Excerpt from this week's: Technical Scoop: Job Surprise, Complicating Inflation, Precious Consolidation

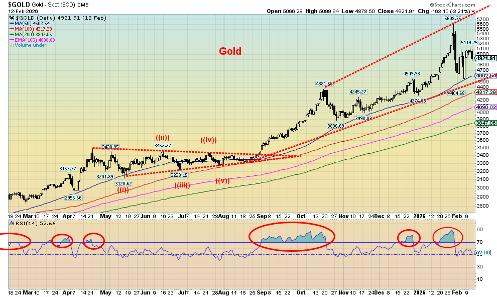

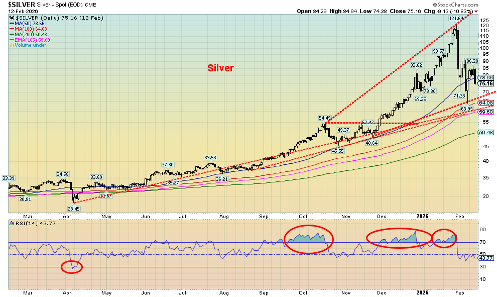

Gold and Silver

Source: www.stockcharts.com

Both gold and silver continue to whip around in a volatile manner. We’d say that’s not normal but then the rise was quite dramatic so a dramatic correction should not be a surprise. The long-term trend remains up, but before we resume the bull market a test lower still can’t be ruled out. Our expectations are that this won’t bottom until March sometime. Given the huge up move in silver once it broke that the long-time high of $50, we could see a retest of the $50 zone. Naturally, new highs would end any discussion of a test lower. The reasons for the rally in gold and silver have not gone away. Geopolitical tensions, domestic political chaos, and sticky inflation are among the reasons it’s rising in the first place. Gold is the safe haven. Not Bitcoin, which is now down 45% from that high last October 2025. In previous declines a drop of 80% was not unusual.

Gold has good support down to $4,500 but $4,300 can’t be ruled out. We’d like to see that hold. We don’t want to see gold break under $3,800 as that would suggest that the bull is over. The RSI is fairly neutral here, in the 50s. Silver’s correction has been far more dramatic so the dramatic drop shouldn’t be a surprise. So far, we found support around $64; however, we note that was down 48% from the high. Silver, right now, is in a bear market. And with gold down around 22% at the recent lows, gold is also arguably in a bear market. Gold needs to break over $5,300 to suggest that the low is in and new highs lie ahead. For silver it’s $108, although regaining above $90 would be encouraging. A bear for gold and silver shouldn’t have been a surprise given the steep rise. This correction will go a long way to work off the excess exuberance as weak hands exit.

Source: www.stockcharts.com

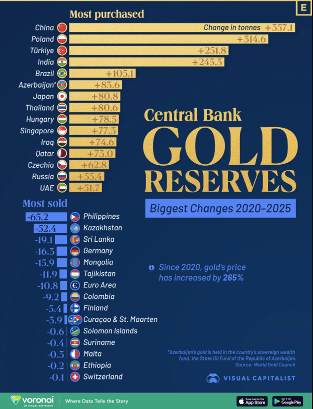

Source: www.visualcapitalist.com, www.globalinvestmentletter.com

Central banks have been adding to their gold reserves over the past 5 years. Maybe this shouldn’t be surprising. Central banks are not adding gold as a speculation. They add it to strengthen their balance sheets and to move away from U.S. securities due to conflict with the U.S. and nervousness over the U.S.’s massive debt the highest in the world. This has been particularly true of China. China’s holdings of U.S. securities have fallen $68 billion over the past year even as total foreign holdings of U.S. treasuries has gone up $632 billion. Others such as Japan, the U.K. and even Canada have picked up the slack. A reminder that Canada no longer has any gold holdings having sold them off in 2016. It’s a decision they may regret as the U.S. dollar falls and bond yields remain high with price pressure to the downside despite this past week’s price rise, yield down.

None of this suggests the U.S. dollar is about to collapse. It’s not. But it does signal that confidence in the U.S. dollar is waning.

Remember, gold does not pay a yield, there are storage costs. Yet still the central banks have been accumulating gold. If central banks are buying, shouldn’t you?

Read the FULL report here: Technical Scoop: Job Surprise, Complicating Inflation, Precious Consolidation

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. Although Artificial Intelligence (AI) may be deployed from time to time, AI output is monitored and adjusted, if necessary, for accuracy. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.