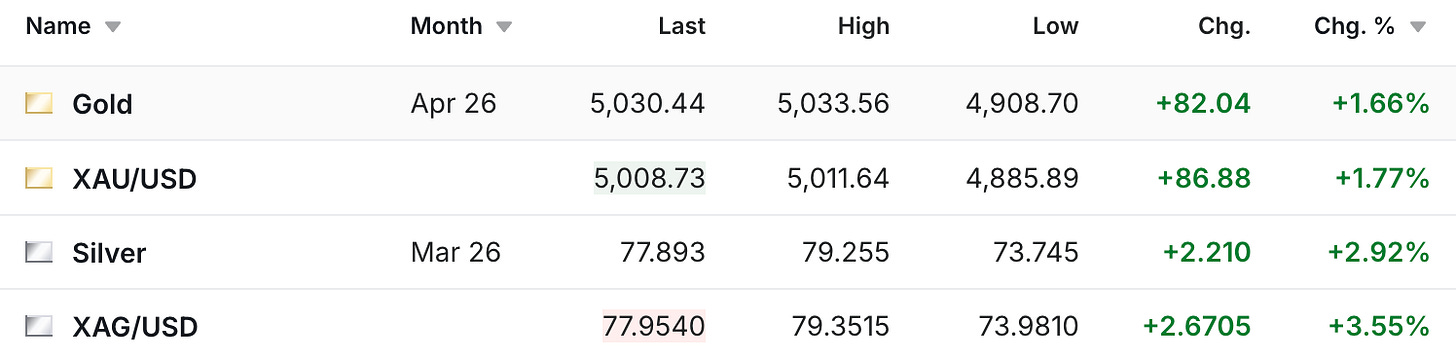

We’re seeing a rebound in the precious metals, as the gold price is once again back over the $5,000 per ounce mark, while the silver futures are up $2.21 to $77.89.

Of course, it’s always good to see a rebound like that after another sharp sell-off, and maybe the positive out of all of this is that at least we’re getting used to it.

I want to be careful to not say that the price doesn’t matter, although given the $60 range that we’ve seen over the past month, it’s definitely one of those times where having your underlying fundamental opinion about what’s happening, and then being able to take a step back from the daily volatility, can go a long way in making good decisions.

Yesterday, we talked about the conditions in the Chinese silver market, and we will dig into India. Fortunately, Metals Focus has put out some reports highlighting what’s going on there, and let’s take a look at them here.

Investor appetite was strong for much of the rally in 2025, during which domestic silver prices surged by 170%. However, as the rally extended into January 2026, signs of fatigue began to emerge. The rapid rise in prices made investors increasingly cautious. Once prices breached the psychologically important Rs.300,000 level on 19th January and subsequently crossed Rs.400,000 by 29th January, profit-taking emerged.

Market conditions deteriorated sharply in the last few days when silver prices witnessed a pronounced fall. On the Multi Commodity Exchange (MCX), silver hit the lower price limit of 27%, triggering panic among investors and consumers. This was followed by heavy selling in the physical market.

It’s interesting to see what’s happening in India right now, as they have traditionally been known as a price-sensitive buyer, yet what Metals Focus is describing about their order flow over January, and then into February on the price decline, is the opposite of their normal pattern.

Over the past few weeks, market sentiment has also been influenced by speculation around a possible import duty hike in the country’s 1st February budget. Anticipation of higher duties pushed up premiums across physical and futures markets, with futures on the MCX at one point trading nearly 10% above the landed cost of silver. With no change announced for import duties, some of these premiums began to unwind, narrowing the spot-futures spread.

Government policy in India is often a big variable, and you might remember how, back in July of 2024, the import levels surged when the tax treatment was reduced.

The current price decline has introduced a new set of concerns in the physical market. Anecdotal information suggests that traders and bullion dealers are reluctant to buy back silver from consumers and investors at prevailing prices. Even when purchases are made, they are being carried out at steep discounts, of 5-10%.

Meanwhile, on the sell-side, dealers are quoting premiums of 5-7%, resulting in exceptionally wide bid-ask spreads. This has severely impaired liquidity and prevented investors from booking profits and, in turn, exacerbated the panic. Margin calls on the MCX have also led to forced liquidations.

We’ve seen a similar situation in the U.S., where there’s a bottleneck with the silver refining capacity. And the last part about margin calls leading to forced liquidation is the kind of thing that, when it’s happening globally, can lead to some of the chaotic price swings that we’ve seen over the past two weeks.

Investor behavior is also being shaped by events of 15 years ago. The sharp price rally and subsequent collapse in 2011, after which silver prices took a decade to revisit these peaks, are also influencing sentiment. Many investors fear a repeat of that episode, leading to increased liquidations even at the above discounts.

