$AR.TO, $ARNGF, $ALO, $ARTG.V, $ARGTF, $BSR.V, $$BBSRF, $KOR.TO, $CORVF, $EGO, $AG, $GBR.V, $GTBAF, GUY.TO, $SVM, $ZIJMF, $LUM.V, $LMGDF, $LUG.TO, $FTMNF, $MGG.V, $MMRGF, $MAI.V, $MAIFF, $NGD, $NUAG.V, $PVG, $WHGOF, $WGO.V

For everyone interested in gold, silver and the mining equities, the must read annual report was published towards the end of May; The In Gold We Trust Report. The following is a link to download the full report (though on the website, there is a compact version as well): Click Here. I had the honor of contributing to the report this year and its rare to find any report where so much time and thought is put in by so many individuals. It is definitely worth taking the time to read.

With the Federal Reserve providing an ideal environment for higher precious metals prices through 0% interest rates, continuation of massive asset purchases, and potentially fixing the yield curve, precious metals prices are poised to take-off in the not too distant future. The gold price continues to consolidate, unable to break resistance, gold and silver prices are still at risk of a correction. It wouldn't be surprising or unhealthy to see gold test the mid-to-low $1,600's but that remains to be seen and therefore a correction in mining stocks. For the week ended June 12th, news-flow continues to be rather subdued as company's focus on ramping up operations, although M&A continues. Stay nimble.

Argonaut Gold: Announced the conclusion of schedule 2 amendment, a key authorization by the Canadian federal government in regards to the Magino project. The regulatory process has been completed. The most likely path forward in developing the Magino project is finding a joint-venture partner. This is a lower return project with initial capital costs of approx. $321m for a project that would produce on average about 130k oz. Au over the first 14yrs and 115k oz. over 17yrs (inclusive of three years processing low-grade stockpiles. At gold prices of $1,450/oz. or higher, its AISC margin will be about 50%, making this a very profitable project with cash costs and AISC/oz. Au of $669 and $711. But the company could unlock additional value as the company has and continues to intersect high-grade gold below the planned open-pit in the feasibility study. Going forward, if the company develops an underground component as well, it would result in a material increase in annual production either initially or a couple years into the start of open-pit mining. Alternatively, it could be mines after depletion of the open-pit. More drilling and technical studies will be needed.

With the closing of the Alio Gold acquisition and if gold prices continue to rise towards or above $2,000/oz., Argonaut should think about developing the project on its own, or at least retain a large controlling interest. In the Alio deal, which was announced primarily for the Florida Canyon project as it adds immediate production, the Ana Paula development project should be the primary focus, in terms of development projects as it would add roughly 115k oz. of high margin gold production from a project of low capital intensity. The company may also choose to divest the asset, but in my view, that would be a mistake.

Highlights from the Ana Paula Pre-feasibility study:

- Initial capital costs of $138m

- Cash costs and AISC of $489/oz. and $525/oz.

- 85% gold recoveries

- Initial 7.5yr mine life (although successful exploration drilling continued after this was published)

- Average annual production of 115k oz. Au

- Underground potential

- After-tax NPV and IRR using a $1,600/oz. gold price of $377m and 51%. Even using a $1,200/oz. gold price, after-tax NPV and IRR of $202m and 32%.

Artemis Gold: Artemis Gold may have made a transformational acquisition as it announced it would acquire the sizeable Blackwater project from New Gold for a $140m cash payment at closing and $20m of Artemis shares, equivalent to 9.90% of the outstanding shares as of closing. It will make a second cash payment of $50m, 12 months after closing for a total of $190m. New Gold will also retain an 8% gold stream with an on-going per oz. payment of 35% of the prevailing spot price, dropping down to 4% once 280k oz. Au are delivered. The BOD and management own 45% of the company and look to retain significant ownership as the company raises money to advance Blackwater.

Blackwater is an excellent project (though it needs higher gold prices such as that which we have now), which New Gold paid upwards of C$600m to acquire back in 2011 and 2012. A feasibility study was published in 2014, demonstrating solid economics at a $1,750/oz. gold price. The M&I resource Is substantial totaling 9.5m oz. Au, with exploration upside potential. Artemis has outlined its strategy towards development of Blackwater, beginning with reducing initial capital expenditures by staging the mine throughput ramp-up while remaining committed to the full-scale project. It will undertake a phased approach, through a smaller initial operation followed by one or two expansion to follow in order to achieve the 20mtpa throughput. The 2014 FS resource modelling identified a larger higher-grade zone of mineralization near-surface within the southern half of the pit design which will be the focus of further mine planning. The company will prepare an updated pre-feasibility study based on its revised approach to developing the project over the next three months.

Per the 2014 feasibility study, life of mine gold and silver production will total 7m oz. Au and 30m oz. Ag. Over the first 9yrs, average annual gold production will be 485k oz. at cash costs and AISC of $555/oz. and $685/oz. The initial mine life is 14yrs, with 17yrs including processing of stockpiles. Initial capital expenditures are substantial at $1.87b, and in turn the project really isn’t economic (meaning generating a minimum of a 17-20% IRR) without a $1,700-$1,800/oz. gold.

On Friday, Artemis announced up to a C$155m private placement through the issuance of 31.5m subscription receipts together with undertaking a non-brokered private placement. The subscription receipts will be issued at a price of C$2.70 per receipt for aggregate proceeds of C$85.05m and the private placement will raise gross proceeds up to C$70m.

Bluestone: As the company moves closer to a production decision, the company has engaged in infill drilling. The company released the results from 14 underground and 4 surface holes:

- 15m @ 21.6 g/t Au and 52 g/t Ag

- 7m @ 10.7 g/t Au and 131 g/t Ag

- 4.8m @ 18.2 g/t Au and 97 g/t Ag

- 2.3m @ 14.6 g/t Au and 9 g/t Ag

A 9,000m ongoing drill program focused on the South Zone of the deposit. Three drill rigs will continue drilling the South Zone from surface, and in the underground working, two additional rigs are expected to be added over the coming weeks. The drilling will build on infill drilling completed in 2019 in the North Zone, which resulted in an updated resource estimate of 1.41m oz. Au @ 10.3 g/t Au. A Feasibility study was completed in 2019, so the company is putting together a financing package, which is expected to be finalized in Q3 and the company remains on track to reach production in the 2H 2022.

Corvus Gold: Provided an update on a lower-capex, nearer-term production scenario. Corvus envisions a mining plan that will differ from the 2018 PEA, which saw both the development of Mother Lode and North Bullfrog. The company is now turning its attention towards a phased approach whereby it is evaluating an initial, lower-capex mining option by developing the North Bullfrog deposit first, which could generate enough cash flow to fund the development and expansion of Mother Lode and other projects throughout the district. Corvus will release an updated PEA in the fall that incorporates an initial Phase-I started projects and information on the North Bullfrog Phase-II expansion and the Mother Lode deposit. This will also include an updated resource estimate. Corvus remains an attractive takeover target and so it will be interesting to see what happens over the next 12-18 months.

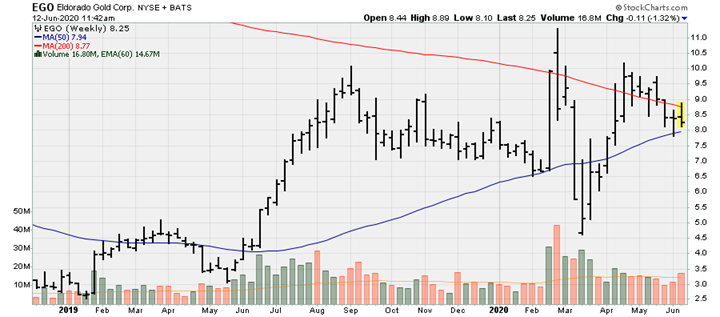

Eldorado Gold: The construction of a 3km decline/tunnel at Lamaque is commencing, from the Sigma mill to the 405m level of the Triangle mine. This is the first step toward increasing annual production. This minimal capital investment will provide both near and long-term benefits as production grows at Lamaque. In Q3, surface construction on the portal will begin. Detailed engineering and site preparations for the decline will commence this month. The decline is expected to be completed by mid-2022 for an estimated $24m. The company is also evaluating the possible additional of an underground crushing and conveying system and a potential mill expansion. The company received a permit allowing for the expansion of the Triangle underground mine production at Lamaque from 1.8ktpd to 2.65ktpd. This could eventually propel production closer towards 160-175k oz. annually, and at the very least increase production towards 145-155k oz. p.a. Towards the end of the year, a clear path forward will be laid out. The company is finally making some headway in Greece, and more should be known regarding the possible restart at Skouries later this year.

First Majestic: The company made a curious albeit smart strategic move by announcing it will acquire a 50% silver stream from First Mining’s Springpole project, and at a very attractive price. In exchange for $22.5m in cash and shares over three staged payments, the company will obtain a 50% silver stream with an on-going purchase price equal to 33% of the prevailing spot price and subject to a cap price of $7.50/oz. as well as 30m warrants with a strike price of C$0.40/share with a 5yr maturity, beginning once this deal closes. In years 2-9 of operations, the project will produce an estimate 2.4m oz. Ag annually (1.2m attributable to First Majestic) and produce a total of 22m oz. Ag over the life of mine barring any additional exploration success. First Majestic will make a $10m payment upon closing ($2.5m in cash and $7.50m in equity). Once the pre-feasibility study is completed, First Majestic will remit an additional $7.5m (3.75m in both cash and equity). Upon receipt of a federal or provincial environmental assessment approval for Springpole, First Majestic will remit the remaining $5m (split equally between cash and equity).

Great Bear Resources: The story only continues to get better and better, as Great Bear is sitting on a substantial high-grade deposit in Canada. Great Bear has only scratched the surface of Dixie’s exploration potential only because the mineralized area is so large and will take time to fully delineate. This year, in 2020, Great Bear’s exploration is focused on the LP fault and it continues to report excellent drill results from its on-going fully funded $21m exploration program. The LP fault continues to illustrate superb continuity of near-surface high-grade gold and just announced the best two intervals (widest, highest-grade interval) from this area to date. Deeper drilling towards the northwest of its planned grid program has extended high-grade gold mineralization. The company has now completed 115 of 300 drill holes in the LP fault target, as part of its 5km long by 500m deep grid drill program. Recent drill result highlights include:

- 20.55m @ 31.33 g/t Au within a total mineralized interval of 45.10m @ 14.65 g/t Au (best interval from the LP fault to date)

- 12.40m @ 30.51 g/t Au within a broader interval of 25.15m @ 15.45 g/t Au (the second-best interval).

Guyana Goldfields: Silvercorp decided not to match what was considered to the be “the superior offer” Guyana Goldfields announced last week. On Friday, it was announced that it was Zijin Mining who made the all-cash offer for C$323m. Zijin has been quite active on the acquisition front over the last couple of years, with its most recent acquisition being that of Continental Gold in Colombia.

Lumina Gold: Ross Beaty, the founder of the Lumina group of companies continues see to Lumina Gold improve (economically speaking) as the updated PEA for the Cangrejos project has improved significantly relative to that published in 2018. The mine life has been increased from 16yrs to 25yrs, with average annual gold and copper production being maintained (366k oz. Au and 46m lbs. Cu). The initial capital costs have increased 20% to $1b (plus an additional $454m in expansion capital), which yields an after-tax IRR of 21%, so this has now become economical (as most companies require a 20% minimum IRR for investment projects) assuming a $1,680/oz. gold price. The economics should continue to improve as the project advances as a result of additional exploration upside and higher gold prices.

Lundin Gold: The company announced the closing of a $57.5m bought deal financing, through the issuance of 4.772m shares, which includes the exercise, in full, of the under-writer’s over-allotment option of an additional 622.5k shares. The proceeds will be used for working capital, resource expansion, and increasing throughput at Fruta del Norte. This may not have been necessary if not for the mandatory suspension of operations caused by the CV19 pandemic. Lundin Gold is ramping operations back up and in Q3, it should really illustrate significant cash flow generation. It also remains a takeover target, with Newcrest Mining looking like the best suitor given its interest in the company but only time will tell.

Minaurum: Closed its 4.2m private placement, issuing 10.525m units at $0.40/share. The primary subscriber was Sprott Global Resource Investments. Each unit consists of one share and one-half warrants. Each warrant is exercisable to acquire an additional common share with an exercise price of $0.60 for a 24-month period following the closing of the private placement. The proceeds will be used for exploration of the Alamos Silver project. This is an exciting silver exploration story to keep track of as it another company Dr. Peter Megaw is involved with, in addition to Reyna Silver, which recently began trading and has acquired some MAG silver assets, including a highly prospective carbon replacement deposit.

