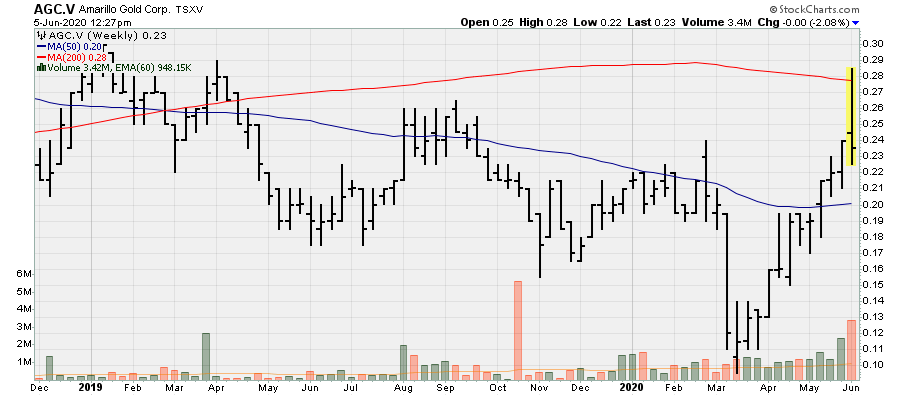

Amarillo Gold: Reported a positive feasibility study (FS) on its Posse Gold project in Brazil. It will have an initial mine life of 10yrs at low operating and all-in sustaining costs (AISC) of $738/oz. The FS supports open-pit mining and a CIL operation, highlighted by the fact it is of relatively low capital intensity and will generate robust returns, especially at gold prices in excess of $1,600/oz. Average annual gold production is projected to be 84k oz. Au, with 102k oz. Au annually over the first four years. Using a $1,400/oz. gold price, the after-tax NPV5% and IRR is $183m and 25%. The project is highly leveraged to the gold price as the NPV5% and IRR essentially doubles at $1,730/oz. Au to $360m and 50%. Initial capital costs are reasonable at $145m. Amarillo will look to advance the project quickly, with one remaining license [expected in Q3], which will be followed by construction financing with a target to begin building the project in April 2021. Once a financing package is obtained or once the projects is built, this could be a takeover target for large junior producers or smaller mid-tier producers.

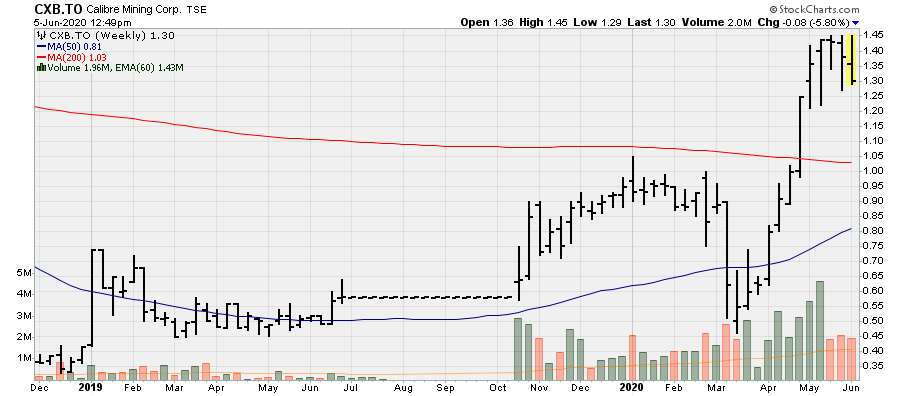

Calibre Mining: Announced a Maiden Mineral Resource Estimate at Panteon Deposit. While small, this is a good first step as the company will incorporate the high-grade deposit into the mine plan and begin sourcing some of this high-grade ore before year end. The MRE has an indicated resource of 29k oz. Au @ 9.88 g/t Au and 66k oz. @ 6.8 g/t Au Inferred. Mineralization continues along strike and down plunge. Further drilling will be undertaken for resource expansion as exploration commence before the end of Q2. Access to the deposit was provided by a shaft which currently provides ventilation for the Santa Pancha underground mine. In anticipation of positive exploration results in Q1, the company began development towards Panteon from existing Santa Pancha infrastructure, completing 125m of horizontal development.

