Gold and silver continue to push higher, curiously, at the same time as variables that normally trade in the opposite direction, namely government bonds and the US dollar, move upward in tandem.

The quandary leads AOTH to ask: who is buying the precious metals?

As of this writing, on April 12, spot gold was at $2,336 an ounce and spot silver was at $27.94. Gold is up 14% year to date and silver has gained even more, 18%, despite headwinds.

Source: Kitco

Source: Kitco

Source: Kitco

Source: Kitco

These include a strong US dollar, positive real yields (Treasury yields minus inflation above zero), investors selling their gold ETFs, and inflation coming down from 40-year highs. (gold buyers often purchase bullion as an inflation hedge)

Gold hit a new record-high $2,365.09 on Monday, April 8.

Meanwhile, the US 10-year Treasury yield is showing a year-to-date advance of 15% and the US dollar index DXY is up 3.7%.

Source: MarketWatch

Source: MarketWatch

Source: MarketWatch

Source: MarketWatch

Gold

The gold price started to kick higher in October when market sentiment began pricing in three quarter-point rate cuts in 2024. This was confirmed at the Fed’s December meeting, and made even more explicit at the March 19-20 meeting.

Demand is being driven by “momentum buying” by institutional investors, strong central bank buying, with developing nations in particular stocking up on bullion as insurance against having their foreign currency reserves frozen like happened to Russia after it invaded Ukraine; and geopolitical instability, with wars in Ukraine and Gaza still raging, and there’s China’s positioning on Taiwan causing stress. Commercial shipping in the Red Sea continues to come under attack from Houthi rebels.

3-year spot gold. Source: Goldprice.org

3-year spot gold. Source: Goldprice.org

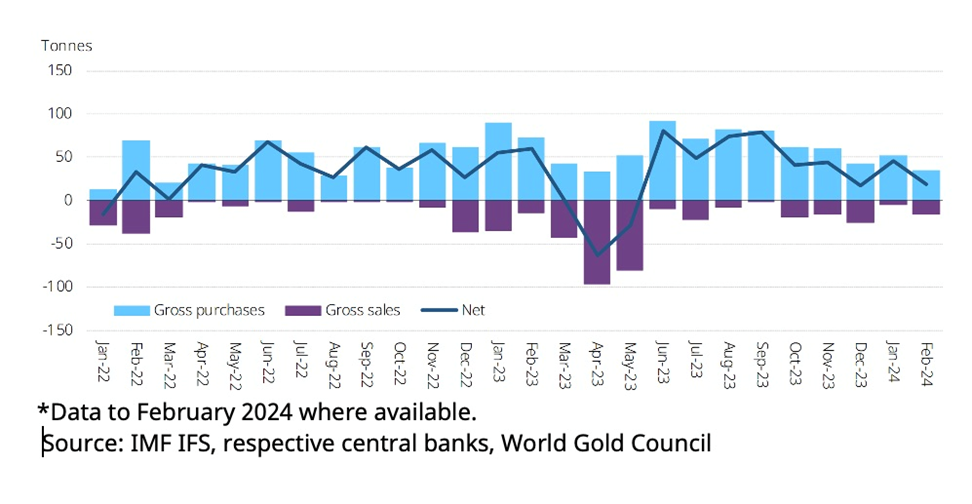

Central banks

A consensus seems to have emerged that the main gold buyers are central banks, which are snapping up gold even though prices are hitting record highs. Retail investors, especially those in the West, have up until now stayed out of the gold rally. We know this because there have been net outflows from gold ETFs, which are the main way retail participates in the gold market. If retail was involved, more money would be moving into gold ETFs than out.

