Timeline:

-

October 29th Bloomberg reports that Janet Yellen said, “Fraud is Huge, Growing Problem in Banking System”

-

October 30th, Silver Academy features how problematic such a statement really is

-

and now it’s October 31 ( here’s your October Surprise. In fact, A special Halloween version. ) Janet Yellen is signaling that banks are unsafe but has a remedy.

-

Let’s guess what the US Treasury and Federal Reserve have as their remedy.

Janet Yellen's recent comments blaming banks for fraud raised my eyebrows as I reported here yesterday

Yellen's Alarming Admission: She Says "Fraud Threatens Banking Stability"

You all know I’m a critic of the US Dept of Treasury and the US Federal Reserve (who work together to manage the Debt for War Machine, aka Kleptocracy)

The Treasury Secretary's focus on banking fraud comes at a time when we argue that the real culprits behind the current economic instability are the Fed's own policies, including quantitative easing, near-zero interest rates, and the elimination of reserve requirements

These policies have left banks in a precarious position, with analysts suggesting they are 7.5 times more vulnerable than during the 2008 Global Financial Crisis.

Yellen's deflection of responsibility onto banks could be said another way.

Yellen is signaling, “Hey American People, don’t trust your community banks, instead trust FedNow or our new Digital Token or our new Central Bank Digital Currency instead of your banker who I just told you are involved in Fraud”

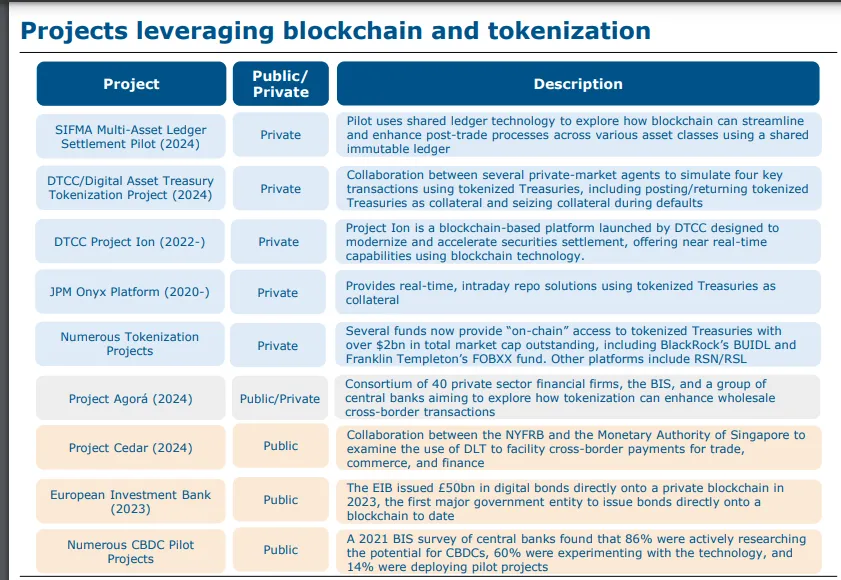

Before the ink was dry from the Government Printing Press (their website) THE U.S. TREASURY PUBLISHES A 17-PAGE BOMBSHELL REPORT ON DIGITAL ASSETS AND TOKENIZATION

source: https://home.treasury.gov/system/files/221/CombinedChargesforArchivesQ4…

screenshots below from their just published pdf

https://home.treasury.gov/system/files/221/CombinedChargesforArchivesQ4…

Look at the US Department of Treasury Selling the concept of tokenizing

Is there anything more frightening?

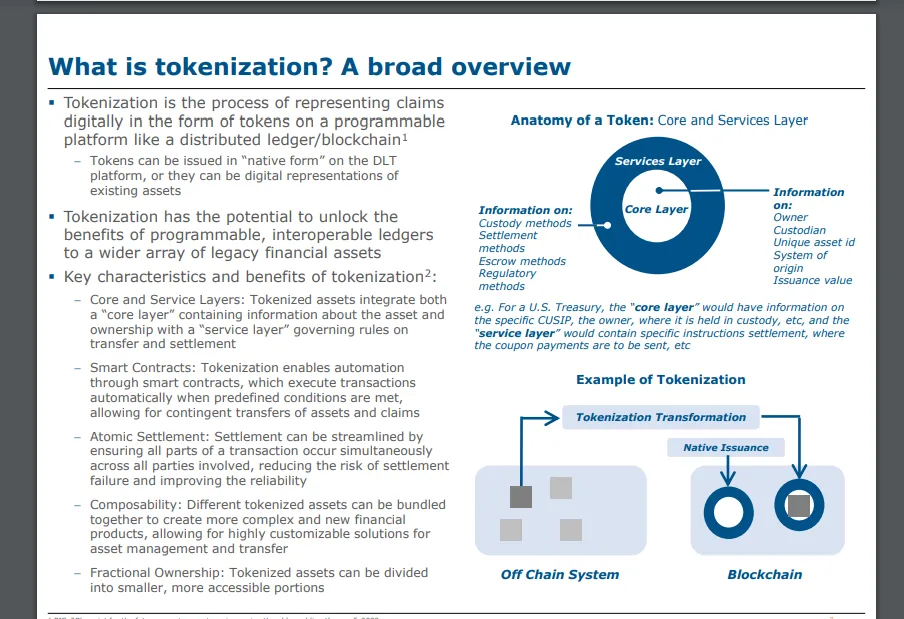

Nothing can be more complicated and fraught with peril than the pending Central Bank Digital Currency

the "Reid Technique" or "Reid Method" of interrogation, which was developed by John E. Reid in the 1940s and 1950s. This technique suggests that innocent people tend to provide straightforward, concise answers, while guilty individuals often offer more complex, detailed explanations.

The idea is rooted in the belief that deceptive individuals may try to fill in gaps or provide excessive details to make their stories more believable. Conversely, innocent people are thought to be more direct and less likely to embellish their accounts

In this metaphor the criminal is The Fed;

and the innocent ones are gold and silver

Gold and silver coins and bars in standard weights (1 oz, 10 oz, 100 oz) are straightforward physical assets. Their value is directly tied to the metal's purity and weight.

In contrast, cryptocurrencies involve complex concepts like tokenization, blockchain technology, digital wallets, hash rates, smart contracts, gas fees, consensus mechanisms, and forks. These require a deeper understanding of technical terms and processes, making the crypto world significantly more intricate than traditional precious metal investments.

this pdf is over 100 pages, wait til you see how jacked up this thing gets, Guess now we all have to learn what core and service layers are?

Conclusion

I used to play recreational golf and in money matches over spirited weekends in Albuquerque New Mexico. My favorite go to golf partner was a gentleman named Wayne Hand (who was also my supervisor at the Brickyard.)

Wayne and I were a good team. We were both single-digit handicaps, but there were times when we were outgunned (quite often). In such cases when we knew we were going to lose the hole or match Wayne would turn to me and say “We’re f*cked like tied-up goats” meaning we were about to get destroyed. He would also sometimes say “We’re doomed as doomed can be”

this post is dedicated to my old best friend Mr. Wayne Hand who passed away recently of pancreatic cancer (I guarantee there was a cure out there but the Health Industrial Complex just couldn’t be humane about such things)

Our opinions are not our sponsors' opinions.

The views expressed on TheSilverIndustry.substack.com are not necessarily those of the Silver Academy.

Not financial advice