If you’re a student of financial market history, consider yourself lucky to be living through what we’re seeing in the gold and silver markets right now. As even beyond the recent price moves, there are truly historic events taking place, which we will dig into in the column.

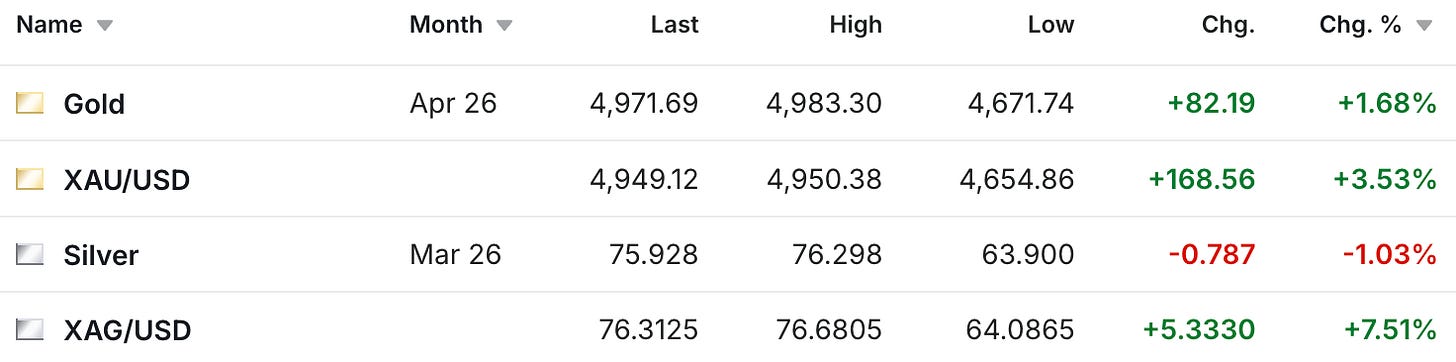

Here’s the current pricing, which has the gold futures at $4,972 and the silver futures at $75.93.

However, these prices are quite a bit higher than last night, and you can see in the next chart how the silver futures went as low as $63.90.

That’s after rebounding to a $91.75 high on Wednesday of this week, following last week’s crash from the new all-time silver futures high of $121.78, down to a low of $71.20 this past Monday.

So to recap, the silver futures hit an all-time high of $121.76, then sank to $71.20 by the following Monday, and then rebounded to $91.76 by Wednesday, before falling to $63.90 this past Thursday night, and then coming back to the current $75.93 level.

Geez….

Like you’ve heard me mention many times over the past year, there’s a high probability of continued volatility like that in the weeks and months ahead. I can certainly understand how unnerving that can be at times, and if you find yourself really having trouble sleeping at night, that’s often a good sign that finding a time to make sure that your position sizing is truly appropriate for the other variables in your life might be worthwhile.

But we’re seeing massive swings, and what’s really fascinating are some of the developments that are happening in the background.

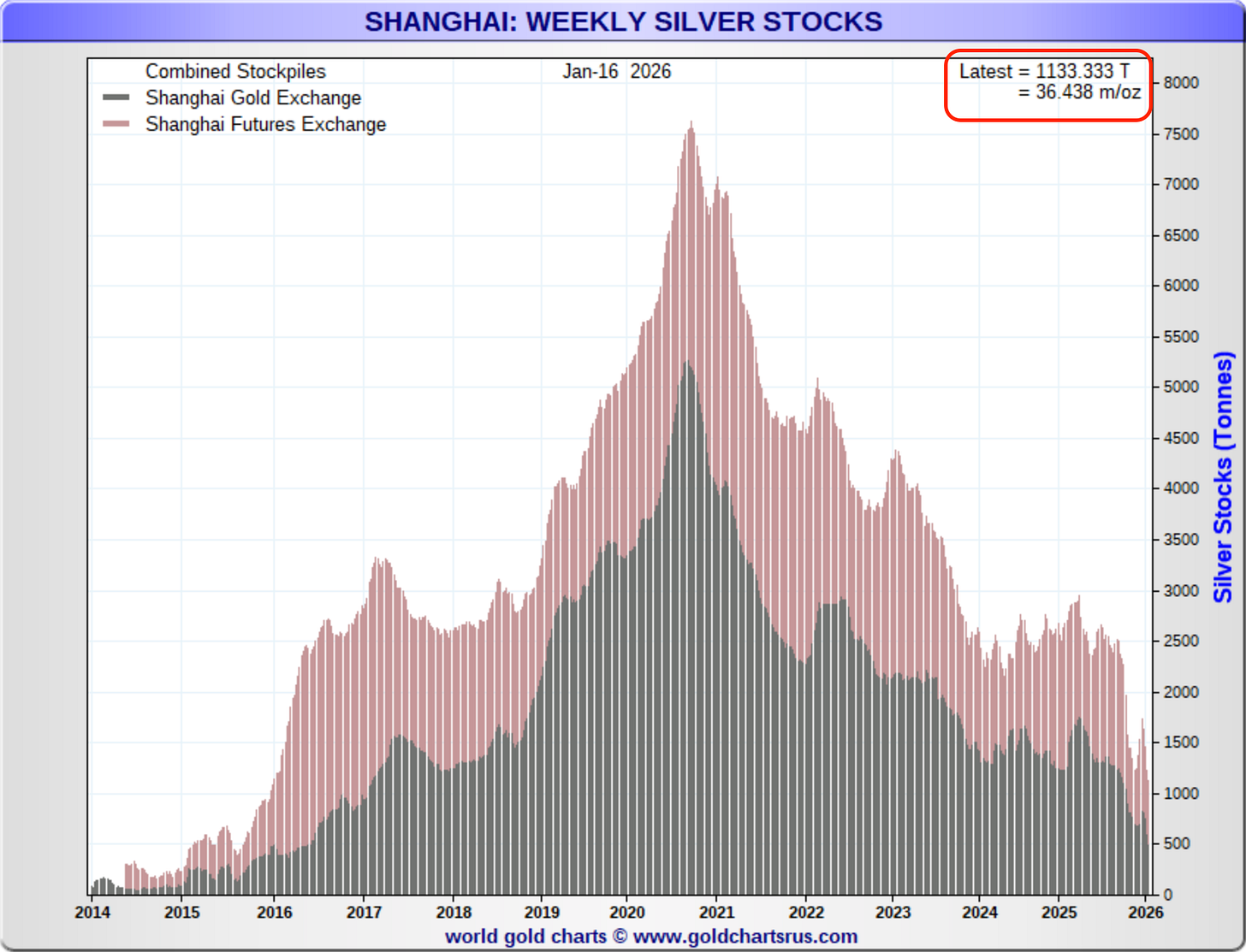

First of which is that not only are we continuing to see silver leave the Comex, but the Chinese inventories are getting dangerously low, in a market that’s already been experiencing supply shortages for months, which has led to increased premiums in the market underpinning the industrial silver center in China.

