There is a chart that every silver investor needs to see. Especially now, as the Fed and Central Banks continue to manipulate the precious metals lower while propping up the broader stock and bond markets. Even though precious metals sentiment is at record lows, this normally represents a turning point in the gold and silver markets.

On the other hand, the clowns on the financial networks continue to be euphoric about the broader stock markets as they head toward the heavens. The Dow Jones Industrial Average hit a new ALL TIME HIGH reaching 17,265 today. However, if we look at the chart below, we can see a troubling trend.

As the Dow Jones bubbles to new record territory, trading volume heads into the toilet. This is not a good sign. The Fed must be holding up the majority of the market as investors with any lick of sense, already bailed out of stocks long ago.

Who knows how long before the Dow Jones Index finally receives a well overdue market enema. I can assure you of this, when it arrives it will be a very MESSY OCCASION.

Before I get to the CHART every silver investor should look at, let’s take a quick peak at this one. This chart shows the total American Gold & Silver Eagle sales since the U.S. Mint started its official coin program in 1986.

From 1986 to 2013, total Silver Eagle sales were 358.5 million and total Gold Eagle sales were 20.1 million. Thus, we had a 18/1 Silver-Gold Eagle ratio during this 28 year time-span.

You will notice after the collapse of the U.S. Investment Banking and Housing Industry in 2007, Gold and Silver Eagle sales increased substantially. Even though Gold Eagle sales improved significantly in the years after the economic and market collapse, Silver Eagle sales shot up even higher in percentage terms.

From 2008 to 2013, the U.S. Mint sold a staggering 200.3 million Silver Eagles compared to 6.1 million Gold Eagles. The Silver-Gold Eagle ratio nearly doubled to 33/1 in this six-year period, due to investors favored Silver Eagles over Gold Eagles.

Moreover, investors purchased more Silver Eagles from 2008 to 2013 (200 million), compared to the 158 million sold from 1986 to 2007.

If current buying trends continue for the remainder of the year, I forecast total Silver Eagle sales to reach 37 million compared to 475,000 oz of Gold Eagles. While sales of Gold & Silver Eagles will be lower in 2014 compared to the previous year, the Silver-Gold ratio is estimated to hit a stunning 78/1…. more than double the 33/1 from 2008-2013.

Furthermore, Silver Eagle sales held up much better than Gold Eagles in 2014. According to my year-end estimates, 2014 Silver Eagle sales will only decline 13% year-over-year, while Gold Eagle will fall 45%.

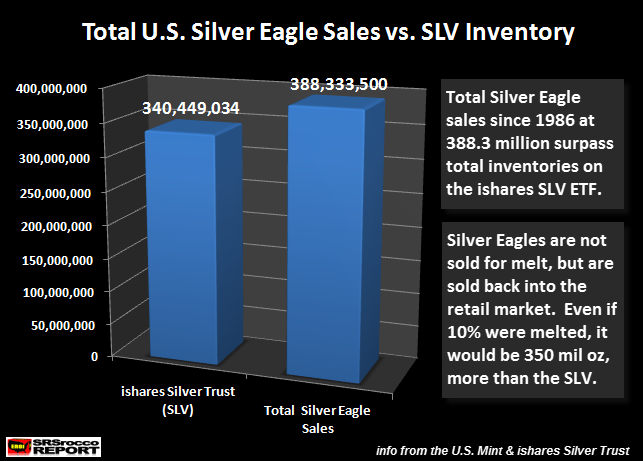

Now… let’s get to the chart I believe every silver investor needs to see:

If we add the total Silver Eagle sales from 1986 to present, it would equal 388.3 million (including the 29,771,000 year to date in 2014). This is higher than the total inventories of the iShares Silver Trust, SLV ETF which currently stands at 340.4 million ounces.

We must remember, Silver Eagles are high premium Official coins that are not sold back into the market for melt and recycling. When an individual sells Silver Eagles back to a dealer, the dealer will resell these coins back to other investors. Which means, the overwhelming majority of Silver Eagle coins are still held by individuals, groups or hedge funds in the market.

Even if we assume that 10% of all Silver Eagles were either lost or sold for scrap (a very high estimate), there would still be approximately 350 million ounces of Silver Eagles held by investors, more than the 340 million held in inventory at the SLV ETF.

After crunching these numbers, I found it quite surprising that there are more ounces of Silver Eagles in investors hands than the metal inventory in the largest Silver ETF in the world.

And, if the rumors are true that the SLV ETF maybe offering paper shares without the real physical to back it up…. then hands down, it makes the Silver Eagle Market a much safer investment to own and acquire.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below.