Strengths

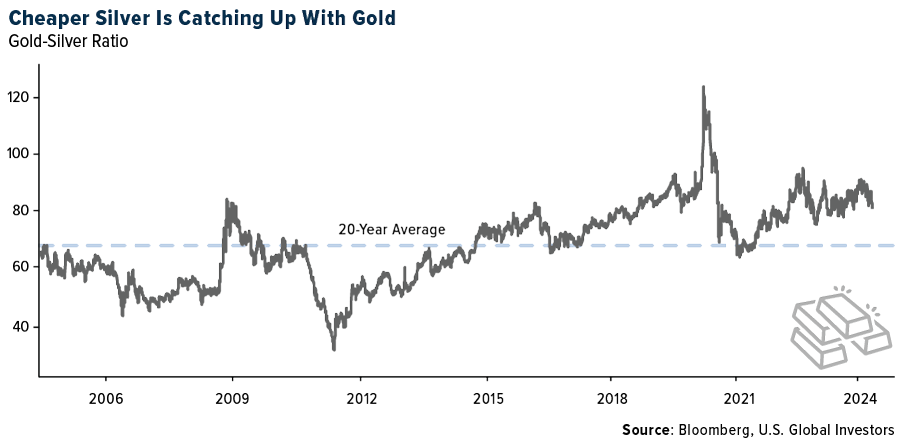

- The best performing precious metal for the past week was silver, up 11.29%, breaking through $30 per ounce for the first time in more than a decade with an increasingly supportive supply picture for prices with a projected fourth year of market deficit in production, reports Bloomberg. Gold’s record-setting rally may have captured the headlines this year, but it is silver that’s running harder and faster as the less glamorous metal benefits from robust financial and industrial demand. Silver has soared by almost 29% in 2024, outpacing gold and making it one of the year’s best-performing major commodities, Bloomberg explains. Yet in relative terms, silver is still cheap. It currently takes about 80 ounces of silver to buy 1 ounce of gold, compared with the 20-year average of 68.

- Johnson Matthey stated that the platinum market deficit will increase to 598,000 ounces this year following a shortfall of 518,000 ounces in 2023. This represents the biggest deficit in the last 10 years. The primary supply is projected to decline by 2% as shipments from Russia return to normal levels from last year's highs.

- Gold rose to the highest level in more than three weeks after the latest data showed ebbing inflation and weak retail sales, reinforcing expectations that the Federal Reserve will start cutting interest rates this year, writes Bloomberg.

Weaknesses

- The worst performing precious metal for the week was gold, but still up 1.90%. Gold slipped from a three-week high, says Bloomberg, as traders weighed a potential slowdown in the U.S. economy against persistent inflationary pressures that may hamper plans by the Federal Reserve to lower borrowing costs this year.

- South Africa's gold production fell 4.5% y-ear-over-year in March versus revised -5% in February, according to Statistics South Africa. Mining production fell 5.8% year-over-year, according to Bloomberg.

- The volume of rough diamond imports in April fell by 15% year-over-year and 10% month-over-month, while their value declined by 18% year-over-year and 15% month-over-month. Run-rates are now back at their five-year average range, indicating a normalization of imports, according to Morgan Stanley.

Opportunities

- Gold equities' performance has deviated from the underlying commodity due to various factors. However, Morgan Stanley expects this trend to reverse as headwinds fade and consensus expectations reset. Moreover, history points to gold equities typically outperforming gold following the initial Fed rate cut.

- The platinum market will remain in a deficit this year as a slowdown in the electric-vehicle boom supports demand for auto catalysts, according to the World Platinum Investment Council. Demand for the metal in the pollution-control devices climbed to the highest since 2017 in the first quarter and is expected to rise about 2% for the whole year, the WPIC said in a report on Monday.

- Anglo American Plc will exit diamond, platinum and coal mining in a massive restructuring designed to fend off a £34 billion ($43 billion) bid from rival BHP Group and turn itself into a copper giant. Anglo’s hand was forced by BHP’s approach — which it has twice rejected — but the move also responds to pressure from shareholders to shed less profitable businesses, reports Bloomberg.

Threats

- The diamond industry has already been feeling the heat. Prices have slumped, Russian sanctions are threatening trade, and the emergence of lab-grown gems is eating into some key traditional markets. Now, the sector’s most dominant name is being cast adrift, writes Bloomberg. Anglo American Plc on Tuesday said it will spin off or sell its De Beers business, ending an almost century-long relationship with the industry’s most famous name.

- The month-over-month import and export values of lab-grown diamonds have both declined, falling close to historical lows. This trend may reflect a weak pricing environment in the lab-grown market and/or a slowdown in demand, according to Morgan Stanley.

- Precious metals refiner Heraeus notes that, “Logically, a second year of (platinum) market deficits could indicate the possibility of a rising price environment. However, during the pandemic period alone, the platinum market built up in excess of 2 million ounces of additional stock that demand did not absorb. Therefore, the market is likely to require several years of fundamental market shortfalls before we see a meaningful impetus for higher prices”.