The gold price was edged quietly lower until around 12:30 p.m. China Standard Time on their Friday afternoon -- about thirty or so minutes later a quiet and broad rally began that ended abruptly at the 10 a.m. EST afternoon gold fix in London...its high tick of the day. Fifteen minutes later 'da boyz' went to work...setting its engineered low tick at 11:45 a.m. EST. It ensuing rally was capped the moment it broke above $4,300 spot -- and it was forced to wander quietly sideways until the market closed at 5:00 p.m. EST.

The low and high ticks in gold were reported as $4,286.00 and $4,387.80 in the February contract...an intraday move of $101.80 an ounce. The December/ February price spread differential in gold at the close in New York yesterday was $28.20...February/April was $31.70...April/June was $32.30 -- and June/August was $31.00 an ounce.

Gold was closed in New York on Friday afternoon at $4,298.70 spot...up $19.50 on the day -- and $53.60 off its Kitco-recorded high tick. Net volume was pretty monstrous at a bit over 266,500 contracts -- and there were 26,000 contracts worth of roll-over/switch volume on top of that.

I saw that 1,531 gold, plus 435 silver contracts were traded in December yesterday and, as is always the case, it remains to be seen just how much of these amounts show up in tonight's Daily Delivery and Preliminary Reports further down in today's column.

The silver price was forced to wander quietly sideways until around 12:30 p.m. in Shanghai on their Friday afternoon -- and then the rally in it commenced. Its high tick was set at the 9:30 opens of the equity markets in New York when it broke above $64.50 spot. Its engineered low tick was also set at 11:45 a.m. EST in COMEX trading -- and its price path after that was managed in an identical fashion as gold's until the market closed at 5:00 p.m. EST.

The high and low ticks in silver were recorded by the CME Group as $65.085 and $61.015 in the March contract...an intraday move of a whopping $4.07 an ounce. The December/March price spread differential in silver at the close in New York yesterday was 64.5 cents...March/May was 46.8 cents...May/July was 45.2 cents -- and July/September was 39.1 cents an ounce.

Silver was closed on Friday afternoon in New York at $61.868 spot...down $1.63 on the day... $1.12 off its low tick -- and 70 cents of its Kitco-recorded high tick. Net volume was horrendous...beyond Mars...at a tad over 173,500 contracts -- and there were a bit under 16,000 contracts worth of roll-over/ switch volume in this precious metal.

![]()

Platinum's two broad rally attempts in Globex trading in the Far East were both turned lower -- and its rally commenced around 3:25 p.m. China Standard Time on their Friday afternoon. From that point onwards, its price path was a carbon copy of what happened in both silver and gold until the market closed in New York at 5:00 p.m. EST...although it didn't give back all of its gains. Platinum was closed at $1,742 spot...up 48 dollars on the day -- and 34 bucks off its Kitco-recorded high tick.

![]()

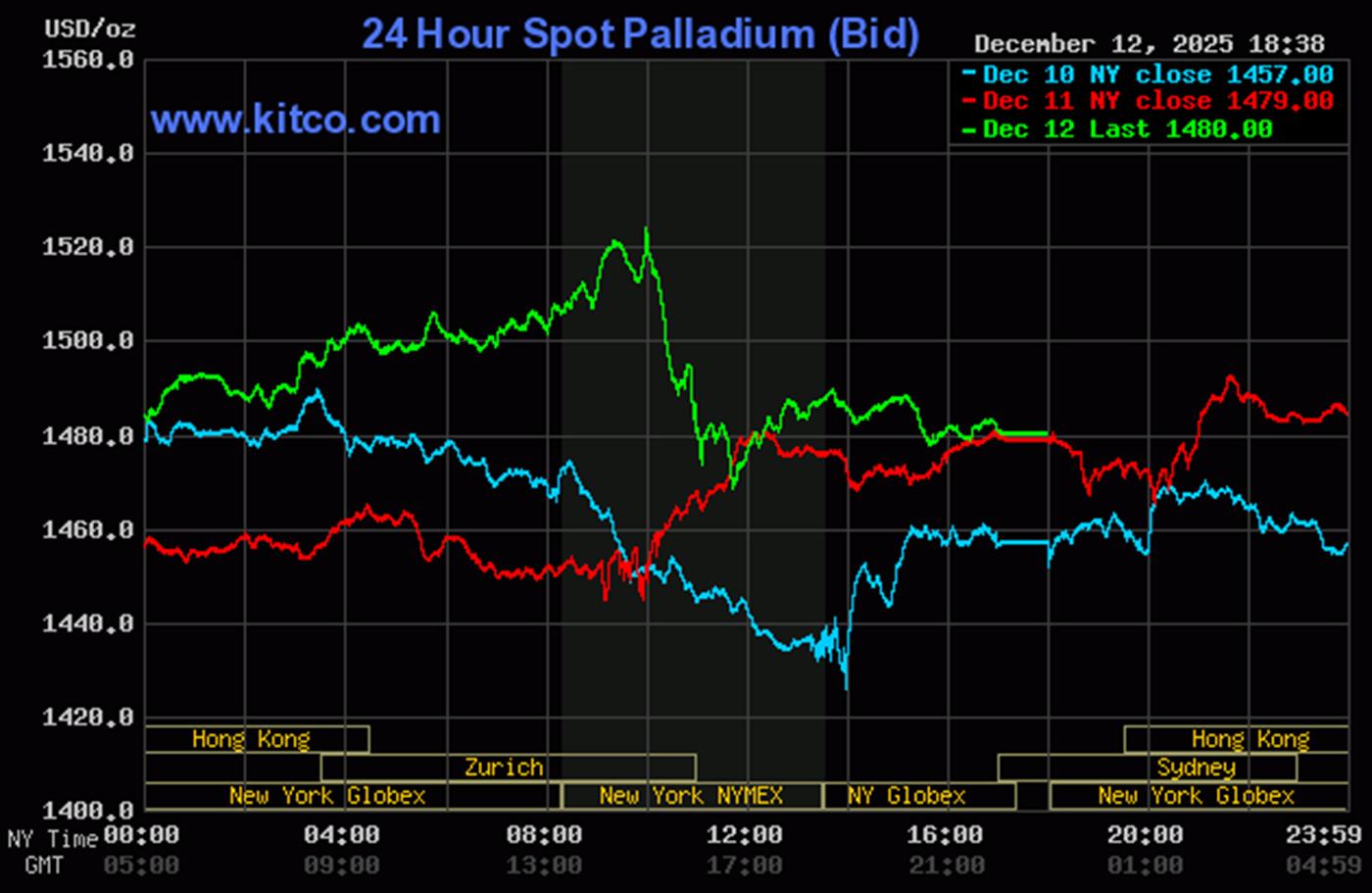

Except for the fact that palladium's high tick was set at the 10 a.m. EST afternoon gold fix in London, its price path was managed in a similar fashion as the other three precious metals. Its engineered low tick was also set at 11:45 a.m. in COMEX trading in New York -- and it then had a quiet and slightly ascending up/down move until the market closed at 5:00 p.m. EST. Palladium was closed at $1,564 spot...up a dollar on the day -- and 60 bucks off its Kitco-recorded high tick.