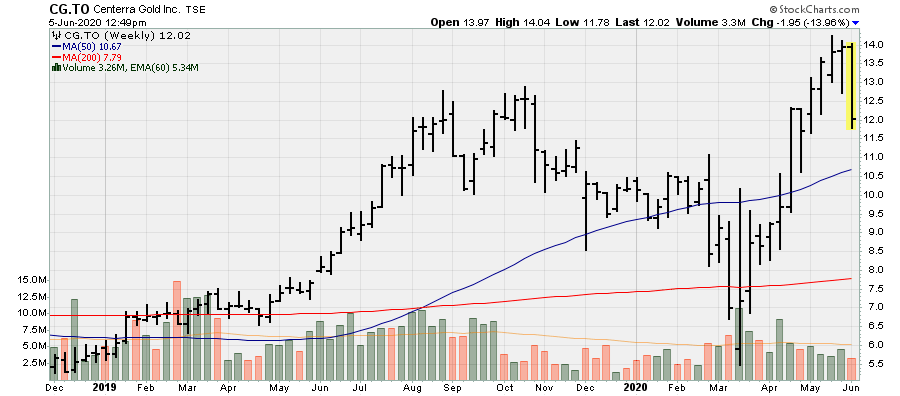

Centerra Gold: The company has had a year with both good and bad news. Earlier in the year, a new mine plan for Mt. Milligan was published, which saw the mine life essentially cut in half as well as lower average annual gold production. This isn’t to say the company won’t be able to extend the mine life with successful exploration or increase output, should it be able to improve recovery rates. On June 2nd, Centerra announced commercial production at Oskut, giving the company three producing mines. While Oskut will be its smallest mine in terms of average output [110k oz. Au p.a.], it will still generate material cash flow as it has an attractive cost structure with LOM AISC of $500-$560/oz. and $750-$800/oz. for 2020.

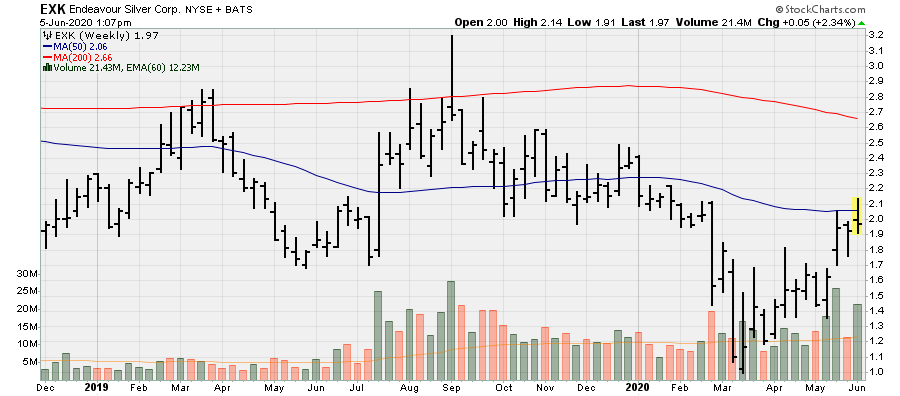

Endeavour Silver: After a flurry of bad news over recent months, the company released promising exploration drill results. Endeavour intersected new high-grade gold-silver mineralization in the Santa Cruz vein on the El Curso property at the Guanacevi in Durango. A total of 18 holes were drilled, 12 of which hit high grades over mineable widths. Select highlights from the 12 core holes include the following:

- 10m @ 1,085 g/t Ag and 3.25 g/t Au

- 5.1m @ 762 g/t Ag and 1.87 g/t Au

- 4.8m @ 986 g/t Ag and 1.43 g/t Au

- 5.7m @ 421 g/t Ag and 1.23 g/t Au

- 3.6m @ 614 g/t Ag and 3.15 g/t Au

Great Bear Resources: The company closed its previously announced bought deal financing, raising gross proceeds of C$33m. Due to its relatively low-cost of equity, the company only issued 1.47m shares for this raise, which should fund them for continuous exploration drilling through 2022. The company continues to have a tight share structure and over $50m of cash on hand, which will allow it greatly expand the Dixie Lake resource without having to raise equity for a couple of years.

Guyana Goldfields: The bidding war for this company has been very exciting. When Silvercorp first announced its intensions to acquire the company, the value creation potential was very significant. As Gran Columbia one upped Silvercorp and Silvercorp them responded by one-upping Gran Colombia, the value adding potential was still there and still quite material, though not what it was initially was. But this week, it received a superior proposal from a foreign-based multinational mining company. The new offer Is C$1.85 in cash for each common share, valuing the company at C$323m. This is a 35% premium to the Silvercorp offer. Silvercorp will have a 5-day “matching period” wherein Silvercorp has the right to propose to amend the terms of the agreement. If Silvercorp believe the gold price will stay at or above $1,600/oz., it should up its bid as this would still unlock material value as well as earning a higher NAV and cash flow multiple. It doesn’t necessarily have to match the current bid as shares in what would be a new Silvercorp would have much more value adding potential than an all-cash offer. However, Silvercorp will need to up its bid by some degree.

