- The best-performing precious metal for the week was silver, up 1.26%. According to BMO, the first silver pour at Aya’s Zgounder expansion was achieved, in line with previous commentary after ore processing in the new plant commenced. The plant reached nameplate capacity of 2ktpd, and commercial production continues to be targeted for year-end.

- Australia’s biggest gold miner, Northern Star, has agreed to buy smaller rival De Grey Mining for $3.3 billion, as the soaring value of the precious metal bankrolls the highest price ever offered for an undeveloped Australian gold project, according to the Financial Review. On Friday, SSR Mining agreed to buy the Cripple Creek and Victor gold mines in Colorado from Newmont Corp. for an upfront cash payment of $100 million.

- Gold buying by central banks surged to 60 tons in October, mainly led by the Reserve Bank of India (RBI), which added 27 tons of the precious metal to its reserves, the World Gold Council (WGC) said on Thursday. India added 27 tons of gold in October, bringing its total gold purchases to 77 tons from January to October, according to WGC data based on reported monthly data from the International Monetary Fund (IMF).

Weaknesses

- The worst performing precious metal for the week was palladium, down 3.11%. According to Scotia, B2Gold announced that a strike has begun at the company’s Fekola mine in Mali with the Fekola workers union giving notice that the strike will last until December 5. BTO continues to process ore through the Fekola mill during this period and noted that it still expects fiscal year 2024 production to be toward the lower end of its 420-450k ounce guidance. Additionally, Mali issued an arrest warrant for Barrick Gold’s CEO Mark Bristow as they have not settled their tax dispute with the company.

- De Beers has cut diamond prices by more than 10% across the board as the world’s biggest producer abandons attempts to put a floor under the slumping market. The diamond industry has been struck by one of its deepest and most prolonged slumps in decades, according to Bloomberg.

- The day after De Beers’ announcement, Chinese lab-grown diamond companies saw their share prices surge 9% to as high as 30%. The price cut instituted by De Beers may stimulate more diamond sales, but this shows the eroding future outlook for natural stones to be undercut by synthetic stones.

Opportunities

- For two years, J.P. Morgan strategists have urged investors to buy gold, and for two years they have been right. On Tuesday, the bank predicted a triple crown, saying gold is once again the top commodity to buy. "Gold still looks well situated to hedge the elevated levels of uncertainty around the macro landscape heading into the initial stages of the Trump administration in 2025," wrote a team led by Natasha Kaneva, head of J.P.Morgan’s global commodities strategy. Gold's extended rally is reminiscent of the late 1970s, another period when inflation was a persistent problem. The price has risen 29% this year to a recent $2,667 per ounce.

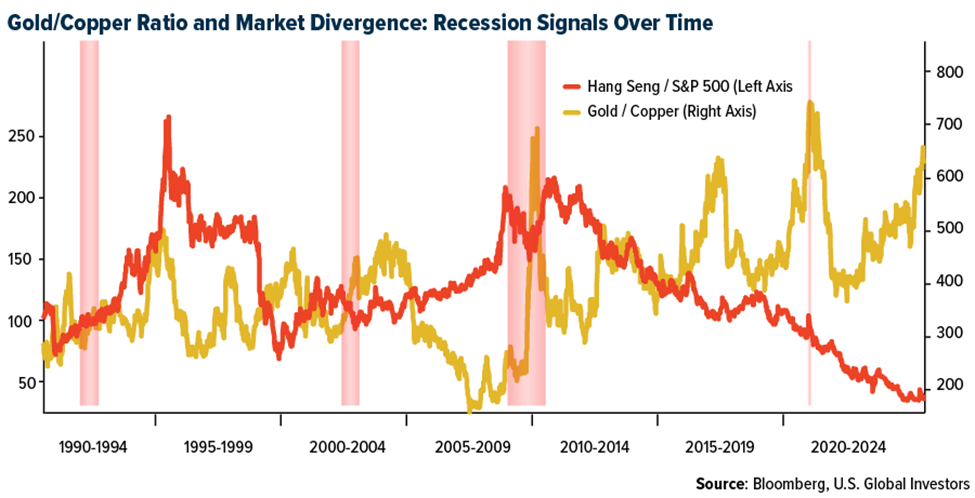

- Gold versus copper and the ramification of China’s strength versus the U.S., (as proxied by the Hang Seng Index divided by the S&P 500 Index) points more toward gold as the best opportunity in this macro backdrop. Copper typically outperforms gold when economic demand forces are predominant. The graphic created by Bloomberg shows the opposite, and with good reason, China is in decline. A roughly 50-year low in the Hang Seng Index versus the S&P 500 may suggest the potential for reversion, but with new U.S. leadership focused on correcting trade imbalances with China, the enduring uptrend in gold/copper could be gaining more fuel. The red shaded areas indicate recessions.

- Montage Gold has entered a strategic partnership with Sanu Gold Corporation, given its highly attractive exploration properties in Guinea, obtaining a 19.9% interest in Sanu through the issuance of 2.3 million basic shares of Montage equating to C$5.5 million. The company is joining existing strategic investor AngloGold Ashanti who acquired a 14.0% stake in Sanu in September 2024.

Threats

- A group of Indigenous tribes in Alaska have launched a legal challenge of a gold mine in northwest B.C., a project the group says threatens the Nass and Unuk rivers. Ecojustice, a Canadian environmental law charity, on behalf of a consortium of 15 Alaskan tribes called the Southeast Alaska Indigenous Transboundary Commission (SEITC), has applied to B.C.'s Supreme Court for judicial review of the Environmental Assessment Office's decision that Seabridge Gold's KSM mine near Stewart, B.C., according to CBC.

- Gold’s year-end outlook faces risks from a resurgent dollar, challenging the seasonal tailwinds that typically support the metal this time of the year. The precious metal typically sees its highest returns in December and January, with average gains of 2.4% and 3.5%, respectively, over the past 10 years. But after dropping 4% in November, its worst month in more than a year, gold has also started off December on the back foot, according to Bloomberg.

- Federal Reserve Chair Jerome Powell was speaking at the New York Times Dealbook Summit and compared Bitcoin to gold. "People use Bitcoin as a speculative asset. It's like gold, it's just like gold ---- only it's digital. People are not using it as a form of payment or a store of value," he said. "It's highly volatile. It's not a competitor for the dollar, it's really a competitor for gold. That's how I think about it.”