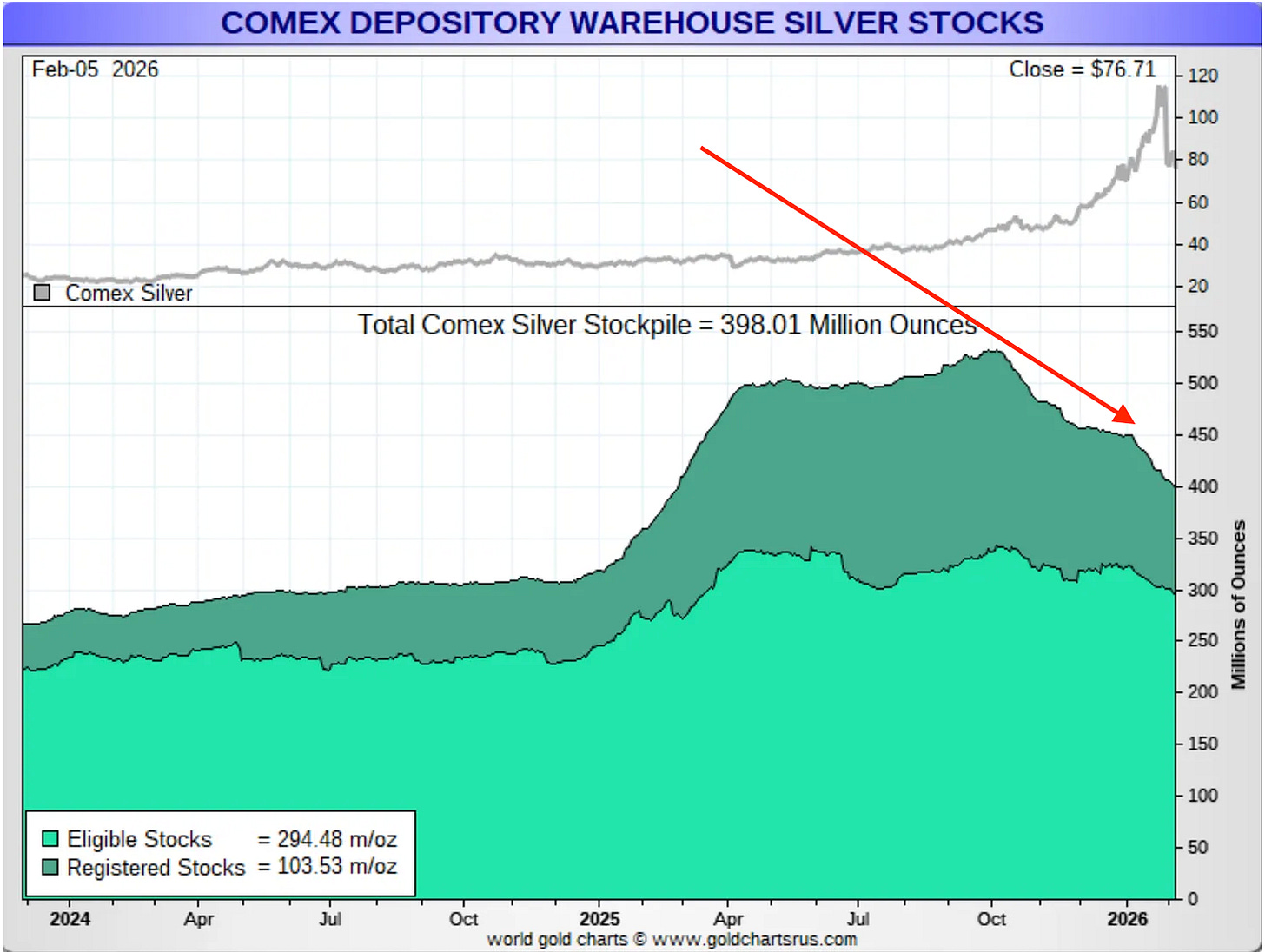

Here’s the chart of the Comex silver inventories, where you can see that metal has been leaving ever since London experienced their shortage back in October.

In the chart above, you can also see that the pace of withdrawals has accelerated at the start of this year, as we’ve seen about 50 million ounces leave since the beginning of January, bringing the COMEX to a total of 398 million ounces, after reaching a peak of 531.8 million on October 2nd.

