By: Simon Russell, GoldSeek Mining Analyst

Foreword

By Peter Spina

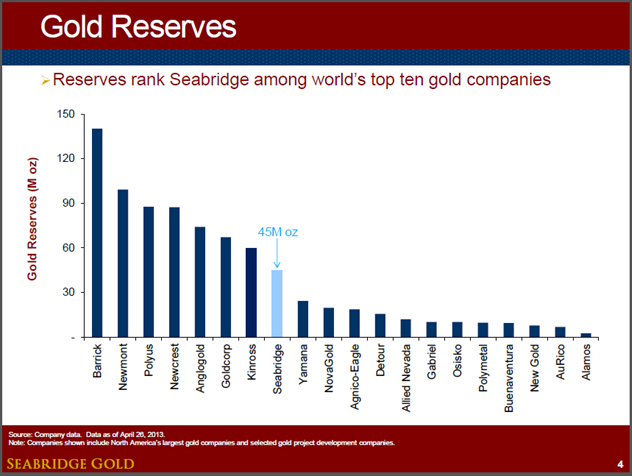

Investing in gold stocks presents a variety of options; however there are very few companies able to boast a gold reserve size that places it in a top-ten echelon globally.

Seabridge Gold (NYSE.SA, TSX.SEA) owns one of the world’s largest proven and probable reserves of gold located in one of the premier mining jurisdictions of Canada. With nearly 45 million ounces of gold reserves (plus 10 billion pounds of copper) between their two core properties and with nearly the same amount of shares outstanding, investors are leveraged to almost one ounce of gold reserve for each share, which currently trades for just under $9. No other gold company gives you so much in gold reserves per share. By contrast, Newmont Mining has about 1/5th the gold ounces per share.

I have invested in Seabridge Gold and watched it develop over the past decade+ into one of the top ten gold companies by gold reserves worldwide. Progressing these assets while retaining full ownership without diluting shareholders has demonstrated their abilities to continue moving these key assets forward consistent with shareholder interests. Seabridge is committed to advancing these core assets to and through permitting where shareholders will be rewarded significantly more than most companies would have been capable of with assets of such size.

I believe that the extreme market conditions which we find the gold stock sector in today present us with one of the best opportunities in the gold bull market to date! I consider Seabridge Gold to be one of the top gold stock opportunities out there with the company well capitalized ($35M+ in cash), well structured (45.6M shares) and led by a highly-qualified management team commanding premier gold-copper assets.

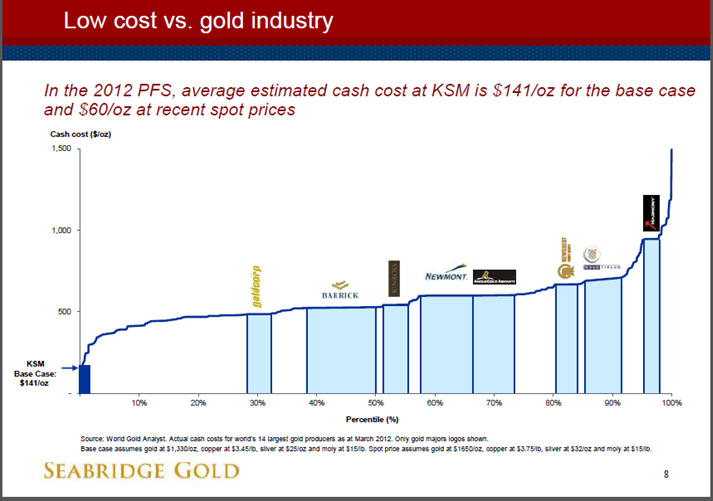

Seabridge’s KSM project’s latest Preliminary Feasibility Study reveals the very good economics behind the project with its 55-year mine life giving the asset a 5% pre-tax NPV of $4.5 billion with annual gold production in years 1-7 of 851,000 gold ounces or a Life Of Mine of production profile of: 508,000 gold ounces, 146.8M lbs of copper, 2.19M ozs of silver and 1.14B lbs of molybdenum. The base case, life of mine cash operating costs, for KSM are just under $150 an ounce, net of by-product base metal credits. More important, with estimated total costs of $598/oz (including up-front capital, sustaining capital, operating costs and closure costs) KSM is projected to produce gold at an all-in cost well below the industry average of around $1150 per ounce. Even with the $5.25B billion dollar CAPEX for a world-class asset of this size, the payback is just over 6 years around these current metal prices. Seabridge’s plan is to attract a joint venture partner that has the technical skills and financial resources to build and operate KSM. Seabridge will look to maintain a meaningful interest in the project while minimizing its capital contribution.

