEX contracts still around -- and silver o.i. in February rose by 57 COMEX contracts, leaving 1,687 still open. I expect some adjustments in both numbers in the CME's final report on Monday...gold in particular.

![]()

There were an impressive 174,703 troy ounces of gold removed from GLD yesterday -- and there were no reported changes in SLV.

The SLV borrow rate started the Friday session at 1.27% -- and closed at 0.71% ...with 10.0 million shares available to short by the end of the day. The GLD borrow rate began the day at 0.56% -- and finished it at 0.57%...with around 7.1 million shares available.

In other gold and silver ETFs and mutual funds on Earth on Friday ...net of any changes in COMEX, GLD and SLV activity, there were a net 21,149 troy ounces of gold added...but a net 2,314,741 troy ounces of silver were removed -- and mostly because of the 2,468,082 troy ounces that left iShares/SSLN.

And nothing from the U.S. Mint of course.

![]()

There was big activity in gold for the last business day of the month... Wednesday...as there were 147,444.486 troy ounces/4,586 kilobars reported received over at the COMEX-approved depositories on the U.S. east coast on that day. The largest amount by far were the 122,173.800 troy ounces/ 3,800 kilobars dropped off at Brink's, Inc...with the remaining 25,270.686 troy ounces/ 786 kilobars finding a new home over at Manfra, Tordella & Brookes, Inc. There was no 'out' or paper activity -- and the link to this is here.

There wasn't much activity in silver, as 351,546 troy ounces were received -- and all of that amount showed up at Brink's, Inc. There were 3,988 troy ounces/ four good delivery bars shipped out of Delaware

![]()

There was fairly decent paper activity, as 899,248 troy ounces were transferred from the Registered category and back into Eligible...601,775 troy ounces/one truckload over at CNT -- and the remaining 297,472 troy ounces making the same trip over at StoneX.

The link to Wednesday's COMEX silver action is here.

The Shanghai Futures Exchange was closed on January 1 -- and again yesterday...so there's no updated silver inventory data available.

![]()