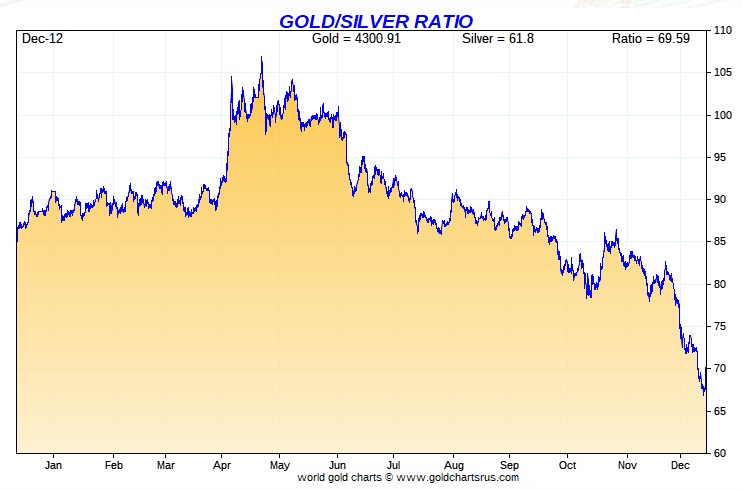

Based on the kitco.com spot closing prices in silver and gold posted above, the gold/silver ratio worked out to 69.5 to 1 on Friday...compared to 67.4 to 1 on Thursday.

Here's the 1-year Gold/Silver Ratio chart from Nick -- and updated with this past week's data. Click to enlarge.

![]()

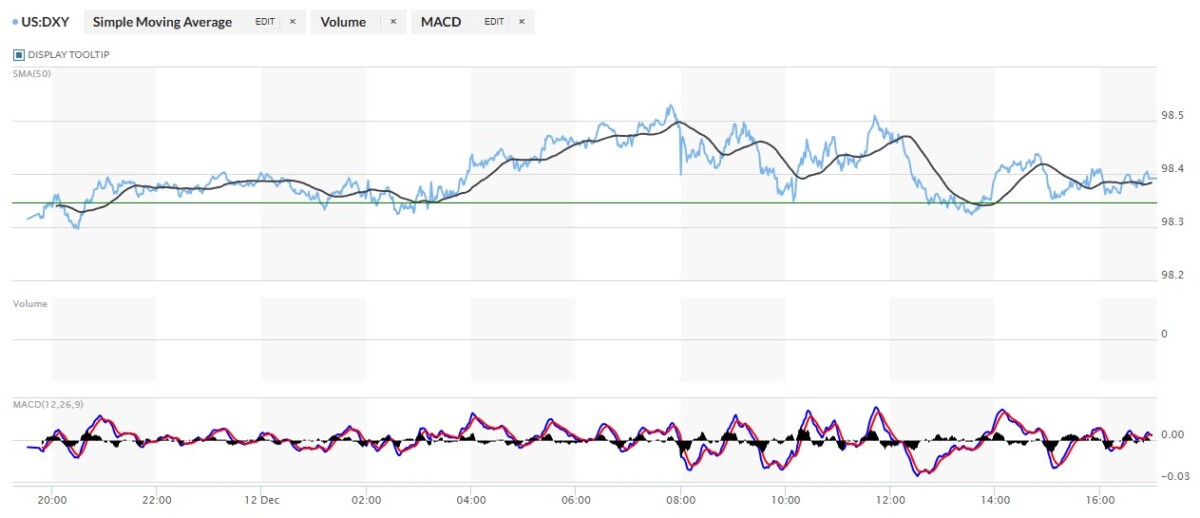

The dollar index closed very late on Thursday afternoon in New York at 99.35 -- and then opened lower by 3 basis points once trading commenced at 7:32 p.m. EST on Thursday evening...which was 8:32 a.m. China Standard Time on their Friday morning. It then had a very quiet and broad up/down move that ended around 3:35 p.m. CST. It then chopped quietly higher until 12:48 p.m. in London-- and then wandered/chopped very unevenly lower until 1:35 p.m. in New York. From there it wandered/chopped very quietly higher until the market closed at 5:00 p.m. EST.

The dollar index finished the Friday trading session in New York at 98.39 ...up 4 basis points from its close on Thursday.

Here's the DXY chart for Friday...thanks to marketwatch.com as usual. Click to enlarge.

A cursory glance at the chart above would indicate that there was no way that the powers-that-be were going to allowed the dollar index to close down on the day, as every time it was about to succumb to gravity...the usual 'gentle hands' were there to save it.

A cursory glance at the chart above would indicate that there was no way that the powers-that-be were going to allowed the dollar index to close down on the day, as every time it was about to succumb to gravity...the usual 'gentle hands' were there to save it.

Here's the 6-month U.S. dollar index chart...courtesy of stockcharts.com as always. The delta between its close...98.37...and the close on DXY chart above, was 2 basis points below that. Click to enlarge.

![]()

You don't me or anyone else to tell you that the dollar index movements paid no part in what was being handed out to the precious metals in the Globex/ COMEX futures market on Friday.

U.S. 10-year Treasury: 4.1940%...up 0.0530/(+1.2799%)...as of the 1:59:53 p.m. CST close

From its daily chart, I get the impression that the Fed showed up at 9:15 a.m. EST in New York to ensure that the ten-year didn't close any higher than that...as its yield barely moved for the rest of the day.

For the week, the 10-year yield closed higher by 5.5 basis points -- and would have closed up far more than that if the Fed hadn't been ever vigilant.

Here's the 5-year 10-year U.S. Treasury chart from the yahoo.com Internet site -- which puts the yield curve into a somewhat longer-term perspective. Click to enlarge.

The 10-year hasn't been allowed to trade above its 4.92% high tick set back on October 15, 2023...but I still suspect that we've seen the 3.9482% low for this cycle...which was set back on October 22. The Fed did cut the rate on Wednesday, as expected -- and has been hard at work controlling its yield both before and after that event. More rate cuts in 2026 are expected...as is the return of QE.

