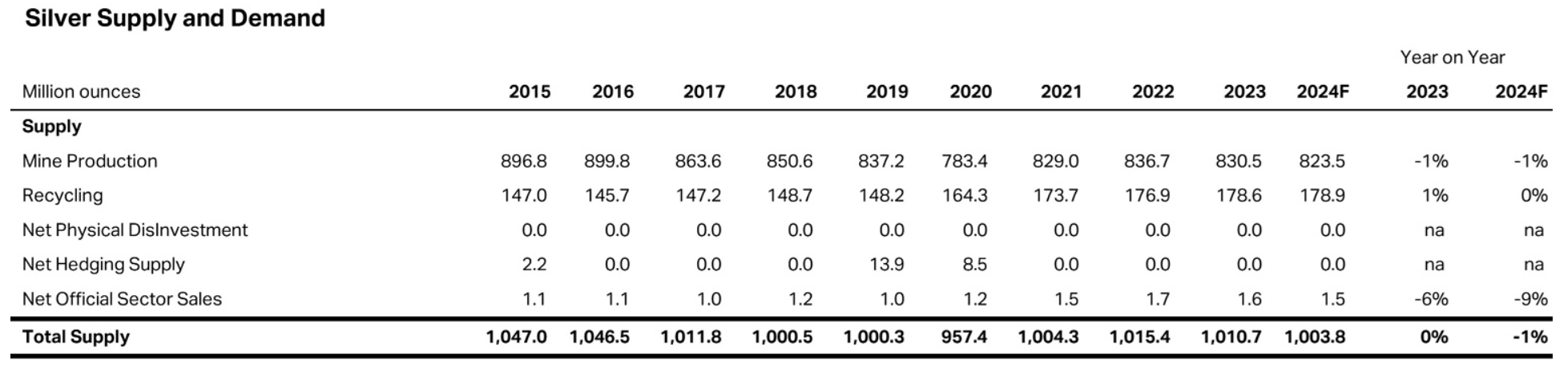

For the last five years, the world has consumed more silver than it produced. Demand from the US Military (for electronics, ships, and weapon systems), the aerospace sector, EVs, and photovoltaic manufacturers keeps climbing—yet supplies lags. By all accounts, the fundamentals of silver are rock solid. You’d think this supply crunch and industrial appetite would send prices soaring and convince retails holders to cling to their physical silver. But instead, many small investors are losing faith at the worst possible time. What gives?

It turns out the real battle is not in the mines, but in our minds!

