Oil Mkt Update

Wave i ended at the 103.65 high and we are now falling in a lengthy and complex wave ii correction.

Within wave ii, we are still working on a double 3 wave corrective pattern. Our first wave three wave abc pattern ran from the wave i high of 130.50 to 63.57, with wave x ending at 95.03.

Our retracement levels for all of wave ii are:

50% = 68.50.

61.8% = 53.87.

With the very strong key daily reversal in Thursday’s trading session, we cannot rule the possibility that all of wave ii ended at the 55.10 low!

After wave ii ends, we expect a very sharp rally in wave iii.

Trading Recommendation: Go long crude with a put as a stop. Go long Suncor or other high quality oil stock.

Active Positions: Long crude with puts as a stop! Long Suncor!

Special Subscription Offer: At $99/mth the Captain Ewave newsletter value is superb, and we have a special offer this week of just $199 for a three-month subscription! Investors get six updates a week from the Captain. Send us an email at admin@captainewave.com or click this link and we’ll get you on board. Thank-you!

Stock Mkt Update

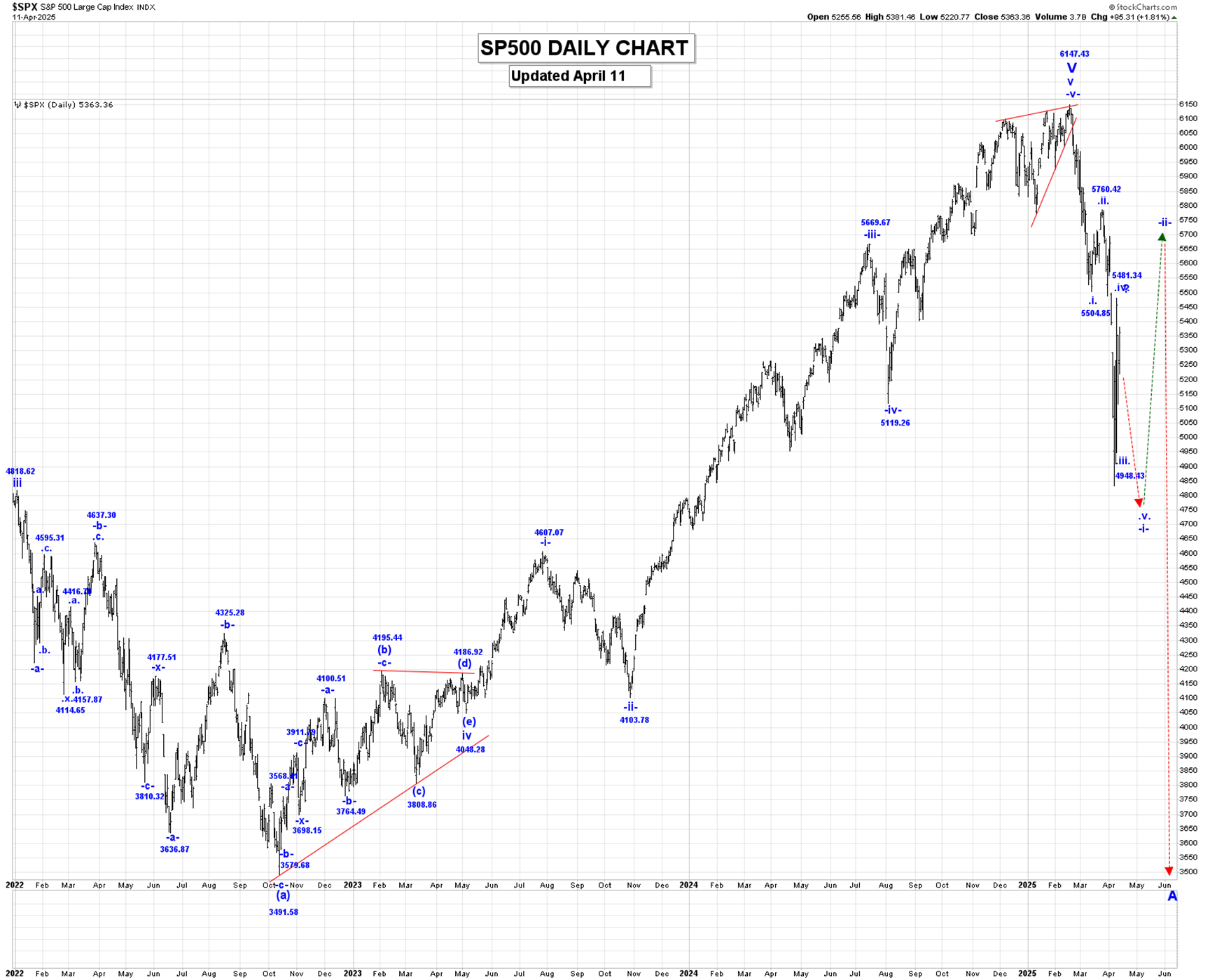

We are now working on the assumption that all of wave .v. of -v- of v is complete at the 6147.43 high and that we have started to fall in a multi-year ABC pattern, and within that pattern we should be moving lower in wave A.

Within wave A, we are falling in wave -i- of i of A and within wave -i-, we completed wave .i. at 5504.65, wave .ii. at 5786.05, wave .iii. at 4948.43(a failure low) and likely all of wave .iv. at 5481.34. If that is the case then we are starting to move lower again in wave .v. to complete all of wave -i-.

The other very bearish option is that wave .iii. is still underway and subdividing with wave $i$ ending at 4948.43 and all or most of wave $ii$ at 5481.34. We should now be falling in wave $iii$.

We plan to take profits at the end of wave -i-.

Trading Recommendation: Go short with a call as a stop.

Active Positions: Short with calls as our stop!

Silver Mkt Update

We have updated our internal wave count within wave 3, as shown on our Weekly Silver Chart. We completed wave i at 29.91 and wave ii at 18.01 and we are now continuing to move higher in a subdividing wave iii.

Within wave iii, we completed wave (i) at 24.39, wave (ii) at 19.94 and we are now moving higher in wave (iii) which has the following projected endpoints:

(iii) = 2.168(i) = 36.64.

(iii) = 4.236(i) = 46.97.

Within wave (iii), we completed wave -i- at 26.43, wave -ii- at 20.85 and have updated our current count to suggest that wave -iii- is still underway, as shown in our Weekly Silver Chart. Our next projected endpoint for wave -iii- is:

-iii- = 2.618-i-=37.84!

Within wave -iii-. we completed our wave *iv* bullish triangle at the 31.36 low, and we are now thrusting higher in wave *v*, to also complete wave -iii-. We do have higher projections for wave -iii-.

Longer term our initial projection for the end of wave 3 is:

3 = 1.618(1) = 86.50!

In the very long term, we completed all of wave III at 49.00 in 1980 and all of wave IV at 3.55 in 1993. We are working on wave V and within wave V we have the following count;

1 = 49.82;

2 = 11.64;

3 = First projection is 86.50.

Trading Recommendation: Go long, with a put as a stop.

Active Positions: Long with puts as a stop!

Thank-you!

Captain Ewave & Crew