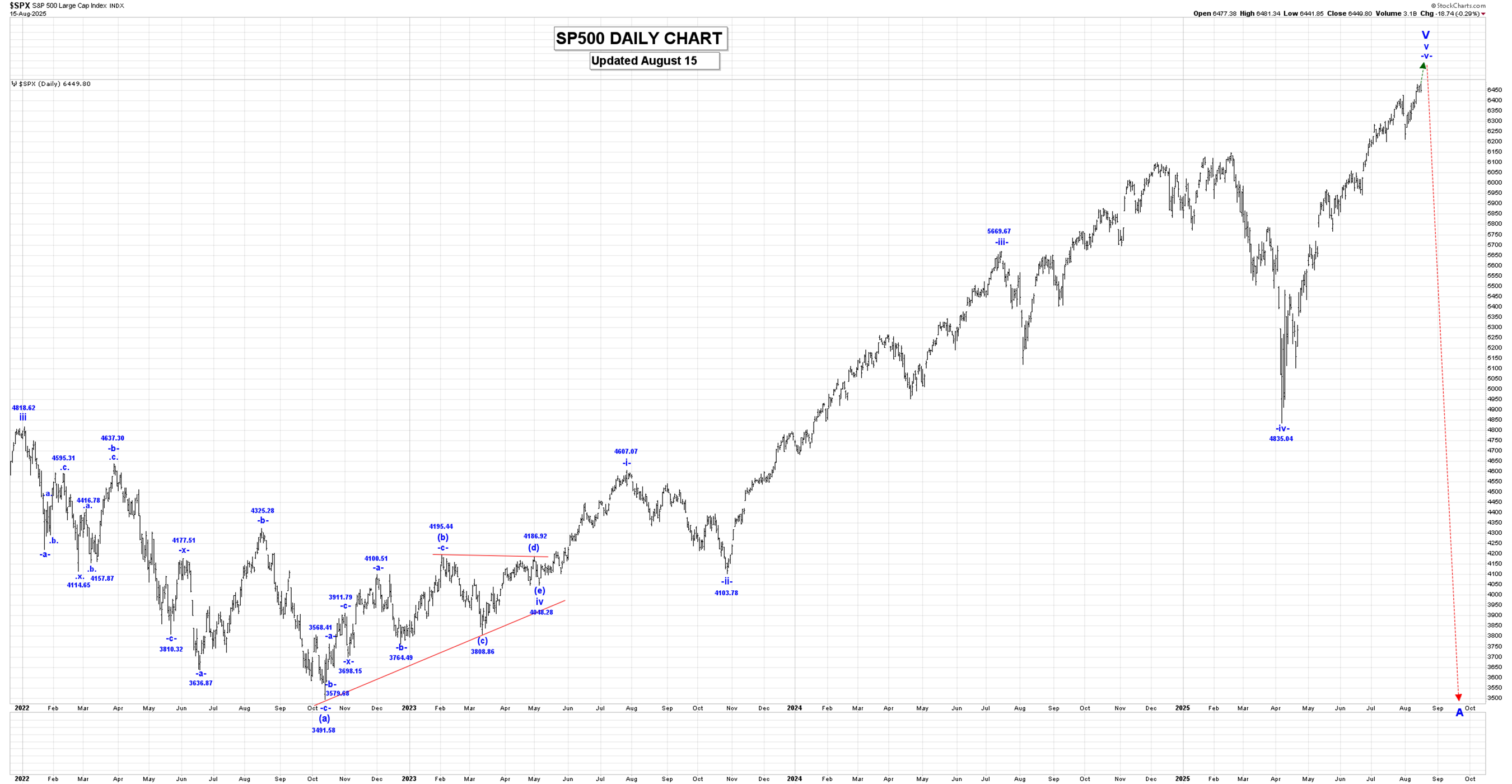

The Captain’s daily SP500 chart.

The Captain’s daily SP500 chart.

We are still working on wave -v-, and within wave -v-, and it looks like wave .iii. is still underway, with our current projected endpoint being:

.iii. = 2.168.i. = 6325.66.

We have reached our projected endpoint, so we need to be on guard for its completion and the start of a correction in wave .iv. that should retrace between 23.6 to 38.2% of the entire wave .iii. rally.

The Captain’s 120-minute SP500 chart.

The Captain’s 120-minute SP500 chart.

The rally from that decline (.iv. on the chart) to new record highs could fool most stock market investors into thinking all the danger is over when in fact….

The real danger is about to begin.

Trading Recommendation: Stay Flat (but not for long!).

Active Positions: Flat and eager to go short!

