YESTERDAY in GOLD, SILVER, PLATINUM and PALLADIUM

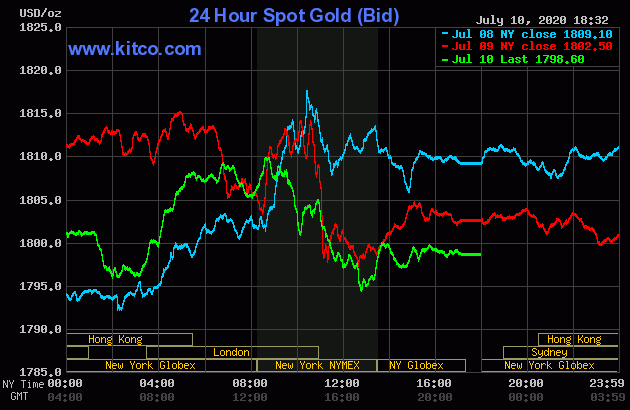

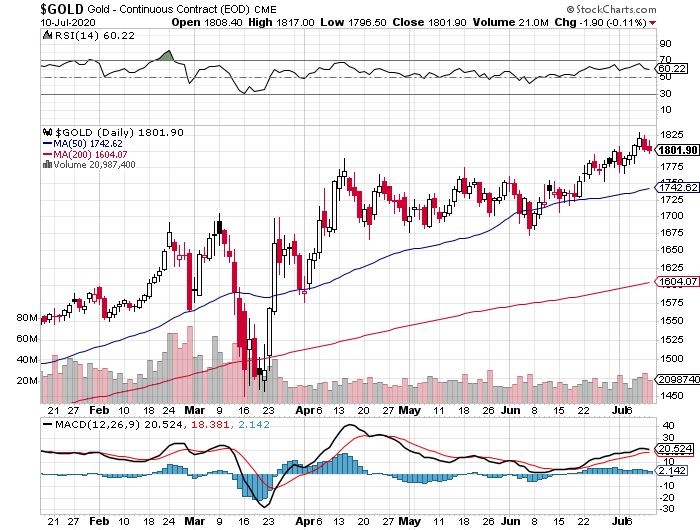

The gold price trended mostly unevenly lower in Far East trading on their Friday, with its Far East low coming at 2 p.m. China Standard Time on their Friday afternoon. From there it didn't do much until shortly after the London open -- and at that point, the dollar index began to head lower. The gold price rallied until the 10:30 a.m. BST morning gold fix -- then it traded unevenly sideways, with the high tick of the day coming a few minutes after 8:30 a.m. in New York. It was sold quietly lower from there -- and the low tick was set around 12:40 p.m. EDT. It was allowed to rally a bit from there, but the moment it poked its nose back above $1,800 spot, there was someone there to make sure it didn't close above it -- and it trended a few dollars lower until the market closed at 5:00 p.m. EDT.

The high and low ticks, both occurring in the COMEX trading session in New York, were recorded by the CME Group as $1,817.00 and $1,796.50 in the August contract. The July/August price spread differential at the close on Friday was $3.70... August/October was $13.70 -- and October/December was $15.70.

Gold was closed in New York on Friday afternoon at $1,798.60 spot, down $3.90 from Thursday. Net volume was very decent at 172,000 contracts -- and there was 48,000 contracts worth of roll-over/switch volume out of August and into future months...mostly December and October, although there continues to be very decent roll-over/activity out into 2021.

|

|

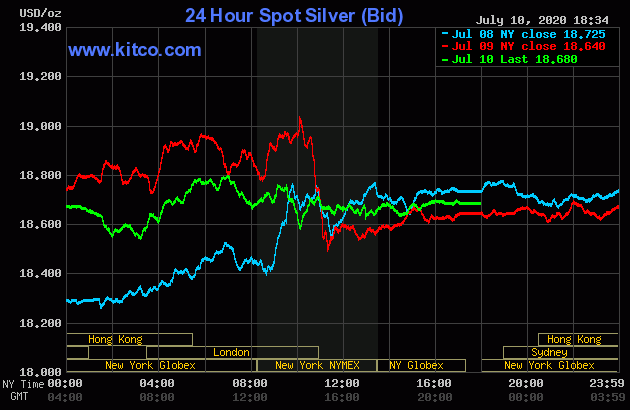

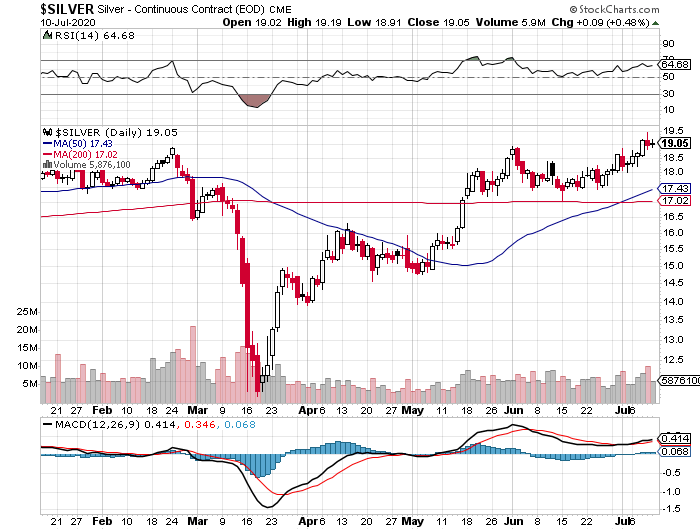

The silver price crept a few pennies higher until shortly before 1 p.m. China Standard Time on their Friday afternoon -- and was also sold lower until exactly 2:00 p.m. CST. It also began to head higher starting shortly after the London open -- and that lasted until the noon silver fix over there. It was quietly and unevenly down hill from that point until minutes after 10 a.m. in New York. It was only allowed to recover a few pennies from that juncture -- and then it didn't do much for the remainder of the Friday session.

The low and high ticks were reported as $18.91 and $19.195 in the September contract. The August/September price spread differential in silver at the close yesterday was 7.0 cents -- and September/December was 17.8 cents.

Silver was closed on Friday afternoon in New York at $18.68 spot, up 4 cents on the day. Net volume was on the heavier side at a bit under 58,000 contracts -- and there was about 3,400 contracts worth of roll-over/switch volume on top of that, most of which ended up in December.

|

|

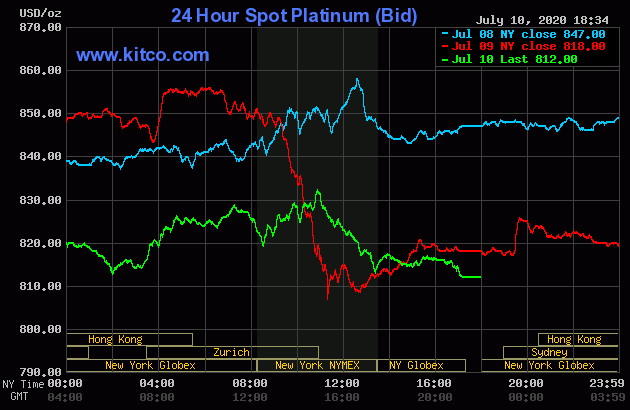

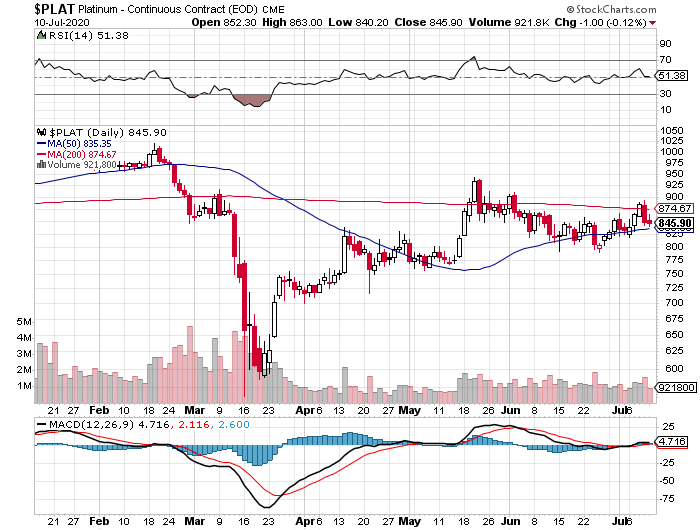

The platinum price jumped up a bit in very early morning trading in the Far East -- and then crept lower until shortly before 1 p.m. CST and, like the other three precious metals, was sold down until exactly 2:00 p.m. CST. It headed unevenly higher from there until a few minutes before the 11 a.m. EDT Zurich close -- and then was sold quietly lower until the 1:30 p.m. COMEX close. It shed a few more dollars in after-hours trading. Platinum was closed at $812 spot, down 6 dollars on the day -- and 32 bucks off its Kitco-recorded high tick of the day.

|

|

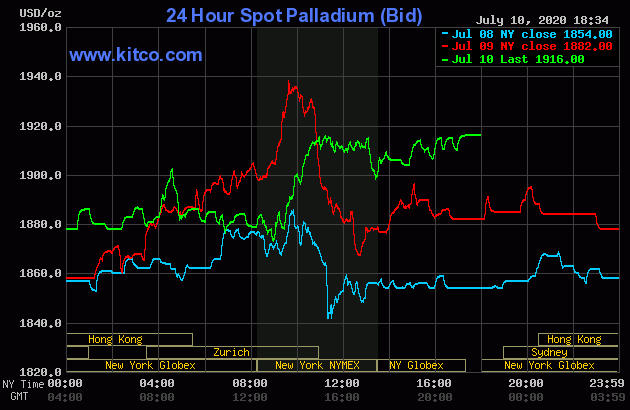

The palladium price jumped quietly around the unchanged mark right up until 9 a.m. in New York. It headed higher from there until it ran into 'something' at the 11 a.m. EDT Zurich close -- and from there it traded quietly and unevenly sideways until trading ended at 5:00 p.m. EDT. Palladium finished the Friday session at $1,916 spot, up 34 dollars from its close on Thursday -- and back above its 200-day moving average.

|

|

Based on the spot closes in gold and silver on the Kitco charts posted above, the gold/silver ratio worked out to a bit over 96 to 1.

