At a glance:

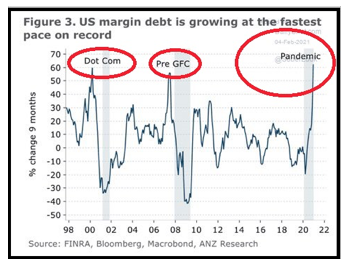

Many stocks are in a bubble. The bubble can inflate even larger, but be careful.

Silver is not a bubble, even though well above its lows from last year. People want something real in a dangerous and unreal world.

Breaking News:

- Gold fell $34 to close at $1,813 on February 5, 2021

- Silver rose $0.10 to $27.02.

- The DOW rose 1,165 to 31,148.

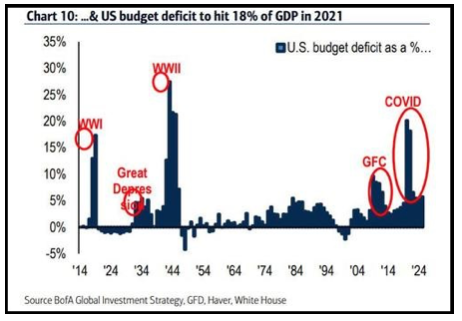

- More stimulus (funded by debt and central bank “printing”) is coming.

BACK TO BASICS:

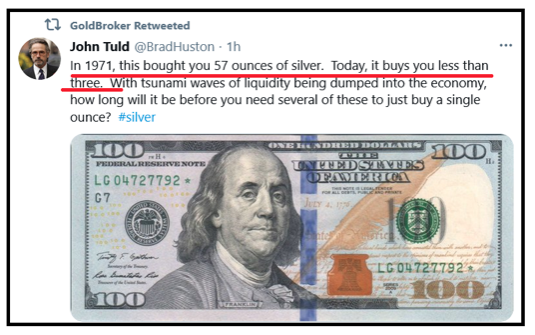

a) Commercial banks and central banks devalue their fiat currencies by creating currency units faster than their economies grow.

b) Devalued currency units buy less. Prices rise.

c) Higher prices for stocks, food, trucks, cigarettes, energy, and necessities are a “fact of life.” We are numb to continual price inflation, “shrinkflation,” and fudged official inflation statistics.

d) The game is fixed, prices rise, stocks are levitated by central bank “printing,” and gold and silver prices rise accordingly… unless we experience a devastating financial reset.

e) A reset could be hyper-inflation where currency units become almost worthless. Think Weimar Germany, Zimbabwe, Argentina, and hundreds of others.

f) A reset could be a devastating deflationary crash, hundreds of $trillions in global debts collapse to near zero value, and much paper wealth evaporates.

g) A reset could result from truthful government, responsible politicians, banished corruption, balanced budgets, honest money and… we can dismiss this as unlikely.

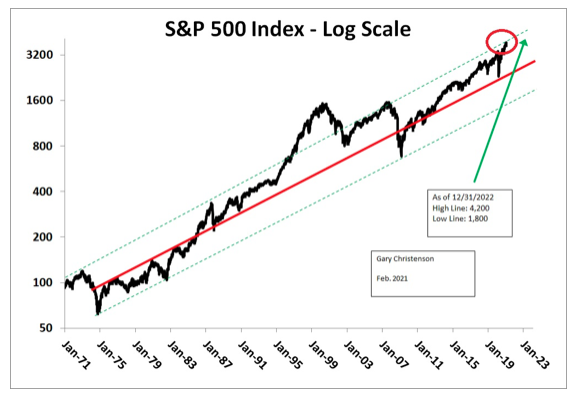

Examine two examples of dollar devaluation and rising prices. The S&P 500 Index has remained within a log scale channel for five decades, except for the bubble in 2000, which collapsed.

From James Rickards: “There’s good evidence that the stock market is now in bubble territory… When CAPE Ratios are as high as they are right now, stock market crashes usually follow.”

The S&P 500 index reached the top of its channel again. Will the Fed pump enough dollars into the market to keep the bubble inflated? Or is a crash imminent? Don’t fight the Fed, but bubbles always implode!