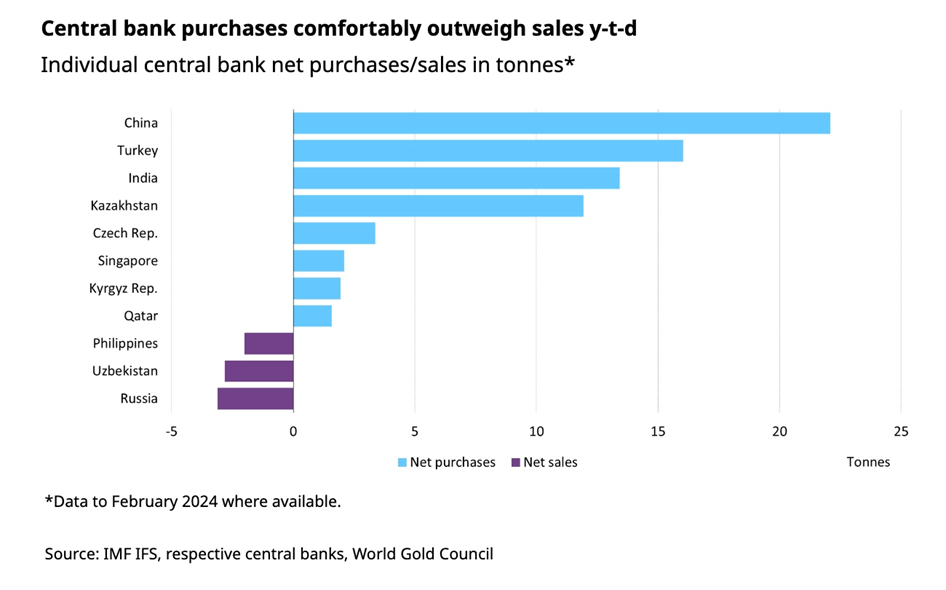

According to the World Gold Council, central bank gold reserves rose in February for the ninth straight month, by 19 tonnes. However, February’s net buying was 58% slower than January’s 45-tonne total.

The People’s Bank of China was the largest buyer, increasing its reserves by 12t to 2,257t. WGC notes that the PBC’s reserves have grown for 16 consecutive months. The available data shows there were only two notable sellers during the month — the central banks of Uzbekistan and Jordan.

Among the net buyers were Kazakhstan (+6 tonnes), India (+6t), Singapore (+2t), the Czech Republic (+2t), Qatar, (nearly 2t), and the Kyrgyz Republic (+1t).

Two observations. First, all of the gold-buying central banks are either part of the BRICS, (Brazil, Russia, India, China, South Africa), or are in Asia and the Middle East. You don’t see any central banks from North America or Western Europe buying gold.

This trend isn’t new, but it has accelerated.

SchiffGold points out that Russia, like China, is doubling its reserves of gold and foreign currencies on its de-dollarization path, further detaching Russia from the petrodollar empire as it reacts to wartime sanctions from the US and EU.

Earlier this month, it was reported the Chinese yuan has replaced the US dollar as the most traded currency in Russia.

US and European governments confiscated around $500 billion in Russian foreign exchange reserves following its invasion of Ukraine. Most Russian banks were also ejected from the SWIFT payment system. China has $3 trillion in forex reserves it wants to keep safe, so Beijing is diversifying out of dollars and into gold.

According to US data, Chinese dollar holdings have gradually fallen by a third since 2011, and now total around $800 billion. Other central banks are doing the same thing.

“That’s a huge trend… that is one big driver of the gold price,” said Chris Mancini, associate portfolio manager at the Gabelli Gold Fund, in an interview with CNBC.

“The other might be that individuals in China for example are seeing the faltering real estate market. That’s where they’ve held their savings, now they’re saying okay, real estate’s going down, what we want to do is diversify into something that’s a hard asset that we can store and hold for very long time.”

Our second observation is that central banks don’t seem to care when they buy gold. Unlike the retail crowd, they aren’t waiting for a dip in the gold price. SchiffGold suggests they are hedging their bets against a potential dollar collapse: if you expect the dollar to fail, as dominant fiat currencies historically have, then “the top” doesn’t matter.

China

We’ve already pointed out that China bought the most gold in February. In fact last year, the PBC scooped up more gold than all the other central banks — its 225 tonnes were about 25% of the total.

As Mancini mentions, it isn’t only Chinese banks that recognize gold’s allure. In China and India, the top two physical gold consumers, people buy gold jewelry (more so than in the West), give it away as gifts, or stuff it under their mattresses because they don’t trust the government or the banks.

DW reports Chinese consumers have been buying gold coins, bars and jewelry, after their real estate investments, the yuan currency and the country’s stock market dropped in value due to recent economic woes in the world’s second-largest economy.