![]()

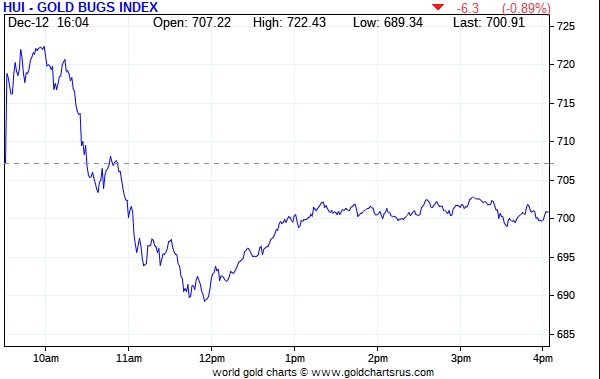

The gold shares rallied a bit at the 9:30 opens of the equity markets in New York on Friday morning --and that lasted until 'da boyz' showed up at the 10 a.m. EST afternoon gold fix in London. The blood-bath in the gold stocks ended a couple of minutes before 12 o'clock noon. They then edged a bit higher...following the gold price...until that quiet rally was capped at 1:15 p.m. The shares then traded flat until the markets closed at 4:00 p.m. EST. Despite the fact that the gold price finished the Friday session up a respectable amount, its equities couldn't managed the same feat, as the HUI closed down 0.89 percent.

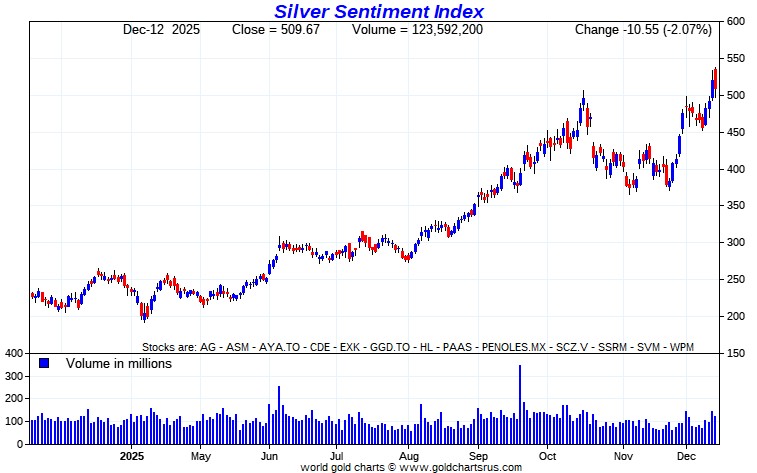

Not surprisingly, the silver stocks didn't fare anywhere near as well, as Nick Laird's Silver Sentiment Index closed lower by 2.07 percent...but it could have been worse. Click to enlarge.

I was surprised that any of the silver equities closed up on the day...but three did...Peñoles by 2.42 percent, Aya Gold & Silver by 3.15 percent -- and Wheaton Precious Metals, it by 0.21 percent. The biggest underperformer was First Majestic Silver, closing down 5.18 percent... followed by Silvercorp Metals and Endeavour Silver, closing lower by 4.80 and 4.57 percent respectively.

I was surprised that any of the silver equities closed up on the day...but three did...Peñoles by 2.42 percent, Aya Gold & Silver by 3.15 percent -- and Wheaton Precious Metals, it by 0.21 percent. The biggest underperformer was First Majestic Silver, closing down 5.18 percent... followed by Silvercorp Metals and Endeavour Silver, closing lower by 4.80 and 4.57 percent respectively.

One has to suspect that most of the people trading the precious metal shares on margin, got blown out of their positions before noon EST yesterday.

I didn't see any news regarding any of the thirteen companies that comprise that above Silver Sentiment Index.

The silver price premium in Shanghai over the U.S. spot price on Friday was 3.42 percent.

The reddit.com/Wallstreetsilver website, now under 'new' and somewhat improved management, is linked here. The link to two other silver forums are here -- and here.

![]()

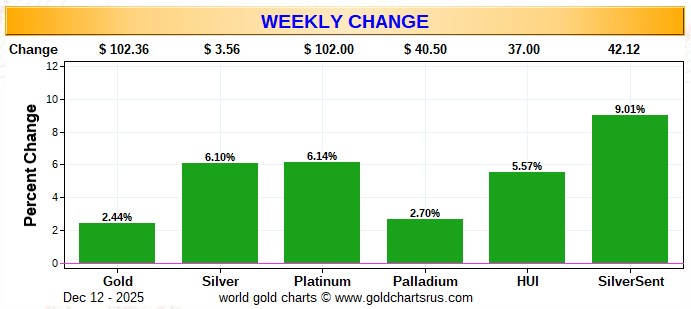

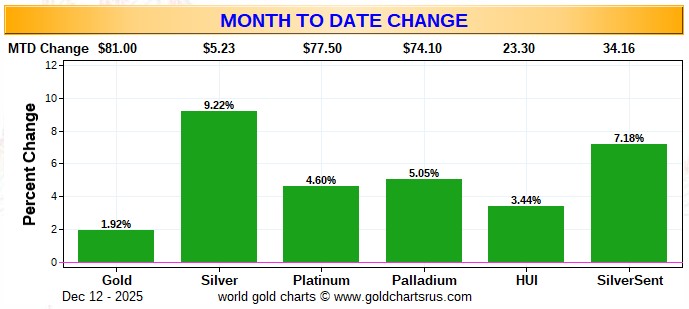

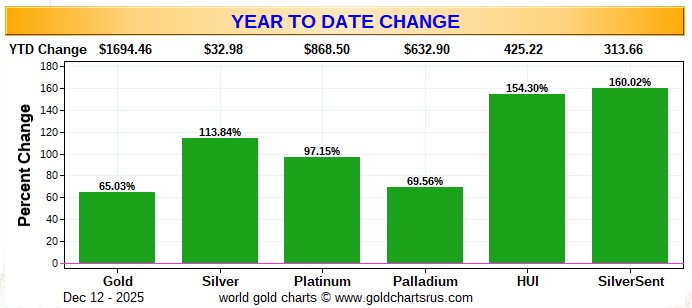

Here are the usual three charts that appear in this spot in every weekend missive. They show the changes in gold, silver, platinum and palladium in both percent and dollar and cents terms, as of their Friday closes in New York — along with the changes in the HUI and the Silver Sentiment Index.

Here's the weekly chart -- and despite yesterday's bear raid, everything is green across the board. On an absolute basis, the silver stocks outperformed ...but on a relative basis, the gold shares did far better. Click to enlarge.

Here's the month-to-date chart -- and, like last week, the only thing worth noting is the continuing ugly underperformance of the silver equities vs. the price of its underlying precious metal. It's a perversion. Click to enlarge.

Here's the year-to-date chart -- and even though the silver price has outperformed the gold price by 75% on a relative basis vs. gold year-to-date, its associated equities are barely ahead of the gains in the HUI. I didn't think that would be possible...but the chart doesn't lie. The silver equities should be priced about 110 percentage points higher than they are now to be equal to the gains in the gold equities vs. the gold price itself year-to-date. Click to enlarge.

Despite the fact that silver has now broken the $64 barrier -- and the silver well in London is running close to empty...with very elevated lease rates...the gold/silver ratio remains at a farcical 69.5 to 1 as of the Friday's close. The 'normal' and historical ratio is around 15 to 1...which would put silver at about $286. And if priced at the ratio of 7:1 that it comes out of the ground at, compared to gold...that would put silver at around $614 an ounce. So a triple-digit silver price is in our future -- and all that remains to be resolved is what that number will be -- and how soon 'da boyz' allow it to happen.

![]()

The CME Daily Delivery Report for Day 12 of December deliveries showed that only 6 gold, plus 488 silver contracts were posted for delivery within the COMEX-approved depositories on Tuesday.

In gold, the largest short/issuer was Dutch bank ABN Amro, issuing 5 contracts out of its client account -- and Wells Fargo Securities, plus British banks Barclays and Standard Chartered, picked up 2 contract each...Barclays for their client account.

In silver, the sole short/issuer was JPMorgan from its client account -- and the only three long/stoppers that mattered were British bank HSBC, JPMorgan and Australia's Macquarie Futures, picking up 209, 173 and 46 contracts respectively....JPMorgan for their client account.

In palladium, there were 10 contracts issued and stopped.

Copper continues to amaze, as a further 683 contracts were issued and stopped yesterday, bringing the month-to-date total up to 340 million pounds/ 13,621 COMEX contracts.

The link to yesterday's Issuers and Stoppers Report is here.

Month-to-date there have been 28,437 gold contracts issued/reissued and stopped -- and that number in silver 11,578 contracts. In platinum that number is only 16 contracts -- and in palladium...590 contracts, which is a lot for this precious metal.

The CME Preliminary Report for the Friday trading session showed that gold open interest in December rose by a hefty 722 COMEX contracts, leaving 2,022 still around...minus the 6 contracts out for delivery on Tuesday as per the above Daily Delivery Report. Thursday's Daily Delivery Report showed that 218 gold contracts were actually posted for delivery on Monday, so that means that 722-218=504 more gold contracts were added to the December delivery month...although none of these have yet been posted for delivery...as only 6 contracts showed up in yesterday's Daily Delivery Report.

Silver o.i. in December rose by 228 contracts, leaving 890 still open...minus the 488 contracts out for delivery on Tuesday as mentioned a bunch of paragraphs ago. Thursday's Daily Delivery Report showed that only 22 silver contracts were posted for delivery on Monday, so that means that 228+22=250 more silver contracts were added to the December delivery month.

Total gold open interest in the Preliminary Report on Friday night increased by 8,310 COMEX contracts. I was expecting a bigdecline. Total silver o.i. fell, but only by 1,007 COMEX contracts -- and considering the hatchet job they did on silver, I was expecting a far bigger drop than this.

[I checked the final total open interest number for gold for Thursday -- and it showed a hefty drop from the Preliminary Report...from +25,644 contracts, down to +13,894 contracts... which is still a number that I'm less than happy about. Final total silver o.i. for Tuesday rose by an immaterial amount, from +1,414 COMEX contracts...up to +1,535 contracts.]

Gold open interest inJanuary in the CME's Final Report on Friday morning increased by 49 contracts, leaving 2,769 still around -- and silver o.i. in January rose by 41 contracts, leaving 4,113 still open.

![]()

There were further deposits into both GLD and SLV on Friday, as authorized participants added 73,576 troy ounces of gold to the former -- and 634,762 troy ounces of silver to the latter. There were 71,262 troy ounces of gold removed from GLDM.

The SLV borrow rate started the Friday session at 0.83% -- and closed at 0.84%...with 10.0 million shares available to short by the end of the day. The GLD borrow rate began the day at 0.33% -- and finished it at 0.33%...with 6.3 million shares available.

In other gold and silver ETFs and mutual funds on Earth on Friday ...net of any changes in COMEX, GLD, GLDM and SLV activity, there were a net 193,202 troy ounces of gold added, plus 2,180,100 troy ounces of silver. The two biggest silver amounts were the 1,466,629 troy ounces that showed up in iShares/SSLN -- and the 399,994 troy ounces that went into Sprott's PSLV.

And nothing from the U.S. Mint.

![]()

There was very decent activity in gold over at the COMEX-approved depositories on the U.S. east coast on Thursday. Nothing was reported received -- but 147,853 troy ounces were shipped out involving three different depositories. The two largest amounts were the 65,886 troy ounces that left HSBC USA -- and the 60,911 troy ounces that departed Malca-Amit USA.

There was a bit of paper activity, as 17,110 troy ounces were transferred from the Eligible category and into Registered...with more than the lion's share of that amount...16,628 troy ounces...making that trip over at Manfra, Tordella & Brookes, Inc.

The link to Thursday's COMEX gold action is here.

But there was more incredible silver activity, as 1,114,623 troy ounces were reported received -- and a hefty 3,571,966 troy ounces were shipped out.

In the 'in' category, the two largest amounts were the 597,057 troy ounces/ one truckload that showed up at HSBC USA...followed by the 513,563 troy ounces that arrived at Loomis International.

There were five different depositories that parted with silver -- and the two largest amounts by far were the 1,413,537 troy ounces that left StoneX... followed by the 953,751 troy ounces that were shipped out of Loomis International. There were 593,697 troy ounces/one truckload that left JPMorgan as well.

The only paper activity were the 220,230 troy ounces that were transferred from the Registered category and back into Eligible over at JPMorgan.

The link to all of Thursday's incredible COMEX silver action is here.

Although I don't have room for the charts in today's column, Nick reported silver imports and exports in and out of the U.K. -- and updated with October's data. During that month they imported 2,076.8 tonnes/66.771 million troy ounces of silver...1,391.8 tonnes/44.748 million oz. from the U.S. -- and 353.0 tonnes/11,349 million oz. from Switzerland. They exported 627.3 tonnes/20.168 million oz...of which 493.1 tonnes/15.854 million troy ounces ended up in India. I'll have the charts for you on Tuesday.

The Shanghai Futures Exchange updated their silver inventories as of the close of business on their Friday -- and it showed that a further 1,296,360 troy ounces/ 40.321 metric tonnes were added... leaving their silver inventories at 26.393 million troy ounces/820.921 metric tonnes.

![]()