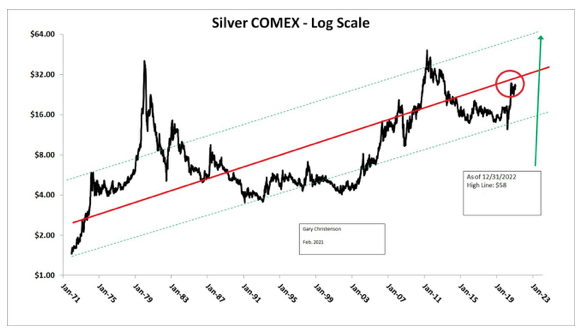

COMEX (paper) silver prices have risen, like the S&P 500, upward in a log scale channel for five decades. Prices are in the center. Prices rose above the channel in 1980 during the silver bubble, fell below the channel during the stock bubble of 2000, and climbed out of the channel in 2011. $15 and $60 are both within the channel.

SUMMARY: Dollars devalue, prices (S&P, silver, and others) rise, often too far and too fast, correct and repeat the cycle. Banking cartel dollar creation distorts the markets, bubbles emerge, bubbles implode, we forget the past, and are condemned to repeat the process.

BUBBLES: THE S&P IS IN A BUBBLE? SILVER IS NOT!

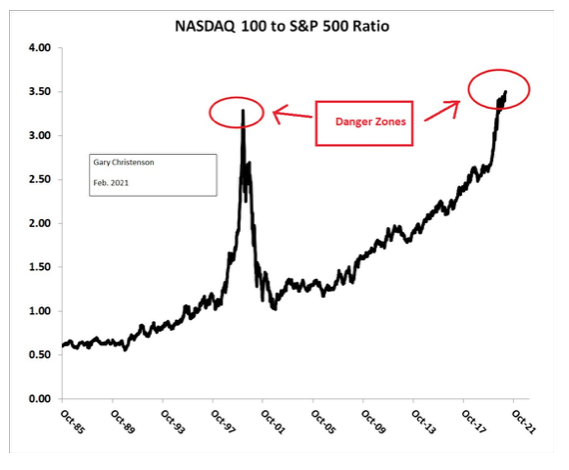

The S&P 500 index has bumped against the channel top. The NASDAQ 100 Index is a good indicator of bubblicious behavior in stocks. Remember the 2000 tech bubble? The 2020—2021 tech bubble is clear.

Graph the NASDAQ 100 to S&P 500 ratio. Note the ratio highs in 2000 and NOW.

The NASDAQ 100 is too high compared to the S&P 500 Index, and both look like price bubbles. Watch out below. A correction/crash could come any time, or maybe not for many months.

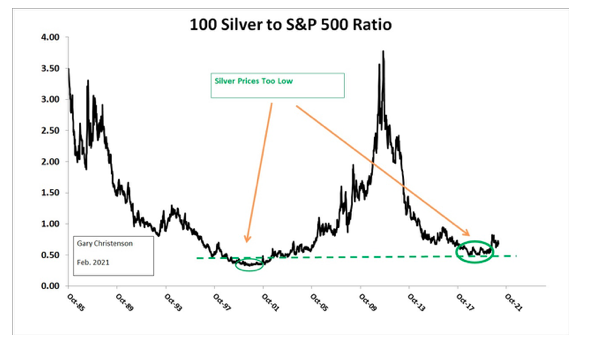

Examine the ratio of silver prices to the S&P 500 Index.

Over the past 25 years, silver prices have been weak compared to the S&P. However, the ratio spike in 2011 shows the S&P could fall while silver prices rally much higher.

It is possible that:

a) The “print, extend, and pretend” games played by central banks become ineffective and stocks regress to the mean – much lower.