“From the start of the year, we’ve seen enormous Chinese retail buying … record amounts of buying on the domestic Shanghai Gold Exchange,” John Reade, chief market strategist at the World Gold Council, told Bloomberg TV last month.

The Chinese are also piling into gold ETFs. On Monday Zero Hedge pointed out that for the second time this week, trading in an ETF that owns gold companies was halted:

China Asset Management Co. – who run the ChinaAMC CSI SH-SZ-HK Gold Industry Equity ETF – halted the investment vehicle “to protect investors’ interests” as the fund’s premium over its underlying assets increased to more than 30%…

As Bloomberg’s Eric Balchunas highlighted: “Investors [in China] are so desperate to buy things that are not linked to their own economy/stock mkt, which has been in the gutter.”

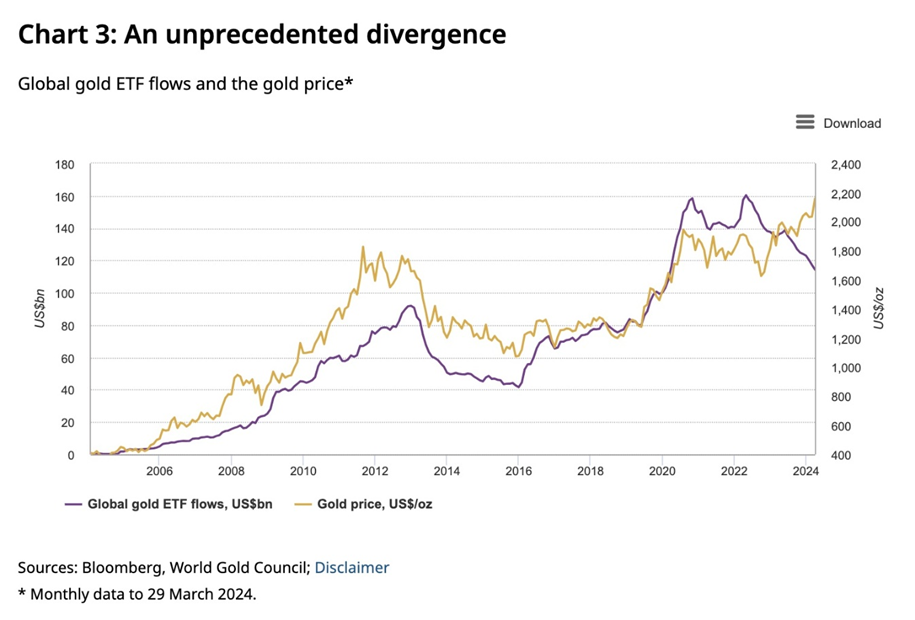

ETF outflows

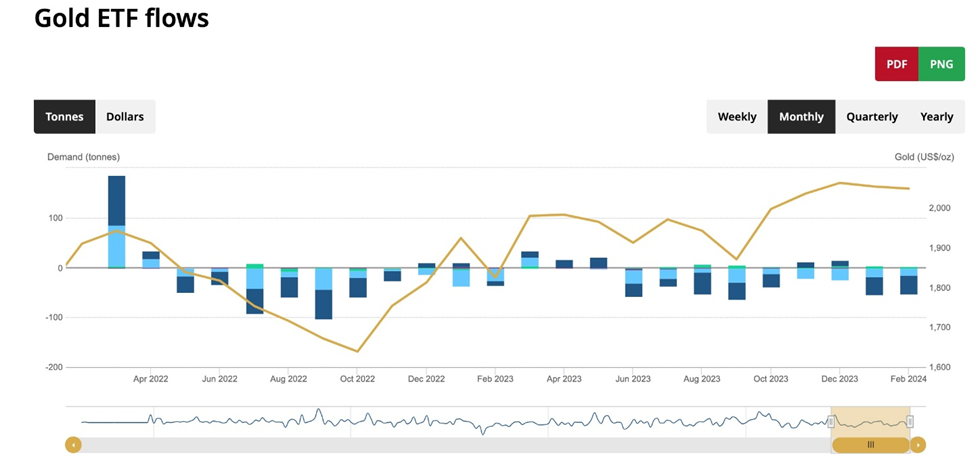

Gold’s breakout has occurred despite a strong dollar, high bond yields, and positive real interest rates. Gold is also going up notwithstanding outflows in gold ETFs.

