An interesting development in the COMEX silver exchange seems to reflect an accelerating silver squeeze.

The stage was set for a silver squeeze last April when significant amounts of metal moved from London to New York, driven by tariff worries. The displacement of metal, coupled with surging Indian demand, set off the first squeeze in October. That drove the silver price over $50 for the first time.

Metal flowed back to London, but that didn’t solve the underlying problem. While shuffling silver between London, New York, and India took the immediate pressure off the market, it didn’t magically create new silver, and it didn’t take long for silver squeeze 2.0 to develop last month. That briefly pushed the price over $80.

This squeeze isn’t manifesting just because metal is in the “wrong place.” The underlying issue is that there simply isn’t enough metal.

Silver demand has outstripped supply for four straight years, and the Silver Institute projects that 2025 will be the fifth. The structural market deficit came in at 148.9 million ounces in 2024. That drove the four-year market shortfall to 678 million ounces, the equivalent of 10 months of mining supply in 2024.

This shortage of metal seems to have created an unusual setup in COMEX futures, as investors appear to be moving March contracts backward to January and February.

Analysts came to this conclusion by examining the open interest data released by the COMEX.

Open interest represents the total number of outstanding contracts. In other words, these are contracts that have been created but not yet closed out or settled by delivery or cash settlement at expiration.

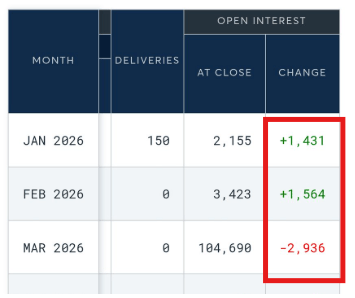

Examining the January 7 data, we find that open interest in the January 2026 contract rose by 1,431. Open Interest in the February 2026 contract also rose by 1,564 contracts. That brings the total open interest contracts for those months to 2,995.

Meanwhile, the March 2026 open interest fell at a nearly identical number – 2,936.

The best explanation for this surge in open interest for earlier contracts and the sudden drop in March open interest is that investors are rolling contracts backward. In other words, they are exchanging positions from a longer contract into earlier contracts that are closer to the expiration date.

Rolling contracts backward comes at a price. Investors have to pay the in and out costs, along with a backwardation premium. So, why would they do this?

Because they want to take delivery of the metal now, they don’t want to wait until March.

Keep in mind, there could be other reasons for this backwardation; however, this seems to be the most logical interpretation of the numbers.

Jon Lindau explained the situation in a report on SilverTrade.com.

“Typically, rolls are forward (to the next front month) in normal markets, as traders wish to maintain a position in silver (exposure to the silver price), without taking physical delivery of the metal. Backward rolling (moving the position from the front month March to nearer months, as seen here) indicates the exact opposite: backwardation along with immediate scarcity of physical silver metal as traders wish to take delivery instead of merely remaining exposed to the futures price of silver.”

Lindau said two scenarios could be driving backwardation.

“Longs positioning aggressively to stand for immediate delivery, which will further drain COMEX registered stocks and further exacerbate the silver shortage. Conversely, if shorts are involved in the roll, they might be attempting to avoid delivery demands in March by shifting earlier, but this would still be extremely dangerous for shorts amid tight supply and increasingly more contracts standing for delivery in January.”

Again, there could be other reasons for the recent shift in open interest. However, Occam's Razor teaches us that the simplest explanation is generally the best. It's at least the best place to start. It appears that the silver shortage has reached a level where those with long positions don't want to wait until March to take possession of physical metal.

As Lindau put it, if this is what's happening, the COMEX is in big trouble.