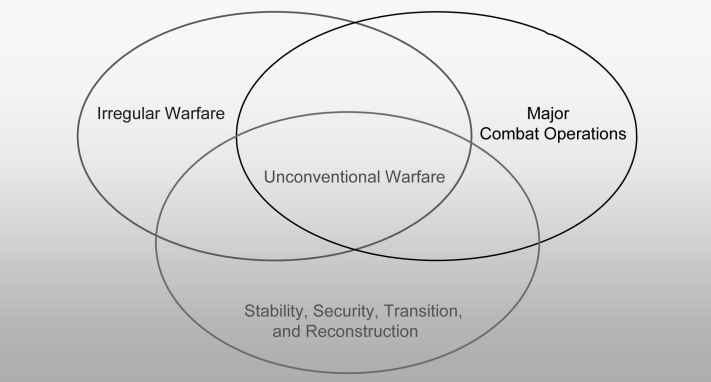

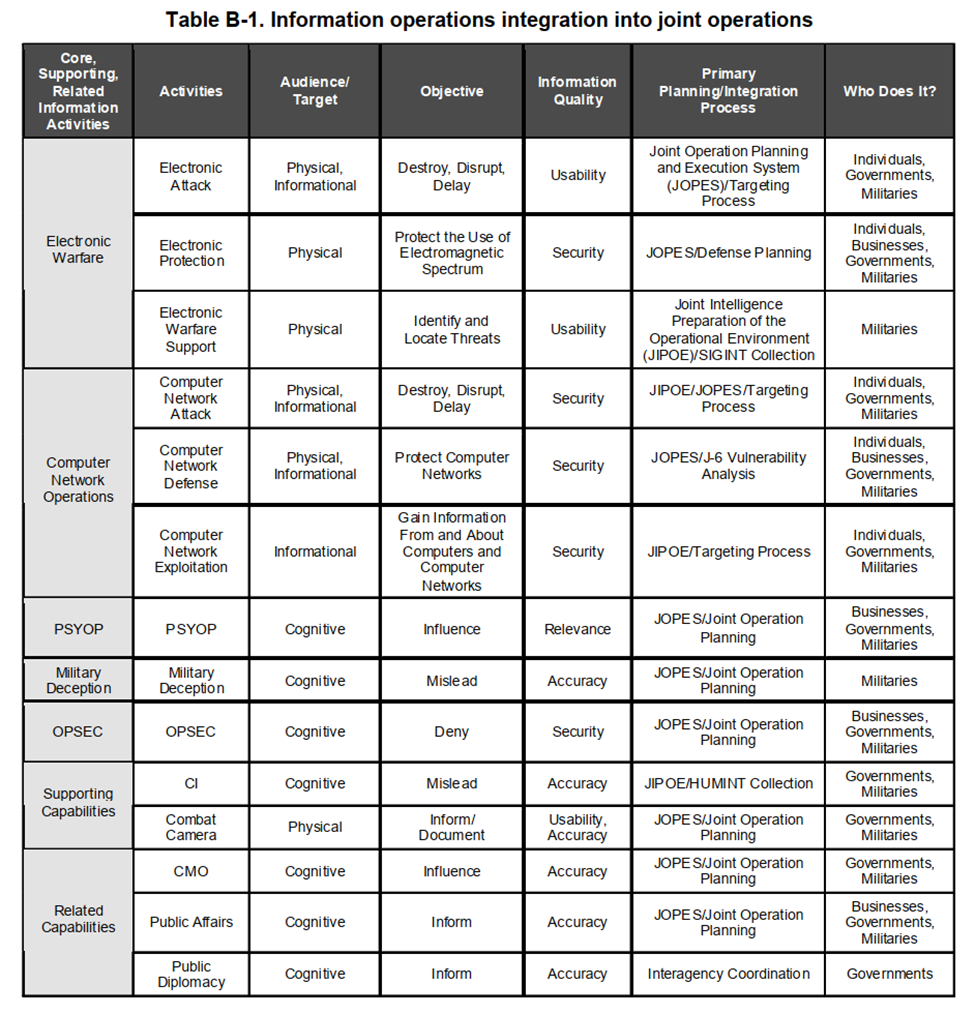

The US government has a long history of psychological operations (PSYOP) to shape perceptions and behavior. According to the Army’s field manual for Unconventional Warfare, PSYOPs are planned operations to convey selected information and indicators to audiences to influence their emotions, motives, objective reasoning, and ultimately the behavior of those targets.

Modern conflict is often a protracted political-military struggle between political systems. It often encompasses all spheres of national activity – political, military, economic, social, and cultural. In protracted operations (including most UW campaigns), noncombat activities can be as decisive as combat operations are decisive in conventional warfare.

If you’ve been holding physical silver, you’ve probably had moments where you have questioned your sanity. But what if we told you this was intentional? What if this is a full-blown psychological operation—designed to make you let go of your physical silver just when its needed the most by industrial demand?

In other words, feeding silver investors carefully crafted narratives to mess with their feelings and choices is just as effective as confiscation, but doesn’t cause panic in the markets or induce foreign hoarding.

This isn’t financial advice. This is a wake-up call.

Not Just Market Noise, It’s Psychological Warfare

Psychological operations are meant to influence, corrupt, or usurp the decision-making of adversaries and potential adversaries to gain strategic advantage.