Among all of the gold stocks out there, Seabridge Gold leads its peers with this strong combination of people, property, and place along with its solid share structure and financial positioning. The management has held to its commitment over the years to put shareholders first, which has been demonstrated by their history of advancing these projects, adding value combined with their anti-dilution policy. This is an investor friendly gold stock which can now be bought for a fraction of its value. I see the current trading levels as an excellent accumulation opportunity.

- Peter Spina, President of GoldSeek.com

1. Introduction

Seabridge Gold (NYSE.SA, TSX.SEA) is an exploration and mine development company that is focused on two 100%-owned Canadian properties, which are located in significant emerging mining regions. Since the company was founded in 1999 their Resources and Reserves have grown into one of the world’s largest portfolios of gold, silver, and copper through exploration success. Their management team intends to continue making new discoveries, and this summer they are preparing to explore several new targets at both of their projects.

Combined, Seabridge’s KSM property in BC and Courageous Lake in the Northwest Territories have NI 43-101 compliant Proven and Probable Reserves of 44.7 million ounces of gold, 191 million ounces of silver, 10 billion pounds of copper, and 231 million pounds of molybdenum. The size of their Reserves is comparable to many of the world’s largest gold mining companies.

Click on image to enlarge.

(Gold Reserves chart from Seabridge’s May 2013 Presentation)

Since they only have 45.6 million shares issued and outstanding, their gold Reserves are trading at around $9 per ounce at today’s share price. Similarly, their shareholders get more ounces of gold in the ground per each share of stock than any major miners and large explorers.

Seabridge is well funded with over $35 million of cash in their treasury and intends to continue advancing their KSM and Courageous Lake projects, as described in the company’s May 2013 news releases. At KSM they just started a drill program to follow up on four new potential high grade gold and copper discoveries. Meanwhile, at Courageous Lake the latest drill assays and metallurgical test results show that their new high grade Walsh Lake discovery has potential to help boost the project’s resources and economics.

Ultimately Seabridge’s strategy is to joint venture or sell their properties to a major gold or copper mining company that has the capital and expertise required to build and operate large mines.

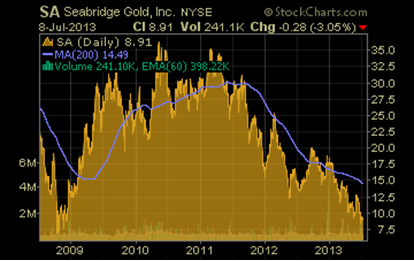

2. Share Structure and Management

Seabridge stock is currently trading around US$9.00 and they have 45.6 million shares issued and outstanding so their market capitalization is about $400 million. They have 48.9 million shares on a fully diluted basis, and their 52 week range is from US$8.23 to $20.34 per share.

The company has over $35 million of cash, plus they have a significant amount of stock in several exploration companies from optioning their non-core properties in Canada and the United States.

Insiders own approximately 30% of the company plus they have many large institutional shareholders. They are included in both the GDX and GDXJ market indexes.

(Seabridge Gold’s NYSE.SA stock chart from stockcharts.com)

Seabridge is led by experienced corporate management and also has an accomplished technical team that has met with the GoldSeek.com authors of this report. In February, 2013 GoldSeek.com Radio interviewed the company’s Co-founder, Chairman and CEO Rudi Fronk.

Rudi Fronk is a mining engineer with over 30 years of experience in the gold industry, and he has worked with publicly traded companies including Greenstone Resources and Amax, plus engineering firms such as Behre Dolbear & Company.

