Summary: Crypto market Cap is over 100 times larger than ALL SILVER MINERS COMBINED.

- Silver entering 5th year of supply deficit

- No new silver deposits

- Silver essential for 20,000 applications because of its unique properties (ductility, malleability, anti-corrosion, #1 conductor, thermal properties, Antimicrobial, reflectivity)

- Crypto has never been through a recession

- Crypto can be wiped out by electromagnetic pulse, or hacked, seized, frozen

- All computing has built in obsolescence

- Quantum computing may compromise blockchain security

- Crypto is not decentralized

- Crypto is not private

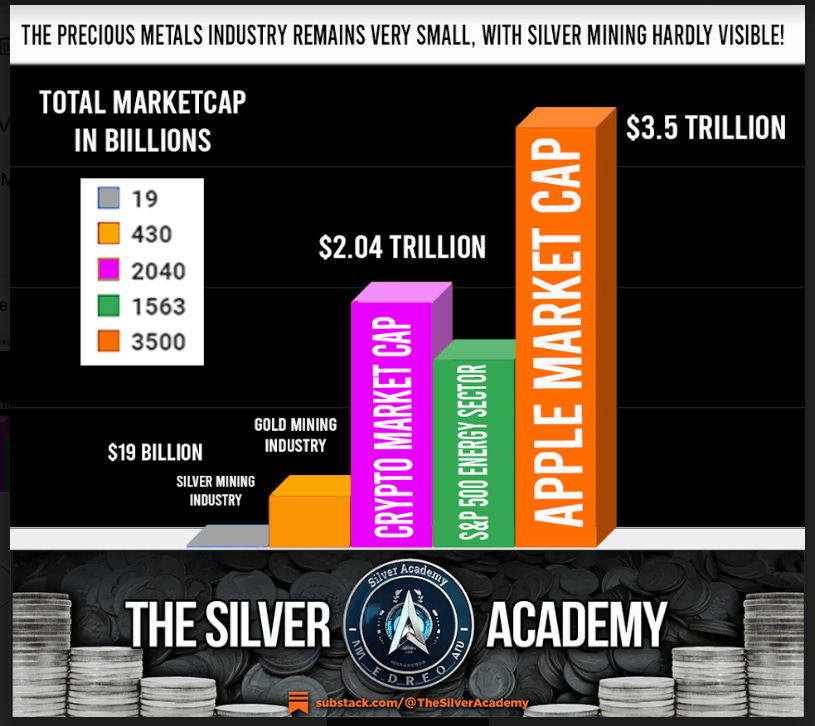

In the modern financial landscape, a curious phenomenon has emerged: cryptocurrency, a digital behemoth, has overshadowed the humble yet crucial silver market. With a staggering market cap of $2.04 trillion, crypto towers over the silver mining sector like a skyscraper next to a garden shed. To put this into perspective, if crypto were a greyhound bus, silver mining would be a mere hummingbird fluttering alongside.

This monumental disparity comes at a critical juncture for silver. As we enter the fifth consecutive year of supply deficit, with no new major discoveries on the horizon, silver's importance in emerging technologies cannot be overstated. It's the lifeblood of our electrified future, essential for solar panels, electric vehicles, and a myriad of applications in robotics, AI, and aerospace.

Yet, investors seem mesmerized by the siren song of cryptocurrency, pouring funds into a market that, like a house of cards, could collapse at any moment. Crypto has never weathered a recession, remains vulnerable to cyber attacks, and could be wiped out by a single electromagnetic pulse. It's as if we're betting our future on a digital mirage while neglecting the tangible, irreplaceable value of silver.

The irony is palpable. We're investing in a technology that consumes vast amounts of energy, often derived from fossil fuels, while simultaneously underinvesting in a metal crucial for sustainable energy solutions. It's like abandoning a life raft to climb aboard a flashy yacht with a leaky hull.

Moreover, the vulnerabilities of crypto are glaring. Governments can seize assets at will, hackers can breach the blockchain, and quantum computing looms as an existential threat. In contrast, silver sits quietly in vaults, impervious to digital threats, its value enshrined in millennia of human history and its future secured by its indispensable role in technology.

As we stand at this crossroads, it's crucial to recalibrate our investment priorities. The magnitude of crypto's market cap compared to silver mining is not just a statistic; it's a wake-up call. We must ask ourselves: are we sacrificing our technological future at the altar of digital speculation?

In conclusion, while crypto may seem like the get-rich quick ticket of our times, we must not lose sight of the silver lining – quite literally.

The underinvestment in silver mining could lead to severe supply shortages, potentially crippling industries vital for our sustainable future. It's time to shine a light on this overlooked metal and ensure that our investment strategies align with the real, tangible needs of our evolving world.