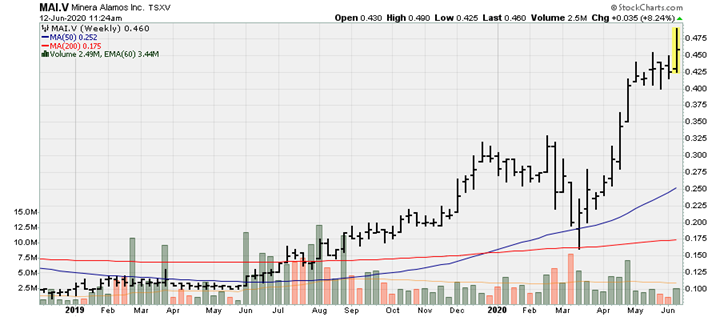

Minera Alamos: The company continues to expand mineralization at its Santana Gold project in Sonora, Mexico. Additional phase II drill results were released. Phase II was completed over the past year and initiated as a follow-up to the company’s first drill program in 2018/2019. These new holes were designed to test the northern limits of the Nicho main zone and to continue evaluating the potential for further extensions of known mineralization to the south and southwest. Highlights include

- 56.5m @ 0.52 g/t Au

- 24m @ 0.65 g/t Au

- 37.2m @ 0.89 g/t Au

- 24.3m @ 1.05 g/t Au

- 109.5m @ 0.89 g/t Au

- 20m @ 0.66 g/t Au

Phase III drilling plans, which will commence in the second half of the year will be relatively small between 6k-7.5k meters. This will include further drilling at Nicho (20-25 holes), initial drilling of 15-20 holes at the Zata, Gold Ridge, and newly identified Bufita.

New Gold: The company continues to illustrate just how bad it has been mismanaged over the course of the last decade, selling what would be its most valuable asset in Blackwater to Artemis gold. It paid roughly $600m in separate purchases (to expand the land package and gain full ownership) back in 2011 and 2012, only to announce the sale this week for $190m. The only silver lining is that it retained an 8%/4% gold stream, which could be sold in the future to a royalty and streaming company for additional capital. New Gold also announced it had commenced a $400m offering of senior notes (7.50%) due in 2027. The company will use the proceeds to fund the redemption of its outstanding notes (6.25%) due 2022.

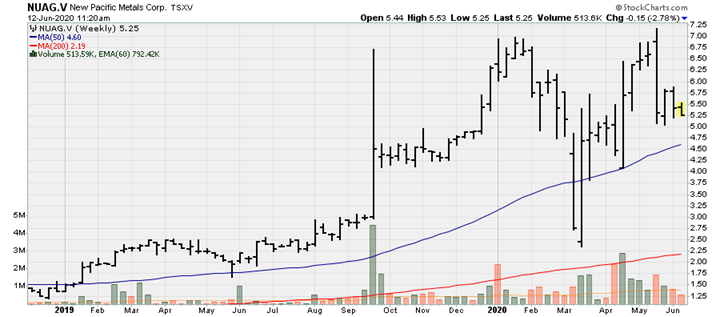

New Pacific Metals: One of the most exciting silver exploration company on the market (as seen through its massive maiden resource estimate, which contained approx. 191m across all categories) announced it closed a C$25m bought deal financing. Due to such early exploration success and a relatively low cost of equity, the company only had to issue 4.238m shares. Silvercorp participated in the offering and purchased 1.32m shares in order to maintain its pro-rata 28.8% and further increased its interest by 100k shares. The proceeds will be used for exploration ad advancing the project towards completed a preliminary economic assessment.

Pretium: The company filed a preliminary base shelf prospectus, which will allow (when made final) the company to raise up to $600m via common stock, debt, and purchase warrants. Although Brucejack has failed to live up to expectations by a wide-margin, the asset is still generating material cash flow, more than enough to pay down existing debt. While AISC is expected to be rather high, this is more than negated by the increase in the gold price. That being said, the base shelf prospectus makes the most sense if it intends to acquire another company or asset. Pretium remains a takeover target given the scale of Brucejack and its jurisdiction.

White Gold: One of the more exciting exploration companies focused on the Yukon, closed a fully subscribed $6m private placement led by Eric Sprott as well as Agnico and Kinross such that both companies maintain a 17.10% interest in the company both contributed exploration assets to. Having select exploration vehicles will likely be how senior producers fund exploration; via outsourcing.