Earlier this week, the World Gold Council reported outflows from gold-backed exchange-traded funds continued for a 10th straight month in March, though at a slower pace than in previous months.

For example, in February, the outflow was worth $2.9 billion, versus $823 million in March. Collectively though, ETF holdings fell by 14 tonnes by March 31, to 3,112 tonnes, the lowest since February 2020.

The investment vehicles have seen three consecutive years of outflows, declining 244.4 tonnes in 2023 amid high interest rates, WGC reported, via Reuters.

The Council points out “an unprecedented disconnect” has appeared between the gold price and gold ETF outflows, shown in the chart below.

Source: World Gold Council

Source: World Gold Council

Institutional investors/ the rich

While most agree that central bank buying is the main driver behind the current price surge, and ETFs are on the sidelines, there are indications of a shift over the past month.

The World Gold Council reported North American funds saw a turnaround in March, adding $360 million.

ABC news quoted Campbell Harvey, a professor at Duke’s Fuqua School of Business who studies commodity prices, saying that Hedge funds and other institutional investors have also bought into the gold craze in an effort to capitalize on the commodity’s blistering rise, Campbell said. “That institutional pressure is pushing the price of gold up,” he added.

One source (subscription required) outlined the top 10 hedge funds holding gold by largest position size, out of a total 702 hedge funds holding the precious metal.

At least one respected gold analyst says there is a new demand source emerging, and it’s not institutional or retail investors.

Rather, we suspect it is wealthy families and institutions, primarily in the Middle East and Asia but also in Europe, looking for an insurance asset to protect against financial instability, writes Adrian Day.

One indication this might be true, and pertaining specifically to North Americans, is the amount of gold being sold at Costco.

Wells Fargo estimates that Costco is now selling up to $200 million a month in gold bars, after offering them for the first time last year.

Silver

As mentioned silver is up 18% so far this year, a major development in a metal market that has traded sideways for the past three years. (Silver jumped in 2020 along with gold, on account of the pandemic.)