Kirkland Lake Gold: The premier emerging senior producer announced it received acceptance to renew its normal course issuer bid (NCIB). The company had already bought back a significant amount of stock prior to the CV19 outbreak, at which time it stopped for precautionary measures. The current NCIB allows Kirkland Lake Gold to purchase up to 27.71m shares or 10% of the current outstanding common shares. Kirkland Lake is not exactly cheap but it has three excellent assets [Detour Lake has become such with higher gold prices, and more so if Kirkland Lake can expand production and lower costs], in Tier-1 mining jurisdictions. The company’s stock price is no longer trading with a premium as it was prior to the Detour acquisition, though this could come back should gold prices continue to rise and Kirkland Lake reduce AISC toward the $950/oz. level. Kirkland Lake continues to boast one of, if not, the strong balance sheet among its peer group, not only because it has a significant net cash position but because it is generating such robust free cash flow.

Lundin Gold: Announced that its first phase for restart of operations at Fruta del Norte are underway. The Company has shipped all of the concentrate and doré that had been stored at site since the suspension of operations on March 22, 2020. Operations are expected to restart early in Q3. Transportation has been re-established to move supplies. Another important phase is moving personnel back to site. During the suspension, workers at the site have been carrying out several projects and maintenance work in preparation for the restart of operations. The SAG mill was relined, maintenance of underground de-watering equipment took place and infrastructure and mill modification to improve recovery rates were implemented.

Osisko Mining: Announced it has entered into an agreement with Canaccord Genuity Corp. and Eight Capital to act as co-lead underwriters, on behalf of a syndicate of underwriters, pursuant to which the Underwriters have agreed to purchase, on a bought-deal private placement basis, 41,100,000 units of the Corporation at a price of C$3.65 per Unit for gross proceeds of C$150,015,000 [US$110.71m].

Each Unit will consist of one common share of the Corporation and one-half of one common share purchase warrant. Each Warrant will entitle the holder to acquire one common share of the Corporation for 18 months from the closing of the Offering at a price of C$5.25. The Corporation shall grant the Underwriters an option to purchase up to an additional 7,400,000 Units at the Offering Price for additional gross proceeds of up to C$27,010,000 [US$19.98m].

It is a bit disappointing that in this market with considerably higher gold prices relative to past years and having a premier development project in Windfall, that the company is issuing ½ warrant per unit. While the cash inflow might be useful as it nears a construction decision, it could end up diluting at below market rates for its cost of equity.

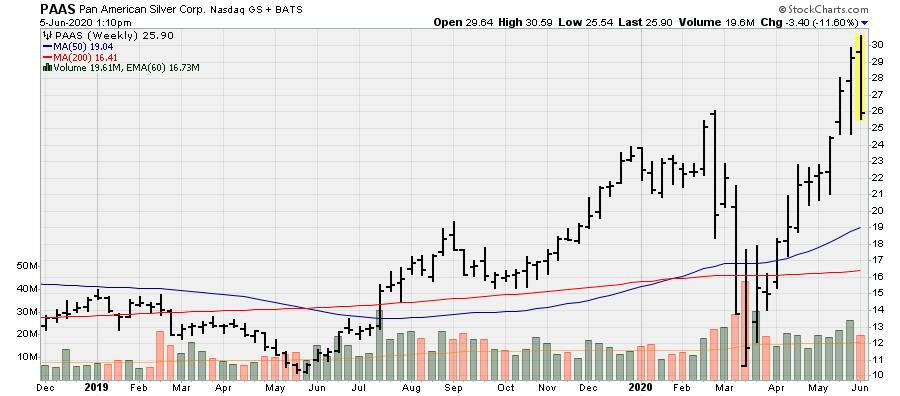

Pan-American Silver: The company announced the resumption of operations that were previously restricted. Operations at La Colorado and Dolores in Mexico have restarted, following the restart of its Shahuindo, La Arena, San Vicente and Manatial Espejo operation initiated in May. The mines are operating at reduced capacity to accommodate new protocols in response to CV19. The company is awaiting regulatory authorization to resume operations at Huaron and Morococha in Peru. The Timmins West and Bell Creek mines in Canada have continued to operate at 90% of capacity. Pan-American has a strong balance sheet and with higher gold prices, it is still generating strong cash flow and while it will dip significantly in Q2, it will bounce back in Q3.

