If you’re anything like me, reading about how much the Fed and other central bankers are grossly diluting their currency baffles you, angers you, and maybe even offends you. It’s maddening—and yet that’s the world we live in at this point in history.

But there is a way to protect ourselves. In fact, it is imperative in my opinion that one implement this solution. I don’t like saying I can prove it, but the evidence here is very clear. See what you think…

Fiat = Free-For-All

At the Fed’s open market committee (FOMC) meeting last week, they confirmed, among other things, that they will continue the latest pace of quantitative easing.

What got me is just how much QE they plan to do. The Fed has already conjured up nearly $3.5 trillion this year, with almost all first-world countries doing something similar. When QE was created in 2008 it was supposed to be a temporary measure. Now it’s business as usual, one of their primary tools.

As their own statements says, the Fed will…

- “Continue to increase the System Open Market Account (SOMA) holdings of Treasury securities and agency mortgage-backed securities (MBS) at the current pace.”

How much?

- “Consistent with this directive, the Desk plans to continue to increase SOMA holdings of Treasury securities by approximately $80 billion per month … Similarly, the Desk plans to continue to increase SOMA holdings of agency MBS by approximately $40 billion per month.”

My calculator says that $80 billion + $40 billion = $120 billion. PER MONTH.

To put that amount into perspective, last week cloud data warehousing firm Snowflake debuted as the largest software IPO ever, ending its first day of trading valued at a whopping $70 billion. The Fed will create in currency nearly two Snowflakes every month.

That’s a lot of currency. If you live to 95 you will have been alive for three billion seconds. The Fed is creating 40 times more currency than that every month.

It takes only a rudimentary understanding of economics to know that the more you create of something, the less valuable it is. This is why fiat currency is ultimately a faulty system. Sooner or later central bankers and politicians can’t resist the temptation to solve their problems by creating more currency units. It eventually becomes, as we’re witnessing right now, a literal free-for-all.

This fact stands in stark contrast to real money…

Currency Creation vs. Gold & Silver Production

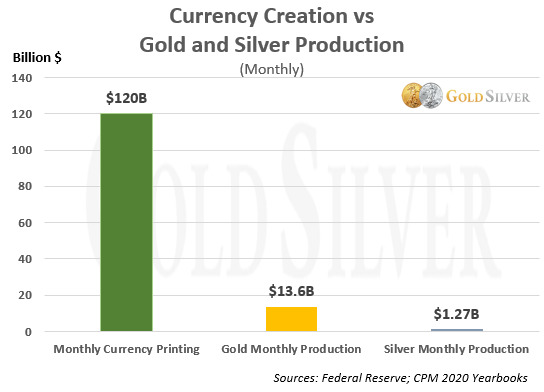

How does the Fed’s monthly currency creation of $120 billion compare to the value of monthly gold and silver production?

The gold mining industry produced 90.9 million ounces globally last year (the latest data available). On a monthly basis this is 7.575 million ounces. Gold’s average price so far this year is about $1,800, which puts the monthly value of production at $13.6 billion.

Silver mining output last year was 760.1 million ounces, or 63.34 million ounces per month. At a $20 silver price, which is slightly above its YTD average, the monthly value is $1.27 billion.

Here’s what that looks like.

The Fed is creating almost nine times more currency than gold, and nearly 95 times more currency than silver, than what the entire world produces.

And this excludes the currency other central banks around the world are creating. If we added in their amounts—or just compared the Fed’s efforts to gold production in the US—the chart wouldn’t have sufficient room to display the values for gold and silver.

