With National debt now well passed $26T and total debt pushing $80T (public & private) and the massive monetary inflation (not consumer Price inflation) that has taken place over the 3-months, gold should be well past $2k/oz. Unlike 2008, all this inflation won't simply be more or less idle in bank reserves [notably excess reserves] or show up primarily in asset prices, rather a significant amount was helicopter money, which will work its way into consumer prices rather quickly. For a lack of a better term, "the new normal" is negative real interest rates as far as the eye can see, numerous stimulus packages [possible every year], deficit spending [inclusive off budget-items] of at least $1.5-$2T/yr and an acceleration of debt accumulation.

The unprecedented monetary and fiscal policy response is unlikely to go away and more likely to become more reckless and dangerous, creating the perfect storm for gold, silver, and related mining equities. Hold Strong. Our time has coming.

This past week was a rather wild rate for the mining indices as they traded in a rather wide range. Gold and mining equities will likely break-out or break-down, at least in the near-term [as we could see the summer doldrums]. A breakdown to the $1,650/oz. level would be healthy and build a strong base for the next leg up. However, with everything that is going on the world, gold and silver should already be much higher. Nonetheless, it is only a short-matter so position right, hold tight and block out of the noise of no-nothings who constantly bash gold due to ignorance, not by fact or logic.

$RZZ.V, $ATBYF, $AGG.V, $AGGFF, $CDV.TO, $CRDNF, $ELY.V, $ELYGF, $FSX.V, $FSXLF, $CGM.TO, $TPRFF, $GBR.V, $GTBAF, $KNT.V, $KNTNF, $KGC, $KTN.V, $KOOYF, $BMK.V, $MCDMF, $MKO.V, $MAKOF, $MUX, $TRX, $TNX.TO

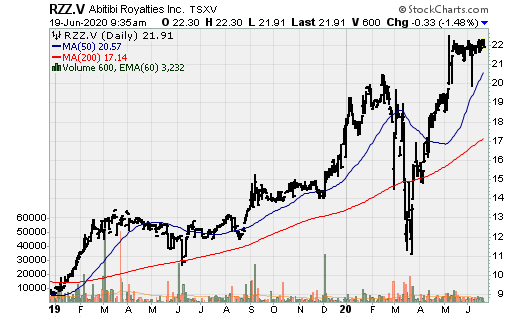

Abitibi Royalties: What has historically been a royalty company primarily focused on and around the Canadian Malartic Mine (as well as the occasionally royalty here and there) and has had great success in terms of share price appreciation, has pivoted in its strategy. The company announced it would acquire the Hammond Reef South Project [which adjoins Agnico’s Hammond Reef Project in Northwestern Ontario]. Hammond Reef is a big project with 5m oz. in total resources, so this could be longer-term strategic planning on part of Abitibi, in that Agnico may choose to acquire this adjacent property in exchange for cash and a royalty. It is an inexpensive move as the project was acquired from a group of private investors for C$70k and a 0.50% NSR royalty.

African Gold Group: The company announced the feasibility study (FS) of its Kobada project, which is rather strong at today’s gold prices. The highlights include:

- Average annual production of 100k oz. p.a. over the first 5yrs, with total gold production of 728k oz. over an initial 9.4yr mine life [based on reserves] and average operating costs and AISC of $704/oz. and $782/oz.

- Using a $1,530/oz. gold price, the after-tax NPV5% is $226m with an internal rate of return (IRR) of 41.1%.

- Initial capital expenditures of $125m.

- Exploration upside with an additional 435k oz. Au of M&I resource and 1.138m oz. Inferred. To date, the company had demonstrated an excellent conversion rate.

Drilling in the second half of the year will focus on upgrading resources to reserves, which, if successful, could extend the mine life by 5-10 years (depending on the conversion success of M&I and Inferred Resources) or maintain a production profile of 100k oz. p.a. (should higher-grade oz. be found via exploration or conversion of higher grade resources) The process plant was designed with the flexibility to exceed 100k oz. p.a. based on throughout and head grades. There are many 100-250k oz. producers focused on West Africa, so African Gold Group could make for a prime takeover target.

Cardinal Resources: M&A continues, although it was slowed by the CV19 pandemic as Cardinal Resources received an all-cash takeover offer by Shandong Gold. The takeover price will be A$0.60/share, representing a 75.5% premium to the 20-day weighted average price (not accounting for volume), and a 39.3% premium to Cardinal’s 20-day volume weighted average price (VWAP) up to June 18th. This is also a 31.1% premium to the Nord Gold proposal of A$0.45775/share. This is the second bidding war we’ve seen over the last several weeks, first over Guyana Goldfields and now over Cardinal Resources. While it has become more common place for senior and mid-tier producers to make offers and acquisitions using at the market prices or a relatively small premium i.e. 20% +/- or so, far more material premiums continue to be the case when it comes to single asset companies.

Ely Gold Royalties: Over the last while and especially so far this year, Ely has been acquiring royalties at a furious pace and while they may be small, they do start to add up. In the last 5-weeks the company has announced the acquisition of the Jerritt Canyon NSR, a key Nevada royalty portfolio, a 3% NSR royalty on the Olympic Gold Project, and a 0.40% NSR on the Borden Lake Gold Mine operated by Newmont. This week, Ely announced an option agreement on the White Rock Gold Project with a 2.0% NSR and will also be paid $250k over four years and a $25k annual advance mining royalty payment from Provenance Gold in exchange for the acquisition of 30 unpatented lode mineral claims.

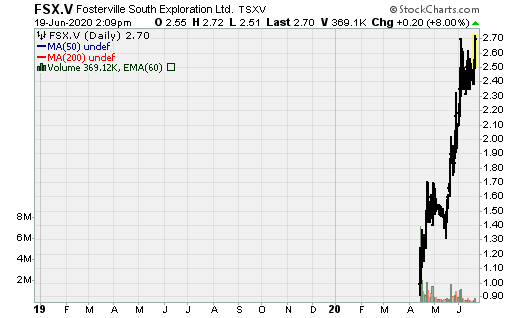

Fosterville South: Provided assays from multiple wide intercepts of high-grade gold near surface from initial shallow scout drilling at Golden Mountain. Results from this initial near surface percussion are summarized as follows: 2m @ 10.78 g/t Au, 18m @ 5.34 g/t Au, 3m @ 5.36 g/t Au and 7m @ 3.57 g/t Au.

Gran Colombia: Like so many companies, operations have more or less return to normal. The company reported production of 18.13k oz. Au in May, 98% of that achieved in May 2019. Gold production in the first five-months of the year are 86.98k oz. Au vs. 99.6k oz. in 2019. This can be attributed in large part to the impact on production in April. The company will need to update its guidance, revised low, though a reasonable estimate would be 215-230k oz. Au. Marmato ramp up has been slower relative to Segovia but given it is so much smaller, at least prior to the completion of the expansion by Caldas Gold.

Great Bear Resources: I sound like a broken record but Great Bear released more positive news-flow again this week. The company announced the discovery of the new high-grade Arrow zone. Targeted regional drilling repeated success of the original Hinge zone discovery of 2018, 1km west of the Hinge zone. Drilling intersected three zones of gold mineralization including a 15m wide interval containing high-grade visible gold in quartz veins, the Arrow zone. These new veins have the same characteristic of the Hinge zone veins at Dixie, and the high-grade zone at the Red Lake Gold mine. This goes to again reinforce the vast discovery potential of the Dixie project. The new drill hole completed 1.2km to the west-northwest of the Hinge zone: 2.10m @ 19.32 g/t Au. As drilling continues, we should expect many more high-grade intervals from this zone.

K92 Mining: The company continues to deliver strong operational performance despite the ongoing CV19 state of emergency in Papua New Guinea [PNG], declared on March 20th. Gold equivalent production in Q2 is on track to exceed that in Q1. Further, on June 16th, the state of emergency ended. Daily throughput as high as 700tpd has been achieved [well above throughput in recent years-550tpd]. Throughout for Q2 is expected to meet or exceed that in Q1. The stage 2 plant commissioning to double throughout from 200ktpa to 400ktpa is expected to start in Q3, reaching completion at that end of that quarter. K92 has been a great story and is looks as though the operations can undergo multiple optimization measures to increase average annual output. The stage III PEA is projected to be completed in July, which will consider an additional expansion. K92 still has considerable exploration potential as its displayed over the last couple of years.

