With all the third-quarter results finally out, the top primary silver miners as a group lost money producing silver at $19 an ounce. This is not good news as the current price of silver is nearly $3 lower. I would imagine the fourth quarter will be extremely painful for the primary silver mining industry that actually produces wealth, unlike the Banking community that behaves more like a BLOOD SUCKING LEECH.

The world is turned upside-down today.. especially in the United States. When it comes to investing and finance this is the current motto (not for long):

CRAP IS GOLD and GOLD IS CRAP

Of course, we could plug-in silver and it would mean the same thing. Yes, it’s true that certain Central Banks are starting to wake up by repatriating some of their gold and we continue to see huge buying of the yellow metal by the more wise Asians and Indians… but the West continues to travel down the road towards complete financial and economic disintegration.

Before I get into the Q3 results of the silver miners, I wanted to say a few things that have been in the back of my mind for some time now. One of the biggest frustrations I have is the failure of the precious metals and energy analysts to understand the importance of knowing each others respective industry.

The energy analysts who study peak oil, could care less about gold and silver, and the precious metal folks (for the most part) don’t take into consideration the ramifications of peak oil on the financial and economic system. There’s this notion put forth by some of the top precious metal advocates that if we had a FIAT MONETARY BANKING RESET, the world would experience serious pain for a while, but the physical economy would regroup and continue to grow into the future.

This sort of thinking comes from not understanding the ramifications of peak oil. If we did have a collapse of the Fiat Monetary System, economic growth would be over for good. Basically, fiat money and debt stole prosperity from the future. Once the fiat monetary system collapses, so with it, economic growth.

Which is why the Fed and Central Banks continue to prop up the economic system with more monetary printing and debt. Because, if they stop, then we head into a global meltdown that we never come out of. Unfortunately, the energy analysts who study peak oil think gold is just a stupid piece of metal. The failure to understand gold and silver’s role as monetary metals will cause energy analysts a lot of pain when their paper assets implode.

Thus, precious metals and energy analysts are guilty of “THE LEFT HAND NOT KNOWING WHAT THE RIGHT HAND IS DOING.”

Top 12 Primary Silver Miners Q3 2014 Results

I was waiting for Aurcana to release their Q3 results, which they did on December 3rd. Aurcana stated a $3 million net income loss for the quarter, but their adjusted income came in at negative $1.3 million. This translated into an estimated break-even of $20.40 an ounce. Aurcana lost nearly $1.40 for each ounce of silver they produced… according to my methodology.

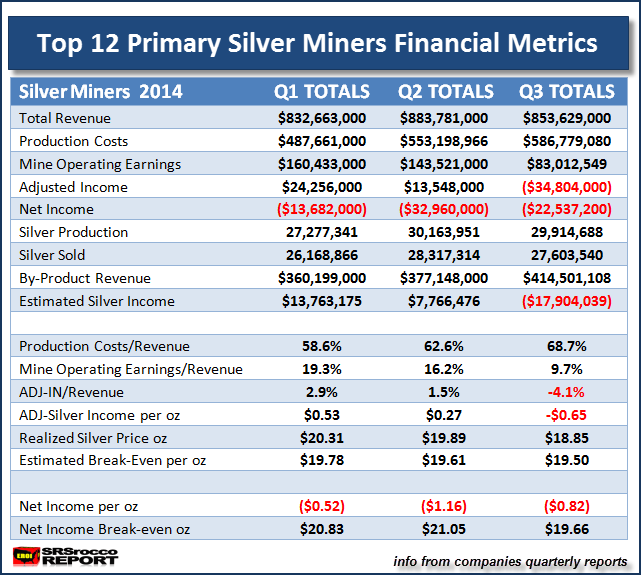

If we add up all the figures for my top 12 primary silver miners, here are the results for the last three-quarters:

Overall revenue declined in the group to $853 million in Q3 compared to $883 million in Q2. Part of the reason for the decline was the suspension of sales of 900,000 oz by First Majestic and 700,000 oz by Silver Standard. I didn’t realize Silver Standard held back so much silver until I inputted the data on my spreadsheet, but if we included this revenue in Q3, it would add approximately $27 million in revenue once we deduct treatment and refinery charges.

