By: Gorm Henriksen

Strong performance and tremendous proven reserves at Silvercorp Metals’ cluster of mines in the prolific Ying Mining District (Figure 1) earned high praise from equity research analysts following a recent site visit to China.

Figure 1: Ying Panorama

Source: Silvercorp Metals

The tour highlighted the scale and efficiency of the company’s hub-and-spoke style operation at Ying, which has undergone major transformation since its inception nearly two decades ago.

Located about 240 km west-southwest of Zhengzhou, the capital city of Henan Province, China, and 145 km southwest of Luoyang, the nearest major city, Silvercorp’s network of mines and processing plants at Ying has produced more than 85 million ounces of silver and 1.1 billion pounds of lead and zinc in high-quality concentrates since 2006, with over 15 years of reserve life remaining.

However, despite Silvercorp’s rock-solid fundamentals and robust financial performance – fuelled principally by the Ying operation – the market has yet to fully recognize the value and potential of this evolving asset.

From modest beginning to one of China’s largest silver mines

The Ying Mining District is endowed with tremendous resource wealth. Silver-lead-zinc mineralization in the region was intermittently mined for several hundred years, and modern (government-led) exploration dates back to the mid-1950s. Recognizing the opportunities at Ying, Silvercorp, under the leadership of CEO & Founder Dr. Rui Feng, acquired an interest in the district in 2004, funded with US$10 million of seed capital raised from Canada. This marked the beginning of the company’s operational launch in China.

Silvercorp announced the start of production at Ying in April 2006, following a brief period of exploration and development. Initially, the operation consisted of one underground mine (SGX) producing ores that were either directly shipped to smelters in the province or toll-milled at local processing facilities (“Ying 1.0”).

Despite its modest initial size, the operation was extremely profitable, thanks to its high grades. In fact, subsequent developments at Ying were funded out of operational cash flows.

Figure 2: Underground Mining at the HPG Mine

Source: Silvercorp Metals

From 2005 to 2007, Silvercorp expanded its footprint at Ying through regional consolidation, adding six new projects (HZG, HPG, TLP, LME, LMW, and DCG) to its operating portfolio. To align with the rapidly growing scale of underground mining, the company commissioned its 700-tpd No. 1 mill in March 2007, followed by the 900-tpd No. 2 mill in December 2009.

In October 2011, another production line was added, the No. 2 mill, doubling its capacity to 1,800 tpd (Figure 3-4). Today, the operation consists of seven underground mines feeding two processing plants with a combined capacity of 2,600 tpd (“Ying 2.0”).

Figure 3: Real-time production monitoring at the No. 2 mill

Source: Silvercorp Metals

Figure 4: Froth flotation circuit at No. 2 mill

Source: Silvercorp Metals

Building on Silvercorp’s regional consolidation and production expansion, exploration is another growth pillar at Ying (Figure 5). From 2004 to 2022, Silvercorp completed over 2.2 million metres of drilling and 735 kilometres of exploration tunnelling in the district.

During this period, the company grew Ying reserves from zero to 102 million ounces of silver equivalent (AgEq; silver + gold converted to silver) and 1.2 billion pounds of lead and zinc (Pb+Zn), while dramatically increasing the operation’s resource base.

Currently, Silvercorp’s Ying resources include 54 million ounces of AgEq and 680 million pounds of Pb+Zn in the measured and indicated categories (not included in reserves), along with 96 million ounces of AgEq and 1.1 billion pounds of Pb+Zn in the inferred category. The operation also produced a remarkable 85 million ounces of silver and 1.1 billion pounds of lead and zinc during this period.

Figure 5: One of several core storage and logging facilities at Ying

Source: Silvercorp Metals

In concert with the expansion of Ying’s reserves and resources, Silvercorp roughly tripled the operation’s silver output, increasing it from less than 2 million ounces in fiscal 2007 to 5.9 million ounces in fiscal 2017, solidifying the company’s status as China’s largest primary silver producer.

Importantly, Silvercorp maintained strong operating margins at Ying while growing its production, with annual all-in sustaining costs remaining below US$10/oz over the last seven years, despite mounting inflationary pressures affecting miners globally. In fiscal 2023, Ying produced 6 million ounces of silver at an all-in sustaining cost of US$9.73/oz, generating US$63 million in income from mine operations (~90% of Silvercorp’s total), representing a peer-leading operating margin of 36%.

