As with gold, the increasing danger going into this Fall is that silver gets caught up in a “pan selloff” involving a market crash triggered by a cascade of bank failures, a crisis in the debt market, and another long period of lockdown using a Covid variant / climate scare as the excuse. The resulting crash would be far worse than what we saw in 2008. If the Fed succeeds in heading this off by creating trillions in advance to throw into up propping up all the failing Banks, then this selloff might be averted, but such action would lead to hyperinflation. And if this course of action is taken, gold and silver will break out and soar, but it is by no means certain that they will do this. As set out in the parallel Gold Market update a market crash this Fall may be planned for various nefarious reasons and it certainly looks at this point the most likely scenario.

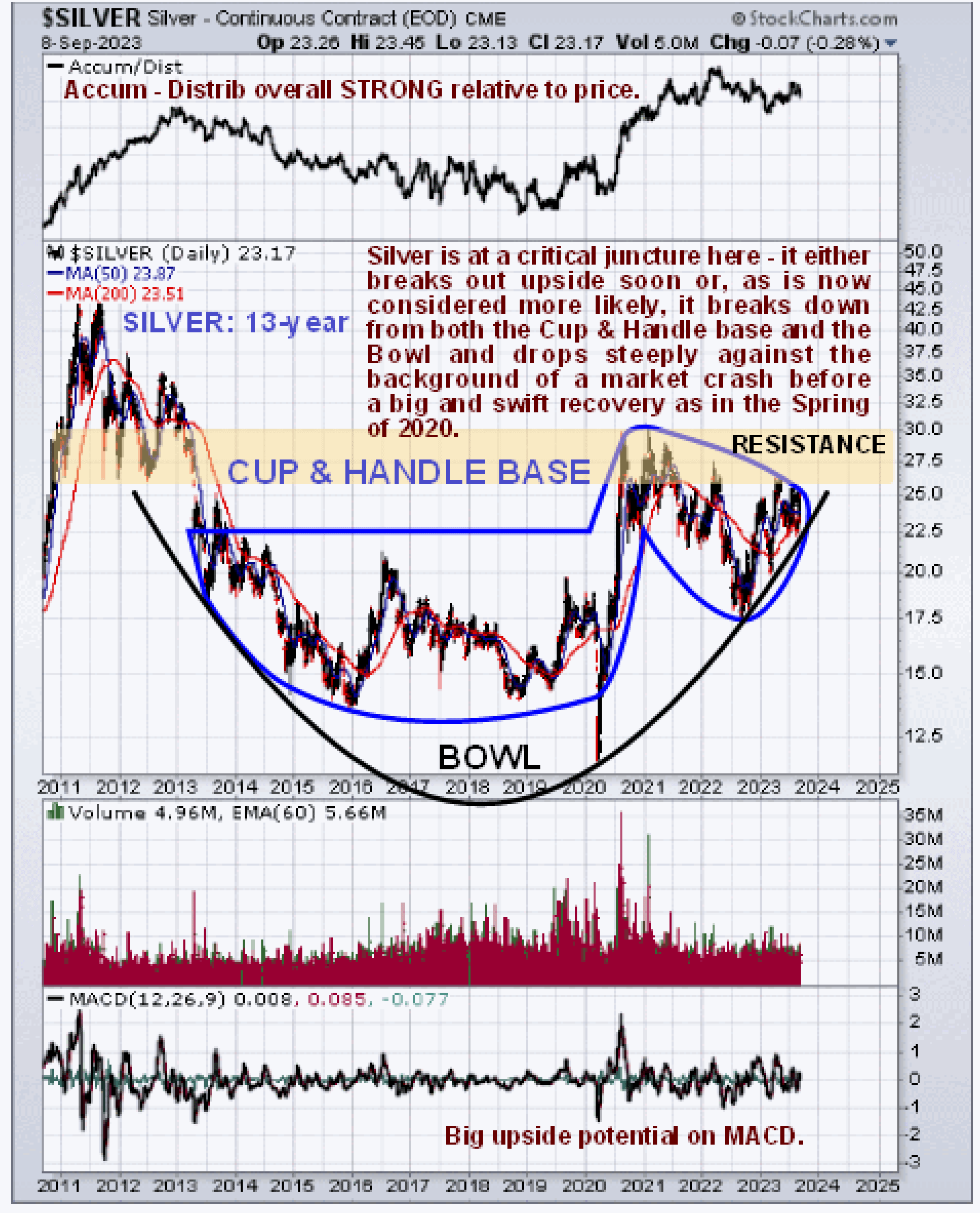

On silver’s 13-year chart we can see that it is definitely at a critical juncture, as it is hovering just above the boundary of a giant Bowl pattern and is also at the right side of the Handle of a giant Cup & Handle base – it must break out soon or break down. A breakout above the major resistance shown will usher in a major new bull market phase while a break down occasioned by a market crash will trigger a plunge that will probably lead to an “icicle” or “stalactite” pattern such as we saw in 2020 at the time of the Covid Crash where it plunges but then recovers just as quickly and what is expected to happen in this scenario is that the Fed comes riding to the rescue with huge wads of newly created crash as they did in 2020. Greg Mannarino did a good job in a recent video entitled SITUATION CRITICAL! of explaining why a big reason for the impending Covid 2 lockdown is to give the Fed the excuse to do just that.

