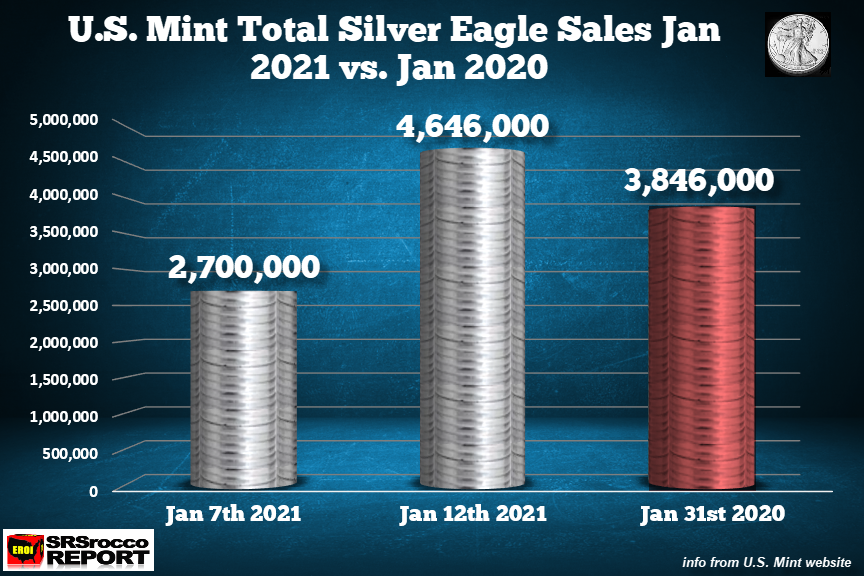

With the continued disintegration of the economic and financial system in 2021, investment demand for physical precious metals continues to be strong. After the U.S. Mint posted a stunning 2.7 million Silver Eagles sold during the first week in January, they just posted another update, which already blew past last year’s figure by a wide margin.

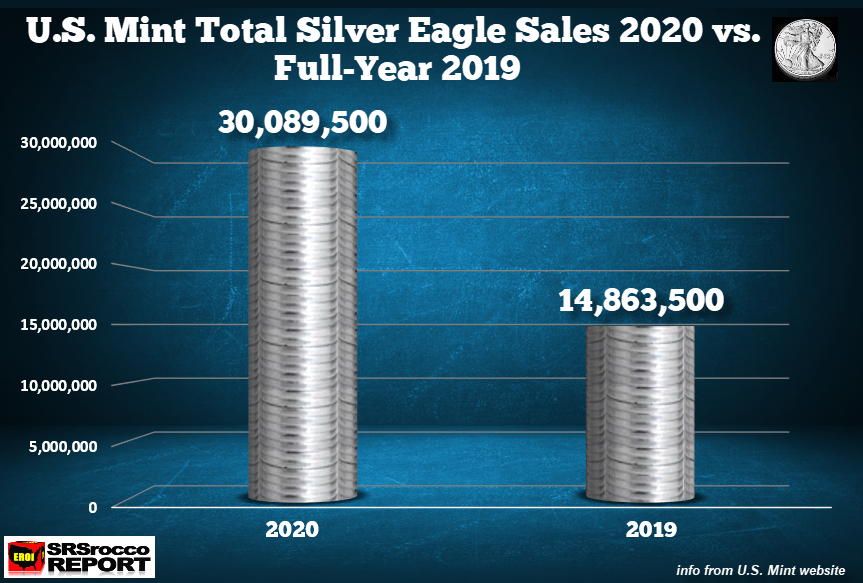

Remarkably, just the U.S. Mint Silver Eagle sales for the first two weeks in January accounts for 7% of the average monthly global silver mine supply. That’s a lot of silver demand, considering the U.S. Silver Eagle sales are only a small segment of the total global silver market. As I have mentioned in several articles, if we see another record year of physical and ETF silver demand this year like we had last year, the silver price will likely surpass the $35 level.

Now, according to the U.S. Mint’s most recent update, they sold almost 2 million more Silver Eagles this week to the Authorized Dealers. Total Silver Eagle sales as of Jan 12th, are 4,646,000. Already, for the first half of the month, the U.S. Mint sold 800,000 more Silver Eagles than during the entire month last year.

What’s interesting about Silver Eagles, even though the quality of .999 silver is less than its closest competitor, the Canadian Silver Maple coin at .9999 silver, the premium is higher. Silver Eagle premiums can run $1+ more than a Canadian Silver Maple. But, for whatever reason, Americans continue to buy a lot more Silver Eagles than Silver Maples.

