The Captain’s 120-minute SP500 chart.

The Captain’s 120-minute SP500 chart.

Here’s our take on the action:

The SP500 was higher again this past week reaching another all-time high at 6508.20!

Within v of V, wave (iv) ended at 4835.04 and we are moving higher in wave (v), which is likely now getting very close to completion.

We will be updating our internal wave count within wave (v) to suggest that we likely only need one more push above the current high of 6508.23 to complete the minimum requirements for a completed wave (v).

We will provide our updated internal count for wave (v) in our next Morning Post.

We will likely be looking to short this market this week!

Trading Recommendation: Stay Flat (but not for long).

Active Positions: Flat… and eager to go short!

Silver Update

Silver is hot… and we are in!

The Captain’s weekly silver chart.

The Captain’s weekly silver chart.

Long Term Update:

Silver was higher again this past week reaching a high of 40.31, closing at 40.26!

We are moving higher in wave 3, as shown on our Weekly Silver Chart. Within wave 3, we completed wave i at 29.91 and wave ii at 18.01 and we are now continuing to move higher in a subdividing wave iii. Our current projected endpoint for wave iii is:

iii = 1.618(i) = 48.05.

Within wave iii, we completed wave (i) at 24.39, wave (ii) at 19.94 and wave (iii) at the 39.91 high and wave (iv) at the 36.28 low.

Within wave (iv), we completed wave ^i^ at 38.88 and wave ^ii^ at 37.53, and we are now moving higher in wave ^iii^, a shown on our Daily Silver Chart.

Longer term our initial projection for the end of wave 3 is:

3 = 1.618(1) = 86.50

In the very long term, we completed all of wave III at 49.00 in 1980 and all of wave IV at 3.55 in 1993. We are now working on wave V and within wave V we have the following count;

1 = 49.82;

2 = 11.64;

3 = First projection is 86.50.

Active Positions: Long with puts as a stop!

Gold Update

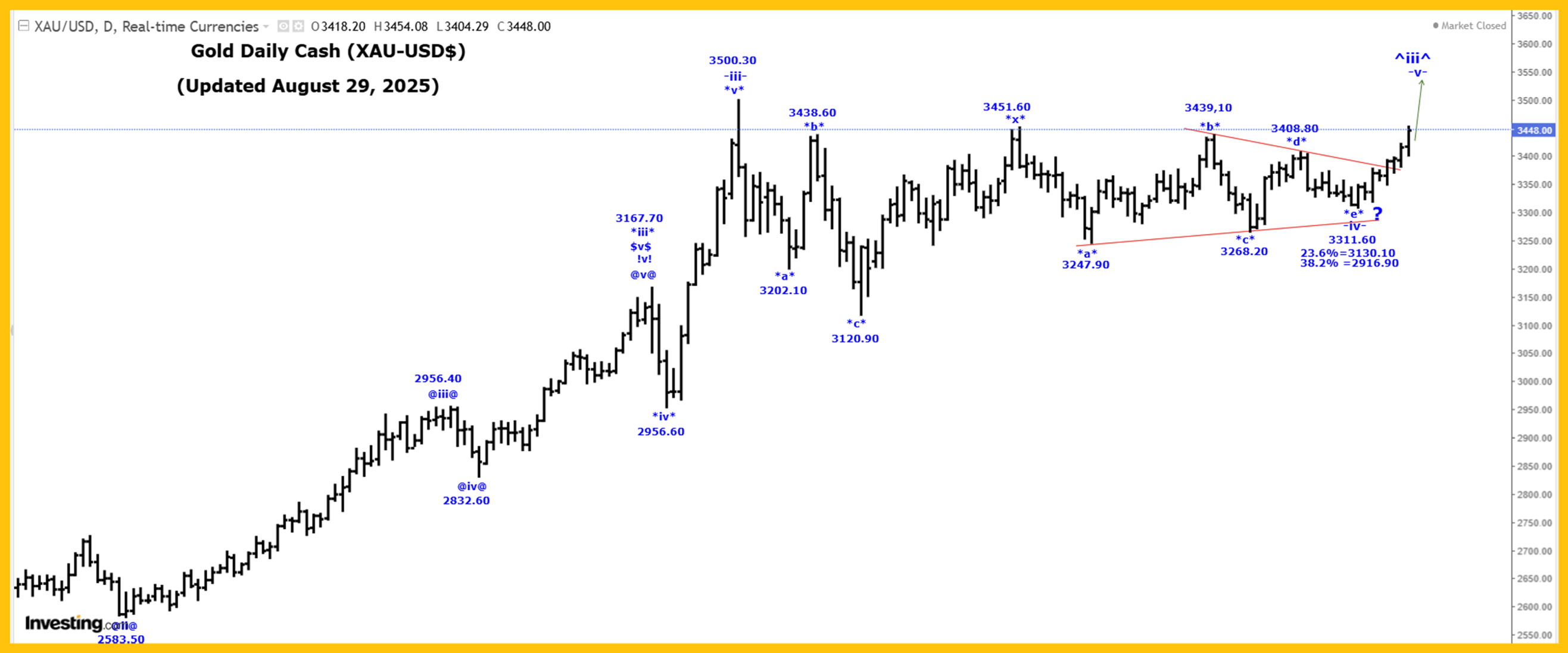

The Captain’s daily gold chart.

The Captain’s daily gold chart.

We continue to rally in wave .v. of -iii-. Within wave .v., we completed wave ^i^ of *i* at the 1997.20 high and all of wave ^ii^ at the 1931.80. We continue to rally in wave ^iii^, which has a projected endpoint of:

^iii^ = 6.25^i^ = 3249.40.

Within wave *iii* of ^iii^, we completed wave -i- at 2151.20 and wave -ii- at 1973.10. We are still rallying in a subdividing wave -iii- with wave $i$ ending at 2088.50, wave $ii$ at 1984.30, wave $iii$ at the 2431.50 high, and our wave $iv$ bullish triangle at the 2277.60 low.

It looks like all of wave $v$ of *iii* ended at the 3167.70 high, wave *iv* at the 2956.90 low and wave *v*, at the 3500.30 high, to complete all of wave -iii-. If that is the case, then we are still moving lower in wave -iv-, which has the following retracement levels:

23.6% = 3130.10.

38.2% = 2916.90.

We have updated our count for wave -iv-, which has aa current internal wave structure of:

*a* = 3202.10.

*b* = 3438.60.

*c* = 3120.90.

*x* = 3451.60.

*a* = 3247.90.

*b* =3439.01.

*c* = 3268.20.

*d* = 3408.80.

*e* = 3311.60, if complete to complete all of wave -iv-.

We cannot rule the possibly that our second triangle formation within wave -iv- is going to expand and extend.

We still have other potential alternates for the internal wave structure of wave -iv-, and for the time being we will not list them all here, but they all point to gold moving sharply higher very soon.

After our complex wave -iv- ends we expect a very sharp thrust higher in wave -v-.

Trading Recommendation: Long gold. Use puts as stops.

Active Positions: Long gold, with puts as stops!

Thank-you,

Captain Ewave & Cre