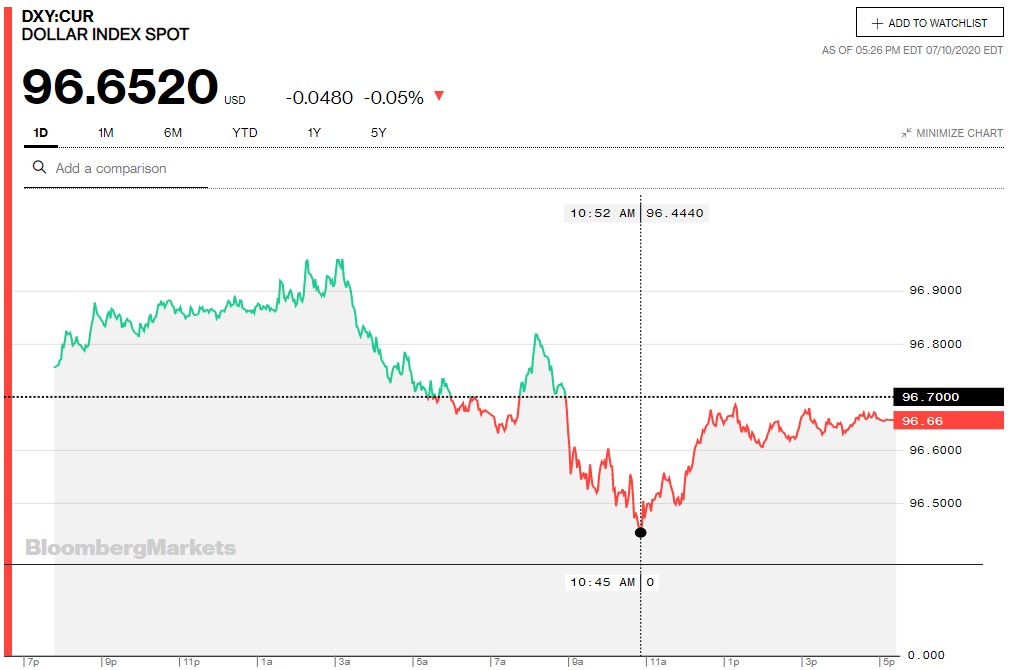

The dollar index was marked-to-close very late on Thursday afternoon in New York at 96.7000 -- and opened up precisely 6 basis points at 96.7600 once trading commenced around 7:45 p.m. EDT on Thursday evening, which was 7:45 a.m. China Standard Time on their Friday morning. It began to chop quietly higher immediately -- and the 96.974 high tick appeared to be set at 8:12 a.m. BST in London. It was all pretty much down hill from there until the 96.439 low tick was set at 10:52 a.m. in New York. It 'rallied' a bit from there until 12:40 p.m. EDT -- and then traded quietly sideways until the market closed at 5:30 p.m.

The dollar index finished the Friday trading session at 96.652...down 5 basis points from its close on Thursday.

Here's the DXY chart for Friday, thanks to Bloomberg. Click to enlarge.

|

|

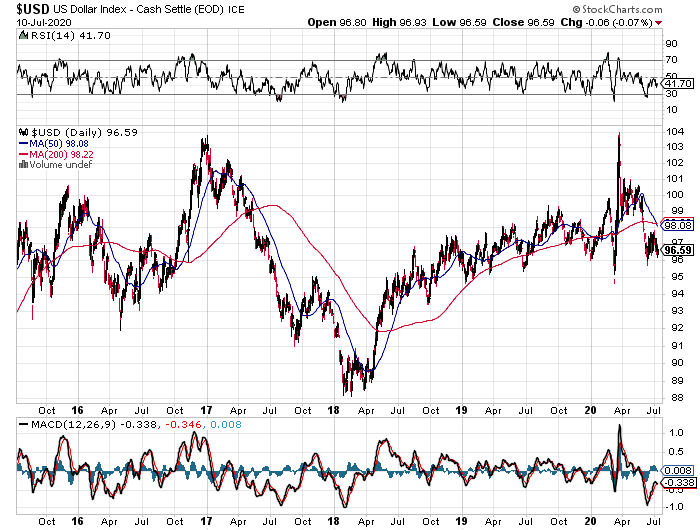

And here's the 5-year U.S. dollar index chart, courtesy of the folks over at the stockcharts.com Internet site. The delta between its close...96.59...and the close on the DXY chart above was 6 basis points below it spot close on Friday. Click to enlarge as well.

|

|

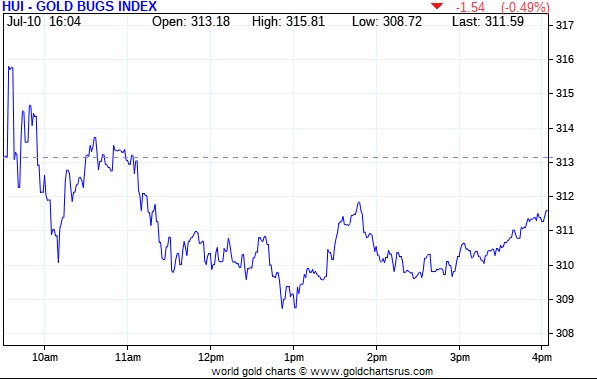

The gold stocks jumped up a bit at the 9:30 a.m. open in New York on Friday morning -- and then traded quietly and unevenly lower until 1 p.m. EDT. Then they began to head a bit higher, but weren't allowed to close in positive territory, as the HUI finished down 0.49 percent on the day.

|

|

The silver equities chopped impressively higher in a very wide range until they topped out a minute or so before 11 a.m. in New York trading. It was all down hill from there until a few minutes before 1 p.m. EDT -- and they then rallied quietly until trading ended at 4:00 p.m. Nick Laird's Intraday Silver Sentiment/Silver 7 Index closed higher by 1.19 percent. Click to enlarge if necessary.

|

|

Computing the above index manually showed that it closed up 1.02 percent.

Here's Nick's 1-year Silver Sentiment/Silver 7 Index chart, updated with Friday's doji. Click to enlarge as well.

|

|

The two stars were Hecla Mining and Peñoles, closing higher by 6.07 and 4.10 percent respectively...the latter on only 400 shares traded. Almost every other component of the Silver 7 Index closed down on the day.

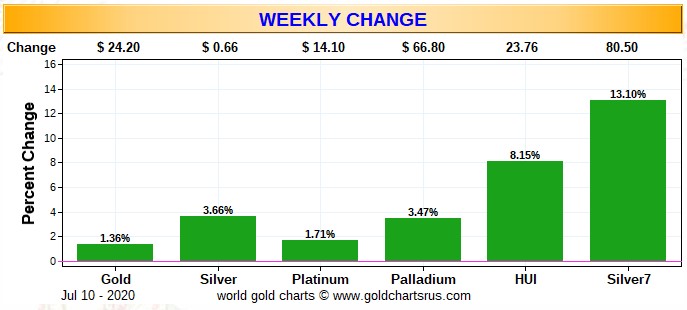

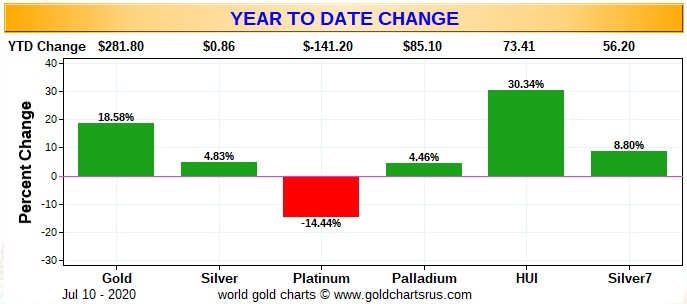

Here are the usual three charts that show up in every Saturday missive. The first one shows the changes in gold, silver, platinum and palladium for the past trading week, in both percent and dollar and cents terms, as of their Friday closes in New York - along with the changes in the HUI and the Silver 7 Index.

Here's the weekly chart -- and it's a joy to behold for once, with the silver equities outperforming their golden cousins... but not compared to the changes in their respective underlying precious metals. That will change soon enough. Click to enlarge.

|

|

Here's the month-to-date chart and, for obvious reasons, it looks very similar to the weekly chart. That's because the month-to-date chart contains only 2 extra business days compared to the weekly chart above. And as you can tell, the first two days of the month were net down days for everything precious metal related. The big gains were this past week. Click to enlarge.

|

|

And here's the year-to-date chart -- and gold is still the clear winner so far. But the underperformance of the gold stocks compared to the underlying metal itself, is obvious -- and that's mostly because of what has occurred during June. Silver and its associated shares also had a set-back...but they've improved a lot recently -- and they're back in the green once more -- and there will be more improvements to come at some point. That applies to gold and its equities as well. Click to enlarge.

|

|

Although no one is happy about the underperformance of the precious metal equities, it's my opinion that the worst is behind us -- even if we get another engineered price decline in the near or intermediate future.

As per the COT and Days to Cover discussion a bit further down, the Big 8 traders are still mega short gold in the COMEX futures market, but enough has now been brought into the COMEX that they could cover by physical delivery if that becomes necessary. But they still remain trapped in silver, with no obvious way out -- and the potential for a JPMorgan double cross of the Big 8 traders is still very much alive.

The CME Daily Delivery Report showed that 303 gold and 245 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, there were six short/issuers in total -- and the three largest were JPMorgan, Marex Spectron and Advantage, with 140, 99 and 56 contracts...all from their respective client accounts. There was another huge list of long/stoppers -- and the three biggest were Credit Suisse, Advantage and Marex Spectron, with 70, 53 and 47 contracts -- and all for their respective client accounts as well. Morgan Stanley and Australia's Macquarie Futures were stoppers as well.

In silver, the sole short/issuer was International F.C. Stone -- and there was a big list of long/stoppers as well. The biggest was JPMorgan, with 76 contracts for its client account. Next came Goldman Sachs with 49 contracts...47 for its own account, plus 2 more for clients. Bank of American came in third, with 32 contracts for its client account. Morgan Stanley and Australia's Macquarie Futures picked up 28 and 22 contracts respectively -- and mostly for their in-house/proprietary trading accounts.