If the US is in a strategic supply crunch for silver--needed for hypersonic weapons, solar panels for remote operations, aerospace tech, precision-guided munitions, various brazing and solders for ships, batteries and more--then who's the "adversary" if not the private hoarders and investors sitting on real, deliverable silver?

"PSYOP(s) are an initial and continuous, integral, and fundamentally central activity of Army Special Operations Forces (ARSOF) Unconventional Warfare (UW)." - Chapter2, Section 2-14

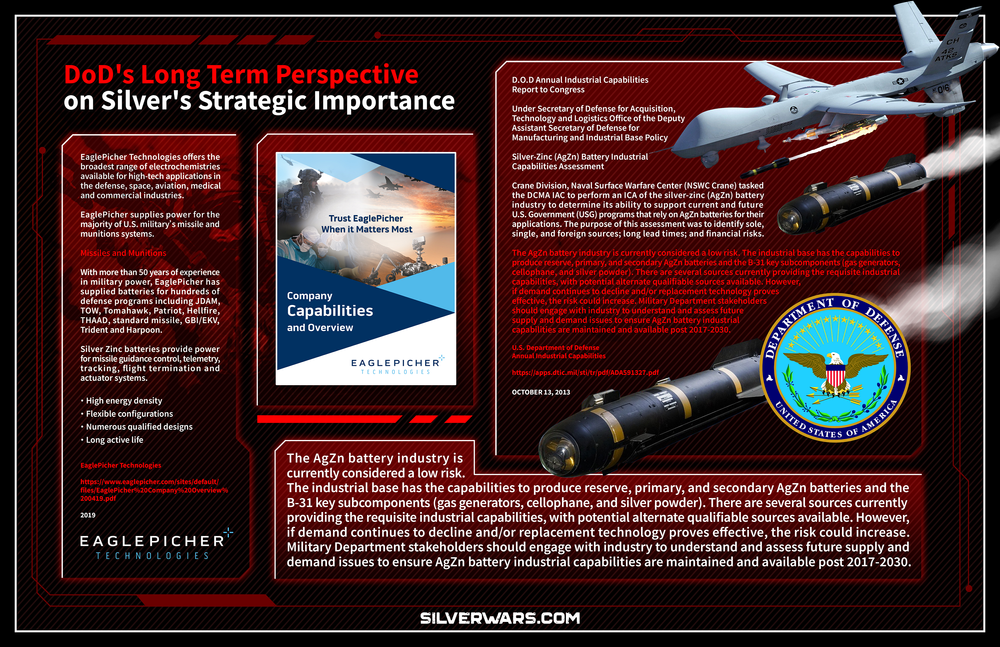

As we exposed in an earlier article, according to official documentation, the US Department of Defense must ensure the availability of silver is maintained for military batteries until 2030.

Exposed: US Military Engaged in Silver Market

Targeting the Human Mind-field

It's all about finding the psychological pressure points. Looking for vulnerabilities, fears, desires, and how information flows among the group. Lines of persuasion are identified. The best media to use (social media, news outlets, word-of-mouth, etc.) is figured out.

In a real war this could mean determining how to turn an enemy tribe against its warlord; in the silver market, it could mean discovering that real investors hang out on Wall Street Silver Reddit, follow certain influencers, and have specific hopes (e.g. getting rich off a silver squeeze) or fears (e.g. value crash/price suppression, confiscation).

The next step is crafting PSYOP Objectives– concrete goals for the behavior change desired. The manual gives examples like "discrediting" and "dividing and defection".

The blueprint for the Silver-PSYOP could easily be:

Discredit the Pro-Silver crowd and its narrative. Divide the community, induce defectors (investors who abandon the cause and maybe even bad-mouth it on the way out).

All suited for the overarching objective of getting silver investors to capitulate their physical silver supply to the market's screaming demand for it.

Crucially, PSYOP(s) are not just about spewing propaganda blindly; it's often coordinated with real events and tailored actions. The manual discusses "Psychological Actions (PSYACTs), which it describes as deeds that are designed to have a psychological impact.