Preview of “Ying 3.0”

Silvercorp’s next phase of growth is underway at Ying. As discussed during the company’s Q2 earnings conference call, the current focus is centred on improving operational efficiencies and productivity. Underground mining will increasingly shift toward shrinkage stoping with scoop tram loading (20 load-haul-dump vehicles have been ordered; Figure 6), aiming to reduce the labour-intensive mucking associated with cut and fill reusing stoping.

Figure 6: New load-haul-dump vehicle delivered to Ying

Source: Silvercorp Metals

As part of this transition, a new X-Ray Transmission (XRT) ore sorting system was recently installed at the processing plant (Figure 7) to address the higher anticipated dilution associated with shrinkage mining. The same ore sorting system has been successfully implemented at the company’s GC Mine in Guangdong Province.

Figure 7: New XRT ore sorting system at Ying

Source: Silvercorp Metals

In addition to enhancing mine mechanization, Silvercorp is considering expanding the No. 2 mill with a new 1,500-tpd production line, which would increase the total processing capacity at Ying to 4,000 tpd. This represents a potentially cost-effective and expeditious means to grow capacity and aligns with the projected increase in mine output, which could include the development of the satellite Kuanping project, located 33 km north of Ying and acquired in 2021 for US$13.5 million.

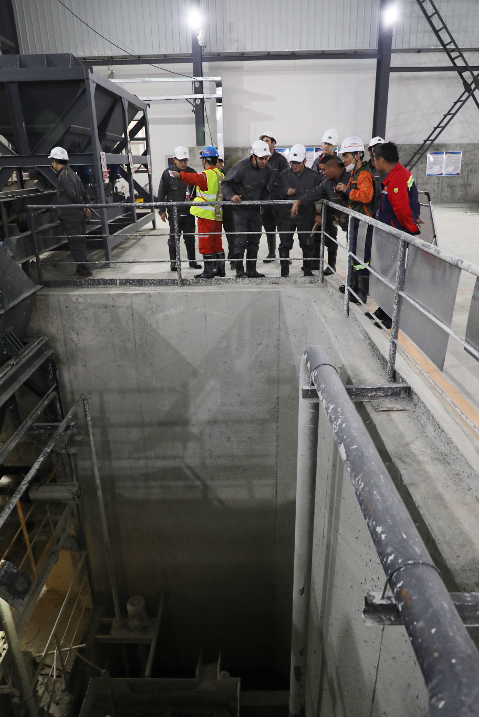

In the meantime, Silvercorp is on track to commission a new US$38 million tailings storage facility in 2024, which will support production at Ying for decades to come. The company recently built a new paste backfill plant to enhance underground mine stability and recovery of high priority ores, but this will also allow for the responsible disposal of tailings underground, which will minimize the amount of waste stored on surface facilities (Figure 8) also.

Figure 8: New paste backfill plant at Ying

Source: Silvercorp Metals

On the exploration front, Silvercorp is budgeted to complete ~218 kilometres of drilling this fiscal year, focusing on upgrading and extending known mineralizing structures near existing mine infrastructure, as well as making new discoveries in a district rich with potential.

As discussed in the company’s October Ying geology webinar, recent exploration has greatly improved the geological understanding of a series of shallow-dipping gold and gold-copper bearing structures discovered in 2020.

While still a growing story, Silvercorp has started to capitalize on Ying’s gold opportunities and commenced production from gold-only structures in the LMW Mine (Figure 9), pouring its first doré bar last September using the Knelson gold gravity separation circuit (Figure 10). In the most recent quarter, Ying produced 1,506 ounces of gold, representing a 105% increase year-over-year.

Figure 9: Gold vein LM50 at the LMW mine

Source: Silvercorp Metals

Figure 10: Gold doré produced at Ying

Source: Silvercorp Metals

More developments ahead from Ying

Silvercorp has made significant strides at Ying over the past 20 years, transforming it from a modest producer into a major silver mine in China. The company remains dedicated to continually expanding and improving its flagship asset, with several ongoing (internally funded) programs aimed at enhancing productivity and profitability. These opportunities will be incorporated into an updated National Instrument 43-101 technical report, expected by the end of H1 2024. As we anticipate further positive developments for Ying, we encourage investors to stay tuned for more news and analysis on Silvercorp.

Gorm Henriksen is the co-founder of Valpal Equity Research based in Stockholm, Sweden, covering a breadth of publicly traded precious metals, base metals, and oil companies. Read their research here: https://www.valpal.io/home