So far in July, there have been 6,974 gold contracts issued/reissued and stopped -- and that number in silver is 13,903 contracts.

And just for information purposes, on First Day Notice for July deliveries in gold back on 29 June, there were only 3,316 contracts open, so about 3,650 contracts have been added to July gold deliveries since that date. That's a lot -- and unprecedented.

The link to yesterday's Issuers and Stoppers Report is here.

The CME Preliminary Report for the Friday trading session showed that gold open interest in July fell by 405 contracts, leaving 343 still around, minus the 303 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 564 gold contracts were posted for delivery on Monday, so that means that 564-405=159 more gold contracts were just added to the July delivery month. Silver o.i. in July dropped by 194 contracts, leaving 2,663 still open, minus the 245 contracts mentioned a few paragraphs ago. Thursday's Daily Delivery Report showed that 165 silver contracts were actually posted for delivery on Monday, so that means that 194-165=29 silver contracts disappeared from the July delivery month.

There was a small withdrawal from GLD yesterday, as an authorized participant removed 11,591 troy ounces. But there was another pretty hefty deposit into SLV yesterday, as an a.p. added 4,843,904 troy ounces.

The new short reports came out for SLV and GLD yesterday. The short position in SLV rose from 16.61 million shares/troy ounces, up to 17.47 million shares/troy ounces...an increase of only 5.17 percent, which is basically nothing at all. The short position GLD fell from 1,090,000 troy ounces, down to 877,000 troy ounces...a fairly hefty decline of 19.58 percent. The short positions in both these ETFs are very tiny -- and not at all significant.

In other gold and silver ETFs and mutual funds on Planet Earth on Friday, net of any changes in COMEX, GLD & SLV inventories, there was a net 196,345 troy ounces of gold added, plus 106,608 troy ounces of silver was added as well.

There was no sales report from the U.S. Mint on Friday.

Month-to-date the mint has sold 9,000 troy ounces of gold eagles -- 5,000 one-ounce 24K gold buffaloes -- and zero silver eagles.

For the first time in many, many months there was no gold received over at the COMEX-approved depositories on the U.S. east coast on Thursday. There was 1,202 troy ounces shipped out -- and that all departed Delaware. There was some paper activity, as 13,530.420 troy ounces/420 kilobars [SGE kilobar weight] was transferred from the Eligible category and into Registered over at Manfra, Tordella & Brookes, Inc. The link to this is here.

There was some activity in silver, as 640,710 troy ounces was reported received -- and 610,334 troy ounces was shipped out. In the 'in' department, there was one truckload...600,147 troy ounces...that arrived at CNT -- and the remaining 40,563 troy ounces was dropped off at Delaware. In the 'out' category, there was one truckload...605,351 troy ounces...that was shipped out of CNT -- and the remaining 4,983 troy ounces also departed Delaware. There was some paper activity, as 397,048 troy ounces was transferred from the Registered category and back into Eligible at Brink's, Inc. -- and the remaining 15,132 troy ounces made the same trip over at Canada's Scotiabank. The link to all this is here.

There was activity over at the COMEX-approved gold kilobar depositories in Hong Kong on their Thursday. They received only 14 kilobars, but shipped out 1,308 of them. And except for the 103 kilobars that departed Loomis International, the remaining in/out activity was at Brink's, Inc. The link to this, in troy ounces, is here.

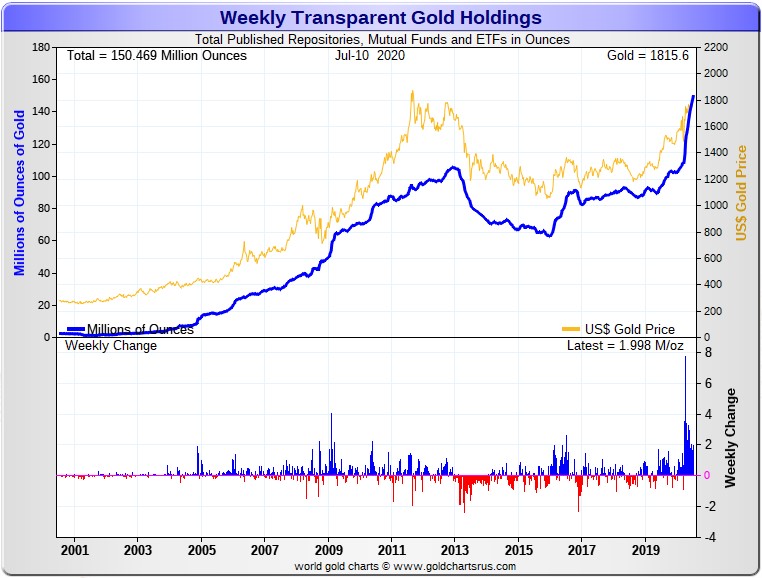

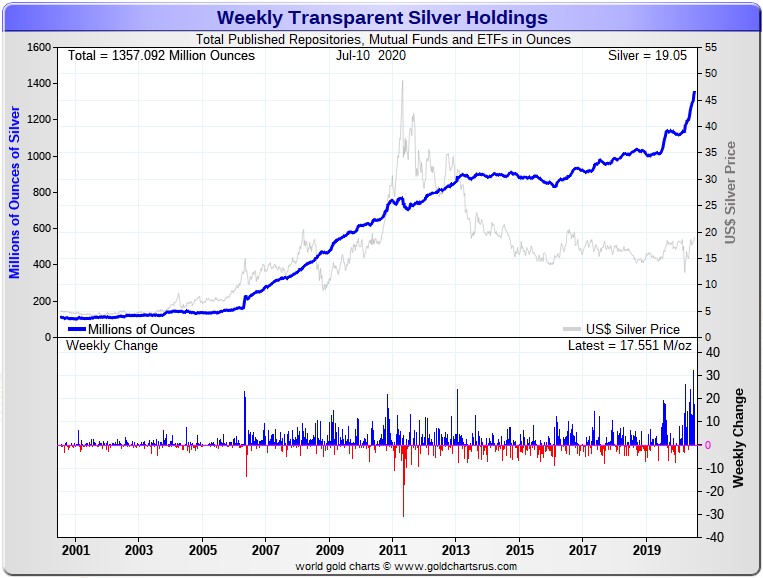

Here are two charts that you should be more than familiar with by now. They are the 20-year charts showing the total amount of gold and silver in all known depositories, mutual funds and ETFs...updated with this past week's data.

During that week, there was 2.0 million troy ounces of gold added, plus a monstrous 17.55 million troy ounces of silver as well. Click to enlarge for both.

|

|

|

|

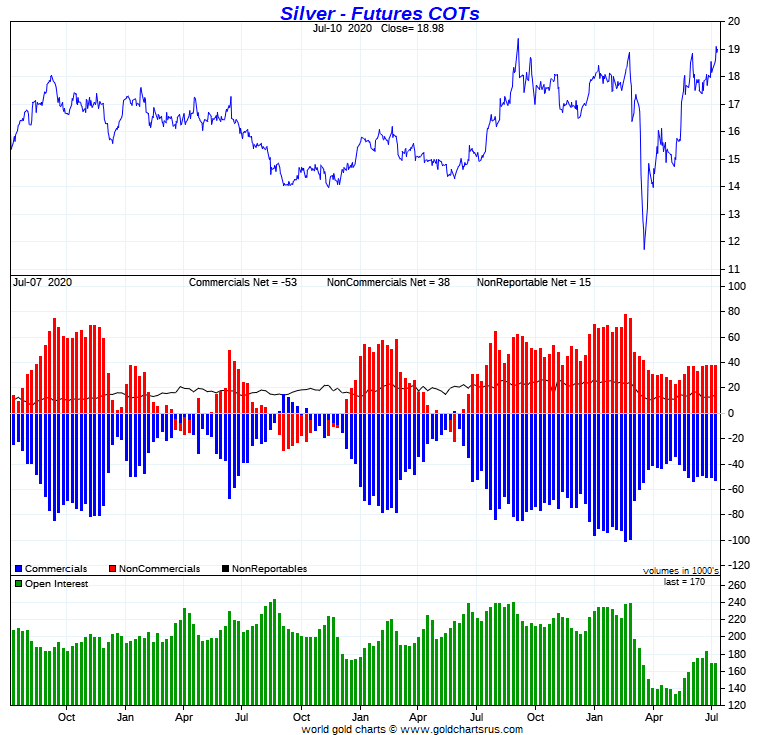

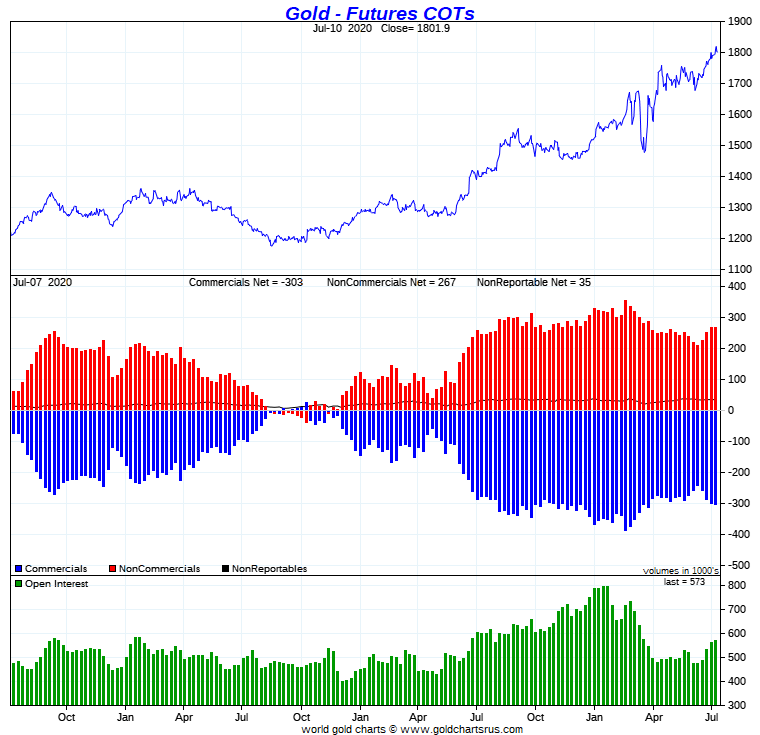

The Commitment of Traders Report for positions held at the close of COMEX trading, on Tuesday, July 7 contained no negative surprises and no major changes. In fact, the increase in the commercial net short position in gold was certainly less than I was expecting -- and Ted as well.

In silver, the Commercial net short position increased by a rather inconsequential 2,368 contracts, or 11.84 million troy ounces.

They arrived at that number by reducing their long position by 3,962 contracts, but they also reduced their short position by 1,594 contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, it was the Managed Money Traders and the 'Nonreportable'/small traders that were the buyers during the reporting week, with the former category increasing their net long position by 866 contracts -- and the latter by 2,144 contracts. The traders in the 'Other Reportables' category went the other direction, as they reduced their net long position by 642 contracts.

Doing the math: 866 plus 2,144 minus 642 equals 2,368 COMEX contracts, the change in the Commercial net short position.

The Commercial net short position in silver now stands at 52,642 COMEX contracts, or 263.2 million troy ounces. The Big 8 traders are short 71,534 COMEX contracts, or 357.6 million troy ounces...about 136 percent of the Commercial net short position.

Ted says that JPMorgan short position in silver remained at zero during the reporting week.

Here's the 3-year COT chart for silver from Nick -- and this week's change should be noted, but is not really material. Click to enlarge.

|

|

The story in silver continues to be the plight of the Big 8 shorts. Although most of their losses have been in gold so far to date, the silver price has been quietly sneaking higher -- and it's only a matter of time before their losses in this precious metal become far more significant.

In gold, the commercial net short position increased by a rather paltry 1,129 contracts...112,900 troy ounces...which was a lot lower than what I was expecting. It could have been ten times that amount -- and I wouldn't have batted an eye.

They arrived at that number by increasing their long position by 1,727 contracts, but also increased their short position by 2,856 contracts -- and it's the difference between those two numbers that represents their change for the reporting week.

Under the hood in the Disaggregated COT Report, there's not much to talk about. Like in silver, all the buying during the reporting week was done by the Managed Money traders and the 'Nonreportable'/small traders. The former category increased their net long position by 788 contracts -- and the latter category by 441 contracts. The Other Reportables decreased their net long position by 100 contracts.

Doing the math: 788 plus 441 minus 100 equals 1,129 COMEX contracts, the change in the commercial net short position.

The commercial net short position stands at 30.26 million troy ounces of gold -- and the Big 8 traders ares short 23.31 million troy ounces...77 percent of that amount.

Ted says that JPMorgan is not short gold, either.

Here's the 3-year COT chart for gold, courtesy of Nick Laird as always -- and there's not much to see here, as this week's change is immaterial. Click to enlarge.

|

|

Gold is still the albatross around the Big 8 shorts collective necks. Ted mentioned on the phone yesterday that their realized and unrealized losses on the their short positions at the close yesterday was a tiny bit under $10 billion. The lion's share of that is in gold.

[Note: I forgot to include the changes in these other two precious metals, plus copper, in the COT Report that came out on Tuesday, so these changes posted below, cover a two week period..from June 23 to July 7. - Ed]

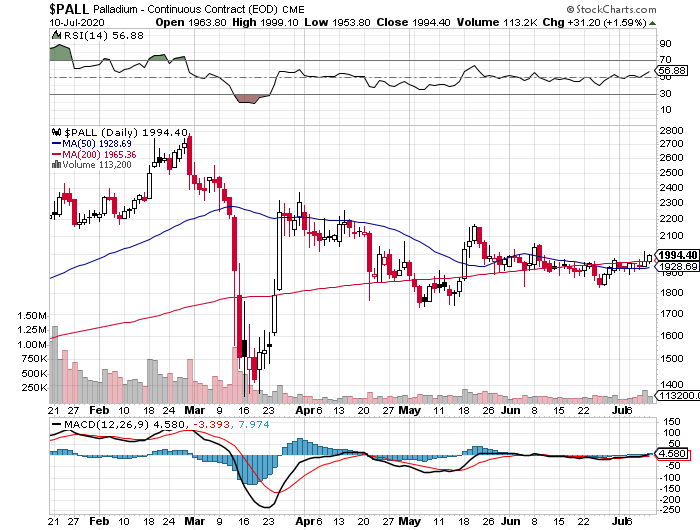

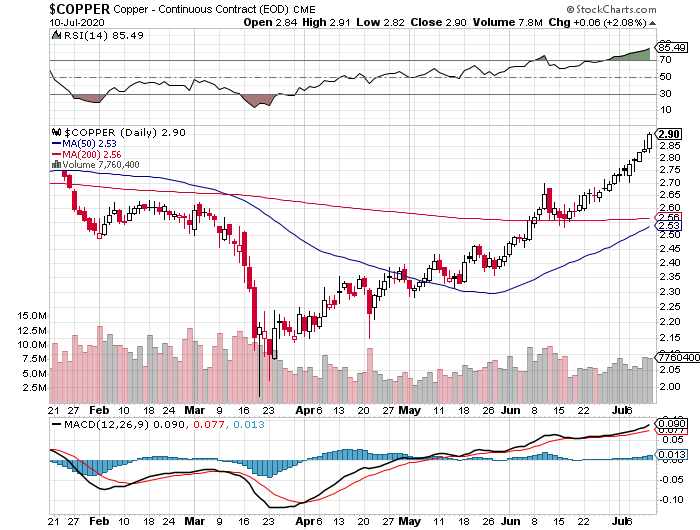

In the other metals, the Managed Money traders in palladium increased their net long position by 334 COMEX contracts during the last two reporting weeks -- and are now net long the palladium market by 1,509 contracts...around 21 percent of the total open interest...up from 10.5 percent two weeks ago. And as I keep saying, palladium is a market in name only now. In platinum, the Managed Money traders traders increased their net long position by a further 1,193 COMEX contracts -- and are net long the platinum market by 8,944 COMEX contracts...about 18 percent of the total open interest. The other two categories in platinum [Other Reportables/Nonreportable] continue to be mega net long against JPMorgan et al...especially the 'Other Reportables'. In copper, the Managed Money traders increased their net long position by a further 3,707 COMEX contracts during the last two reporting weeks -- and are now net long copper by 31,753 COMEX contracts...794 million pounds of the stuff...about 15 percent of total open interest, up from 4 percent two weeks ago.

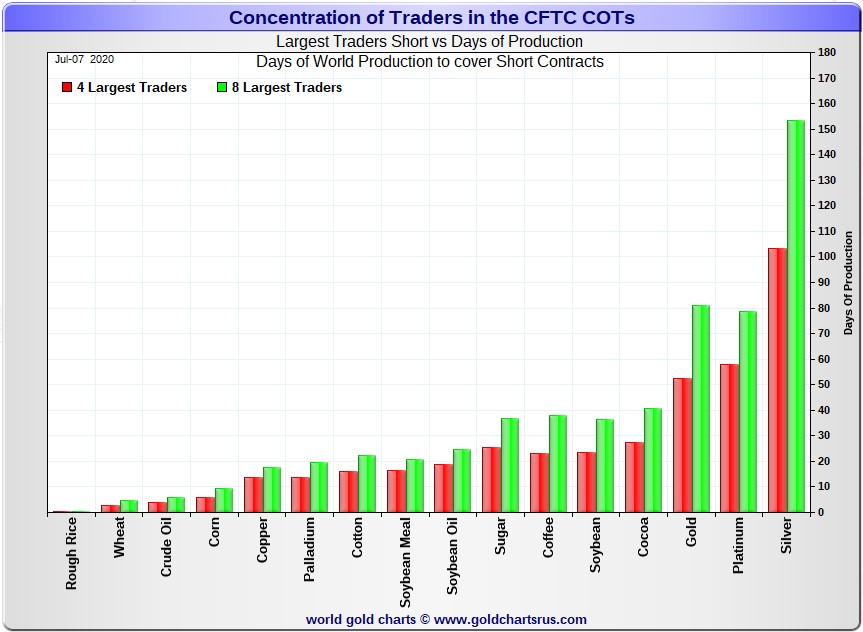

Here's Nick Laird's "Days to Cover" chart, updated with the COT data for positions held at the close of COMEX trading on Tuesday, July 7. It shows the days of world production that it would take to cover the short positions of the Big 4 - and Big '5 through 8' traders in each physically traded commodity on the COMEX. Click to enlarge.

|

|

The Big 4 traders are short about 103 days of world silver production, up 1 day from last week's report. The '5 through 8' large traders are short an additional 50 days of world silver production...unchanged from last week's COT Report - for a total of about 153 days that the Big 8 are short...up 1 day from last week's report. This represents five months of world silver production, or about 357 million troy ounces of paper silver held short by the Big 8. [In the prior reporting week, the Big 8 were short 152 days of world silver production.]

In the COT Report above, the Commercial net short position in silver was reported by the CME Group as 263 million troy ounces. As mentioned in the previous paragraph, the short position of the Big 8 traders is around 357 million troy ounces. So the short position of the Big 8 traders is larger than the total Commercial net short position by about 357-263=94 million troy ounces...which is down about 9 million ounces from last week's report.

The reason for the difference in those numbers...as it always is...is that Ted's raptors, the 30-odd small commercial traders other than the Big 8, are net long that amount.

Another way of stating this [as I say every week in this spot] is that if you remove the Big 8 commercial traders from that category, the remaining traders in the commercial category are net long the COMEX silver market. It's the Big 8 [sans JPMorgan] against everyone else...a situation that has existed for over three decades in both silver and gold -- and in platinum as well.

As per the first paragraph above, the Big 4 traders in silver are short around 103 days of world silver production in total. That's about 25.75 days of world silver production each, on average...up a tiny amount from last week's report. The four big traders in the '5 through 8' category are short 50 days of world silver production in total, which is 12.50 days of world silver production each, on average...unchanged from last week.

The Big 8 commercial traders are short 42.2 percent of the entire open interest in silver in the COMEX futures market, which is up a tad from the 41.8 percent they were short in last week's COT report. And once whatever market-neutral spread trades are subtracted out, that percentage would be close to the 50 percent mark. In gold, it's 40.7 percent of the total COMEX open interest that the Big 8 are short, which is down a tiny bit from the 41.8 percent they were short in last week's report -- and a bit under 50 percent once the market-neutral spread trades are subtracted out.