Kinross: After some-time of negotiations, Kinross reached terms with the government of Mauritania to enhance partnership and while subject to definitive documentation, provides a clearer path forward for Kinross and one of its three world-class operations in Tasiast operation, or rather adjacent to. Under the terms of the agreement, the government will provide Kinross with a 30-year exploitation license for Tasiast Sud and repayment to Kinross of $40m in outstanding VAT refunds, with a payment schedule through 2025. Kinross will remit a $10m payment to the government after completion of the definitive agreement. Upon receiving the exploitation license for Tasiast Sud, Kinross will remit an additional $15m payment to revolve disputed matter arising out of Kinross’s prior application to convert the Tasiast Sud exploration license into an exploitation license. Kinross volunteered to updated its 3% royalty such that it becomes an escalating royalty tied to the price of gold. A renewed partnership approach for Tasiast Sud contemplates the government receiving a 15% free carries interest in Tasiast Sud with an option to purchase an additional 10% participating interest after additional feasibility work is completed. The updated royalty structure is as follows:

- 4% royalty below $1,000/oz.

- 4.5% royalty at $1,000-$1,199/oz.

- 5.0% royalty at $1,200-$1,399/oz.

- 5.50% royalty at $1,400-$1,599/oz.

- 6.0% royalty at $1,600-$1,799/oz.

- 6.50% at $1,800/oz. and above.

It is worth noting that this ISN’T on the primary Tasiast deposit and won’t impact profitability of the on-going operation, which is currently undergoing a phase-II expansion. This is on the nearby Tasiast Sud property, which is rather small at this point in time. Tasiast Sud has a reserve, Indicated, and Inferred resource estimate of 144k oz. Au 193k oz. Au and 817k oz. Au. This could be a ploy by the company just to make the government happy for a while or it could believe the potential economics of mining the Tasiast Sud 5-10yrs down the road will be able to withstand such a hampering royalty structure. Time will tell. Nonetheless, both Kinross and Kirkland Lake Gold [at the right price] may be the best picks for senior gold producer, both having robust organic growth profiles and what will be declining cost structures.

Kootenay: Following up on some nice drill results from its Columba project earlier in the year which had multiple high-grade intercepts, Kootenay just report assay results from first 100m drilled at its other silver-gold project, Copalito, which is believed to be high-grade. The results are a product derived from the initial 105m of the 3,000-meter drill campaign underway. The first hole tests returned a cumulative 8m @ 248 g/t Ag and 0.562 g/t Au, which correlate well with reported chip sampling at surface [10.2m @ 282 g/t Ag and 1.4 g/t Au]. Other highlights include 3m @ 244 g/t Ag and 1.09 g/t Au, 1m @ 360 g/t Ag within 22m @ 106 g/t Ag. Drilling continues at the property with the next holes planned to test the 5 Senores Vein, where chip sampling includes the following:

- 3.2m @ 426 g/t Ag and 2.9 g/t Au

- 5.3m @ 401 g/t Ag and 0.24 g/t Au

- 1m @ 1,155 g/t Ag

- 1m @ 396 g/t Ag

- 1m @ 534 g/t Ag

Macdonald Mines: Reported some excellent drill results (surface drilling) as well as extending the high-grade gold Villeneuve structure to over 225m in strike. These are the remaining assay results from its winter 2020 drill program and results from 3-holes of its spring drilling program at the SPJ property, 20km east of Sudbury. Select drill highlights include (results from another 4-holes drilled this spring are pending):

- 5.13m @ 27.2 g/t Au [visible gold observed]

- 6.04m @ 2.3 g/t Au [visible gold]

- 0.87m @ 9.2 g/t Au [visible gold]

- 3.08m @ 2.1 g/t Au

Mako Mining: There has been a lot of positive news-flow out of the Nicaragua focused mining company. The company is roughly 65% complete building its exceptionally high-grade [one of the highest grades for open-pit mines globally], low-cost San Albino project. But the company isn’t a one-trick pony and has been drilling some exceptional intercepts on its large land package. Mako has been releasing very impressive near continuous positive news regarding drilling both at San Albino and Las Conchitas [the latter near surface] over the last 3-months. Conchitas is located on the San-Albino land package [approx. 2.5km south] but isn’t part of the mine plan. The goal of the 2020 drill program at Las Conchitas is to focus on the most promising zones of near surface, shallow dipping, high-grade gold mineralization in order to delineate a maiden resource estimate. Since 2019, the Company has completed 65 shallow diamond drill holes totaling 4,351.70 meters within the Bayacun Zone, which is among the most promising zones within the Las Conchitas area. A total of 15,052.75 m within 197 holes have been drilled at Las Conchitas since the start of the 2019-20 drilling campaign.

There were 23 holes in this press release with assay results from the Bayacun zone. The company previously released assay results from 15 holes from September 2019- March 2020. Some highlights include: (note: 23 of the 38 holes reported to date at the Bayacun zone encountered at least 1 assay greater than 15 g/t Au)

- 2.2m @ 27.14 g/t Au and 1.7 g/t Ag

- 1.2m @ 12.78 g/t Au and 24.4 g/t Ag

- 1.70m @ 7.31 g/t Au and 10.7 g/t Ag

- 1m @ 15.41 g/t Au and 21.4 g/t Ag

- 5.7m @ 7 g/t Au and 11.4 g/t Ag

- 1.2m @ 21 g/t Au and 28.3 g/t Ag

- 0.90m @ 93.3 g/t Au and 61.4 g/t Ag

- 5.5m @ 23.11 g/t Au and 20.5 g/t Ag

- 1m @ 47.7 g/t Au and 72.5 g/t Ag

Of the last 38 holes drilled (23 in this press release), the following in a breakdown:

- 20 holes with composite interval average greater than 15 g/t Au (9 in this press release).

- 9 holes with composite interval averages ranging from 5 g/t Au to 15 g/t Au (8 in this press release).

- 6 holes with interval averages ranging from 1 g/t to 5 g/t Au (3 in this press release)

- 3 holes with values below the cutoff grade (1 g/t Au), all reported in this press release.

While this is pure conjecture, once production at San Albino is achieved and Calibre Mining has ramped up operations back to normal, Mako would make an ideal takeover target for Calibre, creating an emerging mid-tier producer focused solely on Nicaragua, with a significant land package and countless high-priority targets as well as already identified deposits which need to be developed.

McEwen Mining: The last couple of years have been very disappointing for the company, with its newest mine, Gold Bar failing to meet expectations by a wide margin and its inability to keep costs under control at its Black Fox mine. Higher gold prices should mask many of these issues beginning in Q3 but the company will need to execute on its objectives to really turn things around.

Mining at Black Fox was suspended from March 26th to April 14th due to the CV19 pandemic. It has been operating following provincial CV19 guidelines [below capacity]. The mine is underground a staged ramp-up. Underground exploration drilling along the upper west flank of the Black Fox mine encountered high-grade results within 120m to the west of the nearest mining area. Additional development and drilling are required to demonstrate continuity of mineralization on the west extension. This could suggest the potential to define new gold resources to the west. 2020 drill highlights include:

- 2.6m @ 79.2 g/t Au

- 1.7m @ 62.4 g/t Au

- 2.2m @ 97.8 g/t Au

- 2.5m @ 162.3 g/t Au

- 2.7m @ 19.9 g/t Au

- 1.7m @ 54.1 g/t Au

- 3.8m @ 40.6 g/t Au

- 2.4m @ 776.6 g/t Au

- 10.9m @ 5.3 g/t Au

- 1.8m @ 78 g/t Au

- 2.5m @ 20.2 g/t Au

- 4.6m @ 13.9 g/t Au

- 1m @ 218 g/t Au

- 2.6m @ 24.2 g/t Au

- 1.8m @ 46.3 g/t Au

- 5m @ 47.6 g/t Au

Black Fox obviously has the potential to be a much larger, must lower-cost, though that will take more time. By 2020, the company should commence production from the Froome zone, resulting in higher output and lower-costs. But greatly improved economics won’t end with the Froome zone as the company plans to accelerate the development of the Grey Fox project to coincide with the completion of mining at the Froome deposit. The production objective is 100k oz. p.a. 70-100% higher relative to output today.

The troubled Gold Bar mine was suspended on April 1st, restarting May 6th. An updated resource estimate and more importantly, a new mine plan is expected to be completed in early Q3. It will show a lower return project, likely with both lower output and higher costs.

Tanzanian Gold: Gold production has started at its Buckreef Oxide project. The company Is planning to start construction to increase the processing capacity by 200% in Q4 of this year. The company is moving to financial feasibility for the sulphide operations and now envisions a plant significantly larger than previously modeled, which could produce 150-175k oz. Au p.a.