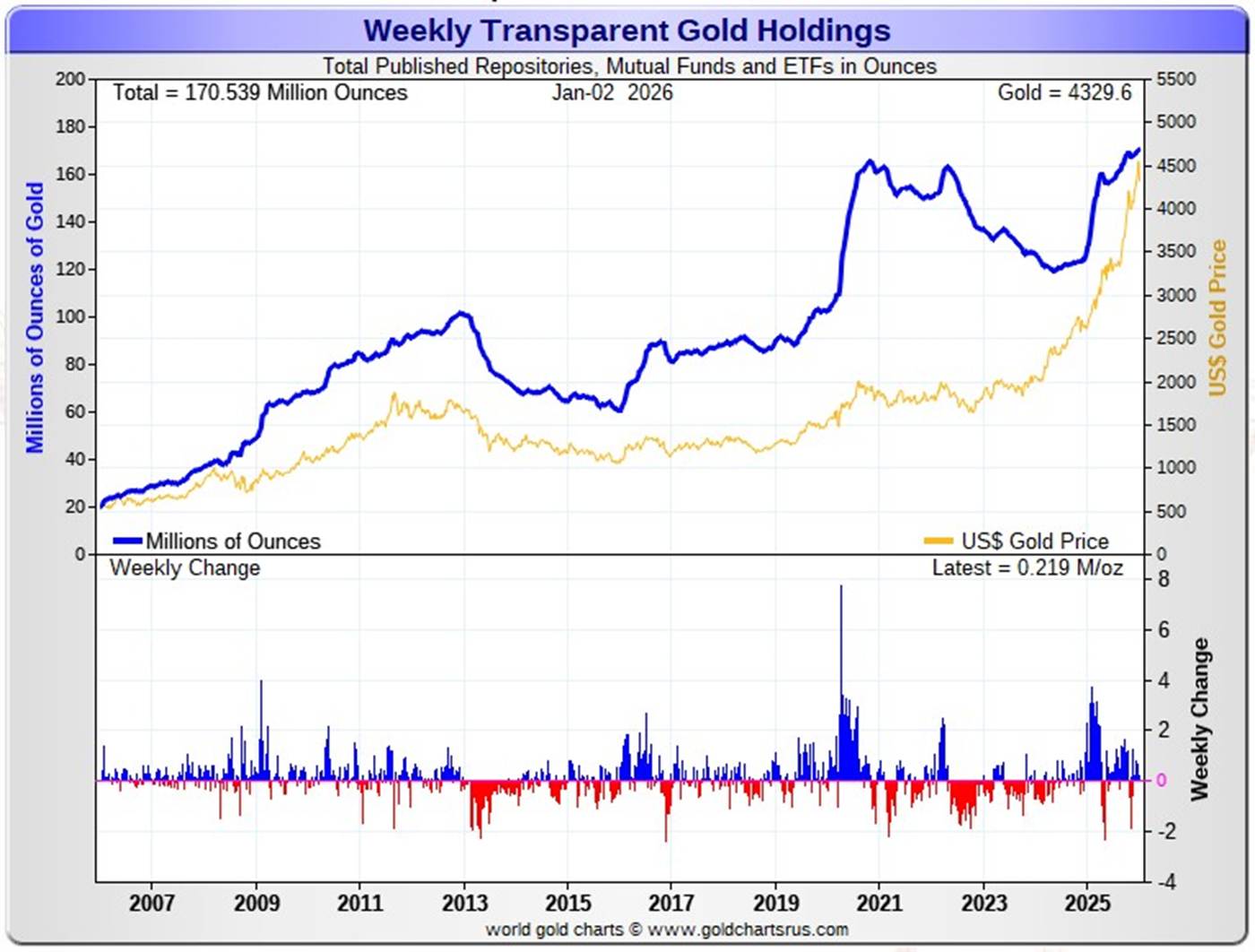

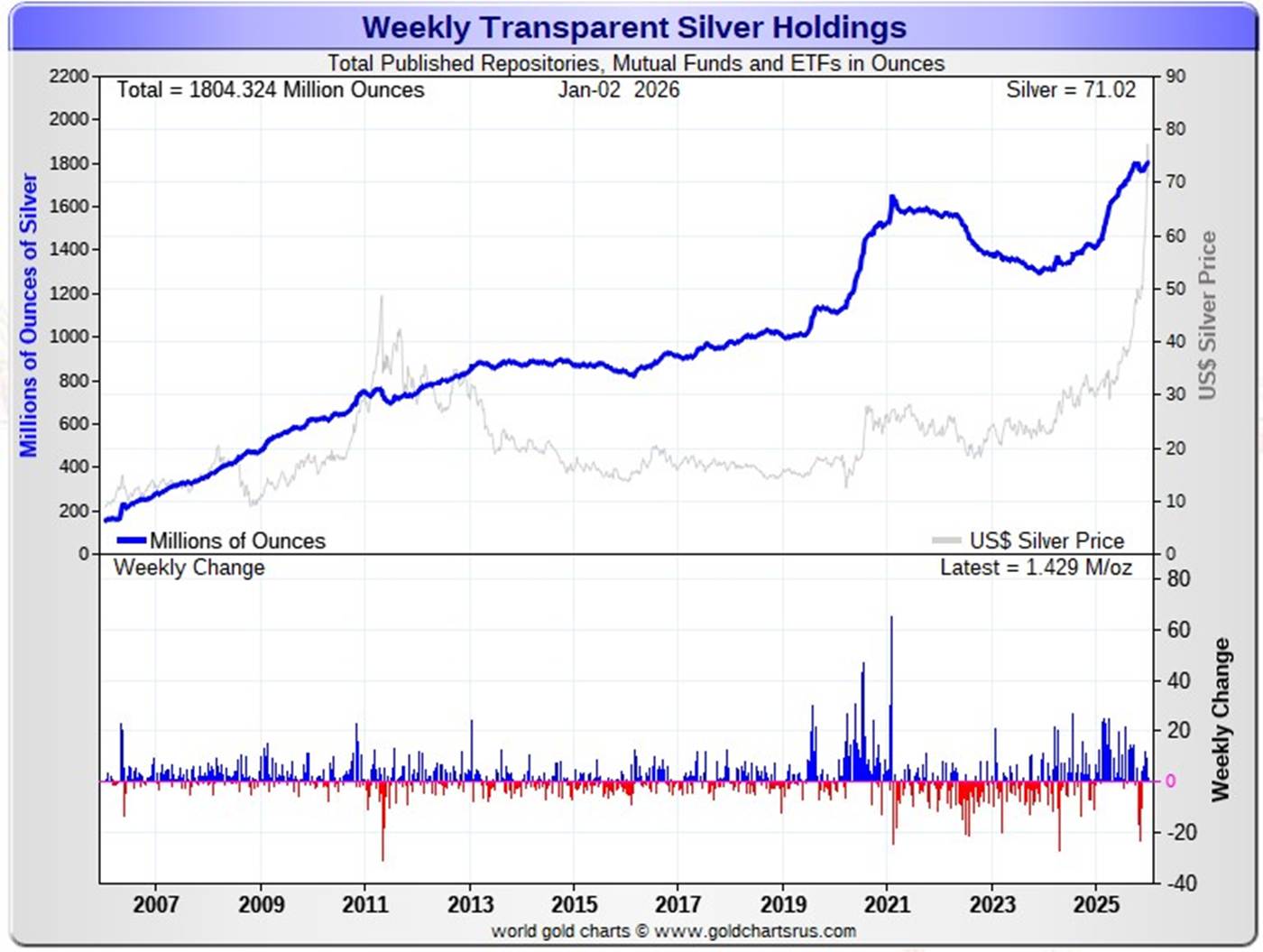

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all known depositories, ETFs and mutual funds as of the close of business on Friday.

During the business week just past, there were a net 219,000 troy ounces of gold added -- and a net 1.429 million troy ounces of silverwere added as well.

According to Nick Laird's data on his website, a net 2.129 million troy ounces of gold were added to all the world's known depositories, mutual funds and ETFs during the last four weeks. The two largest 'in' amounts were the 637,400 troy oz. that went into GLD, followed by the 540,100 troy ounces into China's gold ETFs. Next were the 266,500 oz. into iShares/IAU. The largest 'out' amount were the 129,100 troy ounces that left Invesco's SGLD.

The amount of gold in all the world's ETFs and mutual funds remains barely above its old all-time high of late 2020...but should be far higher, more than double its current amount, considering that gold is now some distance north of $4,300 the ounce...far more than twice the price it was back then. Why it isn't, is beyond me.

A net 20.194 million troy ounces of silver were also added during that same 4-week time period.

The biggest 'in' amount over that four-week period were the 11.243 million troy ounces shipped into SLV...followed by the 7.790 million oz. into Aberdeen. Next were the 5.000 million oz. into Sprott's PSLV -- and the 4.708 million oz. in India's ETFs. The only 'out' amount that mattered were the 7.447 million that left the COMEX...followed by the 1.383 million oz. out of iShares/SSLN.

It should be noted that the amount of silver held in all these depositories, ETFs and mutual funds is a noticeable amount above its old all-time high inventory level of January 2021. But it should be far higher than it is as well, because silver is also handily more than double the price it was back then.