So, in reality the total revenue of the group in Q3 2014 would be about the same as it was in the prior quarter if this silver was sold. And yes, it would change the $34 million of adjusted income loss for the group… but it would still be a loss.

According to my calculations, the average realized price of silver for the group fell a little more than a dollar from $19.89 in Q2 to $18.85 in Q3. However, you will notice that the estimated break-even hasn’t changed all that much in these three-quarters.

Estimated Break-Even Q1-Q3 2014

Q1 2014 = $19.78

Q2 2014 = $19.61

Q3 2014 = $19.50

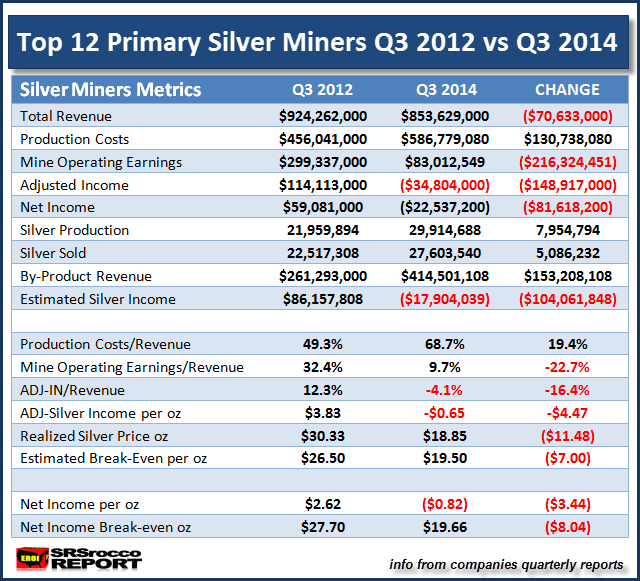

I speculated at the end of 2013, that the estimated break-even for the group would not continue to fall in 2014 as it did over the last two years. This next table compares the change in financial metrics in the top 12 primary silver miners from Q3 2012 & Q3 2014:

In Q3 2012, the group received an average realized price of silver at $30.33, with an estimated break-even at $26.50. The group stated a total revenue of $924 million with an adjusted income gain of $114 million on the sales of 22.5 million ounces for the quarter. Now compare that to the current quarter.

In Q3 2014, the group sold 5 million more ounces of silver but the overall revenue declined $70.6 million to $853 million while the total adjusted income fell negative to a loss of $34 million. Also, the estimated break-even declined $7 from $26.50 in Q3 2012 to $19.50 in Q3 2014. However, the majority cost-cutting took place at the end of 2013 and beginning of 2014, resulting in a small drop in break-even for 2014.

Which means, the primary silver miners have cut as much as they can and I doubt they would be able to lower their break-even all that much going forward.

Another interesting trend is the increased production cost for the group. In Q3 2012 the group stated a total of $456 million in production costs, but this increased $130 million to $586 million in Q3 2014. Part of the reason for this increases was Tahoe Resources coming online at the beginning of 2014 and the addition of a few small primary gold mines to the group.

Some readers have asked me if the lower oil price will impact costs going forward… yes it will. I would imagine costs may fall a bit as the price of Brent Crud oil is now trading at $68 when it was over $100 just a few months ago. That being said, the price of silver is already at $16. So, any reduction in silver mining costs from the lower price of oil will probably not help the industry as the current silver price is more than $3 lower than the estimated break-even in Q3 2014.

There’s a hell of a lot more I could talk about concerning the primary silver mining industry, but that will be put in a PAID REPORT in the future. I did mention that I planned on putting out the U.S. GOLD MARKET PAID REPORT… and its finished and already to go. There is a lot of good data in there.

Unfortunately, one of main assumptions in the report turned out to be INVALID due to incorrect data provided by the USGS Gold department. I will get into that in an article next week.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: