It’s a testament to the unique characteristics of this bull market in metals and miners that silver’s rocket-shot higher in recent days is surprising to so many.

I’ve winced every time I’ve been on a panel during this bull market when one of the assembled experts has noted that silver and mining stocks usually follow after gold has already moved higher in a bull market.

That’s been the unique feature of this bull market — and none other in the history of gold as an investable asset — simply because central bank buying started this whole move.

And central banks don’t buy mining stocks or silver, so we had to wait until Western investors got involved...as they have been since late summer...for silver and mining equities to start playing catch-up.

In actuality, it was once a well-known fact that equities and silver typically moved before gold, especially in a rally within an established bull market, as speculators were quicker to jump in and usually chose to do so with the levered assets.

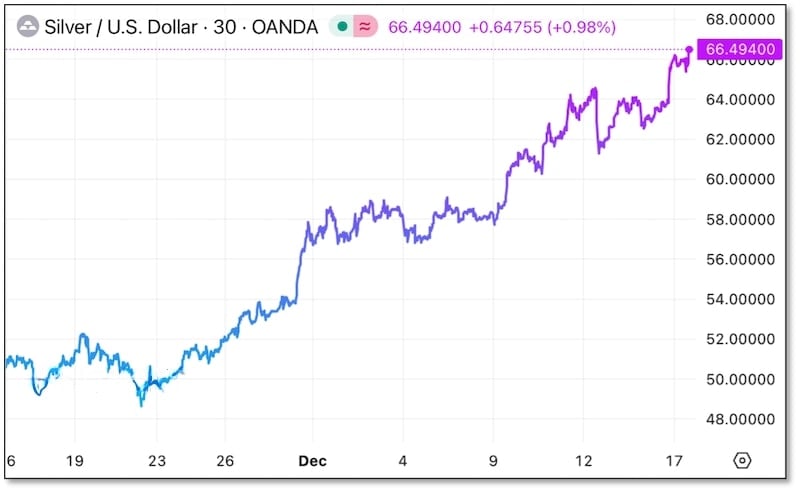

Regardless, I’ve been predicting that the next rally would begin around mid-December, and it seems to be playing out that way.

And if for no other reason, it seems that silver is pulling gold higher.

Soaring Silver

Both silver and gold were victimized by bear attacks yesterday, as traders tried to test the strength of this new rally. Both fell in New York trading, with gold almost recovering most of the losses.

Once those Western specs went to sleep, however, the rally resumed in force in Hong Kong and New York Globex trading during the early morning hours.

As I write, silver is up over $2.60...well over 4%...and nicely above $66.

And this isn’t a one-day wonder. As you can see in the one-month chart above, after clearing the previous record of $50 and back-testing it, silver clearly set a new target of $60 and above.

It seems as if traders recognize the complete lack of any technical resistance not only to $100, but to the inflation-adjusted record of around $200. Even though silver has vastly outperformed gold this year, it still has tremendous catching up to do just to equal gold’s move during this entire bull market.

It’s important to realize that this isn’t just a function of demand...of traders jumping on a bandwagon. It’s the other side of the equation that’s coming to bear right now.

Finally: The Long-Awaited Supply Crunch

Demand for silver is strong, but it’s the supply side that’s really driving this market higher.

As you may know, I’ve dismissed the industrial usages of silver for decades. With huge above-ground supplies available, and with 70% of newly mined silver coming as a by-product of other metal production, there was no shortage of metal to supply the industry.

I maintained that if there was no monetary cachet for silver, it would be trading for merely a few dollars per ounce.

So all we could do, for many years, was simply wait for those physical supplies of silver to be drawn down by the parade of annual supply deficits.

That time has come.

The supply situation that kept the silver price in check has vanished over the past couple of years, as above-ground supplies, even COMEX and London stocks, have dwindled. And now, for the first time in modern history, industrial users have to bid up to get the silver they need.

Consider this: Investment demand for silver can largely be quenched by synthetic supplies created via keystroke on the futures exchanges.

But you can’t put these hypothecated supplies into a solar panel, an electrical relay, or a fighter jet.

Now we’re finally seeing real supply-demand dynamics in silver, and with shorts and manipulators powerless to stand in the way of this juggernaut, the metal is being rapidly re-rated to fair value.

And that level remains far above today’s prices.

I’ve been noting how investors who manage to avoid the distractions of the holiday season to get positioned in metals and miners can often get a big head start on the typical new-year rally.

That opportunity is happening right now.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.