Back at its previous inventory peak in late January 2021, silver was around $27 an ounce. Now its $72 the ounce. Why the precious metal ETFs aren't doing better is a mystery for which I have no answer. Maybe there's a lag time I'm not factoring in. But it's a given that the powers-that-be in the precious metals world are happy they aren't. However, having said that, the amount of silver being gobbled up by these ETFs and mutual funds is enormous...5+ million oz. per week on average...two plus days of weekly mine production. How long can this continue, without something blowing up? But maybe that's what in the process of happening.

Retail sales are doing much better -- and it's now obvious that some of the more popular products are getting hard to come by. Here in Canada, the price of a 1 oz. Canadian maple leaf is CAN$100...simply amazing.

Physical demand in silver at the wholesale level remains enormous/ rapacious. COMEX silver deliveries have been huge all year.

In December there were 3.706 million troy ounces of gold...plus 64.730 million troy ounces of silver issued and stopped. So far in January, a non-scheduled delivery month for both silver and gold, there have already been 424,900 troy ounces of gold issued and stopped -- and that number in silver is 17.980 million troy ounces. These are numbers that I mentioned further up in today's missive.

The "rapacious" silver demand mentioned two paragraphs ago will continue until available supplies are depleted -- and we're now at the start of the sixth year of a structural deficit in silver according to the ongoing reports from The Silver Institute.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 210.7 million troy ounces...up 1.9 million troy ounces on the week -- and a great distance behind the COMEX, which has now been demoted to the second largest silver depository, where there are 449.8 million troy ounces being held...up about 100,000 troy ounces this past week...but minus the 103 million troy ounces being held in trust for SLV by JPMorgan.