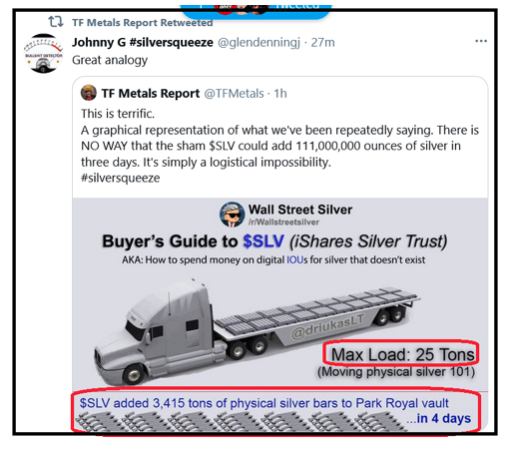

b) Silver prices on the paper markets spike higher because silver investors demand delivery of real assets, not paper promises.

c) COMEX has difficulty finding silver bars for delivery.

d) Prices for Silver Eagles spike higher (already happening) as supply vanishes and demand is high.

e) We are “blessed” with even more Quantitative Easing, government promises for more spending, stimulus, payoffs, and giveaways (already in process).

f) People exchange their paper and digital currency units in anticipation of declining purchasing power, massive central bank intrusion into markets, and “doubling down” on failed monetary policies. Velocity increases.

Yes, silver prices could rise far higher when this phase of the fiscal and monetary stimulus game fails. The S&P could implode 50%, as it did after the 2000 bubble and the 2007 crisis.

Or, central banks could intelligently manage their currencies, governments might responsibly control spending, and congress could refuse payoffs as a symbol of their commitment to honesty and integrity in government. (Maybe not…)

WHAT ABOUT SILVER COMPARED TO GOLD?

Examine the graph of the silver to gold ratio since 1998. Note the spike in 2011, after which silver prices collapsed. The ratio is low and could rise considerably. Gold prices are rising, and silver prices will rise more rapidly. Or perhaps the short sellers on the COMEX can “manage” prices forever…

CONCLUSIONS:

- Prices rise as the banking cartel devalues dollars.

- The S&P is at or near a top—probably.

- Silver is NOT near a top and has room to run higher based on its ratios to the S&P and gold prices.

- The NASDAQ 100 is too high relative to the S&P—a clear sign of a bubble in tech stock prices like the bubble before the crash of 2000.

- Is Tesla of 2020-2021 the Cisco of 1999-2000?

- Be prepared for volatility in the wake of potential stock market corrections/crashes.

- Expect higher silver prices based upon dollar devaluation, massive QE, approved fiscal stimulus, more stimulus and giveaways coming, deteriorating financial conditions that increase investor fear, and the coming huge demand for real physical money (silver and gold), not the fake units the central banks create by the trillions.

- Buy silver for the long term and ignore short-term corrections. Or you can chase the next Tesla or GameStop. Good luck with paper assets than can vaporize in a week.

WHAT ABOUT BUBBLES?

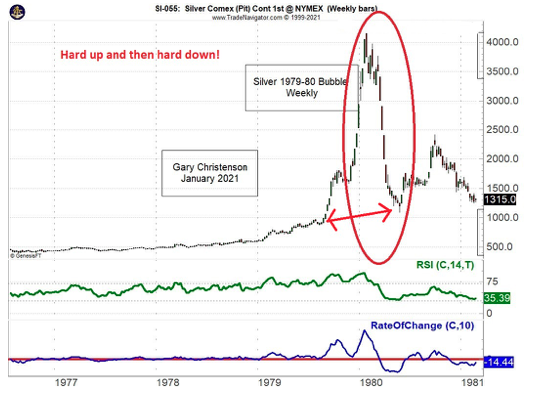

Examine past bubbles in silver, NASDAQ 100, crude oil, and Cisco.

a) Bubbles rise too far, too fast, and appear inevitable as they inflate.

b) Bubbles collapse rapidly, often retracing 100% of their up-move.

c) Much wealth is lost during the euphoria and collapse phases.

d) Bubbles are “danger zones.” They boost wealth for a few and destroy wealth for many.

CONCLUSIONS:

- By many measures, stocks are too high. Expect a correction… someday.

- By several measures, silver prices are too low.

- The banking cartel will continue devaluing dollars. Prices will rise—some more than others. Buy what is inexpensive now (such as silver) and be careful with what is expensive (Tesla stock and MANY others).

- Buy silver. Buy gold. Be patient.

Miles Franklin is trading millions of dollars for silver and gold. People want something real and secure. They sense danger in our “extend and pretend” financial system and seek protection and safety.

Call Miles Franklin at 1-800-822-8080 to protect your savings and retirement assets.