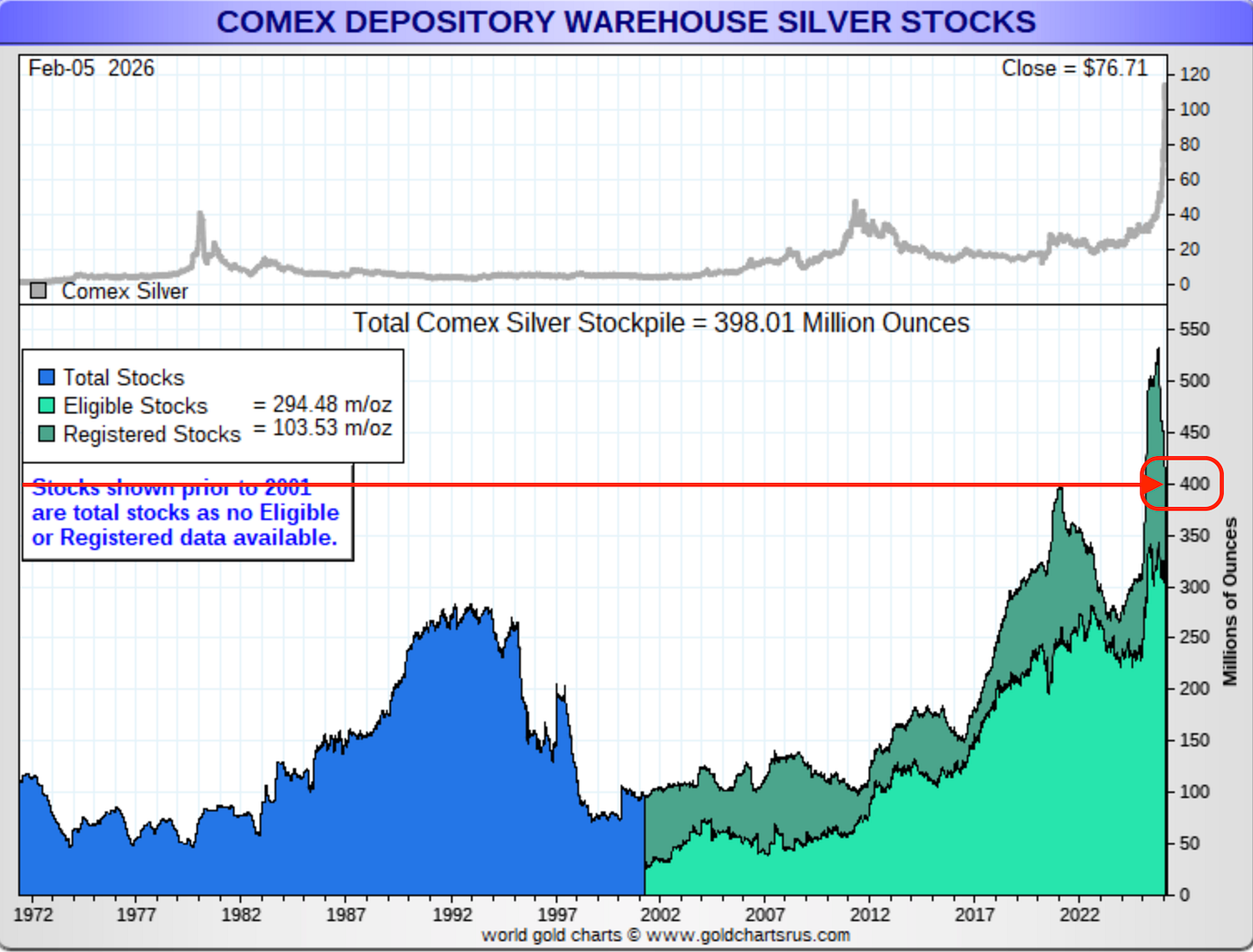

On one hand, I hesitate to call it a run on the Comex yet, because aside from the metal that came from London over to New York last year, as the markets awaited clarity on the tariff policy, we would otherwise still be at an all-time high for the history of the Comex stockpiles.

Yet in the context of the current market dislocations and silver inventory flows, it’s also not insignificant.

That’s a pretty large decline we’ve seen since October, and especially with both London and India experiencing shortages in October, that led to metal beginning to leave the Comex (that was also addressed by silver leaving China to go to London, which led to China’s own supply concerns), we’re certainly in a very different environment than even what was going on at the peak of the silver squeeze in February 2021.

