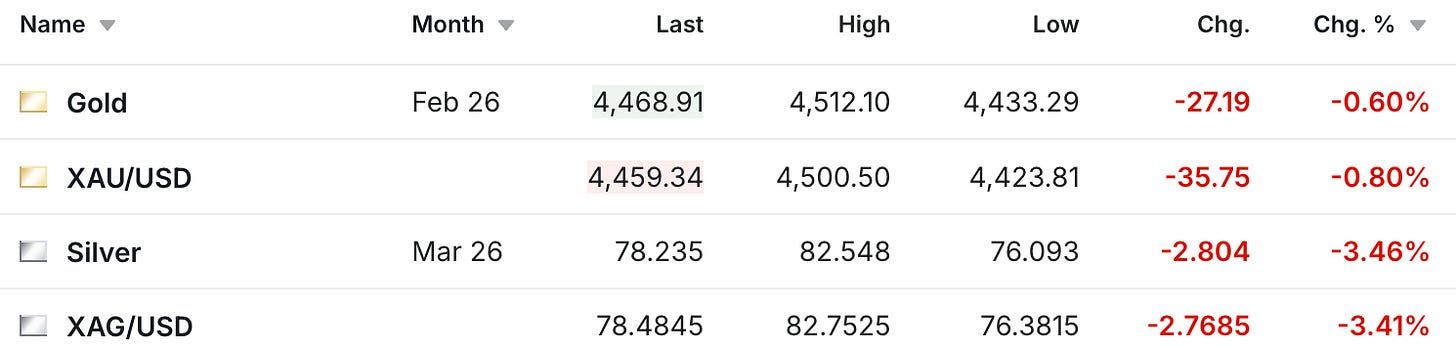

The gold and silver prices sold off on Wednesday after two days of significant rallying to start the week.

Of course, if you’re long gold and silver, you like to see the prices go up. But I think it’s a statement in and of itself if silver is down almost $3, and it’s still over $78 per ounce. And while I understand that investors want the prices to continue to rise, I have to admit, I’m a bit surprised to see as much frustration out there as I do, even with the prices where they are.

Of course, if you’re long gold and silver, you like to see the prices go up. But I think it’s a statement in and of itself if silver is down almost $3, and it’s still over $78 per ounce. And while I understand that investors want the prices to continue to rise, I have to admit, I’m a bit surprised to see as much frustration out there as I do, even with the prices where they are.

It feels like I see a lot more comments about “wake me up when it hits $100,” or “silver might be finally about to have a big move,” rather than excitement about the historic rally that’s already occurred.

Yes, especially with the dynamics in the supply situation in China and elsewhere, there are some valid paths that could result in a price even significantly higher than where it sits today. But with a lot of large three-figure targets being thrown out as if they are simply just a matter of time, there’s something that I touched on in last year’s silver report that seems even more important now to at least just have an understanding of.

Perhaps at the heart of it is that a lot of the price targets that get thrown out there stem from calculations about how much money has been printed, and where the silver price should be based on that. But the fatal flaw in that calculation is that, whether we should be or not, we are not currently on a silver-backed dollar.

Now, if you want to make the case that eventually the government will be forced to start using silver as money again, then perhaps that becomes more relevant. But at least as of today, 1792 Coinage Act or not, we aren’t on a silver standard. Additionally, one of the reasons why I think even if the government did ultimately go back to some form of metallic backing, that it would be more likely that it would be just gold rather than gold AND silver, is that for the silver price to be anywhere near what the amount of dollars out there would dictate, that would basically make any industrial usage non-economic.

However, as I said, I did a dedicated section of last year’s Silver Report (you can access it here if you’d like to read the whole report) to this exact topic, and given that it seems even more relevant now, I’ll share that here. Which is not to say that these are hard and fast rules, but rather just some things I think would be helpful to keep in the back of your mind as we watch the market evolve.

Why The Silver Price Declined During A Decade Of QE And 0% Interest Rates

One of the biggest frustrations, especially for many of the older silver investors, is how, despite a decade of quantitative easing and 0% interest rates in the US after the silver price hit $49 in 2011, the price largely declined throughout most of that period. And with silver still carrying its reputation as an inflation hedge, many investors were left wondering why the silver price sat in the teens for most of the 2010s.

It’s a question that’s often pondered, yet rarely answered. But it’s an important one that deserves to be put in the proper context.

Perhaps it’s understandable that there’s so much confusion around this question due to the complexities of how silver’s priced. This involves an often non-linear balance between physical supply and demand, and the futures trading on the COMEX, where the price is set.

Now, while one could make a valid argument that there are flaws within the way this system operates, for the sake of getting to the heart of why the price responded as it did in the 2010s, we’ll simply stick to examining the situation as it is. And what’s important to remember is that despite how the actions of the Federal Reserve or the government do get priced in by the futures markets, what often gets missed is that aside from whether we should be or not, we aren’t currently on a silver standard.

So when the Fed comes out and cuts interest rates, or announces more quantitative easing, while that increases the supply of money and credit, there’s not a mathematical or financial law that dictates that the silver price has to match that.

Which would be the case on a silver standard, but again, the current dollar system isn’t linked to silver right now. And where things get complex is that monetary actions by the Fed or the government do still normally get reflected in the price set by the futures market. But in silver, because of the way the pricing system works, as we’ve seen, the connection between the physical and futures markets can often break down.

However, that doesn’t mean there aren’t some longer-term boundaries and parameters that do eventually come into play, given that there is a physical commodity involved.

To illustrate the point, I’ll use an extreme example (and please note that I am not suggesting a silver price target here, but rather just using a large number so that the bigger takeaway will be clear).

With that said, imagine that something happens with the Treasury, or some other part of the economy, and the Fed goes back to large amounts of quantitative easing, and cuts rates back to 0%. Then let’s imagine there was an extreme reaction in the silver market, and the silver price goes to a big number like $500 per ounce.

Let’s say this move to $500 also occurred in a way that led mining executives and capital backers to believe that that was going to be the price going forward, and that it wasn’t going to drop back down. Then we’ll say that money flows into the miners, and results in an increase in production (we’ll also leave aside the timeline that it would take for that production to come online for now as well).

But if we’re not on a silver standard, with a redeemability mechanism in place to support the price and create an additional source of demand for the incremental silver produced, and if people aren’t increasing the rate at which they’re actually buying, taking possession of, and using silver monetarily, then eventually over a long enough time period, you’re left with an oversupply.

Because while the silver price is generally tracking the gyrations of the Fed and the economy, it also impacts the decisions made by the silver-producing executives. And while the price went higher in 2011 in response to what was happening following the collapse of the subprime bubble, and silver demand did increase, especially after the price started coming down, it was a lot more common to hear about physical silver investors who were frustrated and throwing in the towel, rather than a surge by the public to buy physical.

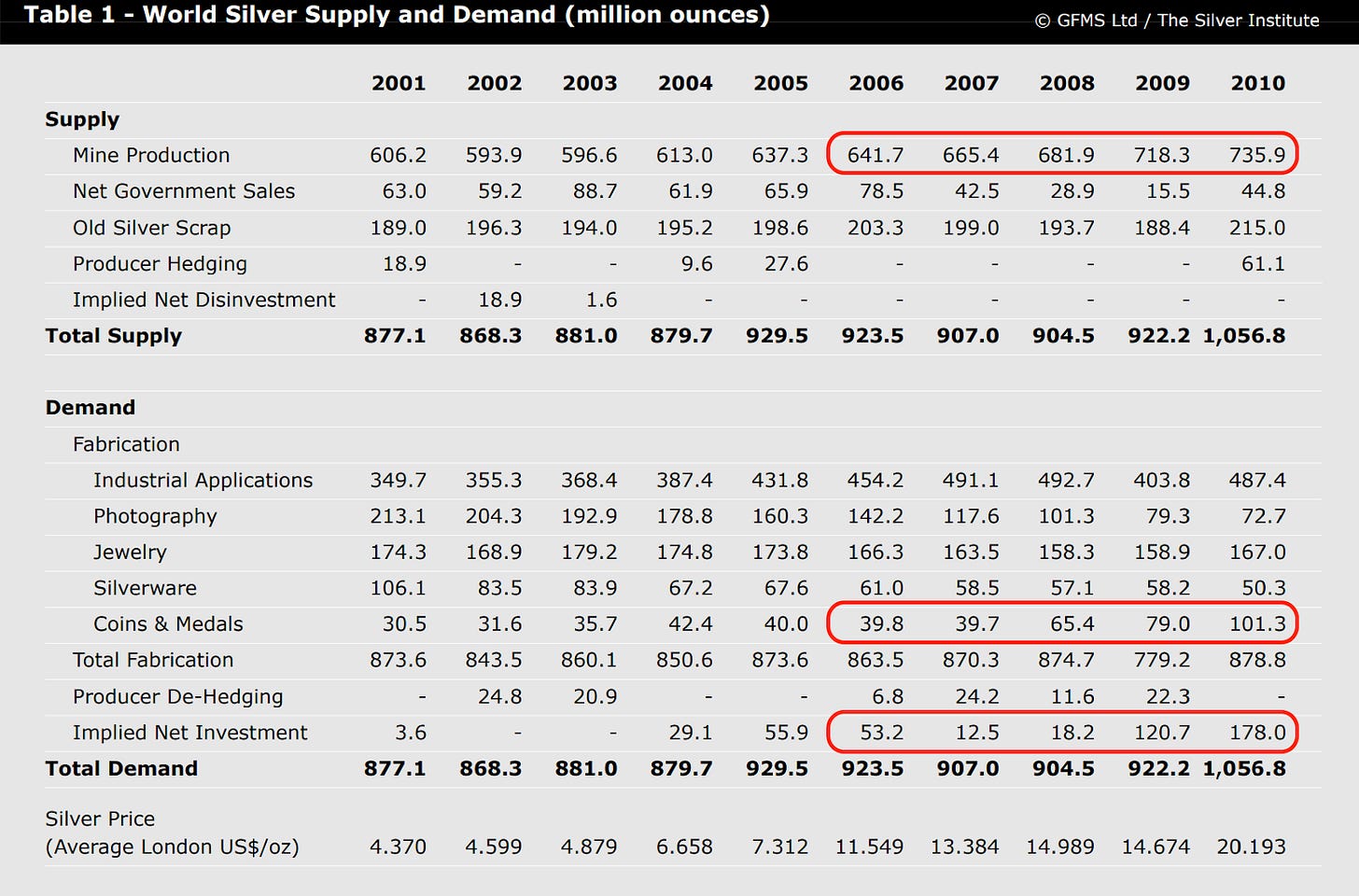

You can see in the data from the older World Silver Surveys how, in 2006, they had mine production at 641.7 million ounces, while coins and metals plus net implied investment came to 93 million ounces.

