What in the world do these two things have in common? Not much other than the fact that they share the same chart. What's that about?

As we all await the latest FOMC mutterings on Wednesday, I thought it might be fun to write this week about something you may not have noticed. And what's that? The curious yet almost 100% long-term correlation between the price of COMEX silver and the price of the popular gold mining share ETF with the symbol GDX.

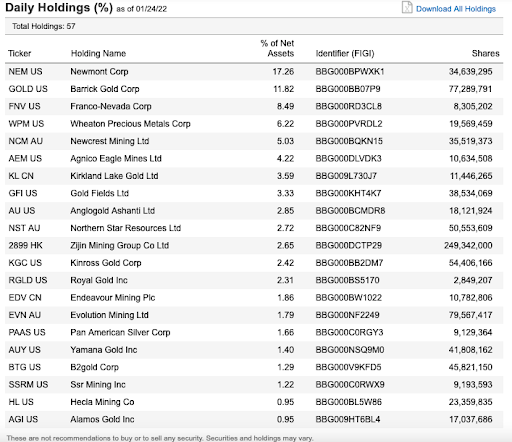

Now on the surface, you wouldn't expect these two to be so closely correlated. And why would you? Why would the price of COMEX silver be in any way connected to the prices of shares in major, producing gold mining companies? The GDX is managed by a company called Van Eck, and from their website, you can find this list of its current holdings:

You might spot a few silver producers on this list, but the top ten holdings are all major, producing gold mining companies. So in a logical investment world driven by human beings making investment decisions based upon fundamentals, you might expect a correlation between the price of COMEX gold and the share price of the GDX. And, as you can see below, there is some correlation. However, mining company investors are always asking me a variant of the same question. Namely, how can the gold price be near its all-time highs yet the GDX be mired at half its level from ten years ago?

On the chart below, you'll find the price of COMEX gold displayed in candlesticks while the GDX is shown as a blue line. Note that since January 2011, the price of COMEX gold has moved up about $500 while the GDX has fallen from $55 to $30, with a severe disconnect since about 2019.

Now of course, there are abundant reasons for such lousy share performance by the gold mining sector over the past decade, but as you can see above, the underlying price of their primary product is not one of them.

So what else is going on here? Well, take another look at that chart, but let's switch out COMEX gold for COMEX silver. What do we find?

Now wait a second. How can it be that COMEX silver is more closely correlated with the GDX than COMEX gold? That makes no logical sense. Again, the GDX is a portfolio of mostly GOLD mining companies. What does silver have to do with it?

Maybe you're thinking that I'm just fiddling around and cherry-picking dates. OK, fine. Let's look at the past five years:

Earlier I mentioned that "disconnect" that appeared in 2019, so how about the past three years?

You want more? Well then, let's keep going. How about the past twelve months?

How about the past six months?

How about just year to date? COMEX gold is up nearly 2% to start 2022, but the GDX is down 3%. Why? See below.

So now the question becomes: WHY? Why does the GDX so closely track COMEX silver on a day-to-day, week-to-week, and month-to-month basis? Well, this is clearly done by algorithmic trading. What part of stock market related trading ISN'T dominated by algorithms these days?

But why this particular correlation? Maybe ask yourself: What party or parties has a rationale or incentive to program a trade that so obviously correlates these two things? And then consider this...If you can control the price of COMEX silver, you can, by extension, also control the share prices of the major gold mining companies, and by further extension, you can control overall investor sentiment for the sector.

Pretty neat trick, huh?

Now maybe I've gotten way off course and there's a more simple and benign rationale for the correlation. I'll let you decide that one. However, what's undeniable is that the gold mining sector, with the value of shares in the GDX as a proxy, is more correlated with the COMEX silver price than with the COMEX gold price.

So the next time you're frustrated on any given day when COMEX gold prices are higher yet your mining portfolio is lower, don't email me and don't message me on Twitter, either. Instead, just be sure that your next move is to check COMEX silver. You're quite likely to find that silver prices are down, too.