In military context, orchestrating a dramatic event (like a demonstration or the timed release of a controversial story) can "harness and build upon preexisting feelings of overall frustration of the populace."

Translation to silver markets: a well-timed story from Kitco: "Silver Squeeze 2.0 could trigger a breakout for silver that sees prices challenge $50/oz", only for sentiment in the market to be demoralized 3-days later with a new story, "SilverSqueeze2.0 falls flat..."

By mid last week, silver prices started to fall drastically from $34 and closing the week out on a low of sub $29. Although silver has seen some recovery yesterday moving above $30 again, this rollercoaster is hitting already frustrated investors.

All of these actions are meant to tip the emotional balance. Harness existing frustration, then push it over the edge.

The cognitive dimension is where all this lands – "where the mind of the decision maker and the target audience" lives, and where people "think, perceive, visualize, and decide."

It's the most important battleground, and it's influenced by public opinion, media, information and rumors. Think of every discouraging headline about silver, every social media post ridiculing "boomer rocks"– they all accumulate in the cognitive space of retail silver investors.

And here's the kicker: "limited time and resources to obtain information leaves decision making subject to manipulation."

So, if "authoritative-sounding info" keeps hitting you from all sides, you might start believing it or at least start doubting your own thesis.

Effective information operations aim to improve the quality of information on one side and degrade it on the other. Silver supply issues or evidence of market manipulation get drowned out or discredited, while narratives of abundance are amplified and repeated until it "conveys the true situation" (or so you're led to think).

The Disconnect that Screams More Manipulation

Photovoltaics? Booming

EVs and aerospace? Skyrocketing.

Artificial Intelligence? Scaling.

Energy Demand? Beyond Current Capabilities.

Military and defense? Silver is Critical.

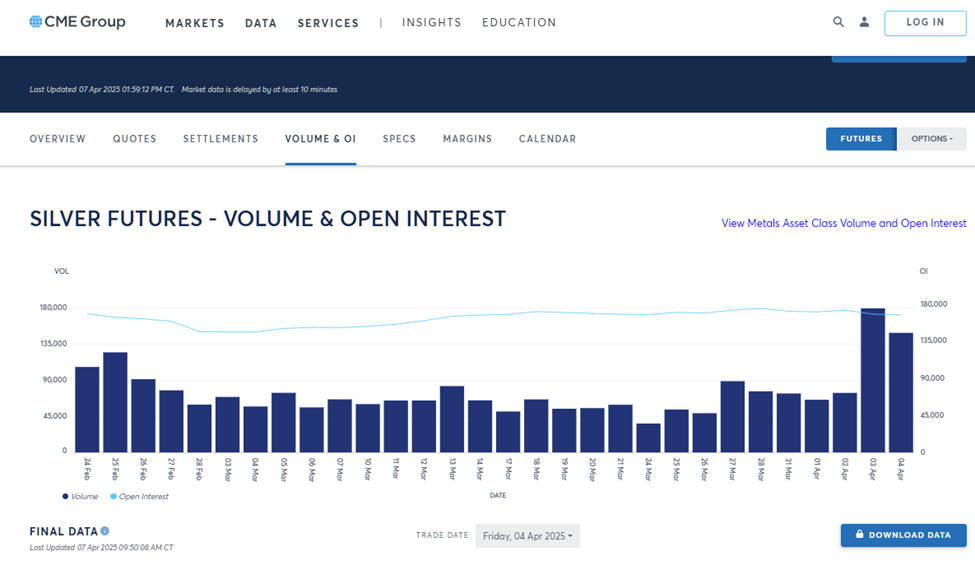

Yet, the COMEX still manages to dump phantom contracts like it’s going for world records. Over 1.6 BILLION paper ounces were traded between Thursday and Friday (April 3-4) of last week.

