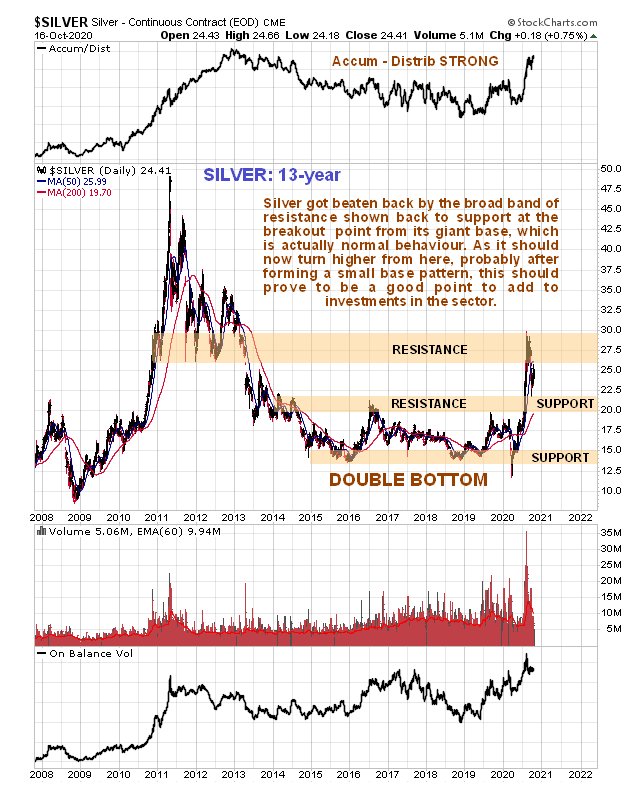

With hyperinflation looming, silver has to be one of the best investments of these times, especially as it leverages gold’s gains. This Summer saw a spectacular high volume breakout from the giant base pattern that had been forming for years, as we can see on its latest 13-year chart, which is hardly surprising considering the Fed’s white hot money creation. The breakout triggered a sharp runup that resulted in silver becoming heavily overbought in a zone of quite strong resistance, hence the reaction since early August which is setting it up for the next big run.

As we can see on the 15-month chart, the strong resistance at the upper boundary of the giant base pattern has now become strong support, which should now strictly limit downside. Last month silver briefly tested this support, bouncing off it and it is thought likely that it will retest it again over the short-term before the next major upleg starts, with similar action being expected in gold. This would be normal following the breakdown from the triangular pattern and below the 50-day moving average which has opened up quite a large gap with the 200-day. Basically silver is backing and filling here ahead of its next major upleg, and in so doing it is providing investors with an opportunity to build positions further on any near-term weakness.

The rather sharp breakdown from the Triangle in mid-September caused some damage to sentiment and on the 6-month chart we can see that a pattern has since formed that looks like a bear Flag. If this interpretation is correct, then we can expect it to break lower again near-term, but due to the proximity of strong support, it is unlikely to drop by much – probably to somewhere between the bottom of the band of support shown and the rising 200-day moving average. This is a rather tough call because other factors are very bullish, including the strong Accumulation line which made new highs about a week ago and the bullish alignment of moving averages. What all this suggests is that we will have one last modest drop to complete this corrective phase before silver takes off strongly higher again in a 2nd major upleg, and this fits with the scenarios set out for gold and the dollar in the parallel Gold Market update. In any event, downside here is viewed as limited and with hyperinflation looming as mentioned at the outset, any short-term dips will be viewed as presenting outstanding opportunities to build positions across the sector ahead of the new major upleg.

As with gold, COT positions are in middling ground and don’t provide much guidance one way or the other, which is why we are not bothering to look at silver’s COT chart in this update.

End of update.