Over the weekend, President Trump enacted a national emergency to impose tariffs against Mexico, Canada, and China. These tariffs apply a 25% tax on consumer-ready goods from Canada and Mexico, but as of Monday (2/3/2025), these tariffs were delayed for one month while the Chinese 10% tariff remains active.

The War on Drugs which justified the national emergency is one that never ends, so these tariffs will likely go forward, but with less abrupt impact on the economy as was tested by fears and uncertainty leading up to the announcement. The hysteria even drove traders to take risky bets by transporting gold and silver to the US by plane on Friday (1/31/25).

In response to the tariffs, members of the US Congress sent a letter to President Trump urging him to reconsider and pointing out how the tariffs in no way are designed to target and mitigate the flow of illicit drugs, but merely an attack on our biggest trading partners.

Of note is Section 2 (b) of the pertinent US Executive Order, as it applies an additional 10% ad volorem tax to energy resources. This section highlights that critical minerals are applicable but only those defined by 30 USC 1606 (a)(3).

Since silver has yet to be classified as a critical mineral by the US Geological Survey or Department of Energy, it is not applicable to the additional tax.

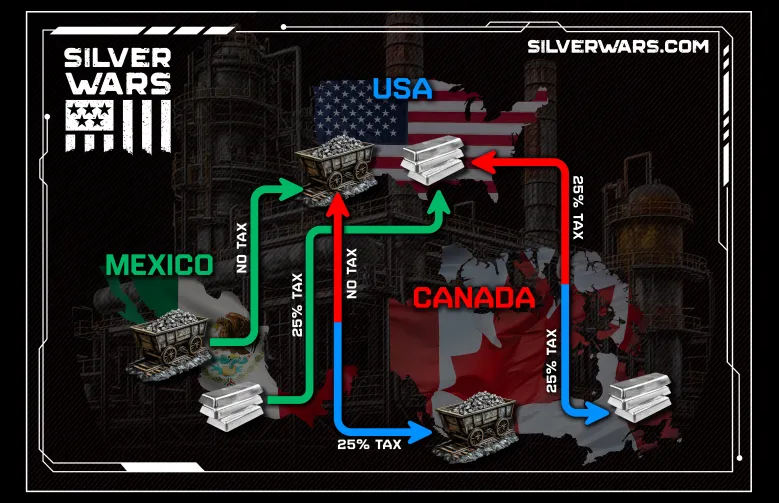

The language of the executive order provides that "products", or consumer-ready goods are subject to the 25% tax. This affects refined silver, such as coins and bars that are meant for the retail investor, or bars ready to be remade or purposed in manufacturing.

The US excludes silver in its raw, unrefined form (ore, concentrate, doré) from any tariffs.

Mexico has yet to announce any tariffs of its own against the US.

Canada's Prime Minister Trudeau responded over the weekend with Canada's own tariffs against the US. These tariffs do include a tax on US silver imported into Canada in both raw unrefined and ready-for-consumer forms. However, it is worth noting that the US does not supply Canada with its silver, but the other way around (17%), which the new tariff system so far hasn't impeded. The outcome only incentivizes silver to be shipped into the US unrefined to avoid the tariffs.

Commodities are only statistically counted once they are refined. This is no different for silver. A benefit of this trade arrangement would allow the US to control the refinement of silver more closely. If the military-industrial complex fears scarcity over price, this move may lead to less transparency, or more silver statistically not being properly accounted for due to national security.

These arrangements would only hurt the physical silver investor who appreciates sovereign coins from Mexico or Canada. These are consumer products that would be subject to the 25% tariff; raising their retail price may drive the investor towards American Silver Eagle coins, or other American minted silver instead to avoid the added premium.

Photo By SilverWars

Silver Tariffs Flowchart - Download

Steinbaum's Plan to Reshape Mexico's Economy with Silver

President Claudia Sheinbaum's first response to the new tariffs was that she had no concern.

