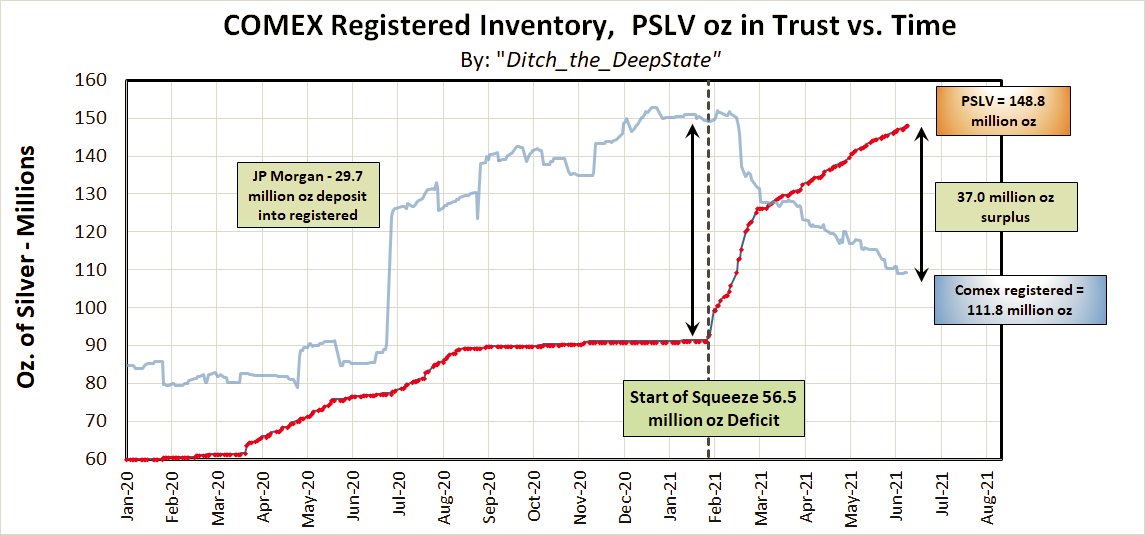

Since the start of the SilverSqueeze in late January 2021, the Sprott closed end fund PSLV has purchased over 58 million oz of silver, increasing from approximately 90 million oz (Jan 2021) to the recent total of over 148 million oz. (See graph below) This was made possible by a new shelf offering issued March 2nd, 2021 to purchase $3 billion worth of silver. In addition, Sprott PSLV has an prior shelf offering also that they were completing. Combined, Sprott PSLV had enough firepower to acquire roughly 120+ million oz of silver at current market prices around $25 to $27 per oz.

Based on the 58 million oz already acquired year to date, Sprott PSLV should have sufficient firepower to purchase another 60+ million oz still, based on the currently active shelf offerings. Based on demand so far, it is extremely likely that Rick Rule and Sprott will complete that shelf offering during 2021 and issue a new shelf offering, probably for another $3 billion in value, so that they can continue their rampage of buying 1/6 of global mining supply.

That was not a typo. Sprott PSLV has been buying approximately 1 out of every 6 ozs of silver mined so far in 2021. This unprecedented buying is causing massive supply imbalances in the silver market. Sprott PSLV has purchased so many 1,000 oz silver bars in North America, that they recently had to open a sub-custodian agreement in London (with Brinks) so that they can acquire 1,000 oz bars in London, store them temporarily there, until those bars can be transported to Sprott vaults in Canada.

Rick Rule, former CEO of Sprott US Holdings, joins us to discuss the details of PSLV, and how they acquire Silver in North America and around the world.

Part 1

Rick Rule, former CEO of Sprott US Holdings, tells us that the Silver Squeeze is working and explains why.

Part 2