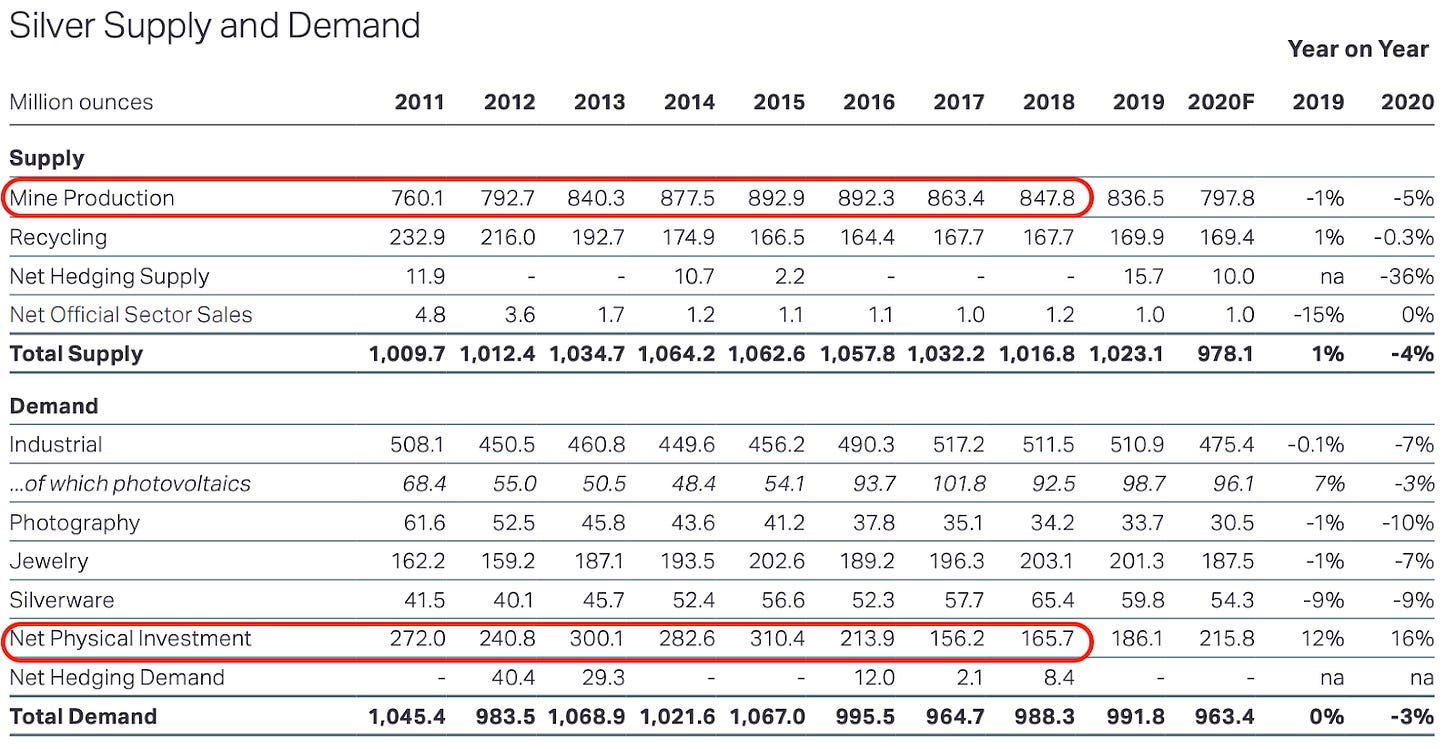

Then we saw a surge in physical silver investment beginning in 2009, which peaked in 2015 at 310.4 million ounces, but by 2018 was down to 165.7 million ounces.

Then we saw a surge in physical silver investment beginning in 2009, which peaked in 2015 at 310.4 million ounces, but by 2018 was down to 165.7 million ounces.

Meanwhile, by 2018, mine production had increased to 847.8 million ounces. Which means that between 2006 and 2018, mine production increased by 206.1 million ounces, while total investment had increased by only 72.7 million ounces.

So ultimately, we ended up with more additional supply than demand after the price rose, because despite the debasement of the dollar over that period, while there was an increase in demand, it didn’t keep up with the incremental production. And if the silver price goes up, and production is increased, but there isn’t a sufficient source of demand to consume that production, over a long enough period of time, you end up with a greater supply, and the price eventually has to come down.

So ultimately, we ended up with more additional supply than demand after the price rose, because despite the debasement of the dollar over that period, while there was an increase in demand, it didn’t keep up with the incremental production. And if the silver price goes up, and production is increased, but there isn’t a sufficient source of demand to consume that production, over a long enough period of time, you end up with a greater supply, and the price eventually has to come down.

We’ve also talked quite a bit in the past year about how the gold price was already rising, but until last fall, precious metals investors kept wondering when silver was going to finally catch up. A lot of that had to do with how central banks have been setting records for the amount of gold they’ve been purchasing, while so far we haven’t seen that incremental source of investment demand in silver. Where, instead, there’s been a lot of selling in the last 3 years.

However, the growing industrial demand, especially over the past five years, has been sufficient to overcome that, and still leave the market in a deficit. Which means that in the same way a price spike led to an oversupply, now we’re in the exact 180-degree opposite of that situation. Where the price of the last 5 years left the market in a shortfall, and now has us on the verge of an even more significant supply disruption, even without investment coming back in a big way.

This is just one of the reasons why following the silver market in the next few years will be so intriguing. And given the current dynamics, if we do eventually get a surge of demand from the investment side, that would only further accelerate the rate at which the existing available supply gets eaten into.

So, in terms of why the silver price reacted the way it did from 2011 to 2019, even as interest rates stayed at 0%, hopefully, this helps to put that into a better context.

Because while we’ve seen that the physical/futures relationship can go through long periods where the correlation breaks down, that doesn’t mean that basic fundamentals aren’t still at play.

I did post a video about this on our YouTube channel today, which also examines how this situation will be affected by some of the other dynamics at play in the silver market. So if you’re in the mood to watch something tonight, I think you would enjoy this one.

But that’s enough for today, and we’ll see what the gold and silver markets hold in store for us tomorrow.

That’s the end of that snippet from last year’s Silver Report, and hopefully, you can take a moment to think about how that concept can be extrapolated onto the situation we’re facing today.

If you had any questions about what you just read, feel free to leave a comment below, and I’ll keep an eye on those to try and make sure you can get an answer. But hopefully that was helpful, and I’ll see you back here again tomorrow.

Sincerely,

Chris Marcus