That 103 million ounce amount brings JPMorgan's actual silver warehouse stocks down to around the 85 million troy ounce mark...quite a bit different than the 188.3 million they indicate they have...unchanged on the week.

PSLV remains a very long way behind SLV as well -- now the largest silver depository...with 528.7 million troy ounces as of Friday's close...up a further 1.7 million ounces from last week.

The latest short report [for positions held at the close of business on Monday, December 15] showed that the short position in SLV rose by 17.87%...from the 43.65 million shares sold short in the prior report...up to 51.45 million shares in this latest short report that came out this past Wednesday...8.82% of total SLV shares outstanding. This amount is grotesque, obscene -- and fraudulent beyond all description...as there is no physical silver backing any of it as the SLV prospectus requires.

BlackRock issued a warning five or so years ago to all those short SLV that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it. However, we are far beyond that point now, as the short position in SLV will never be covered through the deposit of physical silver, as it just doesn't exit -- and never will. And if it does exist, it will only be available at a price far higher than what's being quoted in the public domain now. Those short SLV shares are in equal dire straits as those short silver in the COMEX futures market.

The next short report...for positions held at the close of trading on Wednesday, December 31 will be posted on The Wall Street Journal's website on Monday afternoon EST on January 12...a lifetime away in this market.

Then there's that other little matter of the monster short position in silver and gold held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away. He wrote an article about this back in April 2021 headlined "A New Piece of the Puzzle" -- and linked here.

In the article, the OCC Report stated that BofA had $8.3 billion in precious metal derivatives at the end of Q4/2020 -- and as you'll see in the paragraphs that follow, the BofA's derivatives position is now up to $47.9 billion as of the end of Q3/2025...an almost six-fold increase -- and all because of the increases in the price.

A while after that article came out, he also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well. Once the silver price approaches three digits -- and gold hits $5,000...we'll see if they need to get taken over, like Bear Stearns did back in 2008 -- and for the same reason.

The latest OCC Report for Q3/2025 was posted on their website on Friday, December 19 -- and it showed that the precious metal derivatives held by the four largest U.S. banks increased by $137.54 billion/24.4% from Q2/2025...up to $704.05 billion...which is a very hefty amount.

JPMorgan's precious metals derivatives rose from $358.5 billion, up to $437.4 billion from Q2/2025 -- and Citigroup's also rose...from $150.7 billion, up to $204.3 billion. BofA's increased by a tiny bit...from $44.7 billion, up to $47.9 billion -- and the derivatives position held by Goldman Sachs is a piddling and immaterial $614 million -- up from the equally piddling $219 million it held in Q2/2025.

But with JPMorgan holding 62.1% of all the precious metals derivatives... Citibank holding 29.0% -- and Bank of America about 7% of the total of the four reporting banks, it's only JPMorgan and Citigroup that matter.

But the caveat to the above would be the precious metals derivatives position held by Wells Fargo and Morgan Stanley. The reason that their data is not included, is because they are not one of the USA's four largest banks by total derivatives held. But you can bet your entire net worth that they hold also hold a derivatives position in the precious metals that would choke a horse...Wells Fargo in particular.

This would indicate that these six U.S. banks held a derivatives position in the precious metals something north of $1Trillion dollars at the end of Q3/2025 -- and is more than comfortably above that amount now.

But as I keep pointing out in this spot every weekend -- and mentioned just above...the OCC indicator is flawed for two very important reasons, as way back 10-15 years ago, this report used to include the top dozen or so U.S. banks -- and included the likes of Wells Fargo and Morgan Stanley, amongst others...that hold derivatives positions, both long and short, in the precious metals. Now the list is down to just four banks...so a lot of data is hidden... which is certainly the reason why the list was shortened. On top of that, the list doesn't include the non-U.S. banks that are short and long the precious metals in the COMEX futures market: British, French, German, Canadian -- and Australian.

Including all theirs, the derivatives/paper held in the precious metals...mostly on the short side...is an eye-watering multi-trillion dollar number...which can never be covered, either in the paper market, or through the deposit of physical metal...without driving the prices of all four precious metals beyond the moon in the process.

The next OCC Report for Q4/2025 won't be due out until sometime around the end of March 2026.

Because of the New Year's holiday, there was no Commitment of Report yesterday. It will come out on Monday -- and I'll have it for you in my Tuesday missive. The next Bank Participation Report is due out on Friday, January 9 -- and I eagerly await what's in that.