"I am not worried because Mexico's economy is very strong, very solid, and that is thanks to the people of Mexico, the working people who work every day to move our country forward."

In 2024, Mexico ranked 12th largest economy in the world. It has surpassed both Australia's and Spain's economies since 2018. Mexico accounted for 776 billion dollars in trade with the US in 2024.

Among President Steinbaum's goals are improving Mexico's industrial landscape by focusing on advanced technologies, including semiconductors, drones, and clean energy solutions.

In 2024, Mexico's share of clean energy was 22.5% (80.0 TWh). By 2030, they project clean energies will increase their share to 37.8% (155.6 TWh). It's worth noting that every single TWh of solar power requires about 2.8 to 3.5 metric tons of silver.

Despite the Trump administration's distancing the US away from Green Energy, the rest of the world continues its transition. Mexico is no different. Its Green Energy plans will require it to massively tap its own resources of silver.

Mexico is rich in silver deposits and in 2024 accounted for over 25% of global production of silver and 44% of US demand per the USGS. It will be interesting to see if Mexico is able to produce enough silver for its needs while supplying the hunger of the US.

Trudeau's Heavy-Handed Response to Tariffs

Addressing a press conference on Saturday, Trudeau stressed that Canada's response will be "far-reaching".

"It'll include major consumer products like household appliances furniture and sports equipment and materials like lumber and Plastics along with much much more and as part of our response we are considering with the provinces and territories, several non-tariff measures including some relating to critical minerals energy procurement and other partnerships," Trudeau added.

He said that Canada has critical minerals, reliable and affordable energy, stable democratic institutions, shared values, and the natural resources the US needs, according to CPAC. He said that Canada has all the ingredients to build a "booming and secure partnership" for the North American economy.

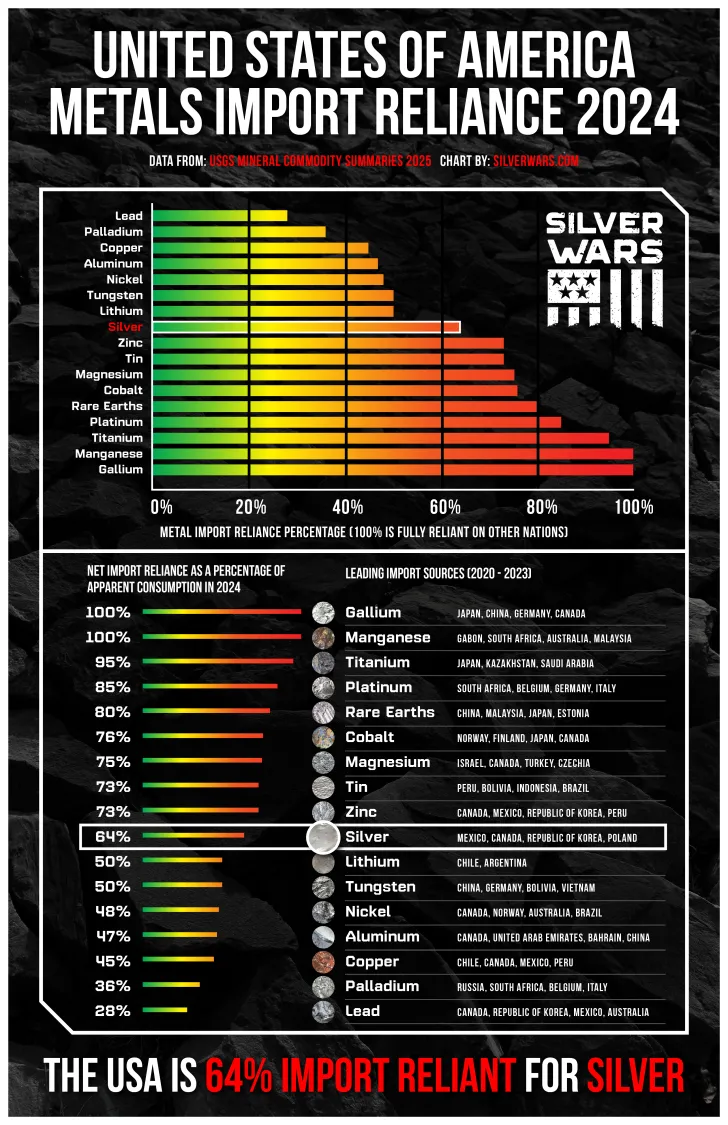

This rhetoric suggests that Canada understands the position it's in with control of energy and critical resources, but leverage here would not be gained from tariffs, but instead sanctions. Such a thing would severely cripple the Military Industrial Complex if Canada were to restrict the export of all forms of their silver to the US which accounts for 17% of US demand.

Photo By SilverWars

US Geological Survey 2024 - US Net Import Reliance Chart - Download

Could We See A Return to Mercantilism?