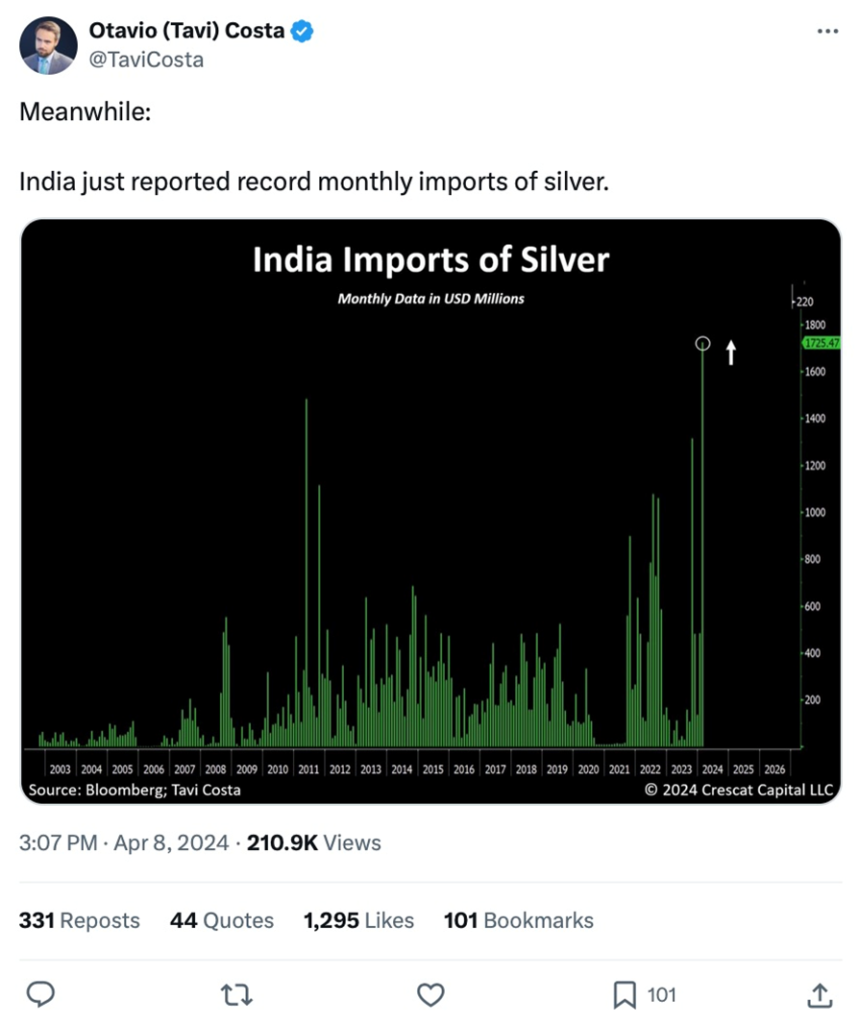

Who’s buying all the silver? The first answer is India, and the second is silver-backed ETFs.

India in February purchased a whack of silver bullion, with silver imports surging 260%. The country bought 2,295 tonnes compared to just 637t in January — a new monthly record.

Source: X

Source: X

Putting that into perspective, it’s about 70 million ounces, more silver than the US Mint produced in American Silver Eagle coins over the past three years combined.

Two reasons are given for the purchase, one factual, the other speculative. Indian buyers bought 939 tons from the UAE in an apparent move to benefit from a lower duty.

SD Bullion reports the silver will likely be used for lithium-ion battery production in a new Indian gigafactory. Again, this is speculation, so we may as well do the same. India is among the locations Tesla is scouting for a new electric vehicle plant worth up to $3 billion, CNBC reported earlier this month.

As most investors know, silver is both a monetary metal, like gold, and an industrial metal. It is increasingly used in renewable energy applications, along with electric vehicles and dozens of other uses.

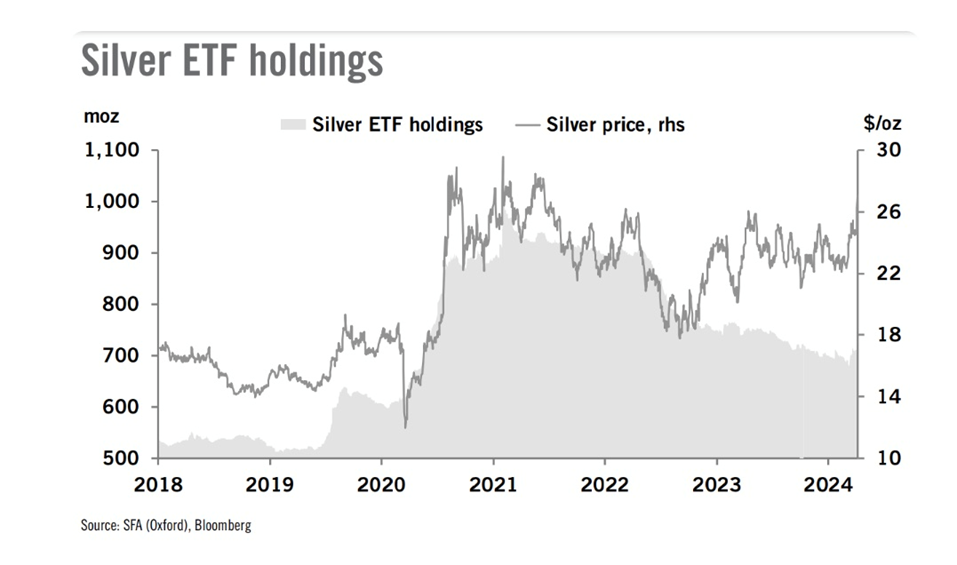

Kitco reported on April 8 that silver appears to be benefiting from both investment and industrial demand, and that silver is following copper, also an industrial metal, higher due to a tight copper market. Many investors are choosing to ride silver in an ETF investment vehicle. Kitco quoted precious metals analysts at Heraeus saying,

“Silver is a higher beta commodity than gold, so if retail investors show more interest as ETF holdings rise then it could outperform gold,” they noted. “Additionally, and in contrast to the gold market, silver investors re-entered the market for ETFs, with 10.7 moz of inflows in the last fortnight, taking total silver ETF holdings 3% higher year-to-date at 724 moz.”