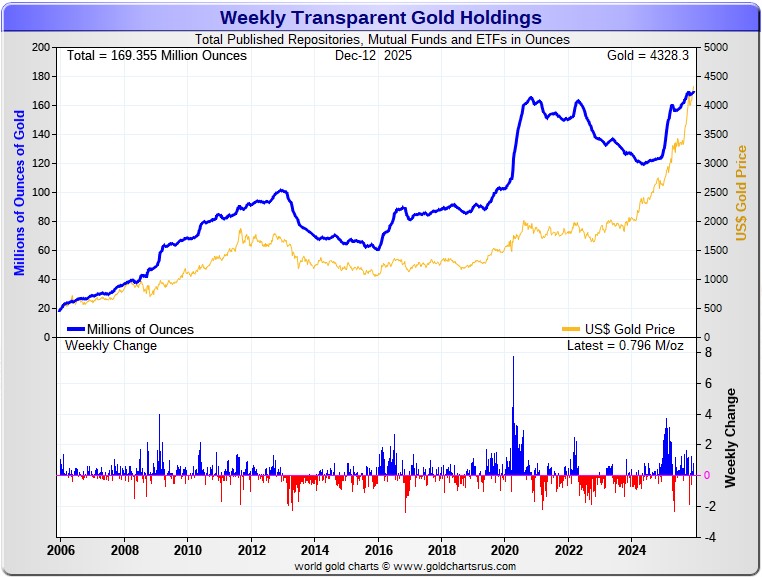

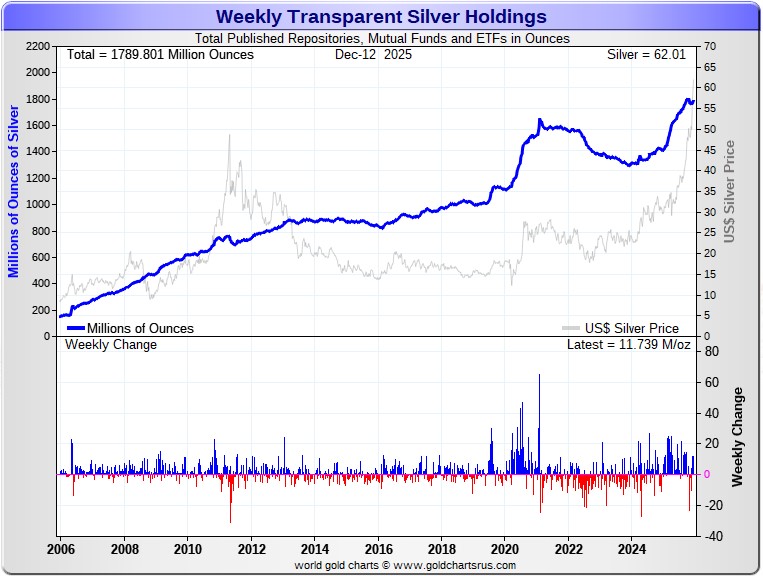

Here are the usual 20-year charts that show up in this space in every weekend column. They show the total amounts of physical gold and silver held in all known depositories, ETFs and mutual funds as of the close of business on Friday.

During the business week just past, there were a net 796,000 troy ounces of gold added -- and a net 11.739 million troy ounces of silverwere added as well.

According to Nick Laird's data on his website, a net 771,800 troy ounces of gold were added to all the world's known depositories, mutual funds and ETFs during the last four weeks. The two largest 'in' amounts were the 540,000 oz. that went into China's ETFs, followed by the 480,500 troy ounces into GLD. Lastly were the 465,500 troy ounces that ended up in crypto currencies/ Tether. The only large withdrawal that mattered were the net 1.415 million troy ounces that left the COMEX -- and all London-bound, I suspect.

The amount of gold in all the world's ETFs and mutual funds remains barely above its old all-time high of late 2020...but should be far higher considering that gold is now some distance north of $4,000 the ounce.. more than double the price it was back then.

It should be noted that the amount of silver held in all these depositories, ETFs and mutual funds is a very noticeable amount above its old all-time high inventory level of January 2021. But it should be far higher than it is, because silver is also handily more than double the price it was back then.

A net 19.429 million troy ounces of silver were also added during that same 4-week time period.

The biggest 'in' amount over that four-week period were the 28.437 million troy ounces shipped into SLV...followed by the 4.708 million oz. into India's silver ETFs. Next were the 2.900 million troy ounces into iShares/SSLN -- and the 2.903 million into Sprott's PSLV. Two other depositories had between 1 and 2 million oz. of silver deposited over the last four weeks. The only 'out' amount that mattered were the 22.310 million that left the COMEX -- and mostly London bound.

Retail sales are doing OK -- and most retailers show that they have stock in most of their popular products.

However, physical demand in silver at the wholesale level remains enormous/ rapacious. COMEX silver deliveries have been huge all year. November deliveries ended the month at 19.68 million troy ounces...which is amazing, considering the fact that November is not a scheduled delivery month for either silver or gold. There were also a whopping 1.267 million troy ounces of gold issued and stopped in November as well.

And, as mentioned further up in the Daily Delivery Report, we're only into Day 12 of December deliveries -- and there have already been 2.844 million troy ounces of gold...plus a knee-wobbling 57.890 million troy ounces of silver issued and stopped so far, with new contracts being added to both every day.

This "rapacious" silver demand will continue until available supplies are depleted...which now appears imminent once more -- and we're also fast approaching the sixth year of a structural deficit in silver according to the ongoing reports from The Silver Institute.

The vast majority of precious metals being held in these depositories are by those who won't be selling until the silver price is many multiples of what it is today.

Sprott's PSLV is the third largest depository of silver on Planet Earth with 207.5 million troy ounces...up 1.8 million troy ounces on the week -- and a great distance behind the COMEX, which has now been demoted to the second largest silver depository, where there are 453.4 million troy ounces being held...down 3.7 million troy ounces this past week...but minus the 103 million troy ounces being held in trust for SLV by JPMorgan.

That 103 million ounce amount brings JPMorgan's actual silver warehouse stocks down to around the 92 million troy ounce mark...quite a bit different than the 195.0 million they indicate they have...down a net and further 2.1 million troy ounces on the week.

PSLV remains a very long way behind SLV as well -- now the largest silver depository...with 517.7 million troy ounces as of Friday's close...up another 5.7 million ounces from last week.

The latest short report [for positions held at the close of business on Friday, November 28] showed that the short position in SLV declined by a further 15.88%...from the 51.89 million shares sold short in the prior report...down to 43.65 million shares in this latest short report that came out this past Tuesday...7.66% of total SLV shares outstanding. This amount remains grotesque, obscene -- and fraudulent beyond all description...as there is no physical silver backing any of it as the SLV prospectus requires.

BlackRock issued a warning five or so years ago to all those short SLV that there might come a time when there wouldn't be enough metal for them to cover. That would only be true if JPMorgan decides not to supply it to whatever entity requires it. However, we are far beyond that point now, as the short position in SLV will never be covered through the deposit of physical silver, as it just doesn't exit -- and never will. And if it does exist, it will only be available at a price far higher than what's being quoted in the public domain now.

The next short report...for positions held at the close of trading on Monday, December 15 will be posted on The Wall Street Journal's website on Wednesday afternoon EST on December 24.

Then there's that other little matter of the 1-billion ounce short position in silver held by Bank of America in the OTC market...with JPMorgan & Friends on the long side. Ted said it hadn't gone away -- and he'd also come to the conclusion that they're short around 25 million ounces of gold with these same parties as well. Once the silver price approaches three digits, we'll see if they need to get bailed, like Bear Stearns did back in 2008 -- and for the same reason.

The latest OCC Report for Q2/2025 came out almost three months ago now -- and it showed that the precious metal derivatives held by the four largest U.S. banks only increased by $25.8 billion/4.89% from Q1/2025...which is nothing much at all -- and that's despite the fact that precious metal prices rose fairly substantially during that time period.