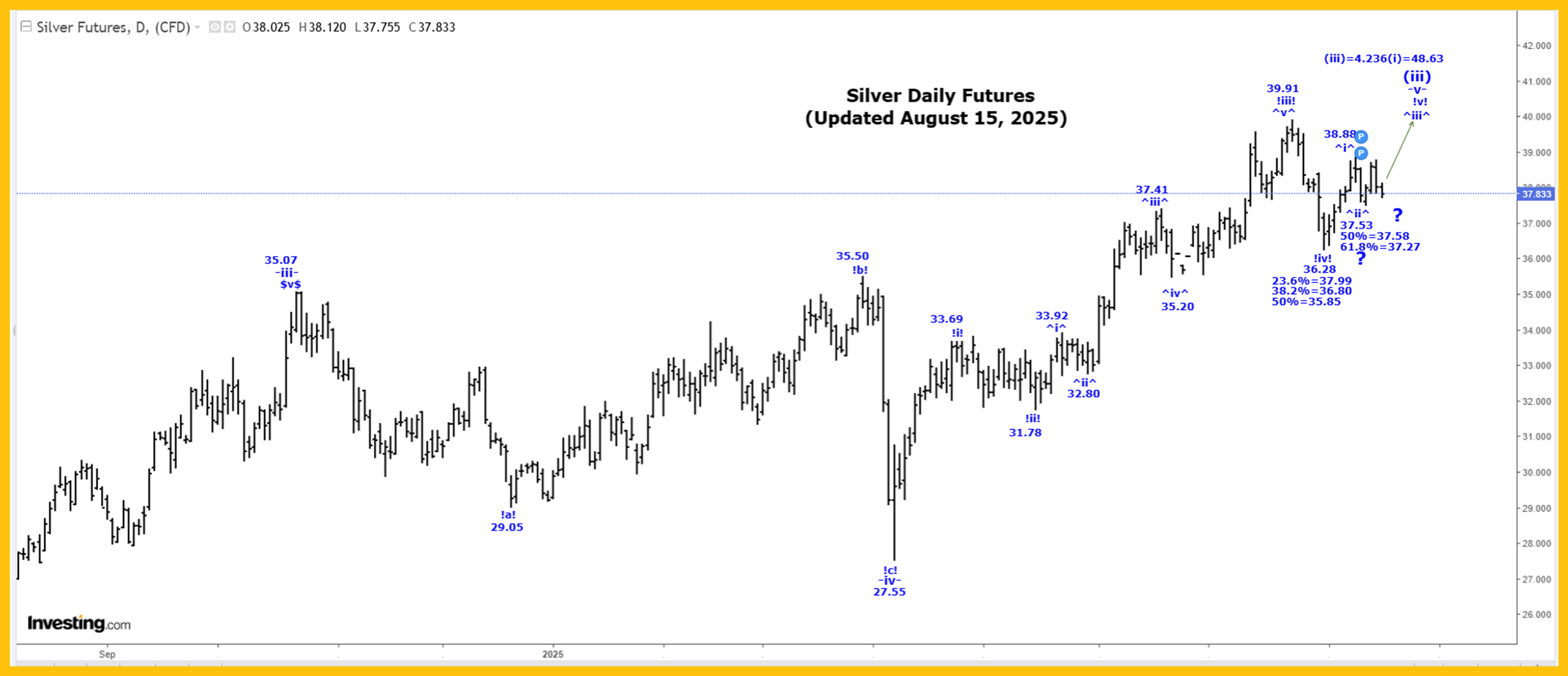

Silver Update

The Captain’s daily silver chart.

The Captain’s weekly silver chart.

We are moving higher in wave 3, as shown on our Weekly Silver Chart. Within wave 3, we completed wave i at 29.91 and wave ii at 18.01, and we are continuing to move higher in a subdividing wave iii. Our current projected endpoint for wave iii is:

iii = 1.618(i) = 48.05!

Within wave iii, we completed wave (i) at 24.39, wave (ii) at 19.94 and wave (iii) at the 39.91 high. If that is the case, then we are moving lower in wave (iv), which retracement levels as indicated in our Daily Posts.

We have entered our retracement zone, so we need to be on guard for the completion of wave (iv), perhaps at the 36.28 low, and the start of another rally in wave (v).

Longer term, our initial projection for the end of wave 3 is:

3 = 1.618(1) = 86.50

In the very long term, we completed all of wave III at 49.00 in 1980 and all of wave IV at 3.55 in 1993. We are working on wave V, and within wave V, we have the following count;

1 = 49.82;

2 = 11.64;

3 = First projection is 86.50!

Trading Recommendation: Go long with puts as stops.

Active Positions: Long with puts as stops!

Gold Update

The Captain’s daily gold chart.

We cannot rule out the possibility that our wave -iv- triangle is going to expand and extend, and if it does, it will look like:

*a * = 3120.90.

*b* = 3451.60.

*c* drop is now underway, heading at least to the 3247.50 low.

*d* rally after wave *c* ends.

*e* drop after wave *d* ends.

We are starting to look at other potential alternates for the internal wave structure of wave -iv-, and for the time being, we will not list them all here, but they all point to gold moving sharply higher very soon.

One such alternate does have wave -iv- ending at the 3120.50 low, which suggests that wave -iv- is complete and we are already moving higher in wave -v-.

After our wave -iv- bullish triangle ends, we expect a very sharp thrust higher in wave -v-.

Thank-you,

Captain Ewave & Crew