In gold, the Big 4 are short 53 days of world gold production, unchanged from last week's COT Report. The '5 through 8' are short another 28 days of world production, down 1 day from last week's report...for a total of 81 days of world gold production held short by the Big 8...down 1 day from last week's COT Report. Based on these numbers, the Big 4 in gold hold about 65 percent of the total short position held by the Big 8...about unchanged from last week's report.

According to Ted, JPMorgan is neither short nor long the COMEX futures market in gold.

The "concentrated short position within a concentrated short position" in silver, platinum and palladium held by the Big 4 commercial traders are about 67, 74 and 70 percent respectively of the short positions held by the Big 8...the red and green bars on the above chart. Silver is unchanged from last week's COT Report...platinum is also unchanged from a week ago -- and palladium is down about 4 percentage points week-over-week.

The Big 8 shorts are still hugely exposed in all four precious metal -- and JPMorgan can spring the trap on them at a time of their choosing, if that's their plan.

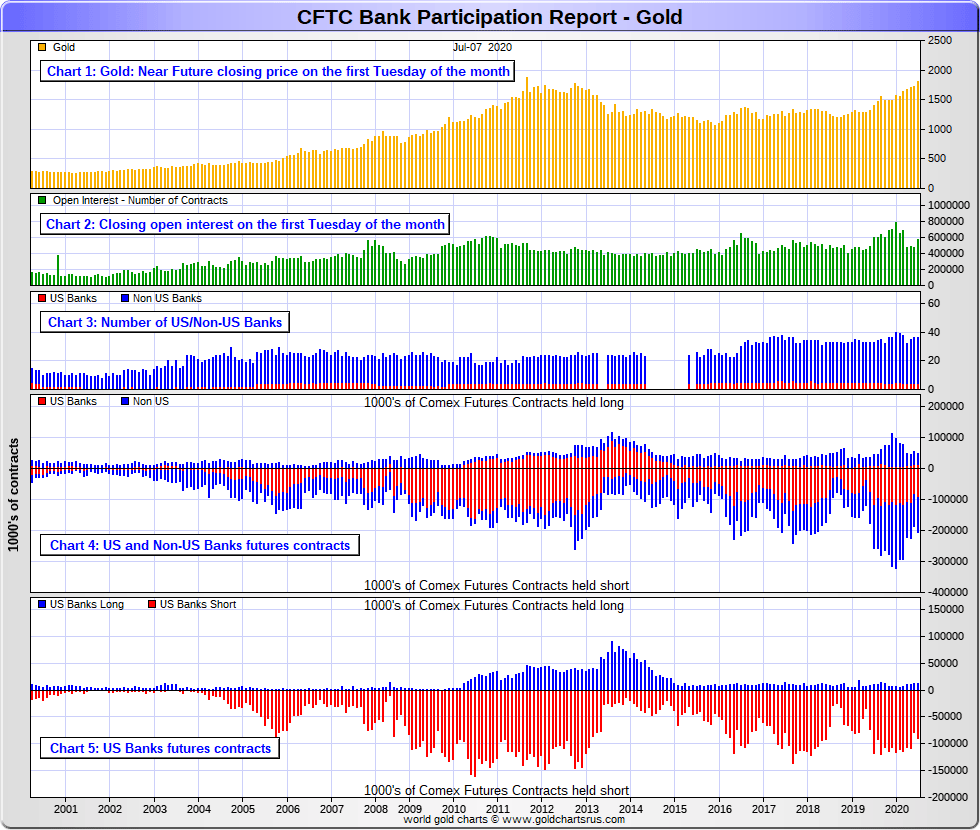

The July Bank Participation Report [BPR] data is extracted directly from yesterday's Commitment of Traders Report. It shows the number of futures contracts, both long and short, that are held by all the U.S. and non-U.S. banks as of Tuesday's cut-off in all COMEX-traded products. For this one day a month we get to see what the world's banks are up to in the precious metals -and they're usually up to quite a bit.

[The June Bank Participation Report covers the time period from June 2 to July 7 inclusive.]

In gold, 4 U.S. banks are net short 77,647 COMEX contracts in the July BPR. In June's Bank Participation Report [BPR] these same 4 U.S. banks were net short 67,675 contracts, so there was an increase of 9,972 COMEX contracts from five weeks ago. This is a remarkably small change considering the price increase in gold over that time period.

Citigroup, HSBC USA and I suspect Goldman Sachs would hold the lion's share of this short position. As to who other U.S. bank might be that is short in this BPR, I haven't a clue, but it's a given that their short position would not be material.

Also in gold, 32 non-U.S. banks are net short 80,523 COMEX gold contracts. In June's BPR, 32 non-U.S. banks were net short 66,651 COMEX contracts...so the month-over-month change shows a fairly decent increase...13,872 contracts.

But at the low back in the August 2018 BPR...these same non-U.S. banks held a net short position in gold of only 1,960 contacts, so they're back on the short side in a big way.

However, as I always say at this point, I suspect that there's at least two large non-U.S. bank in this group, one of which would be Scotiabank/Scotia Capital. I'm starting to have suspicions about Dutch Bank ABN Amro, plus Australia's Macquarie as well. Other than that small handful, the short positions in gold held by the vast majority of non-U.S. banks are immaterial.

As of this Bank Participation Report, 36 banks [both U.S. and foreign] are net short 27.7 percent of the entire open interest in gold in the COMEX futures market, which is down a hair from the 28.3 percent they were short in the June BPR.

Here's Nick's BPR chart for gold going back to 2000. Charts #4 and #5 are the key ones here. Note the blow-out in the short positions of the non-U.S. banks [the blue bars in chart #4] when Scotiabank's COMEX short position was outed by the CFTC in October of 2012. Click to enlarge.

|

|

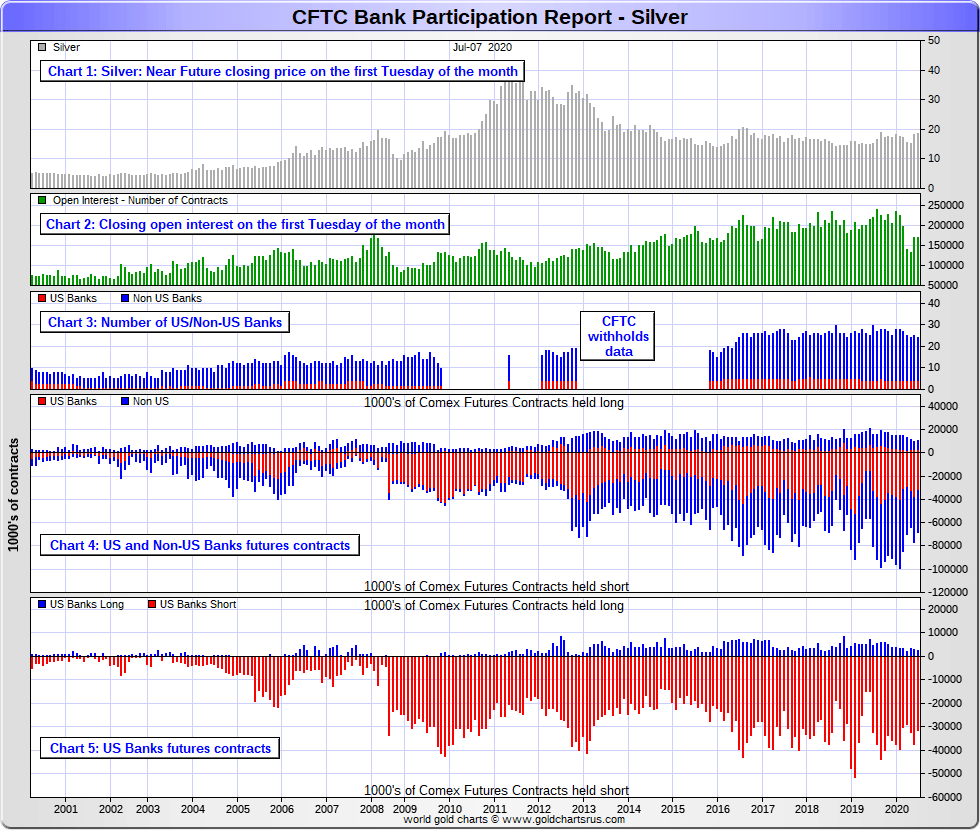

In silver, 4 U.S. banks are net short 28,547 COMEX contracts in July's BPR. In June's BPR, the net short position of these same 4 U.S. banks was 34,173 contracts, so the short position of the U.S. banks has decreased by 5,626 contracts month-over-month. I suspect that would be because of the big delivery that JPMorgan made out of their own account on First Notice Day on 29 June.

As in gold, the three biggest short holders in silver of the four U.S. banks in total, would be Citigroup, HSBC USA -- and perhaps Goldman in No. 3 spot -- and whoever the remaining U.S. bank may be, their short position, like the short position of the smallest U.S. bank in gold, would be immaterial in the grand scheme of things.

Also in silver, 20 non-U.S. banks are net short 28,788 COMEX contracts in the July BPR...which is down from the 32,640 contracts that 21 non-U.S. banks were short in the June BPR. I would suspect that Canada's Scotiabank/Scotia Capital holds a goodly chunk of the short position of these non-U.S. banks. I also suspect that a number of the remaining 19 non-U.S. banks may actually be net long the COMEX futures market in silver. But even if they aren't, the remaining short positions divided up between these other 19 non-U.S. banks are immaterial - and have always been so.

As of July's Bank Participation Report, 24 banks [both U.S. and foreign] are net short 33.8 percent of the entire open interest in the COMEX futures market in silver-down a very decent amount from the 39.4 percent that 25 banks were net short in the June BPR. And much, much more than the lion's share of that is held by Citigroup, HSBC USA, Goldman, Scotiabank -- and maybe one other non-U.S. bank.

