Late last week, a movement to "squeeze the shorts" in silver began, and the impact on physical price was remarkable. However, since the futures market price is still controlled by the market-making Bullion Banks, the concern has been that if the Reddit crowd grew quickly distracted and moved on, the COMEX price was going to fall right back. Now here we are, and it's gut check time.

As you likely know, by late Monday the usual suspects were lining up to do their part in corralling the movement to squeeze silver. The irony that this was all occurring on Groundhog Day should not be lost on anyone familiar with our sector.

- The financial media was talking it down: Silver drops over 4% as retail buying frenzy pauses

- Banks like JPM downgrading silver: Miners decline as JPMorgan downgrades sector and silver prices slide from eight-year high

- "Blue check" trolls on Twitter spreading their usual lies and disinformation: Arieh Kovler Tweet

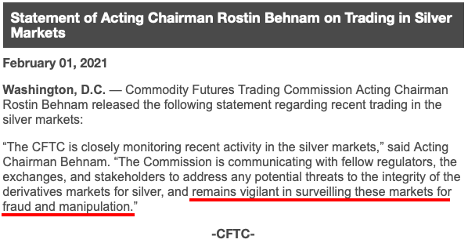

And of course, here came The Keystone Cops late Monday. I posted the chart below to Twitter on Monday, and it's the best way to illustrate CFTC's role in perpetuating the problem. Four big red candles are just fine and business as usual. One big green candle, and it's time for alarm bells and margin hikes.

So where do we go from here?

Though there's still time for Tuesday's smash to be reversed and for the COMEX metals to trade higher later this week, it's highly unlikely that any real change to The Fractional Reserve and Digital Derivative Pricing Scheme will come about through active participation within that scheme. Other than potentially igniting a short-term squeeze of the bullion bank net short position, the impact of buying silver derivatives is always likely to be minimal. Why? Because The Banks monopolistically control these "markets" and their fully-captured "regulator" will always look the other way. See yesterday's sudden imposition of a strict margin hike as just your latest example.

Thus, it is again time for every investor in precious metals to understand that there is only one way to force a change in the pricing system. Only direct acquisition of physical gold and silver can accomplish the changes we desire. And why is this? Because the current system is hyper-leveraged and hyper-hypothecated to the point where there may be as many as one hundred beneficial owners for each physical ounce held within the COMEX vaults of New York and the LBMA vaults in London.

Therefore, every ounce that you physically secure for yourself takes that ounce out of the hands of the bullion banks...thus stretching their leverage even farther. At what point will their system be stretched too far and to the edge of failure? That's hard to say, but that day is most certainly coming.

This change is likely to materialize out of a physical delivery default. This won't emanate from New York, and it likely won't begin in London either. Instead, look for delivery defaults to begin in the unallocated accounts that are run out of Perth, Montreal, and Zurich.

One day soon, a customer will arrive at one of these locations and demand immediate delivery of the "physical metal" they have been led to believe they hold in their unallocated account. When that customer is then told that their metal is not on hand and that they must wait 90-120 days for delivery, an old-fashioned bank run will follow. As with any traditional bank run within a fractional reserve system, banks will close and a "holiday" will be declared. Will those customers eventually be made whole with a delivery of physical metal? It's highly doubtful.

Therefore, DO NOT allow yourself to be a part of a pricing system that has perpetuated misery upon investors, mining companies, and their employees for decades. Instead, keep plowing forward. Purchase physical gold and silver, and demand immediate delivery. You might make an incredible impact, just as we saw earlier this week. However, even if this current movement fizzles out, you'll have diversified some of your assets into sound money, and there is no better safe harbor to be found in this ongoing storm of monetary and fiscal madness.

So please do your part in acquiring some physical metal, and then let's see if we can finally begin to hold The Banks accountable for all of their dirty deeds over the past several decades.