Certainly an understandable fear, and one that any gold and silver investor would be wise to keep in the back of their mind. Although given the ample evidence of supply concerns that we’ve discussed over the past couple of months in this column, I do maintain my belief that we’re in a much different environment.

Also, while people often talk about how silver came down from $49 in 2011, keep in mind that silver also fell from $21 to $9 as the subprime crisis was unfolding in 2008, before then making it up to $49 in 2011.

Overall, while the sharp correction has alleviated some of the speculative excesses built up during the rally, the scale and speed of the decline has hit retail investor confidence. That said, we do not believe that price expectations have decisively turned negative, however, investor sentiment will remain under pressure until volatility moderates and liquidity improves.

No one ever said investing in silver was for the faint of heart. Although if you want to tell your silver legend stories to your grandkids a few decades from now, at least you’re in the middle of it and get to actually be on the field while it’s happening.

In a major regulatory shift, the Reserve Bank of India (RBI) has amended its Gold and Silver (Loans) Directions 2025, permitting loans to be secured against silver ornaments and coins alongside gold. Effective from 1st April 2026, individuals will be able to pledge silver assets to access credit through banks, non-banking financial companies, and housing finance firms under a uniform lending framework. This measure could help mobilize India’s vast household silver holdings, broaden access to formal credit, and formally recognize silver as a mainstream collateral asset.

Similar to how people were disappointed that on the day that silver was finally confirmed as a critical mineral in the U.S. that the price ended up being down, which I suggested would take care of itself over time (and this was back before the silver price had broken $50), this shift about allowing silver to be used as collateral strikes me as the kind of thing that not many will pay attention to now, but at least has the potential to have a noticeable impact on the market over time.

Silver, too, has long been an important component of rural wealth, particularly among lower and middle-income households. Its lower price point has enabled widespread accumulation in the form of jewelry and utensils, including anklets, toe rings, and children’s ornaments. India has for long been the world’s largest consumer of silver jewelry and silverware by volume. Since 2010, Indians have purchased an estimated 29,000t of silver in jewelry and 4,000t in coins up to 2025, primarily in rural areas and among lower income groups.

Silver has remained largely excluded from the formal lending system. The primary obstacle has been purity risk. Much of the silver jewelry in circulation lacks hallmarking and contains alloys of varying compositions, particularly in traditional pieces such as ankle chains and toe rings, which account for more than 50% of the market. These are often substandard and of lower purity than declared. Within informal lending channels, by contrast, many rural communities have used silver to raise funds, typically receiving only 30–40% of the metal’s value.

The RBI’s revised framework aims to bring order and consistency to lending against silver. It includes clearly defined loan-to-value (LTV) ratios and eligibility thresholds. For loans against jewelry, lenders must follow a tiered structure: 85% LTV for loans up to Rs.250,000, 80% for Rs.250,000–500,000, and 75% for loans exceeding Rs.500,000. These caps are calculated on the intrinsic metal value only, with no value attributed to stones, settings, or other components. Weight limits have also been introduced: each borrower may pledge a maximum of 1kg of gold ornaments and 10kg of silver ornaments, along with 50g of gold coins and 500g of silver coins. These limits are designed to cap credit exposure and simplify collateral management. Bullion, including bars, and financial products such as ETPs and mutual funds remain ineligible as collateral.

The RBI’s move comes at a time when silver has posted a remarkable rally. In particular, the rupee silver price has been trading at record highs, well before the international market experienced the same trend. This price strength has a dual impact on secured lending. On one hand, higher prices increase the collateral value of existing silver items, enabling borrowers to raise larger loan amounts under the same LTV ratios. On the other hand, silver’s inherent price volatility poses downside risk: a sharp correction could erode the lender’s margin of safety if regular revaluations are not enforced.

Operationally, silver loans face additional challenges. Its lower value-to-weight ratio requires significantly larger pledged volumes, raising storage, transport, and insurance costs for lenders. Silver purity risk and the prevalence of non-hallmarked jewelry remain key barriers. These factors are likely to constrain disbursement volumes and encourage lenders to adopt more conservative LTV ratios. While loans against silver have existed informally for decades, the RBI’s framework marks the first formal recognition of silver within the regulated collateral ecosystem. Metals Focus believes that rather than displacing gold loans or traditional credit channels, silver-backed lending is likely to emerge as a complementary product. For rural households, especially first-time borrowers or those seeking modest sums, this could significantly broaden access to formal finance. In time, greater standardization, steps such as mandatory hallmarking, and growing market familiarity could bring silver further into the formal financial system, unlocking substantial untapped value.