Here's the BPR chart for silver. Note in Chart #4 the blow-out in the non-U.S. bank short position [blue bars] in October of 2012 when Scotiabank was brought in from the cold. Also note August 2008 when JPMorgan took over the silver short position of Bear Stearns-the red bars. It's very noticeable in Chart #4-and really stands out like the proverbial sore thumb it is in chart #5. Click to enlarge.

|

|

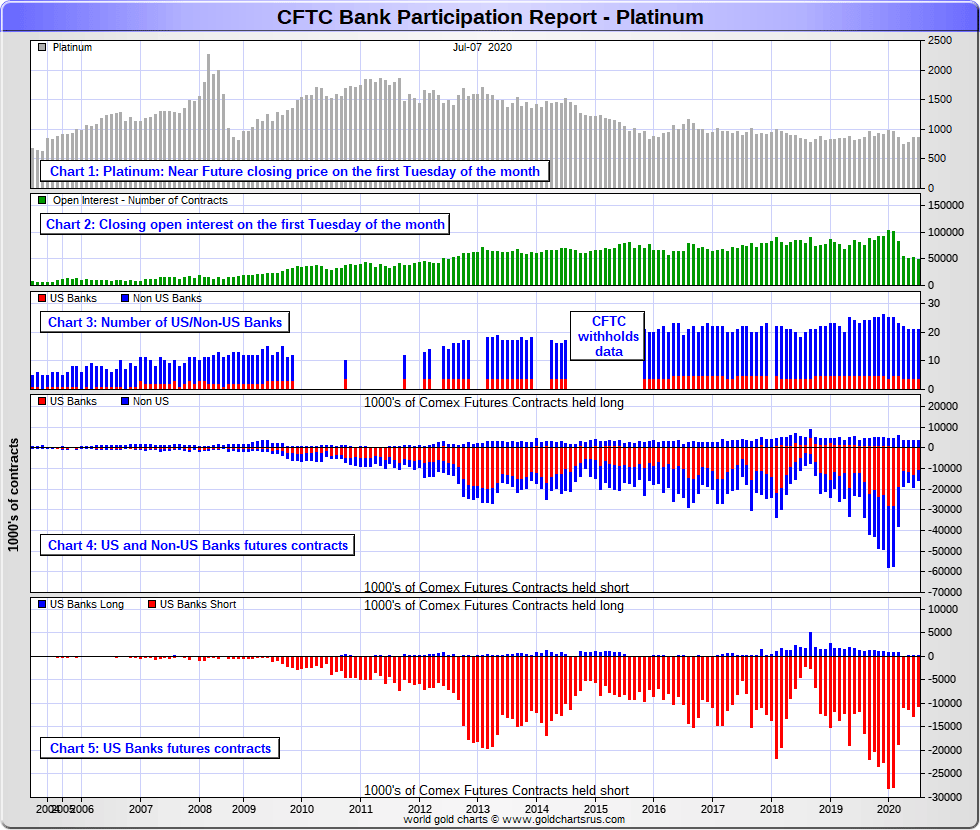

In platinum, 4 U.S. banks are net short 10,563 COMEX contracts in the July Bank Participation Report. In the June BPR, 4 U.S. banks were net short 12,755 COMEX contracts...so there's been a decent-sized decrease [17%] in the short position of the big 4 U.S. banks month-over-month.

[At the 'low' back in July of 2018, these same U.S. banks were actually net long the platinum market by 2,573 contracts -- and they've still got a long way to go to get back to that number, if they ever do.]

Also in platinum, 17 non-U.S. banks are net short 1,659 COMEX contracts in the July BPR, which is down substantially [52%] from the 3,460 COMEX contracts that these same 17 non-U.S. banks were net short in the June BPR.

[Note: Back at the July 2018 low, these same non-U.S. banks were net short only 1,192 COMEX contracts -- and they're almost back at that number.]

And as of July's Bank Participation Report, 21 banks [both U.S. and foreign] are net short 24.9 percent of platinum's total open interest in the COMEX futures market, which is down a fair amount from the 30.3 percent that 22 banks were net short in June's BPR. The short position in platinum has certainly come down a lot from what it was just six short months ago. But the U.S. banks are still on the hook big time.

Here's the Bank Participation Report chart for platinum. Click to enlarge.

|

|

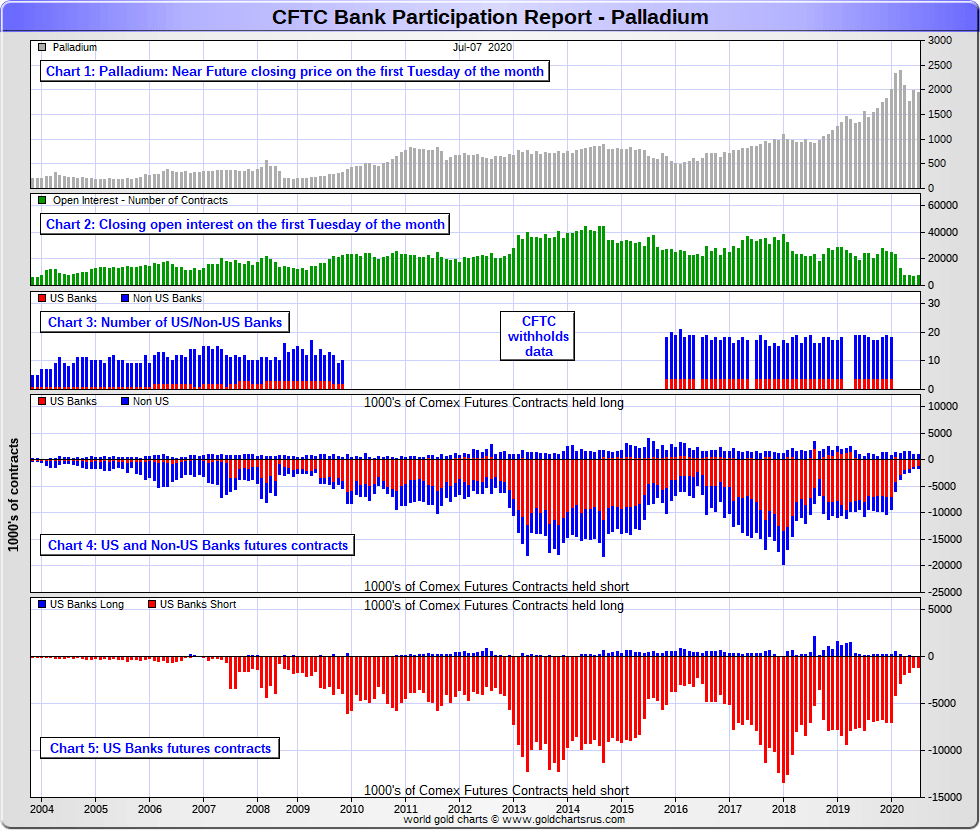

In palladium, 3 or less U.S. banks are net short 1,194 COMEX contracts in the July BPR, down from the 1,210 contracts that these same 3 or less U.S. banks were net short in the June BPR. Nothing to see here.

Also in palladium, 11 or more non-U.S. banks are net long 581 COMEX contracts-compared to the 597 COMEX contracts that 8 or more non-U.S. banks were net long in the June BPR. Nothing to see here, either.

As of this Bank Participation Report, 14 banks [both U.S. and foreign] are net short 8.5 percent of the entire COMEX open interest in palladium...down from the 9.0 percent of total open interest that 11 banks were net short in May. Because of the small numbers of contracts involved, along with a declining opening interest, these numbers are pretty much meaningless.

So, for the fifth month in a row, the world's banks are no longer involved in the palladium market in a material way.

Here's the palladium BPR chart. And as I point out every month, you should note that the U.S. banks were almost nowhere to be seen in the COMEX futures market in this precious metal until the middle of 2007-and they became the predominant and controlling factor by the end of Q1 of 2013. But, as I mentioned above, they have imploded into insignificance over the last five Bank Participation Reports -- and it remains to be seen if they return as short sellers again at some point like they've done in the past. Click to enlarge.

|

|

Except for palladium, only a small handful of the world's banks still have meaningful short positions in the other three precious metals.

JPMorgan is out of its short positions in both silver and gold -- and may be in platinum and palladium as well, but there's no way to know that.

The precious metals are certainly set up for a rocket ride higher if JPMorgan allows it. When it does occur, it will be very much to the detriment of those Big 8 shorts in particular -- and the rest of the shorts in general.

I have an average number of stories, articles and videos for you today. And included in the list are a couple that I've been saving for today's column for length and content reasons.

CRITICAL READS

Wells Fargo preparing to cut thousands of jobs: Report

Wells Fargo is preparing to cut thousands of jobs later this year in an effort to reduce costs, according to a report from Bloomberg Law.

The plans being drawn up by Wells Fargo executives could eventually lead to tens of thousands of jobs being cut, according to Bloomberg, citing people with knowledge of the confidential talks.

Wells Fargo Chief Financial Officer John Shrewsberry had alluded to cuts in June.

"There will come a time, and I assume at some point this year, when we get back to executing on programs that are in place and some that are still under development that are designed to get our total expense base, which for us means our total headcount, to as lean a state as we can reasonably operate," Shrewsberry said at a virtual financial conference.

The news comes as many large employers, from Nike to Boeing, are warning about or implementing job cuts.

This news item appeared on the foxbusiness.com Internet site on Thursday sometime -- and I found it in Friday's edition of the King Report. Another link to it is here. Then there was a similar story about job losses in this Zero Hedge story from Thursday morning headlined "Walgreens Drags Down Dow as Q2 Sales Slump; Company Cuts 4,000 Jobs" -- and that's linked here.

"It's Going to Be a Mess" - Quarter of NYC Renters Haven't Paid Since March

As the U.S. recovery stalls and the fiscal cliff looms, there are new, troubling signs from America's biggest rental market, as an alarming number of renters haven't paid in months.

Bloomberg, citing a new report via the Community Housing Improvement Program (CHIP), a group that represents landlords, said 25% of New York City's apartment renters haven't paid since March.

Shocking, right? Because President Trump has been on Twitter this week, boasting about the economy and jobs "are growing faster than anyone expected." However, the real story is one where the consumer is severely damaged due to the virus-induced downturn.

And the problem gets worse, that is, because when rental income for landlords collapses, they will experience financial hardships as well, including servicing mortgage payments and inability to cover other building-related expenses (if those are fixed or variable costs).

Another issue developing is the fiscal cliff - and we've noted, direct payments to Americans now make up 25% of all personal income, suggesting when the stimulus runs out, expected at the end of July, the economy/consumption will crater. Couple that with a stalled recovery and surging virus cases around the country, it now makes sense why the Trump administration is requesting round two in the stimulus.

If Congress fails to pass the second stimulus bill - this will prove disasters for landlords as renters will not be able to afford rent through the end of summer. Last month, New York state passed the Tenant Safe Harbor Act, which makes it even harder for landlords to evict.

This article put in an appearance on the Zero Hedge website at 8:05 p.m. on Friday evening EDT -- and another link to it is here.

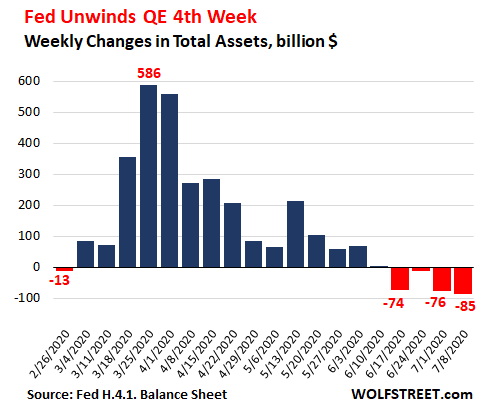

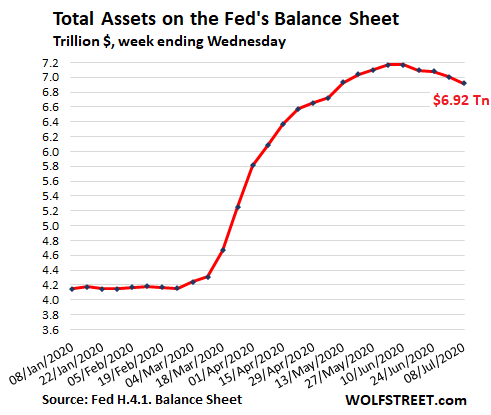

OK, this balance-sheet shrinkage, now in its fourth week, is going faster than I'd expected. Total assets on the Fed's balance sheet for the week ended July 8, released this afternoon, dropped by -$85 billion, the fourth week in a row of declines. This brought the four-week total drop to -$248 billion:

Back on April 9, when markets were just emerging from chaos after the Fed had thrown $1.5 trillion at them in the span of four weeks, Fed Chair Jerome Powell said in a webinar at Brookings that "when private markets are once again able to perform their vital functions of channeling credit and supporting economic growth, we will put these emergency tools away."

This matched what he and other Fed officials had said in the year or so before the Crisis, that at the "next crisis," they would throw all the Fed's might at the problem up front, and then they'd back off, rather than let QE drag on for years. And they did.

By peak QE in early June, the Fed had increased its assets by $2.86 trillion. It has since then whittled this increase down by $248 billion. Note the systematic front-loading then tapering the asset purchases and letting assets top out at $7.16 trillion, and then letting them decline, now down to $6.92 trillion:

Repo balances dropped by $34 billion, to just $41 billion, the lowest since the Fed starting ramping up repos. Repurchase agreements are on the way out. There were zero overnight repos on the balance sheet, and only some older term repos that hadn't unwound yet.

The Fed made repos less attractive over time. On June 16, it raised the bid rate, and for market participants there are now better deals available in the repo market. The Fed is still offering theoretically huge amounts of repurchase agreements every day, but there are no longer any takers.

This longish chart-filled commentary from Wolf was posted on the wolfstreet.com Internet site on Thursday sometime -- and another link to it is here. The Zero Hedge spin on this headlined "Fed's Balance Sheet Posts Biggest Weekly Drop In Over 11 Years" -- and linked here. Gregory Mannarino's post market close rant for Friday is linked here.

It is a central tenet of Credit Bubble analysis that things turn "Crazy" near the end of cycles. And with the thesis that we're in the concluding ("terminal") phase of a multi-decade, super-cycle global Bubble, there's been every reason to foresee Utmost Craziness.

In the most simplified terms, Bubbles inherently gather momentum and inflate to dangerous extremes. Mounting fragilities ensure policymakers employ the increasingly outrageous measures demanded to hold collapse at bay. Craziness is cultivated by a confluence of late-cycle intense monetary inflation (i.e. QE and speculative leverage) and deeply ingrained speculative impulses.

The bigger the Bubble, the more intense the speculative fervor; the greater the attendant government intervention; and the more convinced market participants become that officials won't allow a bust. Throw Trillions at systems already acutely prone to Bubble excess and you're courting disaster (that's you, Washington and Beijing).

The global nature of Bubble Dynamics makes this period unique. And while Europe, Japan and EM are important contributors, the global Bubble is foremost underpinned by historic U.S. and Chinese monetary inflation. That these two countries are increasingly bitter rivals adds unique challenges to Bubble analysis.

The irony of it all: China's communist party readily promoting the stock market. Do they have much choice? The Federal Reserve over three decades shifted away from the traditional model of affecting bank lending - elevating the financial markets to the primary policy stimulus mechanism. Instead of measured interest-rate reductions, on the margin, stimulating bank lending, the Fed has resorted to Trillions of securities purchases (QE) and zero rates to directly trigger market speculation and asset inflation. This model proved an absolute boon to U.S. markets, the economic expansion, the dollar and broader U.S. global influence. To compete, Beijing knew what it had to do.

Like the meme states in the photos and the funnies further up, "I get most of my exercise these days from shaking my head in disbelief. That would apply to what's going on in the world right now -- and Doug pretty much nails it. His weekly commentary appeared on his Internet site very early on Saturday morning EDT -- and it's certainly worth reading. Another link to it is here.

U.S. President Donald Trump has imposed a 25 percent import duty on French goods in an effort to scuttle the country's digital services tax - making it clear that Paris has several months to rethink cutting into Big Tech's profits.

The tariff would affect some $1.3 billion worth of imported French goods like handbags and cosmetics, the U.S. Trade Representative's office revealed on Friday. However, France has a full 180 days to "resolve the issue," including through multilateral fora like the Organization for Economic Cooperation and Development.

The Trump administration has been threatening Paris with fiscal retaliation for months over its digital services tax - ever since France floated the idea of taxing some of the U.S.' most profitable corporations. While the ultimate value of the products affected by Friday's tariff is significantly less than the $2.4 billion in goods the administration had initially threatened in January, which included iconic French products such as cheese and champagne, it runs contrary to a reported promise between Trump and French President Emmanuel Macron to postpone any potential trade war until the end of 2020.

Trump has repeatedly accused the French of "unfairly" targeting U.S. tech firms, which include some of the wealthiest companies on the planet - trillion-dollar firms like Google parent Alphabet, Amazon, and Apple. The French tax is intended to compensate for tech firms' propensity for setting up their corporate headquarters in countries where they pay hardly any corporate taxes while generating massive revenues in the French market. It is expected to supply some half a billion euros annually - if it's allowed to take effect, that is.

It's clear why Washington doesn't want France to move forward with the tech tax, given that several other countries, from the U.K. to Italy, Turkey, and Russia, are mulling similar measures.

The E.U. as well has attempted to pass bloc-wide efforts to tax Big Tech, though none have yet been successful; however, the body floated the idea again in May as a possible way to close the budget shortfalls created by the economic crash that accompanied the Covid-19 pandemic.

These nations are likely watching France anxiously to see what kind of punishment the U.S. metes out in return for what would be an unprecedented attempt at reining in those American firms with more resources and power than most of the world's countries.

This story put in an appearance on the rt.com Internet site at 12:57 a.m. Moscow Time on Saturday morning, which was 5:57 p.m. in Washington on their Friday afternoon -- EDT plus 7 hours. I thank Roy Stephens for sending it along -- and another link to it is here.

Trump Reaps the Whirlwind With China/Iran Mega Deal

For more than three years I've tried to explain that President Trump's foreign policy was having the exact opposite effect of its intended purpose.

Trump, under the advice of people like John Bolton, Secretary of State Mike Pompeo, Israeli Prime Minister Benjamin Netanyahu and Saudi Crown Prince Mohammed bin Salman (MBS) has pursued a maximum pressure campaign against Iran in the hopes of the regime either crumbling or suing for peace.

Trump was warned by both Chinese Premier Xi Jinping and Russian President Vladimir Putin that Iran would 'rather eat dirt' than submit to him on nuclear weapons, support for Hezbollah, Iraq and President Bashar al-Assad in Syria.

In effect, Trump and Pompeo have argued for Iran to give up its sovereignty to appease the fears of Netanyahu in Israel, and they have steadfastly told Bibi and The Donald to go pound sand.

Every six months or so, depending on the state of domestic affairs, tensions with Iran ratchet up another notch. Over the past couple of weeks a series of explosions at key Iranian military facilities occurred with fingerprints of Israel striking deep into Iran to cripple strategic targets.

Trump, distracted by the domestic insurrection against him, has left foreign policy strictly to Pompeo who is avidly pursuing a 'have his cake and eat it too moment,' trying to extend the weapons embargo against Iran at the United Nations while still claiming the unilateral right to leave the JCPOA without further consequences.

In a word, Russia, China and Europe are telling him, "No."

And now we know why. China and Iran just inked a 25-year, game-changing strategic deal covering everything from oil sales, contract bids and massive upgrades to Iran's anti-air capabilities as well as its domestic air force.

This commentary from Tom showed up on his Internet site on Wednesday -- and for obvious reasons it had to wait for my Saturday column. Another link to it is here.

Forbes Censors Award-Winning Environmentalist's Apology Over Three-Decade 'Climate Scare'

Forbes has decided to un-publish an article by award-winning climate activist Michael Shellenberger, in which he apologizes "for the climate scare we created over the last 30 years."

Schellenberger, a progressive, was named one of TIME's "Heroes of the Environment," while his book Break Through was heralded by WIRED as potentially "the best thing to happen to environmentalism since Rachel Carson's Silent Spring."

His book Apocalypse Never was widely praised as an 'eye-opening, fact-based approach' to climate science and 'engaging and well-researched.'