JPMorgan's precious metals derivatives rose from $323.5 billion, up to $358.5 billion in Q2/2025 -- and Citigroup's also rose, but not by much, from $142.8 billion...up to $150.7 billion. BofA's fell from $61.7 billion, down to 44.7 billion -- and the derivatives position held by Goldman Sachs is a piddling and immaterial $219 million -- down from the $269 million held in Q1/2025.

But with JPMorgan holding 64.7% of all the precious metals derivatives... Citibank holding 27.2% -- and Bank of America about 8% of the total of the four reporting banks, it's only JPMorgan and Citigroup that matter.

And as I keep pointing out in this spot every weekend, the OCC indicator is flawed for two very important reasons, as way back 10-15 years ago, this report used to include the top dozen or so U.S. banks -- and included the likes of Wells Fargo and Morgan Stanley, amongst others... that are card-carrying members of the Big 8 shorts. Now the list is down to just four banks...so a lot of data is hidden...which is certainly the reason why the list was shortened. On top of that, the list doesn't include the non-U.S. banks that are members of the Big 8 shorts: British, French, German, Canadian -- and Australian.

![]()

The latest back-dated Commitment of Traders Report...for positions held at the close of COMEX trading on Tuesday, November 18...was posted on the CFTC website yesterday afternoon.

In both gold and silver, all the Big 8 commercial traders increased their short positions by a bit.

Under the hood in silver, the Managed Money and Nonreportable/small traders reduced their net long positions...while the traders in the Other Reportables category increased their net long position by a decent amount. Also on the buy side were Ted Butler's raptors...the small commercial traders other than the Big 8...as they continue to slowly increase their net long position.

In gold, it was exactly the same as silver with no exceptions...the Managed Money and Nonreportable/small traders sold -- and the traders in the Other Reportables categories increased their net long position by a decent amount. And also on the 'buy' side were Ted's raptors, as they bought back/covered a small amount of their still grotesque short position.

The most obvious dichotomy between what's happening in the COMEX futures market in both silver and gold is the behaviour of Ted Butler's raptors, the small commercial traders other than the Big 8. These raptors are the same players in both these precious metals -- and they're net long 7,892 COMEX silver contracts...but net short 36,982 COMEX gold contracts!

This data is about a month old, so I'm not going to read too much more into it, as it's yesterday's news. I'm just hitting the highlights here, as I'll do with all the rest until we're caught up.

And now for a bit on the November Bank Participation Report that came out on Monday. The data in it is for the prior month...October.

In gold, since the high-water mark in the August Bank Participation Report for July, the November Bank Participation Report that came out on Monday showed that the 5 U.S. banks that are short gold in the COMEX futures market, have reduced their net short position from 103,093 contracts, down to 72,084 COMEX contracts...a drop of 31,009 COMEX contracts. The 27 non-U.S. banks have reduced their net short position in gold from 144,476 contracts, down to 111,105 COMEX contracts...a decline of 33,371 COMEX contracts.

In silver, the high-water mark was July -- and since then, the 5 U.S. banks involved in the price management scheme have decreased their net short position from 28,918 COMEX contracts, down to a piddling 6,797 contracts in the November BPR...a drop of 22,121 contracts.

The 16 non-U.S. banks that are involved in silver in the COMEX futures market were short 52,459 contracts back in the July BPR...but are short 'only' 36,930 COMEX contracts in the November Bank Participation Report...a decline of only 15,529 contracts.

So the world banking community has been actively and aggressively covering short positions in both gold and silver starting in July -- and I suspect it has been ongoing through November and into December...culminating in that big bear raid we had yesterday.

The banks, both U.S. and foreign, are still short gold big time. But in silver -- and as I stated earlier this week, with a short position of only 6,797 COMEX contracts at the end of October held by the 5 U.S. banks, it's a near certainty that they're completely gone from the short side by now, leaving the non-U.S. banks and other commercial traders holding the bag. But if they are still short, it's a good bet that they've covered themselves in the options or the OTC markets.

I'll have a bit more on this in The Wrap.

![]()

CRITICAL READS & VIDEOS

Global bond yields continued their march higher – Germany, Portugal, Italy, and Greece another six bps. Ten-year Treasury yields gained five bps to a three-month high of 4.18%. The cryptocurrencies were back under pressure late in the week. Gold surged $102 and Silver 6.2% - to record highs.

Meanwhile, cracks in the AI mania are increasingly discernible.

If inflation has remained above target for going on five years, responsible central bank management dictates prudent focus on financial conditions. In elevated inflationary environments, odds favor upside inflation persistence and upside surprises. Moreover, the longer inflationary pressures are accommodated by loose conditions, the greater the eventual tightening that must be imposed to break inflationary biases and psychology.

Most importantly, the Federal Reserve’s overarching responsibility to safeguard monetary and system stability dictates a sound financial conditions analytical framework and management approach. This is an area where contemporary central banking has completely broken down. Repeated massive QE programs and years of loose “money” accommodation unleashed speculative forces that came to dominate global finance. And it is leveraged securities speculation that today largely dictates financial conditions. “Risk on” leveraged speculation stokes self-reinforcing liquidity excess. Lurking “risk off”, meanwhile, risks triggering deleveraging, illiquidity, market dislocation, and panic.

Of course, the Fed would restart QE as soon as securities funding markets began to turn unstable. The critical issue today is not insufficient reserves. The problem is system fragility caused by a massive increase in speculative leverage. The surge in speculator borrowings creates self-reinforcing system liquidity that fuels asset inflation, speculative excess, and perilous Bubbles. But this structure is inherently fragile. It malfunctions in reverse, with deleveraging leading to liquidity destruction and market dislocation.

This very long but very worthwhile commentary from Doug appeared on his Internet site very late on Friday night PST -- and another link to it is here.

![]()

Are They Going to Use Seized Russian Assets to Trigger the Great Taking?

This week, I uncovered something extremely alarming — a direct link between the Great Taking and the freezing of Russia’s assets. Most people are already aware that hundreds of billions of dollars in Russian reserves were immobilized after the 2022 invasion of Ukraine. What has not been understood, until now, is the deeper significance of how that freeze was possible — and the grave danger embedded in Europe’s plan to now use those very same reserves as collateral for a massive loan package to Ukraine.

Once pledged, the assets shift from “frozen” to effectively confiscated — a transformation with implications that reach far beyond Russia. It’s entirely possible that this single step becomes the spark that triggers a major systemic unwind…or the Great Taking mechanism in full, which I have been discussing with you all recently. Worryingly, the people driving this policy appear to understand exactly what such a decision would unleash.

To understand what is taking place, we first need to understand the structural weakness that allowed the West to seize Russia’s assets in the first place. The critical factor wasn’t sanctions — it was custody. The bulk of Russia’s securities were held at Euroclear, the EU’s Central Securities Depository (CSD). Meaning the assets existed only as dematerialized entries on a digital ledger, registered in what is called street name — which, for those who are not aware, means the ownership of the assets was held by the CSD itself, not the Russian state!