With silver, keep in mind that if it does break down and plunge, it is likely to come back fast and strong and then break out upside into a major bull market, so the plunge will be “the Mother of all Head Fakes” even exceeding the hugely deceptive Head Fake of March 2020 when after plunging to an abysmally low level, silver turned on a dime and soared up to $30. So it could be a wild roller coaster ride and while the scenario shown on the chart is conjecture at this point it could very well happen and if it does we will at least have been aware of the possibility and won’t be caught off guard.

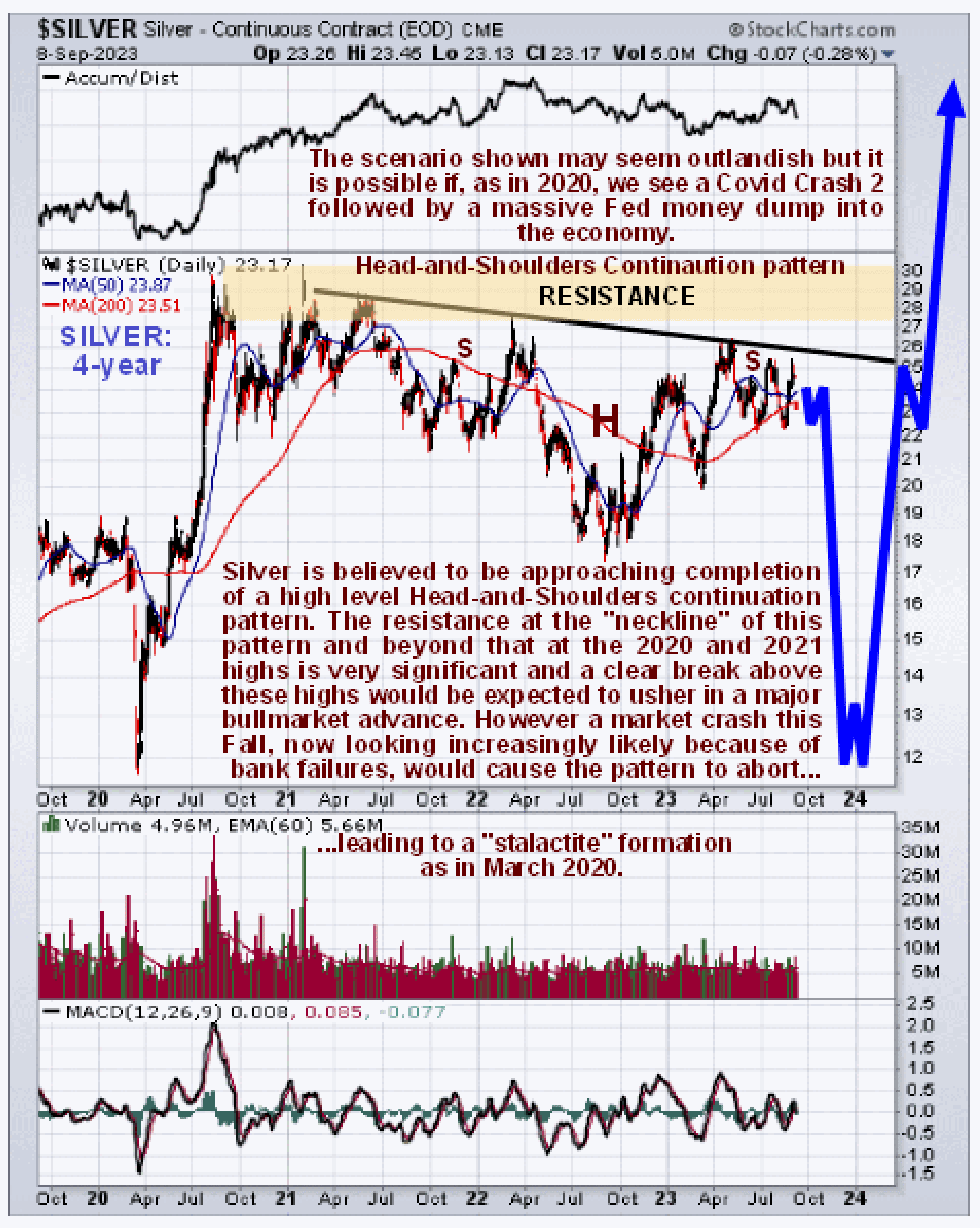

On the 4-year chart we can see how, all things being equal, which they are not, silver looks poised to break out upside from the large Head-and-Shoulders continuation pattern that comprises the latter part of the Handle of the giant Cup & Handle base shown on the 13-year chart into a major bull market, but again, if the stock market plunges, we could first see a gigantic Head Fake drop, as set out above, before silver comes roaring back to fulfil what this chart promises as markets response to the Fed opening the money spigots full bore.

