China Plans, USA Reacts

While the United States is preoccupied with distractions—be it the latest Netflix fight, celebrity gossip, or political squabbles—China is methodically executing a long-term strategy to bolster its gold reserves. This deliberate approach is evident in several key initiatives: the establishment of the Shanghai Gold Exchange (SGE) in 2002 to facilitate gold trade, restrictions on domestic gold production exports, and a focus on importing gold and dore from abroad. The SGE's premium on gold has driven significant market activity, resulting in a 30% increase in spot prices by 2024 as demand flows eastward.

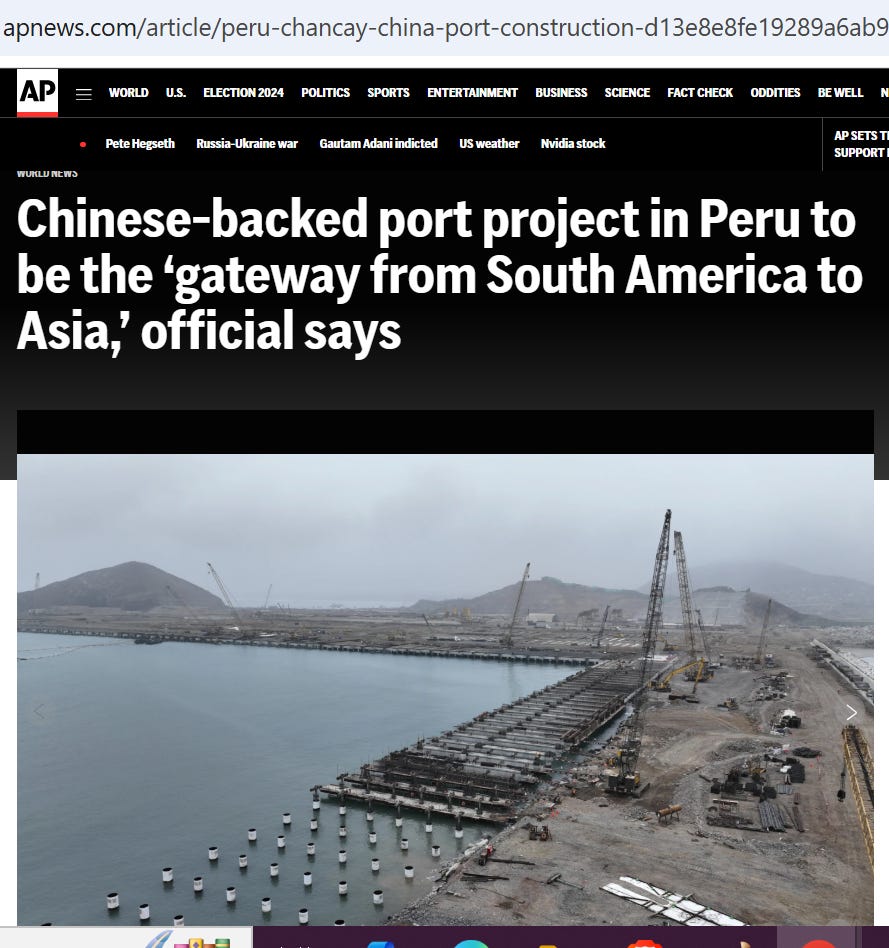

Moreover, China's insatiable appetite for silver is leading to a similar strategy. With domestic supply unable to meet demand, China maintains high premiums to attract above-ground silver stocks while also investing in mining infrastructure abroad. This includes developing ports in Peru and establishing local currency trade settlements to streamline transactions. The upward pressure on silver prices is likely to continue as China quietly accumulates resources without alarming Western powers.

As investors, it is crucial to recognize these trends and understand that while the U.S. remains distracted, China is positioning itself strategically in the global commodities market. Ignoring these developments could mean missing out on significant investment opportunities.

In a stunning display of financial acumen, China has executed a move that could reshape the global economic landscape. By issuing $2 billion in USD-denominated sovereign bonds in Saudi Arabia, Beijing has demonstrated its ability to challenge the US dollar's supremacy with surgical precision.

This seemingly innocuous bond issuance is, in fact, a brilliant strategic maneuver. The overwhelming demand for these bonds, coupled with interest rates nearly identical to US Treasuries, signals China's emergence as a formidable player in the global dollar market.

By choosing Saudi Arabia as the venue, China has struck at the heart of the petrodollar system, offering an alternative to US Treasury bonds right in America's backyard. - Jon Forrest Little

The genius of this strategy lies in its potential for scalability. Should China decide to issue bonds in the hundreds of billions, it could effectively create a parallel dollar system, redirecting the flow of global capital away from the US.

This would not only compete with US Treasury bonds but could also starve the US government of crucial financing, potentially ending America's "exorbitant privilege"

But the true masterstroke is how China plans to utilize these dollars. Through its Belt and Road Initiative, China could offer to pay off the dollar-denominated debts of partner countries, in exchange for repayment in yuan or strategic resources.

This triple win allows China to offload excess dollars, help nations escape dollar dependency, and deepen economic ties with a vast network of countries.

The beauty of this strategy is its elegant simplicity. It costs China virtually nothing to implement, yet it forces the US into an impossible position. Any attempt by the US to counteract this move - be it through sanctions, interest rate hikes, or restricting dollar transactions - would only accelerate the dollar's decline as the global reserve currency.

This is economic warfare at its finest - a Tai Chi move that uses the opponent's strength against them. China has demonstrated that it can redirect the dollar's power to its own advantage, all while giving the US little recourse without self-harm.

While this may currently be a warning shot to the incoming US administration, it showcases China's ability to fundamentally alter the global financial system. The US now faces a formidable opponent capable of challenging its economic hegemony not through brute force, but through strategic finesse.

In this high-stakes game of economic chess, China has made a move that could lead to checkmate. The US must now contemplate a future where its financial dominance is no longer assured, all because of a seemingly innocuous bond issuance in Saudi Arabia. This is the dawn of a new era in global finance, and China has positioned itself masterfully at its forefront.

China's Strategic Silver Acquisition: Direct Purchases from Peru and Record Imports to Fuel Industrial Growth

China's Strategic Silver Acquisition: Direct Purchases from Peru and Record Imports to Fuel Industrial Growth

China is strategically purchasing silver directly from countries it invests in, like Peru, where it recently opened a $1.3 billion port.

Chinese smelters are buying silver concentrate from Mexico, Peru, and Bolivia at above-spot prices, bypassing traditional trading platforms.

In 2023, China imported 1,613,790 metric tonnes of silver ore and concentrates, with Peru being the largest supplier. Remember this doesn’t translate into 999 pure silver (this is the concentrate which would still need to be refined)

This aggressive acquisition strategy aims to secure silver for China's growing industrial needs, including solar panels, silver-zinc batteries, silver-plating, and electric vehicles.