Over the last 55 years, there have been virtually no significant silver rallies during a period when the US Dollar Index (DXY) was rising (as shown here). The current silver rally is no different. Significant silver rallies occur when the US dollar is in decline against most major currencies.

Moreover, the US dollar and all fiat currencies are facing their end times. The current run to monetary metals will likely bring an end to this abominable period of debt-based fiat currencies.

The US dollar, as the talisman of the current monetary order, is facing what could be its biggest decline. After enjoying the best of fiat proliferation since Bretton Woods, the US dollar is likely to experience the worst of its decline.

In other words, the United States will probably be the epicenter during the collapse of the current international monetary system.

When Nixon took the US dollar off what remained of the gold standard, it started a death cycle (common with all fiat currencies) that will likely conclude over the coming years. This appears to be reflected on the DXY (US Dollar Index) chart:

It is as if the 70s decline of the DXY was a trailer for the current US dollar destruction movie. Notice how a big decline comes some time after a Dow/Gold ratio top. This was the case after the 1966, 1976 and 1999 Dow/Gold ratio top. The big decline after the 2018 Dow/Gold top is long overdue, but it is certainly coming.

The strength of the current silver rally, as well as the economic context in which it occurs, is a warning that this is probably it. Goodbye fake money, hello real money. Goodbye debt-based monetary system, hello resource-based money.

The US dollar has become too debased, causing nations to run to an asset like gold and now even silver as a reserve asset instead. While the dollar still has value it can be redeemed for gold and silver to avoid the risk that debasement of the currency presents.

Even while this has been happening, the DXY has held relatively firm, but now a sharp decline is likely near.

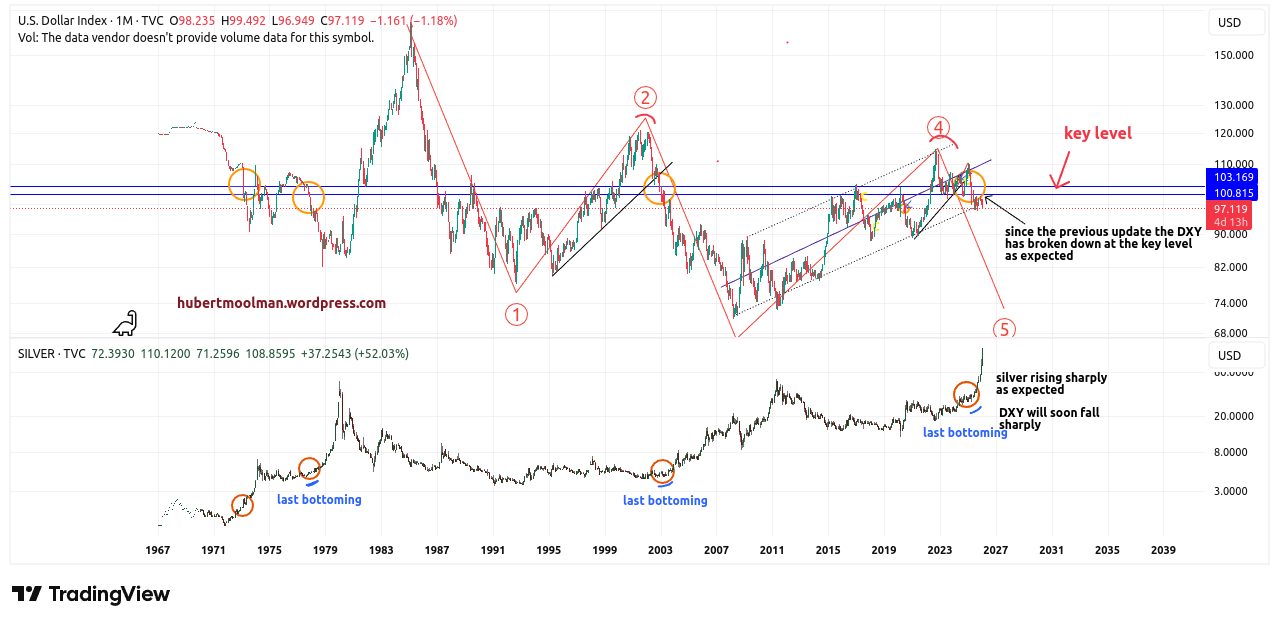

Previously, I have highlighted an important level on the DXY chart and how it relates to significant silver rallies. Below is that updated DXY chart (and a silver chart) showing that important level (the double blue line)

Notice how the DXY broke down at the double blue line, close to multi-year silver rallies in 1977 and 2003. It has now broken down, and this is a great signal also for the silver bull market continuing.

Notice how the DXY broke down at the double blue line, close to multi-year silver rallies in 1977 and 2003. It has now broken down, and this is a great signal also for the silver bull market continuing.

Another major leg down would also complete the regulation pattern of three major moves down (ending at point 5) before a new cycle. This is certainly consistent with a US debt default looming.

Warm regards

Hubert Moolman