With demand for silver investment reaching a record last year, Silver Eagle sales surpassed 30 million in 2020.

If the U.S. government passes the Federal Reserve “Digital Dollar Policy” this year, we could experience serious inflation. The Fed’s Digital Dollar Policy could directly send Americans money into their banking accounts without the need to add debt to the U.S. Government balance sheet. Furthermore, the Fed Digital Dollar Policy would no longer impact interest rates as its current QE policy of buying Treasuries, as a means of liquidity, brings artificial demand, thus lowering interest rates.

The Federal Reserve does not want to force Treasury Rates negative, so getting its Digital Dollar Policy passed by the Congress and Senate will likely be its primary focus. Thus, if the Fed and ECB (European Central Bank) get Digital Currencies, it could be bad news for Bitcoin and Cryptocurrencies.

We put out a new ULTIMATE CRYPTO REPORT on discussing many issues that tend to be overlooked by crypto investors.

My associate, the Tactical Trader, and I agree that Bitcoin will likely continue to experience a lower correction that could wipe out a lot of gains from investors who got in late. With Bitcoin and Ethereum seeing a 24-hour trading action of -20% and -25%, respectively, these will never become alternative currencies. They are way too volatile for wide acceptance as an alternative currency.

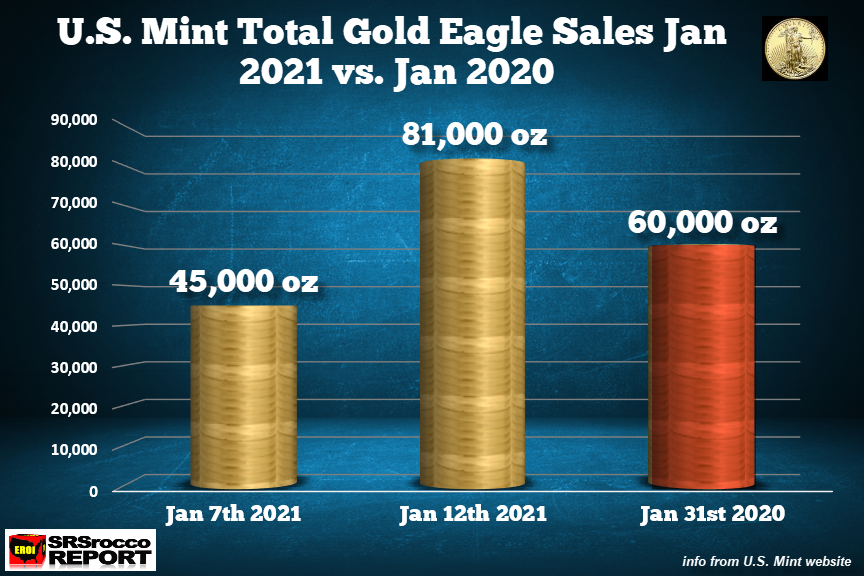

Getting back to the precious metals, the U.S. Mint also sold 81,000 oz of Gold Eagles in the first two weeks of the month versus 60,000 oz for the entire month last year.

So far, during the first half of the month, the U.S. Mint has sold 57 times more Silver Eagles than Gold Eagles. Mark my words, Silver Eagle investors are going to be happily rewarded in the future as the value of silver increases more in percentage terms than gold as the world being to head over the ENERGY CLIFF.

Also, if you have not yet seen my IMPORTANT VIDEO UPDATE on JAN 9th, I highly recommend it. If people think Tesla and Bitcoin stocks prices are signifying a NEW HIGH-TECH WORLD, they will be sadly mistaken. Tesla, Bitcoin, and the broader market indexes are all in MAJOR BUBBLES. While bubbles can go on longer, they all POP.

This is why it’s extremely wise to invest in physical precious metals as they will be one of the best stores of value while most assets (STOCKS, BONDS, & REAL ESTATE) decline during the coming Depression that never ends.

DISCLAIMER: SRSrocco Report provides intelligent, well-researched information to those with interest in the economy and investing. Neither SRSrocco Report nor any of its owners, officers, directors, employees, subsidiaries, affiliates, licensors, service and content providers, producers or agents provide financial advisement services. Neither do we work miracles. We provide our content and opinions to readers only so that they may make informed investment decisions. Under no circumstances should you interpret opinions which SRSrocco Report or Steve St. Angelo offers on this or any other website as financial advice.