On one hand, 103 million ounces in registered is historically on the high side. On the other hand, I’ve described the evidence of extreme tightness in the industrial silver market in China over the past two months, so we’re in a little bit of uncharted territory here.

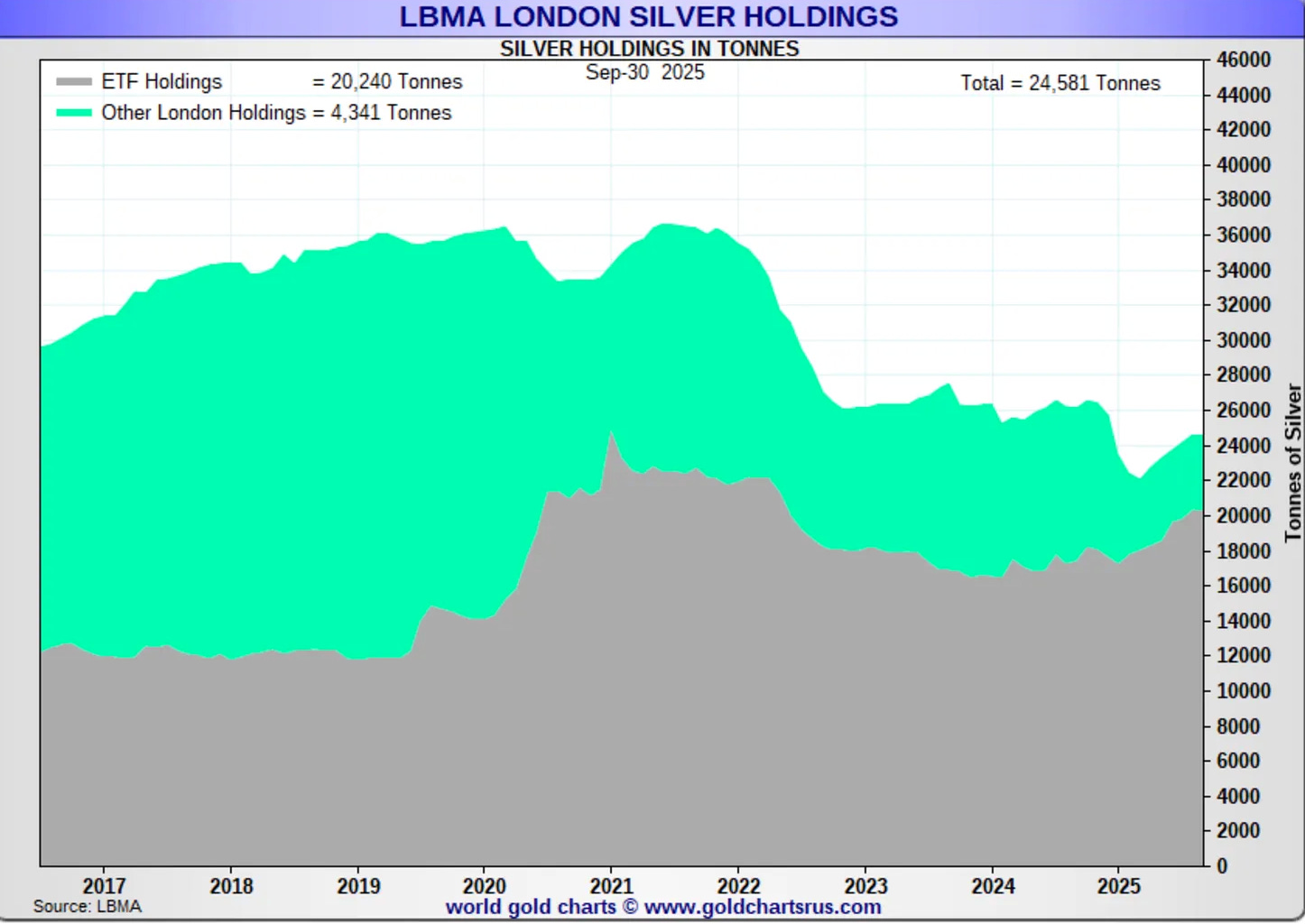

Then, add on that the Shanghai inventories only held 36 million ounces to back the industrial silver market as of January 16, and just for context, consider that the LBMA broke down when its free float got down to 153 million ounces.