Senior VP Exploration Bill Threlkeld was previously Exploration Manager and Vice President with Placer Dome in Latin America prior to co-founding Seabridge with Mr. Fronk in 1999. Before joining the company in 2011, President, COO and Director Jay Layman was Vice President of Solutions and Innovation for Newmont Mining. Seabridge recently announced the hiring of Peter Williams as V.P. Technical Services, following 20+ years at Newmont most recently in charge of global mining engineering.

3. KSM, BC

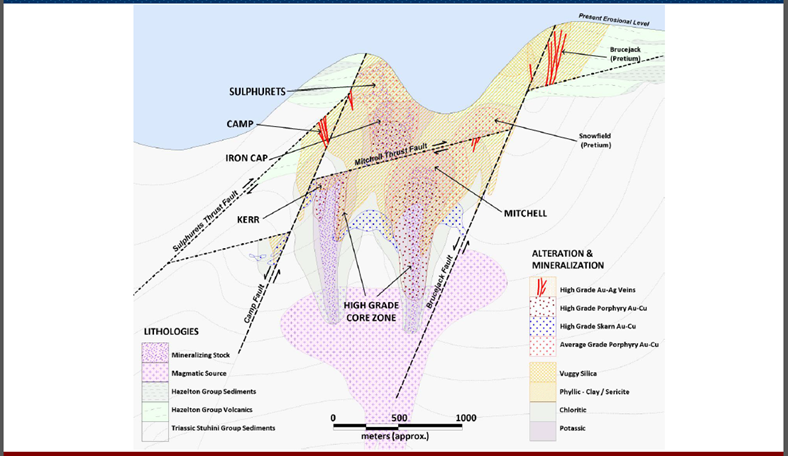

The KSM property in northwestern British Columbia is named after the neighboring Kerr, Sulphurets, and Mitchell ore deposits, which are shown in the photograph below. Combined, KSM’s hosts one of the world’s largest undeveloped Proven and Probable gold Reserves with a total of 38.2 million ounce of gold and 9.9 billion pounds of copper contained within 2.1 billion tonnes of ore. KSM also has additional resource of 1.7 billion tonnes with 25.8 million ounces of gold and 7.9 billion pounds of copper.

Click on image to enlarge.

(Panoramic view of the KSM property looking east, from Seabridge Gold’s webpage)

KSM is located in a mining friendly region of BC that is remote while also relatively close to important infrastructure. The property is about 70 km from the town of Stewart which provides a year round port facility with access to the Pacific Ocean. The Province of BC’s is currently extending hydroelectric power line northward with a hook-up to KSM approximately 30 km away. When completed in late 2014, Seabridge will be able to purchase line power at less than $0.06 per kilowatt hour.

Historically significant gold mines in this region include Barrick Gold Corp.’s (NYSE.ABX, TSX.ABX) reclaimed Eskay Creek, and Newmont’s (NYSE.NEM) past producing Granduc mine. Furthermore, the discovery of many new “elephant” sized deposits over recent years is quickly transforming this region into one of the most significant future gold mining districts in the world.

Seabridge’s KSM claim block is next to Pretium Resources’ (NYSE.PVG, TSX.PVG) Snowfield project that has 25.9 million ounces of gold Measured and Indicated plus 9.0 million ounces Inferred, and a substantial amount of copper, silver, and molybdenum. Near Snowfield, Premium’s higher grade underground Valley of the Kings and West Zone deposits contain combined Proven and Probable Reserves of 7.3 million ounces of gold in their positive June, 2013 Feasibility Study.

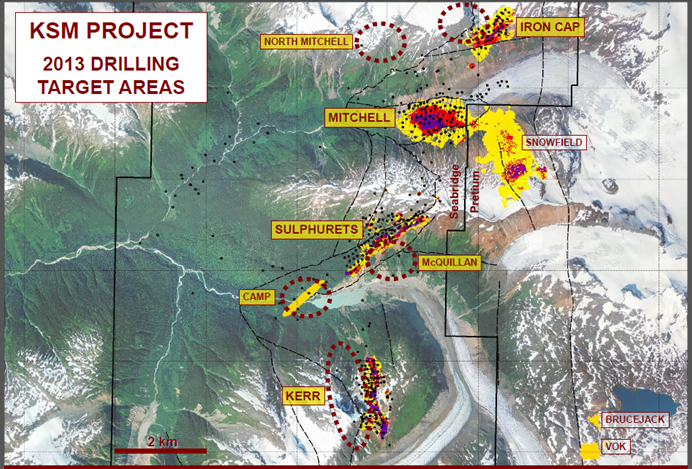

Click on image to enlarge.