Now that he's apologized for three-decades of climate alarmism, Forbes has now blocked Shellenberger's article without explanation. So, here it is:

This essay, originally published in Forbes, was posted on the Zero Hedge website back on June 29 -- and would have been in last Saturday's column, expect it got 'lost' in my in-box. I thank Dave Rodgers for pointing it out -- and another link to it is here.

Silver investment demand up by 10 percent in first half of 2020

Silver's role as a valued investment was broadly on display during the first half of 2020, as investors actively accumulated silver in the first six months of the year, leading to a 10 percent gain in investment demand. Paving the way was remarkably strong growth in silver-backed exchange-traded products (ETPs), which have posted successive all-time highs this year, together with solid silver coin and bar investment.

The silver price averaged US$16.65 through to the end of June. Having fallen sharply in mid-March, the silver price has since recovered strongly, rising by 56 percent to reach US$17.84 at end-June; it has since broken through the US$18 barrier. The gold:silver ratio - the quantity of silver ounces needed to buy an ounce of gold - fell since its multi-decade high of 127 in March, and at end-June stood at 97.8, which is still very high by historical standards, and may signal that silver is undervalued relative to gold.

Silver Investment

Retail and institutional inflows into silver ETPs have been impressive this year. As of June 30, global holdings reached a fresh all-time high of 925 million ounces (Moz), which is roughly 14 months of mine supply. The ETP growth in the first half 2020 of 196 Moz comfortably surpassed the highest annual inflow of 149 Moz set in 2009. North American listed funds accounted for some 90% of the ETP inflows since March.

Retail bullion coin sales jumped by an estimated 60 percent year-on-year. Silver bar and coin sales surged in response to a deteriorating economic outlook linked to the global COVID-19 pandemic, leading to some supply-chain disruptions. This saw dealer stocks for several silver investment products quickly depleted, resulting in extended delivery lead times and higher premiums.

This commentary from the Silver Institute goes out of its way not to talk about where all this silver is coming from that's going into these various ETFs and mutual funds. Nor does it mention the Big 8 shorts, nor the criminal activity of JPMorgan or any of the other bullion banks. This article, although very positive, should be read keeping its obvious shortcomings in mind. Another link to it is here.

Ted Butler -- The Silver Pressure Cooker

The silver market appears ready to blow its top, much like a pressure cooker whose relief valve stopped functioning even as the heat and pressure continued to build. The gold market is also likely to overheat, but at least in gold, its relief valve - the price of gold - appears to be functioning somewhat and has bled off much of the pressure. After all, the price of gold is up substantially on a year-to-date basis and is not that far from all-time highs. While gold looks poised for further gains, perhaps substantial, its price relief valve has allowed much pressure to be released.

It's quite different in silver, since prices are barely changed on a year-to-date basis and current prices are still close to 65% below the highs registered, both 40 years ago and again 9 years ago. Nothing could demonstrate the malfunctioning of silver's price relief valve relative to gold than the recent 5000 year undervaluation of silver to gold.

As for why silver's price relief valve has ceased to function (and gold's valve is somewhat sticky), that's obvious - the release mechanism was gummed up due to concentrated short selling on the COMEX. For years the concentrated short selling was led by JPMorgan, but the bank has recently abandoned the short side, leaving 8 other big shorts to deal with a mess when the lid blows off.

This commentary from Ted was in his mid-week column on Wednesday -- and I certainly urged him to post it in the public domain -- and here it is. It's definitely worth reading. It showed up on the silverseek.com Internet site on Friday -- and another link to it is here.

The PHOTOS and the FUNNIES

After our brief stop at Oak Harbor on Whidbey Island on 29 December, we headed north. But before heading out of town, I took this last shot of the harbour and part of the town from City Beach Park. The Northern Cascades gleam with their snow cover in the distant background. As I mentioned before, this island is about 99 percent forest, so I took a photo whenever there was a break in the trees. In the third shot, stratovolcano Mount Baker is the standout feature in the distance. These last three photos were taken on the east side of the island. It was obviously beginning to cloud over -- and we were running out of daylight as well. So we headed over to Deception Pass State Park before the light disappeared entirely. Those photos on Tuesday. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The WRAP

"The whole aim of practical politics is to keep the populace alarmed (and hence clamorous to be led to safety) by menacing it with an endless series of hobgoblins, all of them imaginary." -- H. L. Mencken

Today's pop 'blast from the past' dates from 1975...forty-five years ago -- and was a Top 10 hit off their album of the same name -- "One of These Nights". This is a live performance with Don Felder and Joe Walsh pounding away on guitar -- and Don Henley wailing away behind the drum kit. A link to it is here.

Today's classical 'blast from the past' is one I've feature before, but it's been a while. It's a very short work by Georg Friedrich Händel from his oratorio Solomon, which he composed between 5 May and 13 June, 1748. The oratorio contains a short and lively instrumental passage for two oboes and strings in Act Three...a.k.a. "The Arrival of the Queen of Sheba". Here's The Academy of Ancient Music doing the honours -- and the link is here. It's wonderful!

The Big 8 traders, with or without the assistance of JPMorgan, spent the entire week attempting to keep gold below $1,800...and silver under $19 in the spot market -- and for the most part they succeeded. They also managed to haul platinum back below its 200-day moving average, but palladium managed to close above its 200-day during the Friday session.

Although these Big 8 traders are well known for their short positions in gold and silver, they are most likely the big shorts in platinum and palladium as well.

As I've pointed out on many occasions, the COMEX futures market in palladium is a market in name only, so their losses in that precious metal won't even be a rounding error. Most of their mega losses are going to come in silver and gold of course, but platinum is not a market to be sneezed at -- and in the COMEX futures market, the Big 8 are not only short against the non-commercial and small traders, but they're short against the swap dealers as well. It's them against everyone else. There have been big platinum deliveries so far this month, but they're only a drop in the ocean compared to their paper short positions.

So Ted's "Silver Pressure Cooker" is very apropos when discussing platinum and palladium as well. At least the Big 8 can deliver the physical metal into their short positions in gold...if push becomes shove...but that option is certainly not available in the other three.

How long these big shorts can last swimming against the tide of physical disappearing into the various ETFs and mutual funds remains to be seen, but their attempts this week are just delaying the inevitable.

Of course it's certainly within the realm of possibility that the CFTC, the CME Group et al. could pull off some nefarious stunt. But since I'm not encumbered by a sociopathic/psychopathic criminal mind set, I just can't image what that might be. However, with the Big 8 shorts now up against the proverbial wall, a resolution of this situation appears imminent...with or without an engineered price decline in the interim.

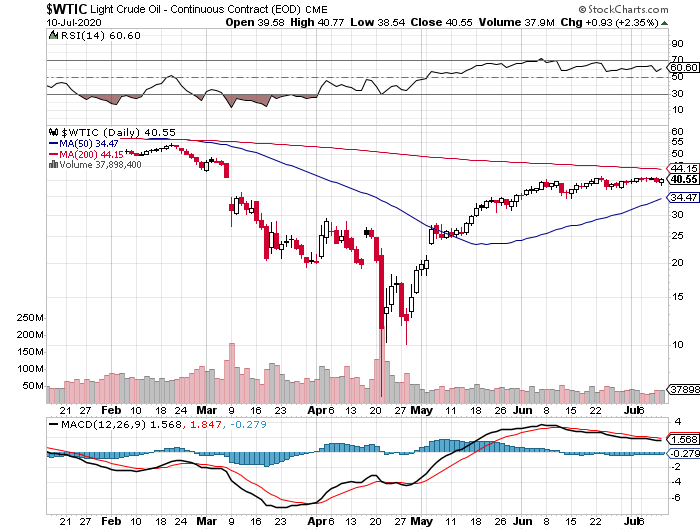

Here are the 6-month charts for the Big 6 commodities, courtesy of stockcharts.com -- and there's not much to see in gold, silver and platinum, as 'da boyz' made sure of that. Copper closed higher by another 6 cents -- and is extremely overbought. WTIC closed up 93 cents a barrel. Click to enlarge.

|

|

|

|

|

|

|

|

|

|

|

|

As for the general equity markets, they're still living on hopes, dreams and fairy dust...with Tesla and the big tech stocks being the poster children for that. Doug Noland's "Utmost Crazy" commentary in the Critical Reads section lays it out nicely.

But my real concern for the good citizens of the U.S. is the rapidly deteriorating civil situation.

I look at what the deep state is doing at all levels of government, banking -- and particularly the media -- and I fear greatly for the survival of the U.S. Republic in its present form. As a Canadian, I'm mortified by what I see happening south of the 49th parallel -- and I'm sure that all my fellow countryman feel the same.

Are the good citizens of the U.S. going to roll over into the waiting arms of the deep state, or will there be insurrection at some point? That's a good question.

I was just rereading part of Thomas Jefferson's letter to William Stephens Smith, the son-in-law of John Adams and, in part, this is what he had to say...which includes one of his most famous quotes...

"What country before ever existed a century and half without a rebellion? And what country can preserve it's liberties if their rulers are not warned from time to time that their people preserve the spirit of resistance? Let them take arms. The remedy is to set them right as to facts, pardon and pacify them. What signify a few lives lost in a century or two? The tree of liberty must be refreshed from time to time with the blood of patriots and tyrants."

I'm hoping and praying that it doesn't come to this, although I fear it may at some point.

Over the last many years I've always given the advice that a current passport, along with precious metals held outside ones country of domicile is an absolute must -- and I'm not just talking about the good citizens of the U.S. here. It's not too late, but the window of opportunity could be slammed shut at any moment once the deep state decides that its time to pull the plug on everything...which it certainly will at some point.

So if you've ever pondered this idea, don't just sit there...do something before its too late.

And I'm sure that you've been keeping close track of all the precious metals that have been pouring into the various mutual funds and ETFs last week, few months -- and few years. Only a tiny portion of that is John Q. Public. Virtually all of it is the smart insider/deep state money.

They can see the writing on the wall better than anyone, as they're the ones that wrote it.

And as I've also said before...if they're heading into the precious metals in a big way, so should you.

Of course I'm still "all in" -- and as the worlds economies and currencies continue to circle the drain at every increasing speed, like you...I still spend a certain amount of time hoping that I'm prepared for any eventuality.

We'll find out soon enough I would think.

See you on Tuesday.

Ed