In practical terms, Russia never possessed full legal ownership over these foreign reserves to begin with. They possessed a claim to them. What is called a security entitlement — the same fragile arrangement that governs the ownership of assets held by pension funds, institutions, and everyday investors across the West. This is the core vulnerability at the heart of the Great Taking that David laid bare in his book. What we are seeing now is that mechanism operating in real time — against Russia and its citizens. Whilst the initial freeze shocked many and spurred a rush into gold across the board, the significance runs far deeper.

But it was only whilst studying Europe’s plan to use these reserves as collateral earlier this week that I finally understood the true nature of what is unfolding. The narrative surrounding this plan — Russia vs Ukraine, the West vs the East — is merely the pretext: the potential gateway to a much more broad based economic crisis. One that will ripple through the entire financial system, risking a systemic crisis that hits stock markets, commercial banks, CSDs, pension funds, and more — meaning it could be the intended trigger for the Great Taking itself.

This very long, but very worthwhile and MUST READ commentary showed up on the parallelsystems.substack.com on Thursday -- and I thank reader Bruno Leonardt for pointing it out. Another link to it is here.

![]()

Russian Central Bank Sues Euroclear as E.U. Tries to Ram Through Assets Seizure

In what could prove a well-timed preemptive attack and shot across the bow, Russia’s Central Bank (CBR) announced Friday it has initiated legal action against Euroclear, one of Europe's largest securities depositories, which is holding 185 billion euros ($217 billion) of Russia’s frozen sovereign assets.

The CBR has filed a lawsuit against the Belgium-based bank in the Moscow Arbitration Court over "illegal actions" - just as European Union leadership is making a move to approve a plan to fund the Ukrainian government for the next years by using income from the Russian assets immobilized under E.U. sanctions.

"Euroclear’s actions caused harm to the Bank of Russia by preventing it from managing the funds and securities that belong to it," the Russian Central Bank said in the statement. The lawsuit seeks compensation for losses as a result of Euroclear indefinitely blocking access to the funds.

The RCB has also separately condemned wider EU plans to use Russian assets to aid Ukraine as "illegal, contrary to international law" as they violate "the principles of sovereign immunity of assets."

This is the first time in the entire frozen Russian asset saga that the bank has publicly commented on this issue. This lack of official condemnation until now is perhaps due to each side knowing greater tit-for-tat repercussions could unfold - or a point of no return could be reached if things unravel.

The European Central Bank has also long cautioned that if Europeans start grabbing other nations' money, it could undermine confidence in the euro currency.

Currently E.U. member states are rapidly advancing a plan ahead of a key summit next week. European Commission President Ursula von der Leyen is seeking to use a loophole to prevent a lone member or two from having an effective veto (especially Hungary), based on invoking emergency powers to sanction the frozen assets on a permanent basis, instead of holding the funds based on current six-month renewals, which requires unanimous agreement from all member states.

This related article showed up on the Zero Hedge website at 12:25 p.m. on Friday afternoon EST -- and another link to it is here. Another related ZH article from Friday morning EST is headlined "Belgium Gets Cold Shoulder Ahead of Russian Asset Confiscation" -- and linked here.

![]()

INTEL Roundtable w/Johnson & McGovern: Weekly Wrap...Friday 12 December

This informative 32-minute video interview featuring former CIA analysts Ray McGovern and Larry Johnson was posted on the youtube.com Internet site very late on Friday afternoon EST. Judge Andrew Napolitano was the host as usual -- and it's certainly worth your time if you have the interest. I thank Guido Tricot for sending it our way -- and another link to it is here.

![]()

Italy has resolved dispute with ECB over gold reserves, Treasury sources say

Italy has resolved differences with the European Central Bank (ECB) over a draft budget amendment on the ownership of the Bank of Italy's gold reserves, Italian Treasury sources said on Thursday.

The ECB was not immediately available to comment.

Sponsored by members of Prime Minister Giorgia Meloni's right-wing party, the proposal stating that the gold held by the Bank of Italy belongs to "the Italian people" had raised concerns from the ECB, which said it could undermine the Italian central bank's independence.

Italian Economy Minister Giancarlo Giorgetti and ECB President Christine Lagarde resolved the issue on the sidelines of a meeting of euro zone finance ministers in Brussels, the sources said.

The Bank of Italy, a public institution independent from the government, holds the world's third-largest national gold stockpile, behind the United States and Germany. Its 2,452 metric tons of gold are worth some $300 billion, equivalent to roughly 13% of Italy's national output.

Giorgetti reassured Lagarde that Rome had no plans to transfer the gold off the Bank of Italy's balance sheet, the sources said, ruling out a move that would circumvent the prohibition on central banks financing the public sector.

This Reuters story, filed from Rome, was posted on their Internet site at 10:52 a.m. PST on Thursday morning -- and I found it embedded in a GATA dispatch. Another link to it is here.

![]()

'Trading sardines' and paper silver -- Adam Sharp

There is an old trading story about sardines, and it's surprisingly relevant to silver today.

During the gold rush in the late 1800s miners were striking it rich in remote parts of Alaska.

But supplies were scarce and expensive. Eventually a large market for basic goods developed, and some suppliers spent more time trading food for profit rather than selling it for consumption.

Sardines were in high demand, and the price of a can supposedly soared 10x at one point. A micro-bubble developed. It got so bad that people were mostly trading the tinned fish rather than eating it.

One day a hungry miner paid through the nose for one of these cans. He opened it and was surprised to find horribly rotten fish. He stormed over to the traders' shop and demanded to know what was going on.

The trader told him, "You fool! Those are trading sardines, not eating sardines."

Today there is a dynamic in silver markets somewhat similar to the old sardine story. Paper silver contracts like those traded on the COMEX exchange outnumber physical silver by perhaps 200 times.

This silver commentary by Adam includes a big and well-deserved salute to silver analyst Ted Butler. It was posted on the dailyreckoning.com Internet site on Friday sometime -- and I found it on the gata.org website. Another link to it is here.

![]()

India's gold investment demand surges above $10 billion in September quarter, says WGC

Rising gold prices are spurring Indian investors to buy bars and coins, with record purchases worth $10 billion in the September quarter lifting their share of total consumption to an all-time high, the World Gold Council said on Thursday.

Gold has become a mainstream asset as investors diversify portfolios and boost allocations, even among those with little prior exposure, said Sachin Jain, CEO of WGC's India operations.

"We believe investors' interest in gold will continue and grow in the coming quarters," he said.

Investment demand in the world's second-largest gold consumer jumped 20% year on year in September quarter to 91.6 metric tons, or 67% in value terms to $10.2 billion, the WGC said.

Overall gold consumption, however, fell 16% to 209.4 tons as jewellery demand slumped 31% to 117.7 tons due to record-high prices.

