Strengths

- The best performing precious metal for the week was silver, up 3.78 percent on stronger industrial demand. After a slow start to the week, gold and silver were moderately higher in midday U.S. trading Thursday as haven demand returned due to China’s security law imposition on Hong Kong. The move by China ratcheted up tensions with the U.S. Gold rose Friday morning as investors awaited President Trump’s news conference to announce his China response. Broader equity markets have been somewhat euphoric on the immediate fear-of-missing-out hope for a COVID-19 vaccine. However, with little mention in the news, American investors cannot get enough gold. Swiss gold exports to the U.S. surged to 111.7 tons in April – the most on record.

- The annual “In Gold We Trust” report was published by Incrementum AG this week and it was filled with bullish expectations for gold. Fund managers and authors of the report Ronald-Peter Stoeferle and Mark Valek wrote that gold could approach $5,000 an ounce and possibly even push toward $9,000 an ounce by 2030. “The proprietary valuation model shows a gold price of $4,800 at the end of this decade, even with conservative calibration.” Kitco News notes that in the 2019 report, they accurately predicted that gold was in the early stages of a new bull market.

- New data out of Russia shows that gold production rose by 9.26 percent in 2019 for a total of 343.54 metrics tons, compared to 314.42 in 2018. Russia is the third-largest gold producer in the world. In April, Russian banks asked the Russian central bank to restart its official gold purchases, citing concerns over gold exports. Silver production was down 11.1 percent on an annual basis in 2019, totaling 996.17 tons, reports Kitco News.

Weaknesses

- The worst performing precious metal for the week was palladium, down 1.16 percent. Gold fell for a third straight day as of Wednesday as signs of improvement in some economies rolled back haven demand and offset concerns about growing U.S.-China tensions over Hong Kong. Gold fell toward $1,700 an ounce on strong economic data from China, but then finished the week around $1,731.

- Sibanye-Stillwater, the world’s largest platinum producer, said that it tested 120 employees for COVID-19 and 51 tested positive for the virus. The company used contact-tracing to identify who needed to be tested after two employees at Rustenburg operations in South Africa contracted the virus. Coronavirus outbreaks at mining operations could halt production and result in reduced output.

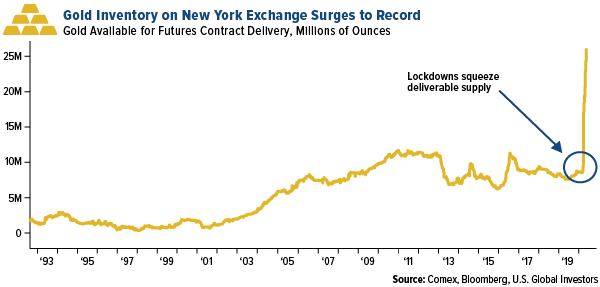

- The New York gold market is continuing to create headaches for traders. After the coronavirus pandemic grounded flights and created concern about physical delivery, gold futures rose to the highest premium to the spot price in four decades and attracted a flood of the metal to the U.S. Now contract holders are trying to avoid taking delivery from the massive inventory reports Bloomberg. This is like what happened with oil earlier this year, where demand plunged after stockpiles rose. The June gold contract is now below spot prices, just after seeing a $12 premium in mid-May and a $60 premium in March. New York exchange inventories stood at a record 26.3 million ounces as of Wednesday. Since the end of March, more than 17 million ounces have flowed into Comex.

Opportunities

- Gold miners in Australia are resuming a pandemic-disrupted exploration boom as metal prices surge amid a lack of new major discoveries. According to government estimates, spending on gold exploration in the country rose to a new record in the fourth quarter of 2019, while the annual total of more than $656 million was 20 percent higher than 2018. S&P Global Market Intelligence said in a report this month that there have been no major gold discoveries in the past three years. Rob Bills, CEO of Emmerson Resources Ltd., said “the cost of drilling hasn’t gone up, and there’s plenty of drill rigs out there, the market is quite responsive to discoveries, we’re quite positive.”

- Shandong Gold Mining plans to set up Streamers Gold Mining Corp. in Toronto to complete the purchase of TMAC Resources, according to a statement on the Shanghai Stock Exchange. The gold miner could invest C$210 million to set up a unit in Canada. Bloomberg News reports that on May 8, TMAC Resources said Shandong agreed to acquire all outstanding shares.

- Gold is known as a store of value and it has been providing a vital lifeline worldwide to those devastated by the economic impact of COVID-19. In Thailand, gold exports rose 830 percent from the same month a year earlier to 48 tonnes. This was also a 90 percent increase from March, as people sell their gold to get a hold of cash, reports Kitco News. Last month Thailand’s Prime Minister even asked people to sell gold gradually as shops could not handle the large volumes of sellers.

Threats

- Gold has seen its rally losing steam over the past month potentially due to rising real yields. Bloomberg’s Sungwoo Park notes that real yields are increasing in large economies such as the U.S., China and Japan, as inflation fell while sovereign yields rose. “That reduces the opportunity cost of holding no-yielding gold.” Other headwinds include improving risk appetite as more and more economies globally re-open as coronavirus restrictions are lifted.

- South Africa’s mines have been operating with half their workforce since a five-week shutdown ended at the beginning of May and starting on Monday all workers can return. However, there are questions surrounding how workers will be able to safely social distance in cramped mining conditions. The country has seen virus flare-ups temporarily closing individual operations, which could curb output and hurt profitability, reports Bloomberg. RMB Morgan Stanley analysts said in a note that “we could see a reset in South African mine production capacity lower, even once government mandated employment restrictions have been lifted.” Impala Platinum Holdings said that it takes between four and five hours to get tens of thousands of workers underground as screenings and health protocols slow the start of their morning shift.

- Cleveland Federal Reserve Bank President Loretta Mester cautioned that the economic recovery from the COVID-19 pandemic could be slow on a Bloomberg TV interview this week. “When we have so many people out of work it’s hard to imagine that we see a quick V-shaped recovery.”