The analysts said that industrial demand for silver is also expected to rise this year, based on “recent strong manufacturing data from the US and China” in addition to burgeoning Chinese solar installations.

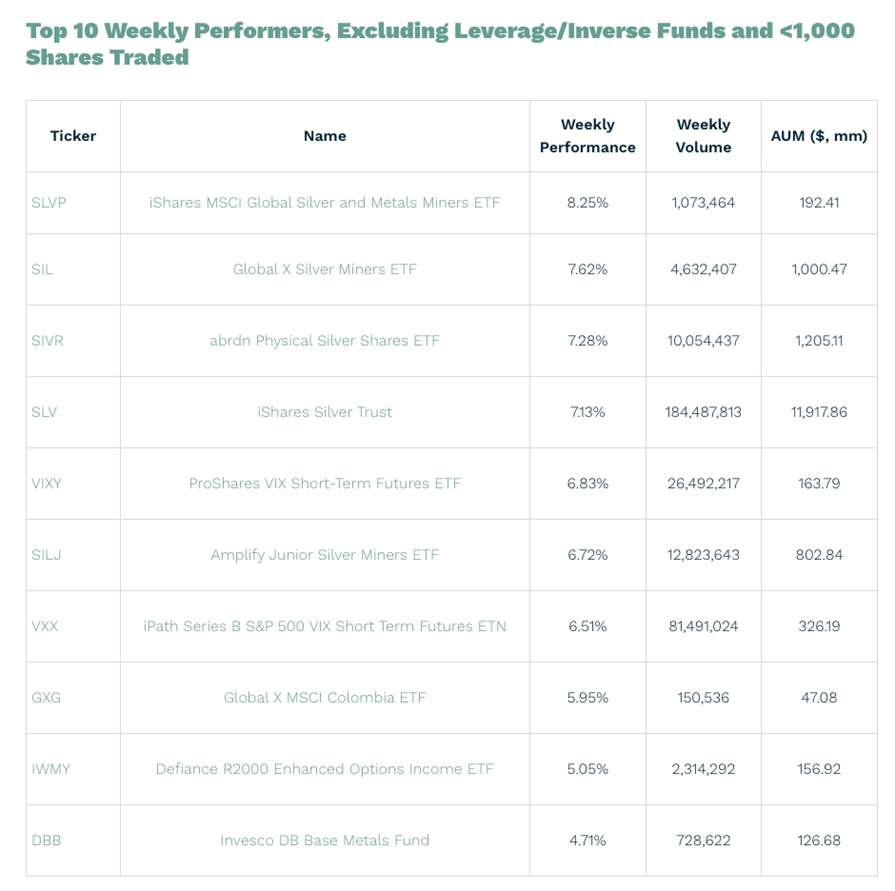

Silver and silver-mining ETFs were last week’s top performing exchange-traded funds, according to etf.com.

Source: etf.com

Source: etf.com

Conclusion

The news is all good for gold and silver. We still have high interest rates — with expectations of a Fed rate cut now pushing out to September from June — a strong dollar, bond yields approaching 5%, and negative real interest rates, and yet gold is up 14% YTD and silver is up 18%.

What gives?

Part of the answer lies in central bank gold buying, which hit a record in 2022, nearly matched it last year, and remains robust so far in 2024. BRICS nations like China and Russia, who are pursuing a de-dollarization agenda, see a need to dump dollars and instead invest in hard assets like gold that cannot be easily confiscated by Western nations.

There is likely some truth in the notion that wealthy individuals are buying gold for the first time or bulking up their stashes of physical metal. Particularly in China, where gold has been popular for hundreds of years, citizens see it as a good alternative to real estate and a safe haven that isn’t affected by the economy.

The fact that ETFs, especially those held by Westerners, have remained on the sidelines of the gathering bull market, is actually good news.

If ETF investors pile in with central banks and other institutional investors, gold and gold stocks could see an explosive move up.

Consider: the gold and equity markets have a total market capitalization of about half a trillion dollars, compared to Microsoft’s market cap of over $3 trillion. Only a small shift in assets, into gold stocks from some of the resource sector’s market leaders, could see the stocks move considerably higher.