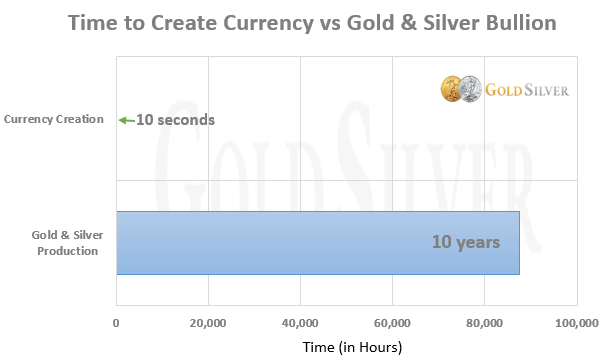

But it isn’t just value. It’s also the time and effort that goes into producing real money. The Fed and most central bankers create most of their new currency with a computer and mouse—point, click and voila!

But producing real money—gold and silver—takes a full decade, from exploration and discovery to development and production and distribution.

Most currency today isn’t printed. It’s basically “imagined” by a central bank, with the new digital dollars then credited to banks and other entities. Easy peasy.

How valuable is something that can be created in literally seconds? This is one reason a gold standard can work; creating new “money” takes real work and lots of time to bring it to market, which forces discipline on politicians (which is why they’ll fight it if it’s ever introduced).

But here’s the kicker to all this…

Today’s Paycheck Will Never Buy You More Than Now

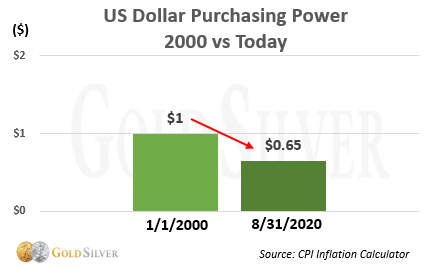

It’s a sobering thought to realize that the dollar you earned today will never afford you more than it will right now. It will only lose more and more purchasing power as you move forward in life.

Here’s how much buying power the dollar you earned in 2000 has lost (through August).

The dollars you were paid in 2000 will now only buy you 65¢ worth of goods and services.

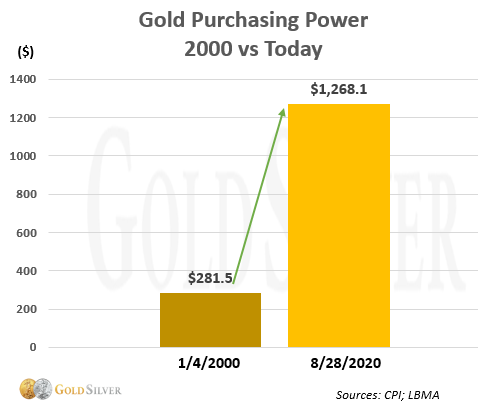

Gold and silver, on the other hand, are long-term stores of value. They maintain purchasing power—and over the past 20 years have increased one’s buying power.

After adjusting for inflation, the ounce of gold that sold for $281 in 2000 will now buy you over $1,200 worth of goods and services. That’s a 350% increase in buying power (before taxes).

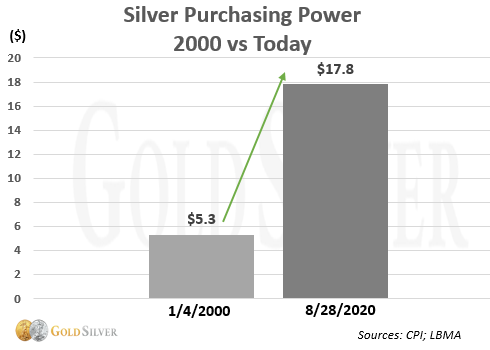

Silver has improved one’s buying power as well, despite not having risen as much as gold during this time period.

After adjusting for inflation, silver’s purchasing power has grown 235% over the past 20 years. All while the dollar has lost 35%.

Given that silver has historically always outperformed gold in bull markets, it would be entirely unsurprising if its purchasing power exceeded that of gold’s over the next few years.

If your savings is denominated in cash, you have a serious long-term leak in your boat. But if your savings is denominated in real money, gold and silver, you’re not only preserving your buying power but growing it.

Keep accumulating, my friends, because the trend shown by these charts is only going to pick up steam.

Which means our buying power will go through the roof over the coming years.

(Follow Jeff on Twitter @TheGoldAdvisor)