Many subscribers ask me about taking profits on their physical gold and silver. While there’s nothing wrong with taking profits on your metal, it defeats the purpose of converting fiat currency into physical gold and silver.

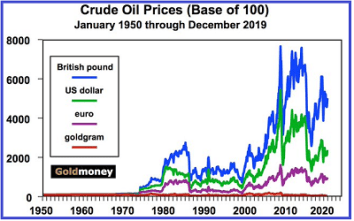

The chart above from James Turk (Goldmoney.com) illustrates the power of gold’s (and silver’s) wealth preservation attributes. The chart shows the cost of oil measured in dollars (green line), euros (purple line), pounds (blue line) and goldgrams (red line). It uses 100 as the “base” price for oil. A gram of gold buys the same amount of oil now as it did in 1950. In contrast, takes a considerable amount more of dollars, euros or pounds to buy the same amount of oil now as each would have purchased in 1950.

If you have large profits in your physical gold/silver holdings and taking profits will make you feel more comfortable, by all means do so. I’m holding all of my gold and silver for when the dollar collapses and there’s a monetary reset. A reset that incorporates gold and silver into the currency system should incorporate a substantial upward revaluation of gold (and silver) priced in all fiat currencies to a level that makes me indifferent between holding the metal or holding the new currency. Those who converted their metal into dollars before a reset occurs will be holding worthless paper.

Chris Marcus (Arcadia Economics) and I discuss several reasons why gold (and silver) is extraordinarily undervalued: