STORY AT A GLANCE:

Dr. Silver says regular silver and gold purchases will diminish vulnerability to fiscal and monetary craziness. That craziness is increasing, so we need the insurance provided by silver and gold.

Breaking News:

• Gold prices rose $3.60 to $1,843 for the week ending December 11, 2020.

• Silver prices fell $0.17 to $24.04 for the week.

• The DOW and S&P500 Indexes reached all-time highs... again.

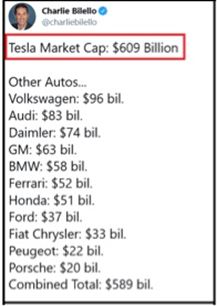

• Tesla stock exceeded $650, up from $70 one year ago. The bubble inflated further.

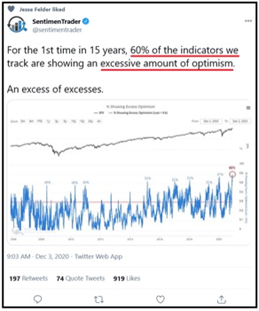

• The global crazy index reached a new high. Sorry, no hard data is available to prove this statement.

• Politicians spoke on many topics and said little.

• As in past presidential elections, the political party that "fudged" better (when necessary) won first rights to suck up government currency units at the public trough. Counting votes is far more important than actual voting.

Global Craziness:

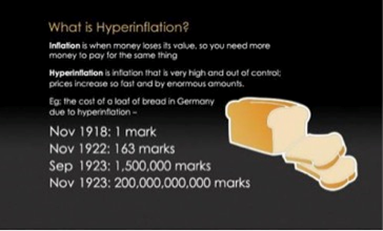

Negative "yielding" bonds exceeded $18 trillion. Portuguese and Spanish ten-year bonds "yield" less than zero percent interest for ten years.

Central banks have created over $28 trillion in currency units. As central banks create currency units, global billionaires become wealthier. The poor and middle classes... well, never mind.

The official U.S. DEFICIT for 2020 exceeded $3.2 trillion, or over ten times the value of gold supposedly stored in Fort Knox. Gold is underpriced.

Official U.S. national debt exceeds $27.4 trillion, up $22 trillion since 2000. We can't borrow our way to prosperity.

News headlines confirm craziness is widespread and deep.

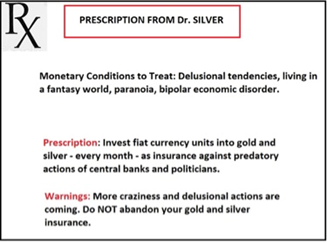

If the U.S. economy were a person, a psychiatrist might diagnose delusional tendencies, living in a fantasy world, paranoia, and bipolar economic disorder. The delusions are increasing and becoming more dangerous.

Dr. Silver's Prescription for economic sanity:

• Buy silver. Buy gold. Save with honest money.

• Trust honest money that can't be created by central bankers or politicians.

• Demand the rule-of-law.

• Demand personal accountability in government and central banking.

Buying silver and buying gold sounds simple. However, examine the following charts of silver and gold after the 1980 bubbles. The charts show that prices languish for years and then zoom higher. Huge gains occur in a few years, followed by a crash, followed by years of minimal price changes.

SCARY!

The prescription to succeed during erratic price action is:

a) Take a long-term view. Money supply, debt, and monetary madness increase every year.

b) The dollar devalues. Yes, devaluation occurs every year, so prices for silver and gold rise, on average, punctuated by short-term booms and busts.

c) Erratic Prices: Expect erratic price action to increase because national debt and government spending will rise to even crazier levels, regardless of who serves as President.

d) Make monthly purchases: Average purchase prices over time and don't trade core holdings. Expand your stack of silver and gold every month.

e) Ignore short-term price volatility: Worries about short-term price changes distract from the long-term goal of protecting savings and retirement from the predations of central banks and politicians.

SILVER INVESTING TACTICS:

1) Dollar cost averaging. Invest a fixed dollar amount every month in silver or gold. Example: $100 per month.

2) Weighted dollar cost averaging: Invest a fixed dollar amount every month when the RSI (relative strength index-monthly) is neutral (40 to 60). Invest half as much when the RSI is high (over 60), and one and one-half times your fixed dollar amount when the RSI is low (under 40).

3) Gold to silver ratio investing: Invest a fixed dollar amount every month into silver when the ratio is high - gold/silver more than 50. Invest a fixed dollar amount into gold when the ratio is low-less than 50.

4) Constant Ounce Purchases: Purchase a fixed number of ounces of silver or gold every month. Because prices rise, the cost of monthly investments increases.

5) Any plan that works for you and progresses toward your goal of financial security.

What Could Go Wrong?

1) Like a New-Year's resolution, we lose interest in purchases.

2) It's more fun to buy Tesla stock and get rich quick. (Works until it doesn't...) Trading is exciting and more profitable if you are one of the rare individuals who is consistently successful at trading.

3) The anti-gold propaganda is overwhelming, and you believe fiat dollars, backed by nothing, are somehow superior to real money-gold and silver. Those who become wealthy via "fake-money" will encourage fake money investments, and promote the propaganda, not gold and silver. Be wary.

4) Monthly investing in gold and silver is boring. People like the action and chaos of stock market investing. However, few people, outside of Wall Street, succeed in the world of "fake money" and fast action.

5) It takes time to realize that boring can be good.

SHOW ME THE RESULTS:

Option One: Dollar cost averaging over the long-term buys more ounces of silver or gold when prices are low. Commit to the plan for several decades. Over three to five decades, your silver value (at today's prices) exceeds three times the total invested, assuming 10% in fees. The return is slightly less over the past two decades.

Option Two: Fixed ounce investing buys a set number of ounces every month (week, quarter, whatever). For example, buy one roll of silver eagles (20 coins) every month. In 21 years, you will have 5,000 ounces of silver worth about $150,000 today and $500,000 in a few years.

Variations: Buy more when prices are low as measured by the RSI. Buy less when prices are high. This slightly increases the number of ounces you own. Success comes from consistent purchases over a long time, not by optimizing purchase prices.

Buy gold OR silver every month, depending on whether the ratio is high or low. This will slightly improve your investment results.

The primary determinant for success is consistent purchases. Parallel example: the best exercise machine is the one you use, not the one that has the fanciest electronics.

CONCLUSIONS:

• Read the headlines. Debt and QE4ever "printing" must increase because politicians spend too much using their fiat money scam.

• More debt will not solve our excessive debt problem. But it will devalue the dollar and boost prices for hard money - gold and silver. Silver sold for under $5 from 1995 to 2003. It is five times higher today and will be five times higher again in a few years.

• It is possible to time the market and trade your way to wealth, but few succeed. Embrace the easier solution-convert fiat dollars (fake money) every month into real money-gold and silver. Be patient while politicians force prices higher.

• Craziness will increase. The prescription for fiscal and monetary craziness says we should take the long view, expect dollar devaluation, and make consistent purchases of real money-gold and silver.

• Patience and consistent purchases will produce financial security.

• The best method is the one you use consistently.

• Gold and silver are insurance against fiscal and monetary craziness. Protect your savings!

Miles Franklin will convert your fiat dollars (debts of the Federal Reserve) into real money-gold and silver. Consistent purchases will help you sleep.

Gary Christenson