It’s a well-known strategy in cycling to win races.

Cyclists ride in a peloton formation to conserve energy by drafting behind lead riders.

The cyclists take turns being in the front and spending most of the energy. But for the riders behind the leaders, the resulting decrease in air resistance – drag – is incredible.

In a race where winners and losers are separated by seconds, this strategy can reduce drag by 5-10%.

Stretch that reduction over hundreds of miles and the amount of energy saved adds up – in a big way. This allows riders to sprint to the front with much more energy.

Right now, it feels very much like gold is leading the precious metals pack at the front of the peloton.

Could silver be conserving its energy looking to make a sprint to the front of the pack?

Let’s Start with Silver 101

Silver (or ‘Argentum’ in Latin) has been a prized metal since antiquity.

Though too brittle to forge swords or armor, its luster and rarity made it a prized medium of exchange.

Powerful empires from Ancient Rome to Imperial Spain couldn’t mine enough of it.

Silver coins became the unit of account in many important currencies: the Greek Drachma; the Roman Denarius, the Islamic Dirham and the Spanish dólar.

Here is a cool side fact for all the silver bugs out there…

It was the Spanish dólar, with its standardized dimensions, that inspired Treasury Secretary Alexander Hamilton to adopt the United States Dollar as the currency of the newly-founded United States of America.

Nowadays, Silver has one thing that gold does not – affordability and abundance.

Over 60% of silver is used in industrial applications, with the residual sub 40% used in jewelry and silver bullion. There’s certainly an argument to be made that silver is a base metal that likes to pretend that it’s still precious.

Production and Pricing

One of the most important things to understand about any commodity is its supply and demand fundamentals.

Silver production has been impacted severely by COVID-19.

- As much as 66% of primary silver mine production was put on hold from anywhere from 2 weeks to 4

Over 101 mines are still affected as at June 18, 2020. This represents about 33.52M oz. of total production at risk, and accounts for 26% of 2020 estimated mine production.

A second round of lockdowns would be good for the price of the silver, at least on the supply side. But bad news for miners who have to shut in or curb production.

What Are the Largest Silver Producing Countries?

Over 60% of primary silver production comes from Latin America, or Silver CAMP: Chile, Argentina, Mexico and Peru.

And let’s not forget Guatemala will become a major producer once my buddy Ross Beaty starts up the Escobal silver mine. It truly is one of the world’s most attractive primary silver mines.

Many of those countries are facing a resurgent Coronavirus.

All these countries have eventually come around to classifying mining as an essential service. But, a serious outbreak on a mine site could result in closures.

Below is a chart showing the estimated global silver production for this year.

Note that these production estimates were made pre-COVID-19.

Note that these production estimates were made pre-COVID-19.

In fact, many of the largest silver miners, including Fresnillo, Buenaventura and Pan American Silver have withdrawn their production guidance for 2020.

Normally, production deficits are a positive for prices. However, the fact that 75% of silver’s demand is used for industrial and commercial purposes is likely crippling its safe haven demand.

- This is one of the reasons why silver hasn’t been performing as well as gold or US Treasuries to date.

But there’s another reason why most portfolio managers won’t put ‘silver’ in the same breath as US Treasuries, Japanese Govt Bonds, US Dollars and Gold…

That’s because, it’s simply too volatile to act as a hedge.

For this, we can instead look at the magnitude of daily price changes (both positive and negative) for both assets.

In the next chart, you can see the volatility of how silver prices have much higher daily percentage gains and losses than gold over the last 10 years.

Do Central Banks Hoard Silver?

Do Central Banks Hoard Silver?

In short, no. Sorry Silver Bugs.

Central banks don’t deem it stable or valuable enough to hold as foreign reserves.

Also, the value of reserves per square foot in the vault is massively inefficient compared to gold.

For gold, up to 47% of annual gold demand is for investments – including central bank foreign exchange reserves.

Gold Demand vs. Silver Demand

Gold prices are primarily determined by its demand as an investment (think store of value).

On the other hand, silver prices are as much determined by industrial and commercial users than investors.

It’s also worth noting that the investment market for silver is substantially smaller than gold’s. In 2019, ~$4.3B worth of silver produced went to investments in physical products or ETFs. This figure was $62.7B for gold produced in 2019.

Which Precious Metal Peaks First?

Which Precious Metal Peaks First?

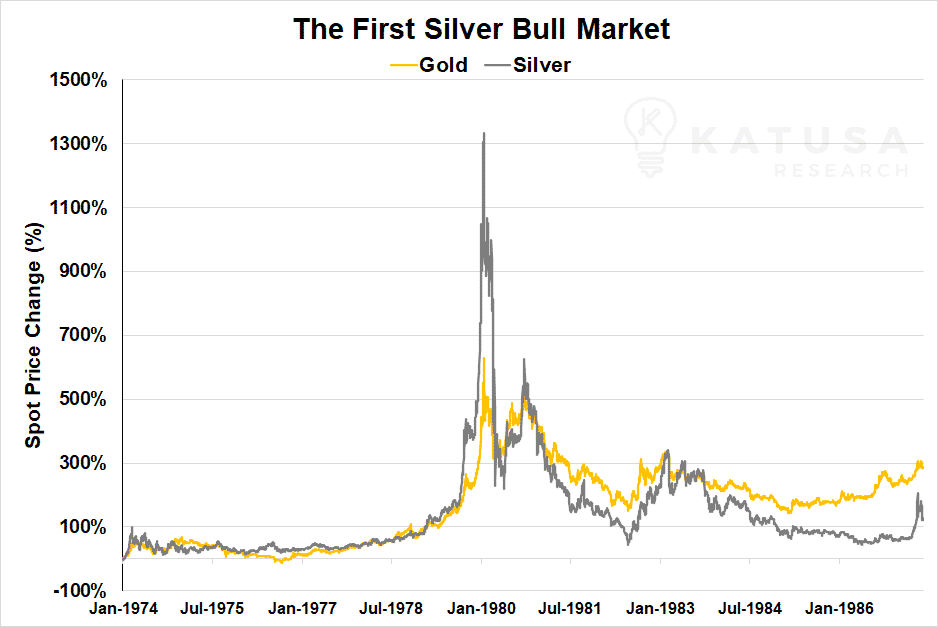

Looking back at the historical data, it’s clear that silver peaks first before gold.

And true to its volatile nature, it does so far more dramatically.

Silver’s outstanding performance, relative to gold, can best be seen from January 1974 – May 1987; and most recently from Nov-2010 to April 2013.

But today…

- The spread between gold and silver prices is widening to levels not seen in 50 years of pricing data.

If ever there were a time for history to play catch-up, then now’s the time.

The chart below shows the first silver bull market from January 1974 to May 1987. The returns on silver spiked to over double that of gold, with silver hitting $48 / oz. vs $850 / oz. for gold.

From November 2010 to April 2013, the second bull market for silver was not as impressive as the first. Silver didn’t reach quadruple digit percentage gains, yet it still pulled ahead of gold significantly.

From November 2010 to April 2013, the second bull market for silver was not as impressive as the first. Silver didn’t reach quadruple digit percentage gains, yet it still pulled ahead of gold significantly.

Currently…

- Silver is 61% off its record intraday high $49.50 on April 28, 2011.

- Gold is only 6% off its record intraday high $1923.70 on September 6, 2011.

This means that silver has a lot more room to move up to its record highs than gold.

A Look at Silver Technicals

The biggest key to look out for is that psychological $20 resistance level.

If the price of silver breaks out above that $20 price, then every trader and algo will start to take note.

Below is a long-term chart which shows how compressed silver has been. A consolidation in the $20 per ounce range, could provide a base for a major slingshot move upwards.

Below is a long-term chart which shows how compressed silver has been. A consolidation in the $20 per ounce range, could provide a base for a major slingshot move upwards.

Silver Commitments of Traders

In the next chart, you’ll see that non-commercial long positions increased by over 35,000 contracts in the past 6 weeks.

Non-Commercial positions is a term used by the CFTC to classify speculative futures and options trades.

Spec traders holding long positions in silver futures are betting that the price of the silver will increase in the future.

The chart below indicates an increasingly positive trader sentiment. It would not surprise me to see silver rally like it did in 2011.

Follow the Big Money – Fund Flows

Follow the Big Money – Fund Flows

ETFs like the iShares Silver Trust attempt to track the price of silver at a ratio of one unit per ounce of silver.

Commodity-based ETFs are not as simple as you might think. These funds are traded on an exchange, separately from spot and futures markets.

For an ETF to track the price of silver, the fund and its market makers must issue or redeem blocks of shares in exchange for bullion. By necessity, the funds are open-ended.

When an ETF adds silver bullion, it is typically doing so in anticipation of having to issue additional blocks of shares to keep up with market demand.

This is so that its unit (share) price doesn’t exceed the price of silver.

- The fact that silver ETFs have posted net inflows for six straight months is a very bullish sign.

How to Invest in Silver

How to Invest in Silver

You can invest in silver bullion or silver ETFs, and if it takes off, perhaps you could double your money. But I think the best way to get exposure to a silver slingshot move is through the miners.

- When the price of silver rises, the Net Asset Value (NAV) of many producers can soar dramatically.

Share prices are determined off a company’s NAV, so as the NAV appreciates, the share price is likely to rise as well.

As central banks and governments around the world continuously pour money into their economies, stores of value and beneficiary industries can deliver major portfolio gains.

Our portfolio has been on fire this year. But still, I am working tirelessly on new ideas.

I just got back from a site visit internationally working on a project for my subscribers. As of this publication date, I am halfway through my government mandated quarantine. With little else to do than work, we are putting together a very strong August KRO for our subscribers.

If you want to know the next stocks, companies, and deals I’m looking that fit the bill…

And where I’m putting my own money on the line… it’s all in my premium research service. Click here to learn more.

Regards

Marin