(Plan-view map of KSM with Pretium’s adjacent projects, from Seabridge’s May 2013 Presentation)

KSM’s Preliminary Feasibility Study (PFS) that was published May 2012 demonstrates this project has realistic potential to be economically viable over a 55 year mine life. Initially mining would begin at surface with an open pit at a strip ratio of 1.5:1, and then transition to an underground block-caving type of operation. The capital cost of C$5.3 billion would take approximately 6.2 years to payback, and has a NPV(5%) of $4.5 billion with IRR of 11.5%.

Furthermore, the PFS’ estimated cash operating costs of $148/oz Au and total costs of $598/oz Au would be much less than the industry average, as shown by comparison to the major gold mining companies in the Cost Curve chart below.

Click on image to enlarge.

(Cost Curve chart from Seabridge’s Why KSM Makes Sense presentation)

As described in Seabridge’s May 22nd news, the KSM drill program that just began will test a total of four new targets that were discovered in 2012. The three potassic “core zone” targets known as Deep Kerr, McQuillan, and Iron Cap have potential to host higher gold and copper grades than the current reserves (possibly around 1 g/t gold and 1% copper). Their fourth prospect is called the Camp Zone, which shows potential for finding a high grade epithermal system similar to Pretium’s Bruce Jack gold deposit at Valley of the Kings.

Finding new high grade gold-copper resources should help make KSM more attractive to major copper and gold miners, plus large polymetallic producers.

Click on image to enlarge.

(Geological cross-section showing the locations of Seabridge’s and Pretium’s inter-related deposits, from May 2013 Presentation)

Recently the company achieved a major milestone towards attaining mine construction and production permits when they submitted KSM’s Environmental Impact Statement (EIS) in February. The project has passed its initial screening and the EIS has been accepted for formal technical review, which is the second sage of a three-stage approval process. Approval is expected in Q2 2014. The company has been proactively engaging stakeholders, including Aboriginal groups, for over five years, and they have already incorporated design changes into their EIS as a means of accommodating their comments.

4. Courageous Lake, NT

Seabridge’s Courageous Lake property includes a 53 km long greenstone belt located in Canada’s Northwest Territories, about 75-100 km south from Rio Tinto’s Diavik and Domion Diamond Corp’s Ekati diamond mines. Although the project is fairly remote, it has access via the same seasonal ice roads that the diamond mines utilize. The Territorial government recently built a bridge across the MacKenzie River near Fort Providence.

Courageous Lake’s July 2012 Preliminary Feasibility Study includes Proven and Probable Reserves of 6.5 million ounces of gold at the FAT deposit, within 91 million tonnes that have an average grade of 2.2 g/t. The PFS open pit mine design calculates annual production of about 385,000 ounces of gold with a cash operating cost of C$780 per ounce and total costs of $1,120 over a 15 year mine life.

The main technical challenge with the FAT deposit is that it has refractory mineralization. Basically this means the ore minerals need to be oxidized by an autoclave in order to extract the fine-grained gold particles. This is a common process for treating ores at many gold mines in Nevada, however it is more expensive than simpler methods such as flotation and heap leaching.

Consequently, Seabridge is now focused on exploring numerous additional targets that show potential for higher grades and less complex mineralization. Their $8.5 million 2012 exploration program discovered high grade gold mineralization at Walsh Lake that typically has grades around 3.5 g/t. Furthermore, this second deposit’s metallurgical test results show that its mineralization is not refractory but is free milling instead.

The 29 holes drilled this past winter are being used to build the Walsh Lake deposit’s first resource model, which is expected to be published in Q3. Follow-up drilling in 2013 intends to help better define its second resource estimate, which will then be used for a preliminary open pit mine design and related environmental studies.

