Excerpt from this week's: Technical Scoop: Tariffs Reason, Golden Rebound, Dollar Tumble

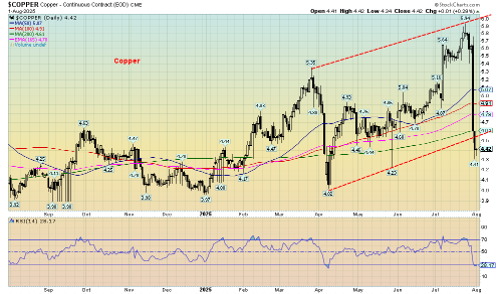

Copper

Source: www.stockcharts.com

We’ll close with the Fed standing pat at this week’s FOMC. The key message is the economy is doing just fine, according to Fed Chair Jerome Powell. But do the weak July job numbers change everything? Trump is calling for the Fed board of governors to overthrow Powell. That’s not likely to happen.

The world is drastically changed as a result of these tariffs. Add in the threats to Russia and others. Notably, other countries do not take orders from Trump and the U.S. But we can’t help but hark back to the 1930s and the trade wars that culminated in the Great Depression and World War II. So far, there are few signs that we are headed in that direction, but it is a warning.

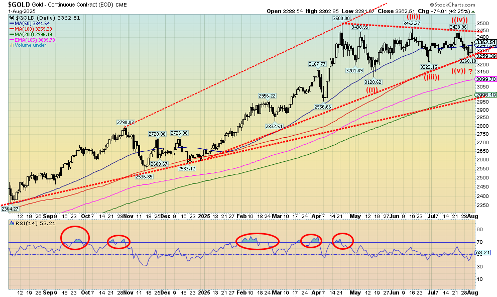

Gold

Source: www.stockcharts.com

It was a frightening week for the precious metals, especially copper. But then along came the July jobs report and the metals bounced back. However, only gold managed to bring its head back from under water, closing with a gain of 0.8% on the week. The others weren’t so successful. Especially hard hit was copper that crashed, down 23.5%. We covered copper earlier so no point in repeating. As to the others, silver fell 3.0%, platinum was knocked down 7.1%, while palladium dropped 4.3%.

After earlier having made new 52-week highs, both silver and platinum came down to earth. Both broke support. Earlier we had noted our nervousness over the fact that both silver and platinum made new highs but gold did not. A divergence. Did the chickens come home to roost? Now they both broke a support line but gold held. Another divergence? We’ll just have to wait and see. Only new highs for all three could save

the day. The big concern, however, is copper, a metal we normally see rising (or falling) with gold. Copper recovered a bit on Friday but it was only a small 0.3%.

Our key support for gold remains at $3,200. Below that level, a fall to $3,000 is possible. Optimistically, we look at what appears to be an ABCDE-type corrective pattern. Have we finished the E wave? Only new highs can confirm that. Gold likes the sound of potential rate cuts and Friday’s job report could be the catalyst to rate cuts. In one of his usual piques, Trump had the head of the Bureau of Labour Statistics (BLS) fired, accusing her (without evidence) of manipulating the figures for political purposes. Oddly, the deputy commissioner was appointed, at least temporarily, in her place. Nonetheless, the whole affair now throws into question future reports from the BLS. The agency has roughly 2,300 employees gathering data.

Gold appeared not to react to geopolitical maneuverings of the U.S. sending nuclear subs into regions closer to Russia. It’s hard to say at this time whether it means anything or is just bluster, given the current war of words between Russia and the U.S. Memories of the Cuban Missile Crisis (1962) leaped to mind. The U.S. has threatened to impose punishing tariffs on Russia and all who buy oil from Russia if Russia doesn’t comply with ending the Russia/Ukraine war in roughly 12 days. Those potentially impacted have noted it as a potential act of war that prompted strong words from Russia’s Deputy Chairman Dmitry Medvedev. If this dispute heats up any further, gold could rise more.

Analysts we follow seem mixed, with some noting the big drop earlier in the week as negative that could send gold and the metals lower. Others were more buoyed by Friday’s gains and signaled this could be the start of another rally. That’s why we await new highs. Silver has important support at $35.50/$36, but if that broke it could fall to $34.50 and, in a worst-case scenario, down to $33.00. The gold stocks weren’t hit too hard this past week so that bodes well for a rebound to get underway. The Gold Bugs Index (HUI) fell 3.0% but the TSX Gold Index (TGD) was down only 1.6%. It’s a bit worrisome if the TGD breaks 500 but more of a concern if it breaks 490. 10% or more corrections of the gold stock indices are not unusual, even in a strong up move.

The short-term (daily) trend did weaken for all the metals this past week but, outside of platinum, none have yet to turn down. And, so far, platinum’s downtrend is weak. Another down week could change all that, but an up week and positive follow-through from Friday’s action would be positive for the sector, supporting the rebound and continuance of the uptrend.

Read the FULL article here: Technical Scoop: Tariffs Reason, Golden Rebound, Dollar Tumble

Disclaimer

David Chapman is not a registered advisory service and is not an exempt market dealer (EMD) nor a licensed financial advisor. He does not and cannot give individualised market advice. David Chapman has worked in the financial industry for over 40 years including large financial corporations, banks, and investment dealers. The information in this newsletter is intended only for informational and educational purposes. It should not be construed as an offer, a solicitation of an offer or sale of any security. Every effort is made to provide accurate and complete information. However, we cannot guarantee that there will be no errors. We make no claims, promises or guarantees about the accuracy, completeness, or adequacy of the contents of this commentary and expressly disclaim liability for errors and omissions in the contents of this commentary. David Chapman will always use his best efforts to ensure the accuracy and timeliness of all information. The reader assumes all risk when trading in securities and David Chapman advises consulting a licensed professional financial advisor or portfolio manager such as Enriched Investing Incorporated before proceeding with any trade or idea presented in this newsletter. David Chapman may own shares in companies mentioned in this newsletter. Before making an investment, prospective investors should review each security’s offering documents which summarize the objectives, fees, expenses and associated risks. David Chapman shares his ideas and opinions for informational and educational purposes only and expects the reader to perform due diligence before considering a position in any security. That includes consulting with your own licensed professional financial advisor such as Enriched Investing Incorporated. Performance is not guaranteed, values change frequently, and past performance may not be repeated.