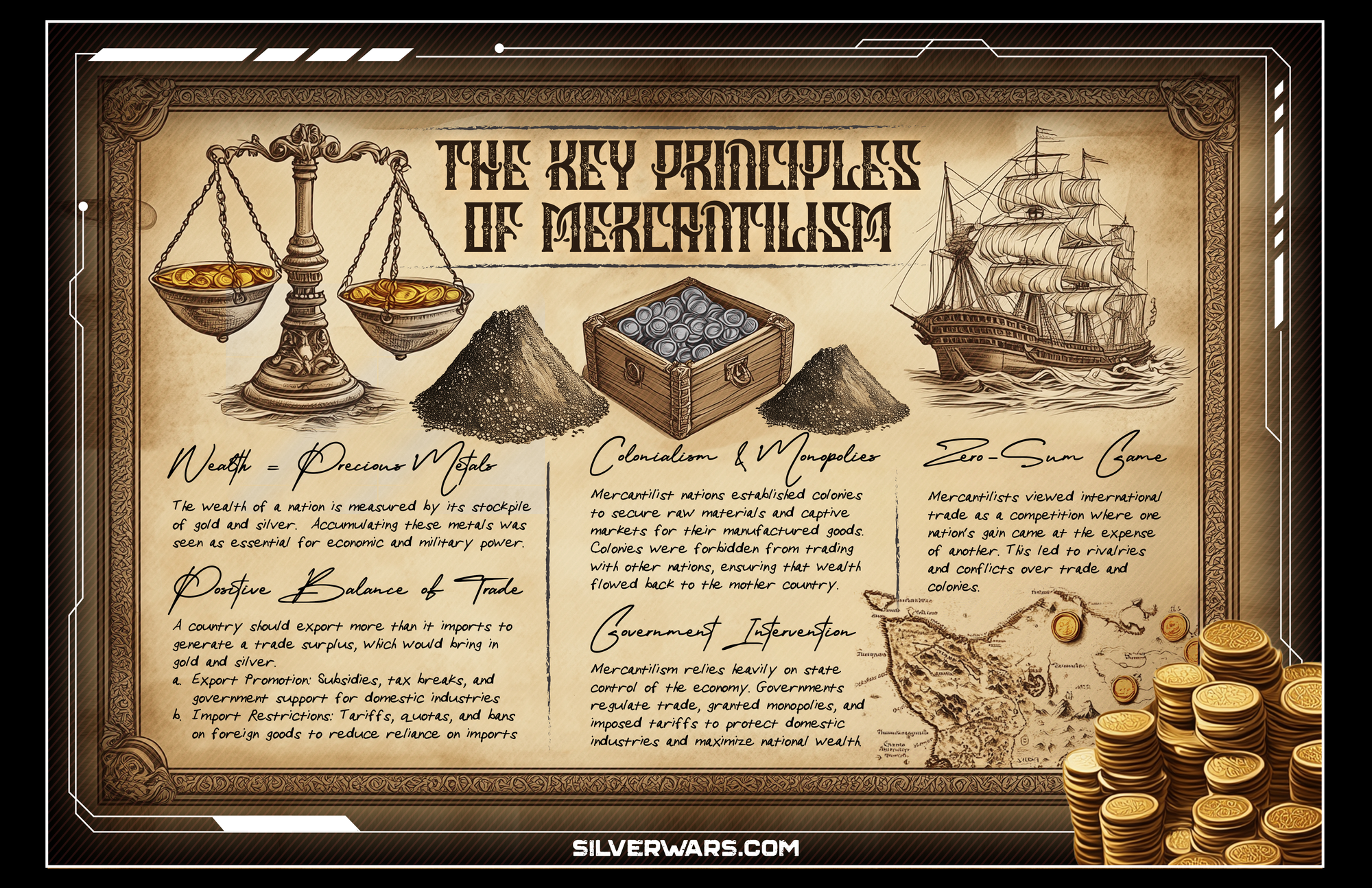

For centuries, most nation-states maintained high tariffs and many other restrictions on international trade through a belief in mercantilist trade theory.

At the core, Mercantilism is a trade theory that emphasizes the lessons:

"One Nation's Gain is Another's Loss" and "May the Victor Go the Spoils".

Gold and Silver, internationally accepted as money at the time, were used to measure a nation's wealth, which was seen as essential for economic and military power.

Photo By SilverWars

Key Principles of Mercantilism - Infographic Download

It was only around the 19th century, especially in Britain, that the belief in free trade became paramount. Since that time, this view has dominated the thinking among Western nations. In the years since WWII, multilateral treaties and organizations have attempted to create a globally regulated trade structure enforced through diplomatic pressure and international law.

Some nations support the regulation of international trade because of the risks inherent in the free trade ideal.

Free trade makes economic sense because the elimination of artificial costs and barriers lowers the cost of goods and services. However, comparative advantage would automatically flow to those producers with natural advantages (such as favorable climates for agriculture or national resources) or artificial advantages based on preexisting conditions (such as cheap--or even "slave"--labor or a well-developed industrial base).

While free trade theory may be economically sound, it has been also disruptive to markets, industries, and entire societies. Throughout history, unresolved trade disputes, perceptions of interstate exploitation, seizure of assets, or denial of access to markets or resources have caused wars.

There may not be a perfect system, but recent tariff actions by the new Trump administration and efforts by Central banks to stockpile gold may start to shape the world back toward a new form of Mercantilism.

Conclusion:

The recent tariff measures enacted by the Trump administration underscore a strategic pivot toward economic nationalism with far-reaching implications for global trade dynamics.

At its core, this moment signals a potential resurgence of mercantilist principles, where nations prioritize hoarding strategic resources and protecting domestic industries over collaborative free trade. The allure of economic self-sufficiency, however, carries inherent risks: trade wars, supply chain fragmentation, and the destabilization of long-standing alliances.

For investors, these policies may reshape the market, redirecting demand toward domestic silver products or mining stocks. Exchanges may also run into future trouble sourcing refined silver that meets their requirements if the tariffs move forward as silver-capable US refineries have a current backlog of 3 months.

As the world navigates this uncertain landscape, the tension between between nations remains high. Whether these measures foster security or spark broader conflict remains to be seen, but one truth endures: in an interconnected economy, the pursuit of national advantage often reverberates far beyond borders.

Sources:

Imposing Duties to Address the Flow of Illicit Drugs Across Our Northern Border – The White House

Trump’s trade war among allies triggers retaliation from Canada and Mexico

https://archive.md/20250131225138/https://www.bloomberg.com/news/articles/2025-01-31/traders-load-us-bound-planes-with-gold-and-silver-in-tariff-bet

https://pubs.usgs.gov/periodicals/mcs2025/mcs2025.pdf

Trump and leaders of Canada and Mexico say tariffs will be delayed one month after talks

Federal Register :: Request Access

The Federal Register The Daily Journal of the United States Government

A U.S.-Canada trade shock now in play: first economic takeaways - RBC Thought Leadership

Canada has been hit with its largest trade shock in nearly 100 years.