![]()

CRITICAL READS & VIDEOS

Trading at year-end and the start of a new year can be intriguing. I tend to de-emphasize market action during a year’s final couple weeks of trading. There is the typical “Santa Clause rally” markup dynamic to enhance performance, bonuses, and hedge fund payouts. What’s more, tax loss selling often pressures the year’s underperforming stocks and sectors.

January trading can be fascinating. Hefty early-year inflows traditionally support stocks. But January markets can also be buffeted by significant portfolio reallocations and strategy adjustments. Early 2022 trading comes to mind. At January 24th intraday lows, the S&P500 was down 11.5% month-to-date, losses that increased to 13.7% at February 24th lows. The Nasdaq100 (NDX) lost 8.5% during January 2022. Early selling portended a tough year for stocks. At October 13th 2022 lows, the S&P500 had suffered a 27% decline (S&P500 returned negative 18.1% in ’22). The Nasdaq100 ended 2022 down 33%.

A poor 2022 was preceded by a stellar 2021. And while the NDX returned 27.5% during 2021, late-year trading dynamics flagged market vulnerability. Heightened volatility saw two pullbacks (7.3% and 5.5%) in the late-November through mid-December period. But between December 20th and 28th, a swift 7% rally locked in big 2021 returns. The year-end rally would be reversed in January’s first five trading sessions.

Year-end 2025 trading dynamics were reminiscent of 2021. A big performance year was under threat from late year market instability - by two bouts of selling in particular. Between November 3rd highs and November 21st lows, the NDX dropped 8.7%. And then between December 10th highs and lows from the 17th, the NDX was 4.6% lower. The index then rallied 4.3% from lows on the 17th to December 26th highs.

Looking back a few weeks, there were indications of developing market cracks. Bitcoin traded at an intraday low of 84,413 on December 18th – down a third from the October 6th high. Cryptocurrencies were at the cusp of breaking below November lows, which would likely trigger another wave of selling. And with the proliferation of crypto “basis trades” and myriad levered strategies, a major cryptocurrency de-risking/deleveraging would be systemically relevant.

Between December 8th and 17th, Oracle CDS surged 40 to 156 bps – the high back to financial crisis 2009 (began Q4 at 57). Over this period, CoreWeave bond yields spiked 180 bps to 12.27% (began Q4 at 8.30%).

The AI mania/arms race/Bubble began fraying at the edges. OpenAI reciprocal agreements. Massive unending financing requirements, increasingly relying on Credit market borrowings. Electricity. Accounting. Inflating data center buildout costs. Opaque and suspect returns on investment. Mounting public backlash. “Jitters Over AI Spending Set to Grow as US Tech Giants Flood Bond Market.”

Doug's weekly commentary is always worth your while if you have the interest -- and this one was posted on this website late on Friday evening PST. The link to it is here.

![]()

Is Cash Now Trash? (vs. Gold, Silver & Bitcoin) | Lawrence Lepard

Lawrence/Larry is one of only a very small handful of commentators that I have any time for at all. This no nonsense call-a-spade-a-shovel interview with host Adam Taggart appeared on the youtube.com Internet site on December 31 -- and is definitely worth your time. If you can believe it, I found it all by myself -- and another link to it is here.

![]()

Silver keeps ripping as debt fears and tensions push new records

Silver has turned into the breakout story of global markets, ripping higher as investors scramble for protection from swelling debt loads and a more dangerous geopolitical backdrop. The metal has not only outpaced gold, it has shattered historical relationships and forced traders to rethink what "safe haven" really means in a world of fiscal strain and conflict risk.

Behind the fireworks is a potent mix of fear and fundamentals: worries about currency debasement, a rush into hard assets, and a genuine squeeze in physical supply. I see those forces converging into a feedback loop that has already delivered triple‑digit gains and could keep volatility elevated well into 2026.

For years, silver was the underachiever of the precious‑metals complex, overshadowed by gold's four‑figure price tag and central‑bank cachet. That changed dramatically in 2025, when silver prices soared 169%, turning a once‑sleepy market into one of the most aggressive trades on the board. The move has been powerful enough that an ounce of silver briefly commanded more attention than some high‑flying tech stocks, a reversal that would have seemed far‑fetched only a few years ago.

