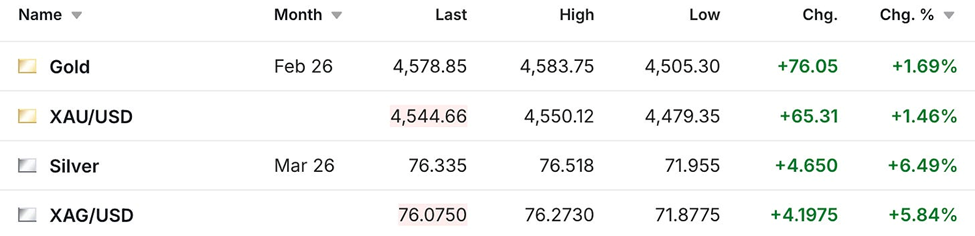

I know I said no column today, and we will keep this one short. But how can you not say something about the Christmas silver rally that now has the price up over $4, has the COMEX futures over $76, and has left the silver price in China over $80?

My jaw is still on the floor, so I’m not even sure what else I can say about that one right now (and for what it’s worth, gold's up another $70 too).

Although fortunately my dear friend and colleague Vince Lanci did record his morning show today, and I really think you would enjoy it if you have not already seen it.

There was something in there that he mentioned in particular, that I’ll be thinking more about today, and also reaching out to some of my colleagues in the silver industry to discuss.

He mentioned that this is being driven by physical demand issues, rather than speculators, which if correct, is an important distinction in my mind.

Because while I was watching the silver price soar last night, I started to get the feeling that there might be something else going on here. And if there is, and that’s what’s driving the rally rather than the futures trading on the COMEX, that changes my perception on how easily we could see a sharp correction.

If it was just the COMEX traders, then I would be a little bit more concerned. But if that’s not the case, and the elevated premium in China is a good piece of indicative evidence to support that, my initial gut reaction is that the latter outcome could mean a higher probability of us not seeing a sharp correction.

For now, let’s just put that in the category of thinking the situation through, as opposed to any sort of definitive conclusion. But I’m sure I’ll learn more as the day goes by, and of course I’ll keep you posted.

So just have fun watching this history that’s being made, and I genuinely hope you’re enjoying a wonderful holiday!

Sincerely,

Chris Marcus