But after more withdrawals during yesterday’s price crash, the combined Chinese inventories are now down to just 27.1 million ounces.

So if the London market had a crisis when their free float got down to 153 million ounces, at what point should one get concerned about a Chinese market, that still has a $10 premium to New York (both China and India were trading at $86 while New York was trading at $76), while it was known to be having supply issues as far back as November 10?

I also see a lot of speculation about whether the Comex will commit force majeure on the March silver contract based on how the current open interest is well in excess of what’s in the Comex registered category, even if the Comex stockpiles are still at an elevated level. And while that part is true, remember that for the past 46 years, the majority of those contracts got rolled over.

Now, if you wanted to make the argument that if we’ve ever been in an environment where there could be an issue with a delivery, I’d certainly agree that we’re in the middle of it. Although, just be careful with what you’re reading, because I see a lot of people suggesting a force majeure is on the way due to the open interest, but leave out that other part, which is equally important.

Yet further adding to the pressure in the silver market is that the lease rates have surged again.

I mentioned yesterday how a Chinese investor, whom my colleague Vince Lanci wrote about last year when he described him as the Shanghai Silver Hunt brother while he was establishing a large long position, has recently established a large short position.

‘A reclusive Chinese commodities trader who made billions from gold futures has built the largest net short position in silver on the Shanghai Futures Exchange, highlighting diverging investor views on precious metals amid heightened volatility and speculative positioning.’

Then add in that there was additional selling pressure created by the leverage in the AGQ 2x ProShares Ultra Silver ETF, and you can see how there’s a lot of trading activity going on right now, that doesn’t necessarily have anything to do with silver’s true fair value.

As silver saw the biggest intraday fall on record, AGQ had to mechanically reduce futures exposure as part of its daily leverage reset, unleashing a wave of selling into an already crowded market. AGQ, which targets daily investment returns of twice the move in silver futures, must rebalance based on net asset values at 1:25 p.m. Eastern time, according to a prospectus on its website.

I think we’re in one of those environments where anyone who gives a guarantee on a short-term forecast is asking for trouble. There are a lot of variables at play that aren’t 0% or 100% chances, and depending on how they go, that will determine your silver price.

Also, remember that in 2008, as Lehman Brothers was failing and the financial world was melting down, silver went from $21 to $9 while there was a physical shortage, before then making it up to $49 in 2011. Then, in 2020, when COVID was breaking out, silver actually fell below $12, but a few months later, it came within a dollar of the $30 level.

So there’s supply and demand and cost of production and all that, but then there are periods where the price swings $60 in a week, and we remember that the two can get divorced at times. Yet I keep going back to the question of where I think these markets will be in five or ten years, and starting there also has the added advantage of making the more near-term decisions a lot easier.

Lastly, Treasury Secretary Scott Bessent recently mentioned that the Trump administration had been conducting financial warfare on Iran for months, before a currency collapse led to protests, and now it appears as if a new regime change is checking off another box from the 1998 PNAC plan that required a Pearl Harbor-like event, that then was delivered on September 11th, 2001.

David Stockman, who has an extensive Washington background, had a different description for Bessent’s comments.

But that’s probably about enough for this past week.

Although, in case you’re looking for something that provides an overview of where things are at in the silver market right now, I did record this conversation with Jason Burack of Wall Street for Main Street this past Wednesday night, a day before the second silver sell-off.

There are going to be ups and downs in any market, and keeping the bigger picture in mind will help a lot throughout that journey. So with that said, go out, relax, and enjoy your weekend, and I’ll look forward to seeing you back here next week.

Sincerely,

Chris Marcus