The scale of the repricing is underscored by the fact that, for the first time in recorded history, an ounce of silver has been treated in markets as a record‑breaking store of value in its own right, a shift captured in a December snapshot that described how this "Something unusual" moment marked a turning point in how investors weigh hard assets. That "For the first time" framing matters, because it signals a psychological break from the old hierarchy where gold was the only serious refuge and silver was a speculative sidecar.

This silver-related article from The Daily Overview website was picked up by msn.com on January 1 -- and I thank Bill Moomau for pointing it out. Another link to it is here.

![]()

China names companies allowed to export silver, tungsten, and antimony

China today named the companies that will be able to export tungsten, antimony, and silver during the 2026 and 2027 period, metals Beijing deems as critical to support its own industries.

A total of 44 companies will be allowed to export silver, while the numbers for tungsten and antimony will be 15 and 11 respectively, the Ministry of Commerce said in a statement. That's two more than in 2025 for silver, while tungsten and antimony are unchanged.

Citing national security, China in the past two years has imposed a wave of restrictions to leverage its dominance in the mining and processing of critical minerals used in everything from smartphones and electric car batteries to infrared missiles and ammunition, in response to U.S. chip restrictions and tariffs.

This Reuters story from Tuesday was something I found in a GATA dispatch -- and another link to it is here.

QUOTE of the DAY

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

![]()

Today's pop 'blast from the past' is one I've featured at least once last year -- and I want to start the New Year off with it as well. Never in a million years did I think that the cover of this iconic rock classic could come close to matching the original...but this one surpassed it, at least in my opinion -- and the link to it is here.

Last week's classical 'blast from the past' was my desert island recording of Rachmaninoff's Piano Concerto No. 2 -- and this week it's my desert island recording of Mozart's Requiem Mass in D minor, Kv. 626. The story behind this composition is steeped in some mystery and intrigue -- and was the basis of Peter Schaffer's 1979 play 'Amadeus'...which Miloš Forman turned into a movie five years later. It was nominated for 53 awards -- and won 40 of them.

As one comment stated..."This is the voice of God on earth. It’s the best version of the Requiem you’ll hear in the last 100 years." -- and another [about the tenor]..."This was Boris Johnson's former job before he became U.K. Prime Minister"...the absolute truth...LOL!

The choir is the Arsys Bourgogne -- the soprano is German-born Dorothee Mields -- and the other three solists aren't named. The Maestro is Luxembourg-born Pierre Cao. This is as good as it gets. The link is here.

![]()

As I pointed out at the top of today's column, the collusive commercial shorts of whatever stripe stepped on the gold price minutes after it broke above $4,400 spot, which happened five minutes before the COMEX open in New York. Silver's rally that began at 8:30 a.m. EST was capped and engineered lower starting right at the 9:30 opens of the equity markets in New York yesterday. Nothing free-market about any of that.

Volumes in both were lighter that normal...if one can call 99,463 contracts traded in March...'light'. It was just lighter than it has been of late.

There was a bit of backwardation in silver. At the close in New York yesterday its spot price was $72.89 -- and it last traded in the March contract at $72.265. But at its 'settle' price in March on the CME's website last night, the silver price was shown as $71.015 an ounce.

Platinum and palladium, like silver, were both allowed to close up on the day...but like the other two precious metals, would have closed massively higher if 'da boyz' hadn't been ever vigilant.

All four precious metals are now well below overbought on their respective RSI traces -- and in the case of gold and palladium...are back at market neutral. The only thing that remains to be seen is if 'da boyz' are determined to cover more of their short positions in the very short term. If that turns out to be the case, then there may be a bit more price pain in our future before this current iteration of the all-too-familiar 'wash, rinse & spin' cycle comes to an end.

Copper didn't do much...trading in 9.2 cent price ranges -- and finished the Friday session higher by 0.8 cents at $5.647/pound.

Natural gas [chart included] closed lower by 4 cents at $3.64/1,000 cubic feet -- and is now only 7 cents above its 200-day moving average. WTIC traded in a $1.33 price range on Friday -- and closed down a dime at $57.32/barrel.

Here are the 6-month charts for the Big 6+1 commodities as of the COMEX close yesterday...thanks to stockcharts.com as always. They fixed the Wednesday candle for gold...but the silver chart only shows the closing prices for both Wednesday and Friday...not their respective intraday moves. Hopefully they'll have that sorted out by Monday. Click to enlarge.