Encouraging assays from the company’s work at Walsh Lake and other targets imply this property has potential to find a higher grade deposit that could ultimately be used to generate the cash flow for the Autoclave and related infrastructure that will be required to mine their FAT deposit’s Reserves.

5. Summary

Seabridge Gold has one of the world’s largest portfolios of gold, copper, and silver resources and reserves at their two main projects in Canada. The company has a lot of metal in the ground and a very tight share structure. Current market conditions have discounted their Proven and Probable Reserve to around $9 per ounce, which is relatively inexpensive considering their low political risk, attractive projected economics and additional geological potential.

The company has over $35 million in cash and intends to continue growing shareholder value by exploring for additional deposits, plus increasing the quality of their known Reserves with permitting and engineering.

2013 exploration programs at both KSM and Courageous Lake have realistic potential to add significant Resources and improve these projects’ economics. At KSM the Camp Zone target will be tested for high grade mineralization similar to Pretium’s neighboring Bruce Jack deposit, along with three high grade gold-copper potassic “core zone” prospects. Meanwhile, follow-up drilling at Courageous Lake intends to grow the Walsh Lake maiden Resource calculation that is being prepared for publication.

- Simon Russell, Mining Analyst for GoldSeek.com

Resource Links for Seabridge Gold

Corporate Site:

Sedar Filings:

http://www.sedar.com/DisplayCompanyDocuments.do?lang=EN&issuerNo=00007531

Stock Quote:

NYSE: SA

TSX: SEA

Simon Russell is a mining and geological engineer with 10 years of experience. His background includes hydrology and environmental engineering, exploration geology, underground contract mining, mine engineering and project management, and mine investment analysis. Mr. Russell has worked for many different types of mineral projects internationally and across the western United States for investors, consulting firms, and both major and junior resource companies.

Simon Russell is a mining and geological engineer with 10 years of experience. His background includes hydrology and environmental engineering, exploration geology, underground contract mining, mine engineering and project management, and mine investment analysis. Mr. Russell has worked for many different types of mineral projects internationally and across the western United States for investors, consulting firms, and both major and junior resource companies.

Mr. Russell is not an investment advisor, and this is not intended as investment advice.

Peter Spina's experience with the precious metal markets started back in the mid-1990s, which led to the creation of GoldSeek.com back in 1995. Today GoldSeek.com ranks in the top three most popular global gold websites and its sister site, SilverSeek.com ranks as the most visited silver website in the world. Back at the start of the new secular precious metals bull market, Peter established the technically-focused subscription newsletter, which at the start of 2005 was merged into the more comprehensive Gold Forecaster (goldforecaster.com) service. In addition to the newsletter and websites, Peter frequently appears in the media including MarketWatch, Reuters, and Investors Business Daily

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. GoldSeek.com, have based this document on information obtained from sources it believes to be reliable but which it has not independently verified; GoldSeek.com makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of GoldSeek.com only and are subject to change without notice. GoldSeek.com assume no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, we assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information, provided within this Report.

Additional Disclosure: The owner, editor, writer and publisher and their associates are not responsible for errors or omissions. The author of this report is not a registered financial advisor. Readers should not view this material as offering investment related advice. Authors have taken precautions to ensure accuracy of information provided. Information collected and presented are from what is perceived as reliable sources, but since the information source(s) are beyond our control, no representation or guarantee is made that it is complete or accurate. The reader accepts information on the condition that errors or omissions shall not be made the basis for any claim, demand or cause for action. Past results are not necessarily indicative of future results. Any statements non-factual in nature constitute only current opinions, which are subject to change. The information presented in stock reports are not a specific buy or sell recommendation and is presented solely for informational purposes only. The author/publisher may or may not have a position in the securities and/or options relating thereto, & may make purchases and/or sales of these securities relating thereto from time to time in the open market or otherwise outside of the trading timeframe listed above. Nothing contained herein constitutes a representation by the publisher, nor a solicitation for the purchase or sale of securities & therefore information, nor opinions expressed, shall be construed as a solicitation to buy or sell any stock, futures or options contract mentioned herein. Investors are advised to obtain the advice of a qualified financial & investment advisor before entering any financial transaction.