This story from the Economic Times of India was picked up by msn.com -- and I found it on Sharps Pixley. Another link to it is here.

QUOTE of the DAY

![]()

The WRAP

"Understand this. Things are now in motion that cannot be undone." -- Gandalf the White

![]()

Today's pop 'blast from the past' is one I featured earlier this year, but here it is again. I was at local eatery earlier this week -- and it showed up in the local radio station's rotation -- and I haven't been able to get it out of my head since.

The singer's father was a Julliard-trained classical pianist -- and he recalled ..."lying beneath his dad's piano as a three-year-old listening to him play classical music. That's where I got the chordage for the song", he said -- and the lyrical composition was completed when he was 14 years old...four years before his band got going..."It was just this little thing I was playing, and I never dreamed it would end up as a real song or anything. ... It's about dreaming until your dreams come true."

The rest, as they say, is history. The link is here.

Normally I include a bass cover to Saturday's pop 'blasts from the past'...but not today, as it's really a nothing track. But the lead guitar, now that's something else again. This one is as good as it gets, including the improvised Phrygian Dominant outro at the end. The link is here -- and its definitely worth your while. This guy is awesome.

Today's classical 'blast from the past' was an immediate hit with the audience at its premiere in London on November 10, 1910 -- and a "complete triumph" for the composer, Edward Elgar. It's his Violin Concerto in B minor, Op. 61.

Even though Elgar's music fell out of fashion in the middle of the twentieth century, and the concerto's reputation as one of the most difficult in the violin repertoire grew (because of its use of constant multiple-stopping, fast and unorthodox string crossings, and massive, rapid shifting around the instrument), it nevertheless continued to be programmed and played by acclaimed violinists.

Here's England's own Nigel Kennedy doing the honours at the Proms in London in 2008. He was a child prodigy -- and a hellion when he was a teen. I know that from personal experience, as I met him when he was about 18 years old when I was on the board of directors of the Edmonton Symphony Orchestra. He has matured greatly -- and is now beloved and respected by audiences and orchestras world-wide. The link is here.

![]()

When I got up on Friday morning and saw the charts, I was prepared to be 'spectacularly wrong' about 'da boyz' not wishing the precious metals to end the week on a positive note...like I'd mentioned in The Wrap yesterday. However, true to form, they showed up in force at the 10 a.m. EST afternoon gold fix in London -- and that was that.

This bear raid by the collusive commercial shorts was most likely premeditated -- and they weren't taking too many prisoners, although gold, platinum and palladium did manage to close in the green by varying amounts...which I consider to be a big positive. But it was silver that 'da boyz' were really after -- and they got it good...an intraday move of a bit over four bucks in the March contract...not too shabby.

Of course the sole purpose of this bear raid was to get the Managed Money traders et al. to puke up as many long positions as possible, so the commercial traders could cover more of their short positions...especially in silver.

Gold was closed well off its high tick of the day -- and it remains a hair below the overbought mark on its RSI trace. 'Da boyz' took back virtually all of silver's big Thursday gain...but not all of Thursday's gains its associated equities. It's still a tad above the overbought mark on its RSI trace.

But the volume in silver was absolutely off the charts. If there's been a bigger volume day in silver, I don't remember when it was. It's certainly one of the small handful of record volume days I've seen in silver since I began to follow this sort of thing when I latched onto Ted Butler about fifteen years ago. Gold's volume was very heavy as well, but barely moved the needle on 'Record Volume' dial.

That massive silver volume...along with the huge $4+ intraday price move, is all the proof one needs that the collusive commercial traders of whatever stripe were almost solely focused on it. My kingdom for a peek at the COT Report for silver as of the COMEX close yesterday!

And one last thing. It should be noted that 'da boyz' were careful to close gold just below $4,300 spot -- and all three attempts that silver made to close above $62 spot...were also quietly turned aside.

Platinum was stopped in its tracks shortly before it broke above $1,800 spot -- and was closed well off that mark. Palladium was the last remaining precious metal that would have closed at heaven only knows what price if 'da boyz' hadn't worked their magic in the COMEX futures market.

Copper wasn't spared, either...as it was closed lower by 13.3 cents at $5.281/pound...giving back all of Thursday's gain, plus most of Wednesday's as well. It certainly appears as if the commercial traders of whatever stripe are trying to roll over its current rally.

Natural gas [chart included] continued its precipitous decline, as it was closed lower by a further 13 cents at 4.10/1,000 cubic feet. At its intraday low tick ...$4.07...it touched its 50-day moving average. WTIC closed down by an inconsequential 7 cents at $57.53/barrel. This is a dirt-cheap price for crude.

Here are the 6-month charts for the Big 6+1 commodities...thanks to stockcharts.com as always -- and are worth a look if you have the interest. Once again, the silver candle for yesterday doesn't show its intraday move...only its closing price. Click to enlarge.

It's impossible to know if yesterday's premeditated bear raid by the collusive commercial traders of whatever stripe was a 'one and done'...or is there more price pressure to the downside still to come.

There are about ten trading days left in the month -- and the year -- and as I mentioned earlier in the week, it's hard to tell what 'da boyz' have in store for us between now and then.

The November Bank Participation Report [for October] showed that since at least July, the world's banks have been aggressively covering their short positions in both silver and gold -- and in the case of the 5 U.S. bullion banks in silver, they appear to out totally.

Of course all this big short covering by 'da boyz' in the last many months is certainly one of the reasons why both silver and gold prices have been rising like they have -- and also why total open interest in both has been in a general decline. Of course not to be forgotten is the ongoing 'Bonfire of the silver shorts'...as many small traders are short covering and finally booking huge losses.

That 'bonfire' had a little cold water thrown on it yesterday, but it hasn't been extinguished -- and with that 'rapacious' silver demand still out there, I doubt that it will be too long before silver recovers all of its paper losses that 'da boyz' handed out yesterday.

As I've been saying since early in the year, what appears to be going on is a global book-squaring operation by the banks and other big commercial traders -- and it's still ongoing in December, with huge deliveries on the COMEX continuing unabated...with more contracts being added every day.

On top of that -- and hanging over all of it, is the ever-louder drumbeat of that structural deficit in silver.

And if that wasn't enough, there's the showdown in the European Union coming up next week -- and all of that is spelled out in the Critical Reads section further up -- and in this almost 31-minute video commentary over at the duran.com from yesterday, which is linked here. It's definitely worth watching if you have the interest. Will this event trigger David Rogers Webb's 'The Great Taking' you ask? Who knows.

Because of that, I'm wondering if yesterday's bear raid in the precious metals was one last swing for the fences before everything comes unglued in Europe.

As Gandalf the White said..."Things are now in motion that cannot be undone."

All we can do is watch, wait -- and hope that we're not collateral damage if things really do go totally nonlinear over there...because any problems that develop over there, will spread like wildfire across globe in very short order.

I'm done for the day -- and the week -- and I'm still "all in."

See you here on Tuesday.

Ed