As I pointed out in Thursday's column, despite the big bear raids in the four precious metals since Christmas, the shorts are still screaming in pain -- and as I've been pointing out over the last several days, 'da boyz' came in to save the day for as many shorts as possible...especially the larger commercial traders that were faced with eye-popping and most likely calamitous margin calls of the kinds that sunk Bear Stearns back in 2008.

Bill King of the King Report fame had something to say about this earlier this week -- and again, extensively, in his Friday commentary yesterday...

"Someone ‘systemically important’ must be in big-time trouble on silver (maybe gold) shorts!

Late Tuesday night, the CME announced that it would raise margins on precious metals, again, after the close on Wednesday. This is the second margin hike on precious metals in about 48 hours!

CME Hikes Precious-Metal Margins Again After Wild Price Swings – BBG 20:47 ET

CME Group will raise margins on precious-metal futures for the second time in the space of a week…

Margins for gold, silver, platinum, and palladium contracts will increase after the close of business on Wednesday, the group said in a statement dated Dec. 30. The decision was made based on a review of “market volatility to ensure adequate collateral coverage,” it said…

March Silver plunged 10% (1 ET). After a robust rebound, someone pounded March silver in the afternoon, pushing it to 69.255 (-11.11%) at 15:02 ET. This was obviously a manipulation by someone short silver that needed to mark it as low as possible to end 2025.

February Gold fell as much as 2.3%; but it rebound from the daily low of 4284.30 at 0:50 ET to 4367.80 at 9:54 ET. February AU then eased lower but was NOT pounded like silver. This strongly implies that there are NO problem AU shorts in “systemically important” banks.

Despite the suspicious CME margin hike on precious metals and subsequent precious metals tumble, U.S. big banks declined – and all major equity indices were negative. The CME claims it hiked precious metal margins due to arrest violent price swings. But it created larger price swings with the margin hikes! It’s clear the CME wanted to halt higher prices. Who ordered this? Qui bono?

@MPelletierCIO: The CME can squeeze the spec longs out in paper markets, but it doesn't stop the physical demand for the commodity at much higher prices. The more this continues, the greater the arb."

As I've said several times in the wake of this price smash...silver analyst Ted Butler's "Bonfire of the silver shorts" was in the process of going supernova -- which would have brought a lot of financial institutions in the west to their knees. This was 100% the reason why 'da boyz' did what they did, when they did.

And while on the subject of the precious metal price management scheme, I'm going to resurrect British economist Peter Warburton's three classic paragraphs from his April 2001 article headlined "Debasement of World Currency: It's inflation, but not as we know it."

This article appeared on David Tice's Prudent Bear website way back then -- and I found it a few weeks after it was posted. I know I've quoted this before countless times over the last 25 years...but I have a lot of newbie subscribers that have come onboard in the last several months -- and it's for their benefit that it appears once again. Warburton writes...

Central banks are engaged in a desperate battle on two fronts

"What we see at present is a battle between the central banks and the collapse of the financial system fought on two fronts. On one front, the central banks preside over the creation of additional liquidity for the financial system in order to hold back the tide of debt defaults that would otherwise occur. On the other, they incite investment banks and other willing parties to bet against a rise in the prices of gold, oil, base metals, soft commodities or anything else that might be deemed an indicator of inherent value. Their objective is to deprive the independent observer of any reliable benchmark against which to measure the eroding value, not only of the U.S. dollar, but of all fiat currencies. Equally, they seek to deny the investor the opportunity to hedge against the fragility of the financial system by switching into a freely traded market for non-financial assets.

It is important to recognize that the central banks have found the battle on the second front much easier to fight than the first. Last November I estimated the size of the gross stock of global debt instruments at $90 trillion for mid-2000. How much capital would it take to control the combined gold, oil, and commodity markets? Probably, no more than $200 billion, using derivatives. Moreover, it is not necessary for the central banks to fight the battle themselves, although central bank gold sales and gold leasing have certainly contributed to the cause. Most of the world's large investment banks have over-traded their capital [bases] so flagrantly that if the central banks were to lose the fight on the first front, then the stock of the investment banks would be worthless. Because their fate is intertwined with that of the central banks, investment banks are willing participants in the battle against rising gold, oil, and commodity prices.