Hopefully, that gives you a better idea of what they’re planning, and we’ll see in due time what impact that has.

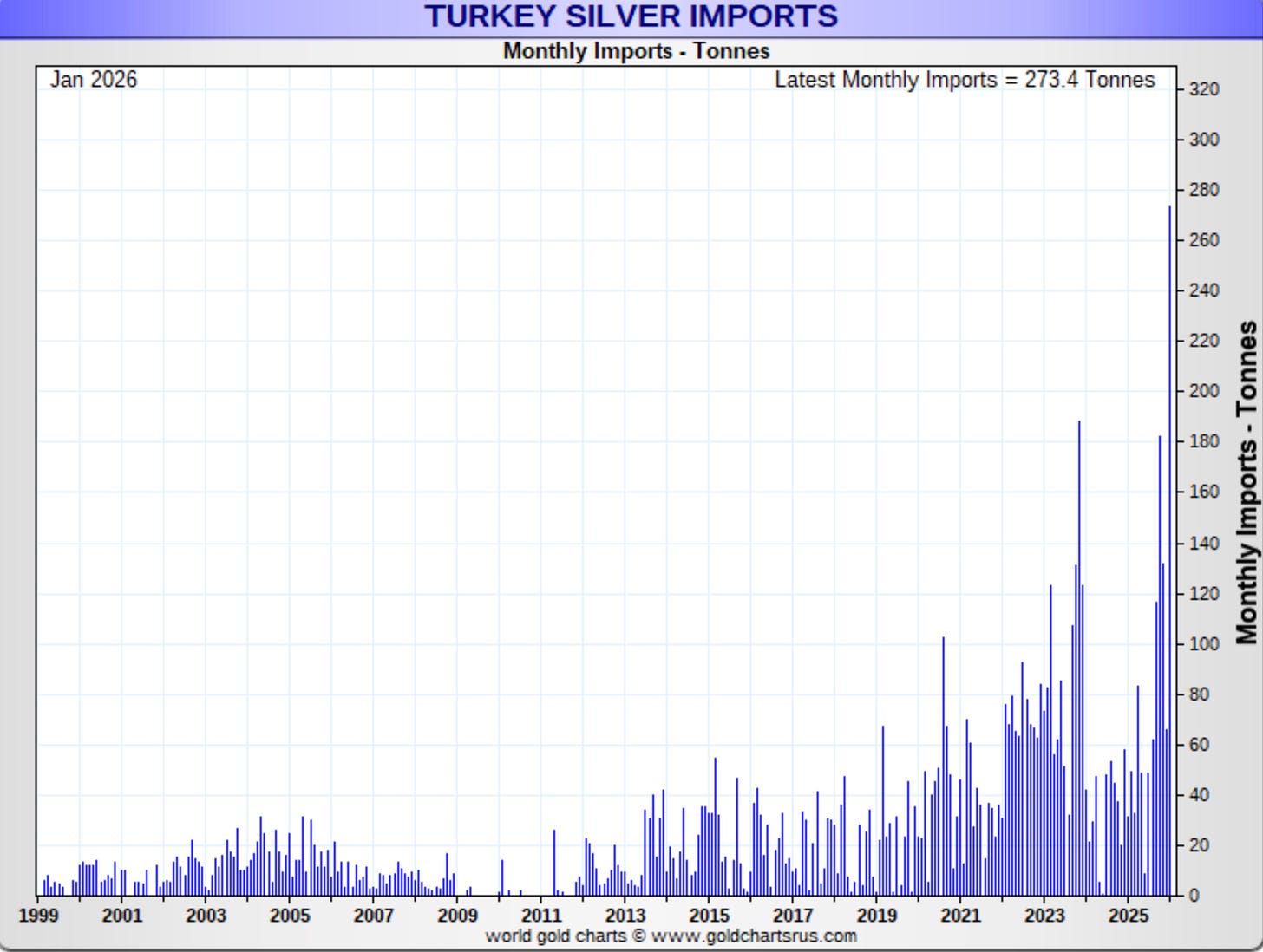

However, we can also see that Turkey just set a record for the most silver imported in a single month this January.

Türkiye imported a total of 273.3 tons of silver last month, a monthly record high in imports, as silver prices rose at an unprecedented level at the start of the year.

According to Turkish stock exchange Borsa Istanbul’s precious metals market report, the country imported 273.3 tons of silver in January, surging from 31.55 tons in January 2025.

So all in all, it was another volatile week, yet the price remains well in excess of the $50 mark that it took 45 years to break, while the gold price is having a hard time staying below $5,000...

Sincerely,

Chris Marcus