The scenario shown is not assigned a high probability because it is so outlandish but it is much more possible than would normally be the case because of the way things are shaping. This is why it is shown so that you are at least aware of it and won’t be taken by surprise by a plunge and sudden dramatic reversal to the upside. Keep in mind what Mannarino always points out – that the more debt Central Banks create the stronger they become. Essentially these Banks are a “wealth transfer engine” who sluice wealth up to the top of the pyramid as they create vast quantities of money out of thin air, gift most of it to themselves and their cronies and stick society with the tab via inflation – nice work if you can get it.

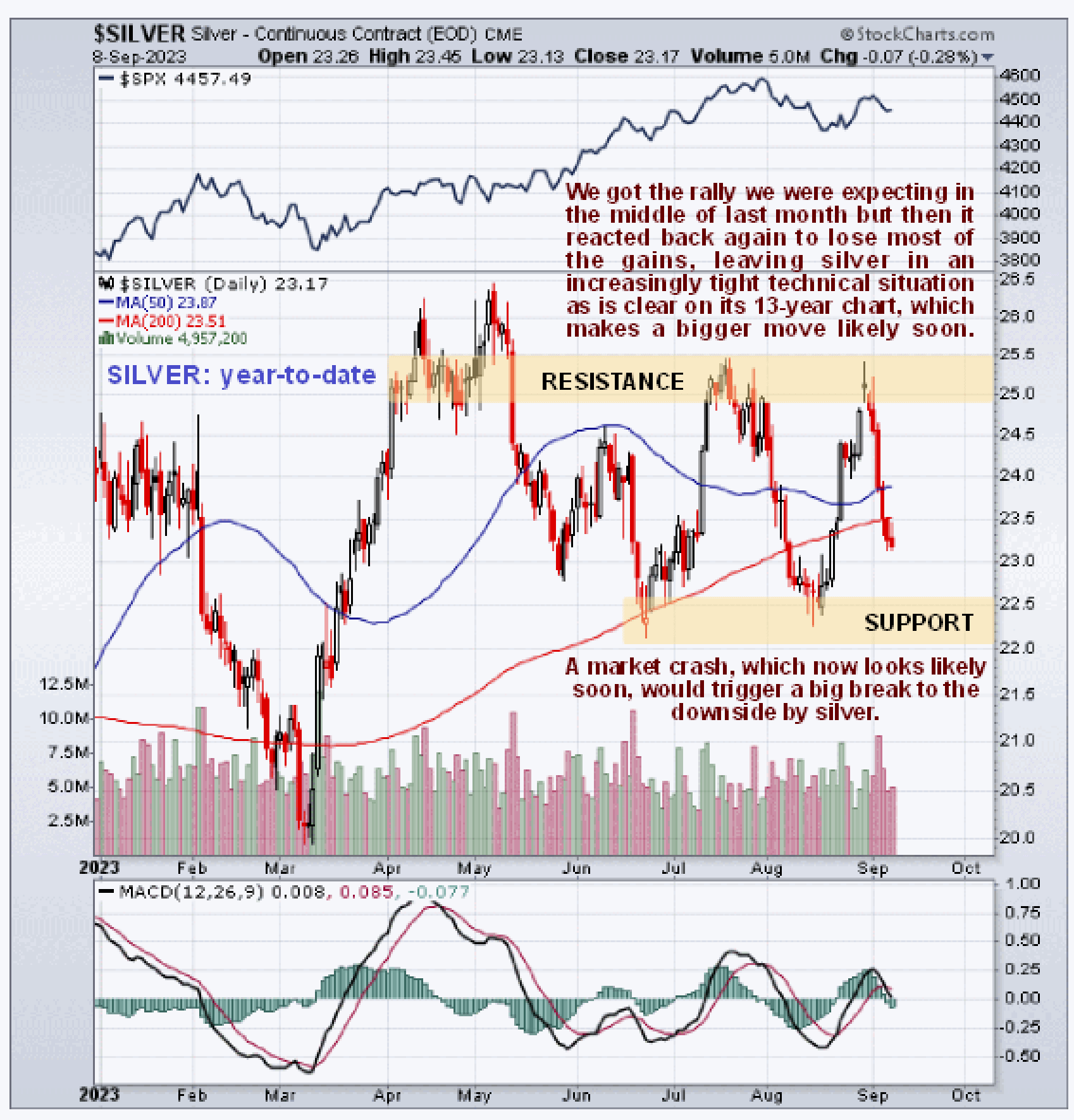

On the year-to-date chart we can see a further indication of the tight technical situation which currently exists that is abundantly clear on the 13-year chart, which is the current close bunching of the price and its moving averages with recent price swings and momentum swings (MACD) tending to narrow. All this points to a big move soon and as set out above, with markets looking set to crash in coming weeks or over the next month or two, this break is expected to be a “head fake” plunge to the downside and if this eventuates it should present a rare and brief opportunity to buy silver (and gold and the PM sector) ahead of a gigantic and probably unprecedented upside explosion.