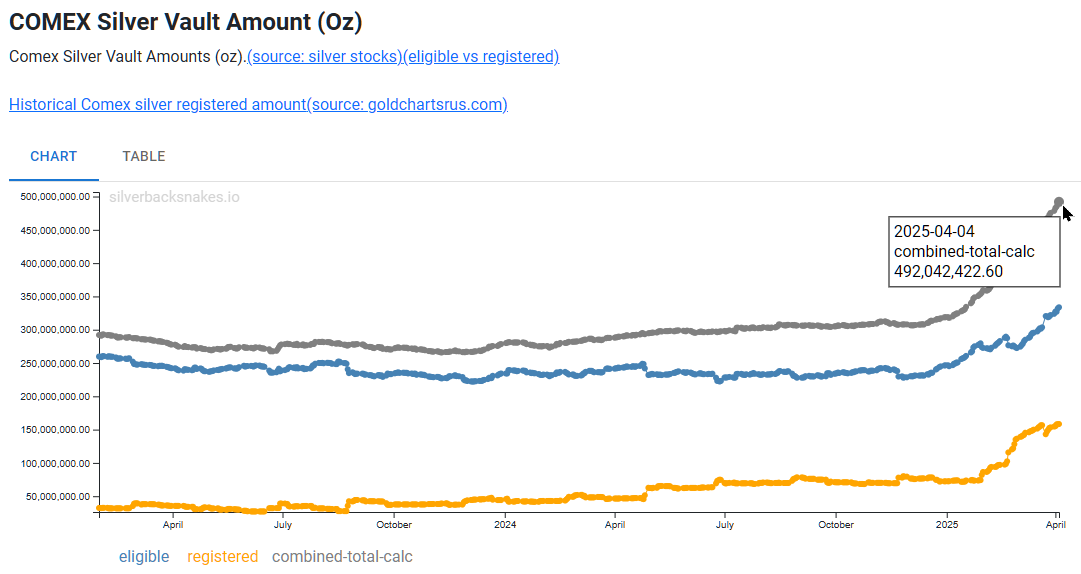

For context, this supposedly represents more than 2023 & 2024 global Silver mine production traded in the span of only two days, or over three times the combined total of registered and eligible silver on the COMEX.

The End Game: Forced Liquidation Without Force

This is warfare but made to be soft. It’s not tanks and missiles—it’s memes, charts, and talking heads. The play is simple: create so much psychological pressure that retail silver investors capitulate voluntarily.

But why now?

1. The Deficit is REAL: Five Straight Years of Insatiable Demand > Supply

- The Deficit is likely Worse: Military usage has been largely suppressed since WW2.

- Industrial needs are compounding: Whether for Green Energy, Big-Brother satellites or Defense Sector Upgrades, these drivers are silver-hungry!

- Above-ground silver is disappearing: There are no governments with strategic stockpiles to bail out the market, banks have leased their silver out to industry as an unrecoverable consumable resource, this leaves only what investors hold available to supply the market now.

“A fundamental military objective in UW is the deliberate involvement and leveraging of civilian interference.” – Chapter 1, Section 1-6

Civilian interference = you, the silver investor, the miner, the government worker, the industrial manufacturer, the market analyst, the meme artist, etc.

Your choices are now battlefield maneuvers.

The ancient Sun Tzu is more relevant today; although battles should be won, "winning 100 victories in 100 battles is not the acme of skill; defeating the enemy without fighting is the acme of skill."

Join the Largest Online Community of Silver Investors - Apes Hold; Banks Fold.

Strong Hands Won’t Sell

You have been manipulated by a psychological operation, but now you are fully aware its happening.

The fundamentals of silver haven’t changed. What has changed is the intensity of the psychological warfare deployed against physical holders. This isn’t about price anymore—it’s about control of resources. Your stack is more than metal. Its leverage. It’s optionality. And for those steering U.S. policy, it’s a problem.

So, when you see another -10% daily candle or a demoralizing headline, remember—it’s not random. It’s designed.

The Military Industrial Complex wants your silver. Will you give in?

Source:

US ARMY Special Operations Force - Unconventional Warfare

US ARMY Special Operations Force - Unconventional Warfare - Field Manual.pdf