Central banks, and particularly the U.S. Federal Reserve, are deploying their heavy artillery in the battle against a systemic collapse. This has been their primary concern for at least seven years...[1994 - Ed]. Their immediate objectives are to prevent the private sector bond market from closing its doors to new or refinancing borrowers and to forestall a technical break in the Dow Jones Industrials. Keeping the bond markets open is absolutely vital at a time when corporate profitability is on the ropes. Keeping the equity index on an even keel is essential to protect the wealth of the household sector and to maintain the expectation of future gains. For as long as these objectives can be achieved, the value of the U.S. dollar can also be stabilized in relation to other currencies, despite the extraordinary imbalances in external trade."

In a nutshell, what the western financial system has been frantic about during this fiat currency experiment that began in August 1971, is to prevent investors from running from the paper asset side of the street -- and into hard assets of any kind...commodities in general -- and the precious metals in particular.

This is they system that is now blowing up in their faces -- and most on the short side in the COMEX futures or options market are now facing certain financial Armageddon as commodity prices continue to rise -- and more shorts start to cover, which draws in the speculators behind them. This accounts for the parabolic rise we've been witness to over the last many months.

Twenty-five years ago when Peter Warburton penned his now-famous tome...China, India Russia, Brazil were not the economic and financial powerhouses they have become today. They have coalesced in the BRICS+ -- and are now challenging the west on many fronts...with China's 20,000+ tonnes of gold -- and now export permits for silver. And lest I forget the formidable gold holdings of both Russia & India.

If you remember me mentioning about a month ago in the last Bank Participation Report for November, the 5 U.S. banks that are active in the COMEX futures market in silver, held a net short position of 28,918 silver contracts back in April...which has now morphed into a net long position of 773 contracts as of the end of November. So in the last seven months, they've bought back/covered 29,500 COMEX silver contracts -- and it's a given that other traders down the food chain have been doing the same thing.

So, if you're looking for a reason for silver's spectacular price rise so far this year...look no further. The Bank Participation Report for December comes out next Friday, January 9 -- and what's in it will be of more than passing interest.

Of course this all came to a crescendo in December and, as I'm mentioned many times, the prices of everything would have gone parabolic on countless occasions prior to Christmas eve, if those commercial traders/short sellers of last resort/not-for-profit sellers...call them what you will...weren't riding shotgun over them 24/7...silver in particular, followed closely by platinum.

All they've done in the last week or so is delay that day of reckoning. The only way to save the shorts, especially the commercial shorts -- and the western financial system is, what I've been saying for years...the COMEX and LBMA will have to be closed.

Such a draconian measure is being fought tooth and nail by the western globalist financial power elite at this very moment. But it's a battle...like their proxy war in Ukraine against Russia...that they have already lost. All that remains to be seen is just how much more collateral damage is done both at home and abroad before the transfer of power from west to east is formalized -- and commodity pricing ends up where it now belongs...in Shanghai.

I know I quoted this in Thursday's column, but it dovetails perfectly with everything mentioned above, so here it is again...

In an interview from July 2024 with ex-British diplomat Alastair Crooke, hosted by Judge Andrew Napolitano, Crooke had this to say...

"If you're going to be sanctioned, will you have the strength, with more than half the population and a greater proportion of GDP than the G7 has...why don't you sanction the west? Why does it always be the west sanctioning you?

You should have the ability to sanction the west, particularly in raw materials -- and key strategic materials and energy. The west cannot survive, cannot produce it...cannot mount a military response to China. If those elements are switched off, I mean it would change the strategic balance in the entire globe.

[I]t's obvious [that] dedollarization...is very much on the agenda, but it seems to me..by some logic, then you look at the question of managing, because part of this process is to get control of commodities.

For too long commodity prices have been set in the United States and Europe by paper commodities -- and the paper commodities which are managed and manipulated by the hedge funds and the big banks in America for financial gain -- and not just political gain, but sometimes for political gain..."

The confrontations between the east and west have picked up in the last eighteen months since Crooke made those comments. It extends into all spheres now...military, economic, monetary -- and finally into the geopolitics that has now engulfed the commodities sector.

It may be worth noting at this point that almost all of the BRICS+ nations were former colonies of one of more of these western/European nations at one time or another in their pasts...Britain, the Netherlands, France, Spain, Portugal, Italy...etc. China, Russia and India also have their ugly memories of western imperialism...which remain ongoing and intensifying as I write this.

If they're so inclined -- and push really becomes shove [more than it already is] from the U.S.A. et al...payback, after centuries of maltreatment for most, could be a bitch.

I'm done for the day -- and the week -- and more 'all in' than ever.

See you here on Tuesday.

Ed