Perseus Mining: The fast-growing West African producer, with its third mining operation set to reach production before year end 2020, propelling the company to become a 500k oz. Au producer in 2022 also announced it will acquire Exore Resources. It is a small acquisition with an implied equity value of A$60m. This deal will add Exore’s Bagoe and Liberty projects. There is strategic logic behind this deal as the Bagoe project has the potential to be developed either as a stand-alone operation or transported to Sissingue for processing as its with trucking distance. Without additional exploration success the Sissingue deposit, it will essentially be depleted in 2024, so these projects could fill that gap. This is smart acquisition as its small but could allow Perseus to maintain being a 500k oz. Au producer beyond 2024, or at least come close to it.

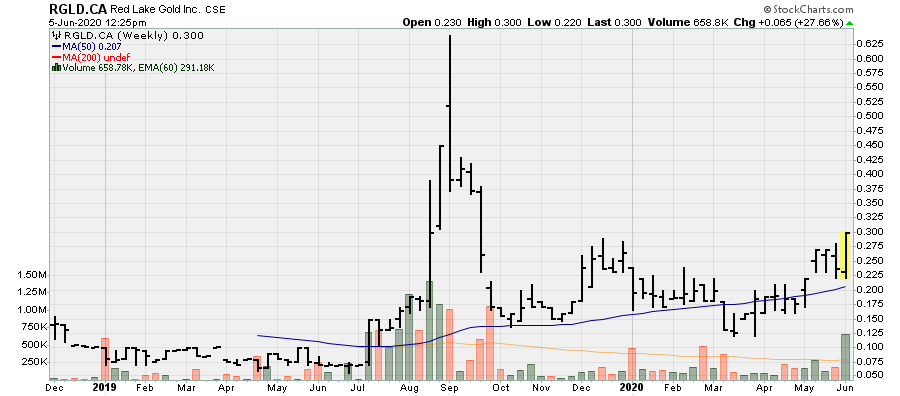

Red Lake Gold: With the success of Wallbridge mining at its high-grade Fenelon gold project, other companies are acquiring adjacent claims with hopes of similar success. This includes Red Lake Gold, which announced it entered into an arm’s length purchase agreement for a large portfolio of mining claims in Quebec, which will more than triple the size of its Fenelon North Gold project. Red Lake has an interesting portfolio of properties, having claims in Red lake, adjacent to and on-trend with Great Bear Resource’s LP discovery and its Fenelon North Gold project.

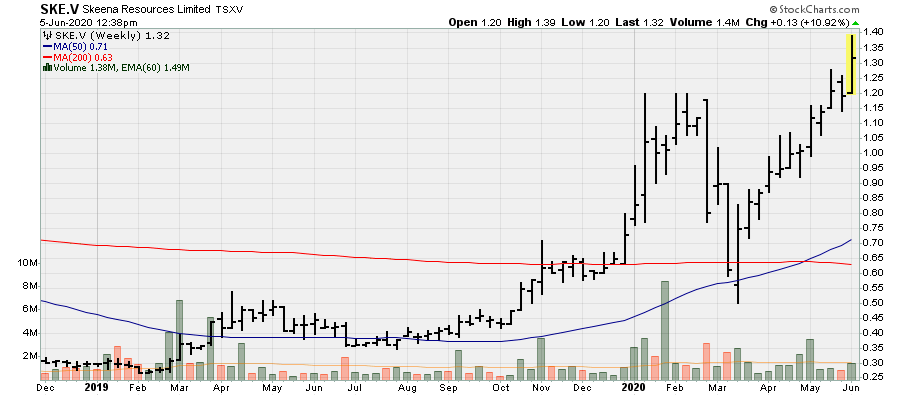

Skeena Resources: The company appointed Shane Williams as the company’s new COO. He has as history in mining and oil/gas industries of development, construction, and operations of large-scale projects. He was previously with El-Dorado Gold where he led the team that brought the Lamaque gold project to commercial production in 18-months. Skeena is getting serious about moving Eskay Creek forward and this appointment marks the next phase of development. Eskay Creek is a very exciting project with material exploration upside remaining.

Victoria Gold: The Company reported it made the first principal repayment against the senior secured credit facility of US$7,133,266 on May 31, 2020. April saw a significant increase in output, which was more or less flat in May as the company produced 7.76k oz. Au [25k oz. Au YTD]. These were below expectations as measures undertaken due to the CV put pressure on productivity. The ramp-up period will continue and production will rise. The Yukon government and chief medical officer announced that travel restrictions are set to relax soon. This will make a difference as the company relies on multiple specialty contractors south of the Yukon border to support operations. Commercial production should be achieved towards the back of Q3, if not Q4.