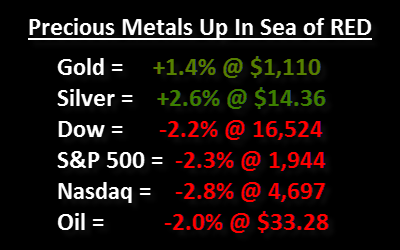

If we look around the majority of the market today, not much is up besides gold and silver. Not only is the Dow Jones down big time, so are the S&P 500 and Nasdaq. Hell, even oil is lower by more than 2%. What we have here is gold and silver floating up nicely in a sea of RED. Oh, by the way… the U.S. Dollar is down a hefty 100 basis points. Well done.

As I stated in the title, investors better get used to days like this… because it’s just the beginning. There’s gonna be a lot more RED in the broader stock and bond markets. If investors think the prices of gold and silver are going to continue down much lower along with the broader markets… think again. It’s highly unlikely, as they have been crushed over the past four years.

The downside risk in the value of gold and silver is a fraction compared to the highly propped up stock and bond markets. While precious metal investors continue to belly ache about the current low price of the metals, they fail to realize there really isn’t much else worthwhile owning going forward.

This includes most paper and physical assets such as the bell-weather of REAL ESTATE. Real Estate will no longer be the safe asset to own in a future when we start to experience the collapse of the U.S. and Global Oil Industries. I am not saying this will happen tomorrow, or next year… but it just gets worse from here on out.

Market Timers Are Playing Russian Roulette… GOOD FRICKEN LUCK

I hear through many contacts, articles and interviews that there are one hell of a lot of folks who are trying to time their EXIT of the markets… LOL. Good luck with that. While some will be successful in getting out with some fiat profits, I imagine most will be caught like a deer in the headlights. Who knows how this unfolds going forward, but I gather there will be a lot for which investors are terribly unprepared for.

Furthermore, I empathize with folks who have their retirements tied up into 401k’s and other financial assets that can’t be liquidated without a serious penalty. Although, when the FAN finally hits the COW EXCREMENT, I would bet my bottom Silver Dollar that these folks would have rather sold when they had the chance and taken the penalty, then watch their retirement accounts continue to head into the toilet.

I totally agree with David Collum’s forecast that The Next Recession Will Be A Real BARN-BURNER. You see, the next recession will turn into a depression that the U.S. never pulls out of. Oh sure, we may see a leveling off of market indexes and economic activity, but continued CLIFF DIVES will follow soon thereafter.

This will be due to several factors, but energy will play the key factor. According to the EIA – U.S. Energy Information Agency, they see U.S. oil production falling to 8.5 million barrels per day (mbd) by Sept. 2016:

EIA expects U.S. crude oil production declines to continue through September 2016, when total production is forecast to average 8.5 million b/d. This level of production would be 1.1 million b/d less than the recent monthly peak reached in April 2015. Forecast production begins increasing in late 2016, returning to an average of 8.7 million b/d in the fourth quarter.

I actually believe U.S. oil production declines could be even more severe in 2016 (and going forward) than what the EIA has forecasted. As I have stated in several articles and interviews, I believe U.S. oil production will be down 30-40% by 2020 and 60-70% by 2025.

If current U.S. oil production is 9.2 mbd, a 40% decline would be production of 5.5 mbd, and a 70% decline would be production down to 2.8 mbd. Investors need to realize the U.S. has been able to import oil, goods and services due to its ability pawn off inflated U.S. Dollars and U.S. Treasuries. This will no longer work in the future as it has in the past… especially as U.S. oil production declines in earnest.

Thus, rapidly falling U.S. oil production on top of lower oil imports will be a crushing blow to the highly leveraged debt based U.S. Fiat Monetary System. When this occurs, debating on whether or not the COMEX will default will be totally meaningless. Americans who have invested in precious metals will have a lot more to worry about at this time. However, owning physical gold and silver during these troubled times, will offer more options than those poor slobs who held onto most of the assorted paper garage assets.

The Death Of Gold & Silver ETF’s Are a BLINKING RED LIGHT Indicator

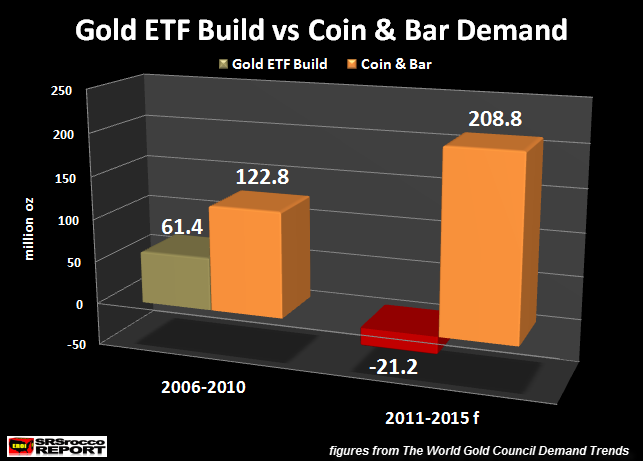

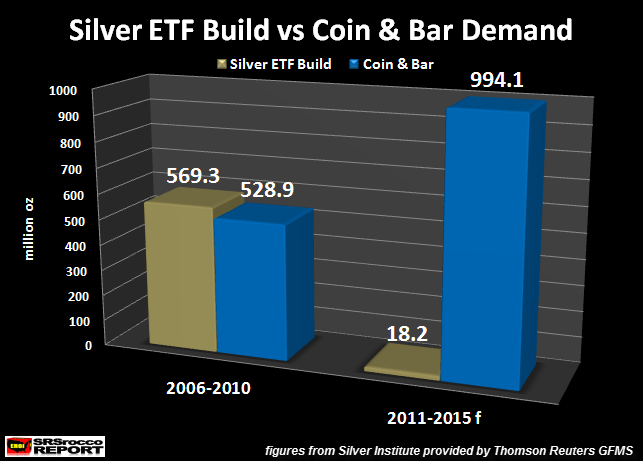

I don’t have many graphs to show in this post, except for these two I published in a recent article. There was a distinct change in buying habits of gold and silver since the peak in price of the precious metals in 2011:

These two charts show the huge increase in physical Gold and Silver Coin & Bar demand from 2011-2015 versus the net Global ETF builds compared to the previous period from 2006-2010. Basically, investors wouldn’t touch the Gold or Silver ETF’s with a ten foot pole after 2011.

The biggest change is seen in the silver market as investors purchased nearly a billion ounces of silver bar & coin from 2011-2015 compared to only a pathetic 18 million oz net build of Global Silver ETFs.

An analyst can look at this change in many ways, but the obvious is certain… investors for the most part, don’t trust paper gold and silver…. PERIOD. I believe this is a BLINKING RED LIGHT for what is to come in the entire precious metal market in the next 2-5 years… or possibly sooner.

Investors who own the real thing (IN HAND) will be much better off than those invested in paper gold and silver.

Please check back for new articles and updates at the SRSrocco Report. You can also follow us at Twitter below: