Many precious metals investors have heard about silver manipulation or suspected it, but few fully understand how it works or can clearly explain it. Many also intuitively sense that silver’s price is artificially low and should be much higher but struggle to identify what—or who—is keeping it suppressed. I have committed myself to studying silver price manipulation, documenting the evidence, educating others, and exposing these practices to bring them to an end and ensure justice is served. In this article, I will explain in clear and accessible terms how silver’s price is systematically manipulated and suppressed.

Simply put, the goal of silver price manipulation is to keep silver’s price artificially low as well as prevent it from breaking above key technical levels that could trigger a full-blown bull market. According to consensus within the precious metals community, the primary culprits behind silver price manipulation are the bullion banks—the most influential players in the precious metals market. These include major financial institutions such as JPMorgan Chase, UBS, HSBC, and Goldman Sachs, several of which have been found guilty of manipulating precious metals markets—particularly gold and silver.

Bullion banks are typically members of the London Bullion Market Association (LBMA), the leading authority overseeing the global over-the-counter (OTC) precious metals market. As LBMA members, these banks play a central role in the market by acting as market makers, facilitating large trades, managing vaulting and storage, and participating in price-setting mechanisms such as the daily London Gold and Silver Fix. This dominant position allows them to exert significant influence over silver prices, making manipulation not just possible, but systemic.

The most common, obvious, and widespread form of silver manipulation is price slams—also known as "tamps"—which almost exclusively take place during the New York COMEX trading session between 8:30 and 11 AM EST. As I’ll explain in greater detail shortly, these slams occur on a high percentage of mornings, but they become even more frequent and aggressive when silver is attempting to break above a key technical or psychological level.

When silver approaches a breakout point that could trigger a snowball effect of additional buying, bullion banks step in to drop the hammer, forcefully slamming the price back down below that level. This calculated suppression is designed to demoralize existing silver investors, discourage new participants, and ensure that silver’s price languishes, preventing momentum from building in its favor.

Silver’s price action over the past year serves as a textbook example of how silver tamping works. As the chart below illustrates, silver has repeatedly attempted to break above the $32–$33 resistance zone, only to be slammed back down each time—except for the current breakout attempt (the outcome of which remains uncertain).

Notably, these persistent price slams have kept silver stagnant, even as gold has surged by approximately $1,000 per ounce to $3,000—a powerful 50% bull market rally that, under normal conditions, would have pulled silver higher due to their historically strong price relationship. However, bullion banks have gone to extraordinary lengths to prevent silver from following its sibling, gold.

To see what one of these slams or tamps looks like on an intraday chart, let’s examine a particularly egregious example from Friday morning, February 14th. While the daily chart above provides a broader view of the price action, the intraday chart below captures exactly how it unfolded that morning. Bullion banks rely on the assumption that most people won’t scrutinize their tactics too closely—but that’s exactly what we’re going to do here.

Some of the most aggressive slams tend to occur on Friday mornings during the U.S. trading session. With the Asian and European markets closed, trading volume and liquidity are significantly lower, creating the perfect conditions for bullion banks to manipulate silver’s price with minimal resistance. This lack of market depth allows them to maximize their impact, giving them more “bang for their buck” when executing price suppression tactics.

As you can see from the 5-minute intraday chart, silver staged a powerful breakout, surging $1 per ounce (3%) during the Asian and European trading sessions. This rally pushed silver above the key $33 resistance level, which had acted as a ceiling for much of the past year, sparking excitement within the precious metals community as many believed silver was finally taking off.

However, around 9 AM New York time, as the U.S. trading session got underway, a massive flood of "paper" silver—in the form of futures contracts—was suddenly dumped onto the market. This deliberate maneuver drove silver back below the critical $33 level, halting the breakout in its tracks and demoralizing silver investors once again.

Note that the silver dumped onto the market was "paper" silver—futures contracts largely unbacked by physical metal. This is the primary way bullion banks artificially suppress silver’s price, keeping it well below where it should be based on true supply and demand for physical silver. What’s both infuriating and disheartening is that this manipulative pattern has persisted almost daily for decades, consistently driving prices downward—never upward.

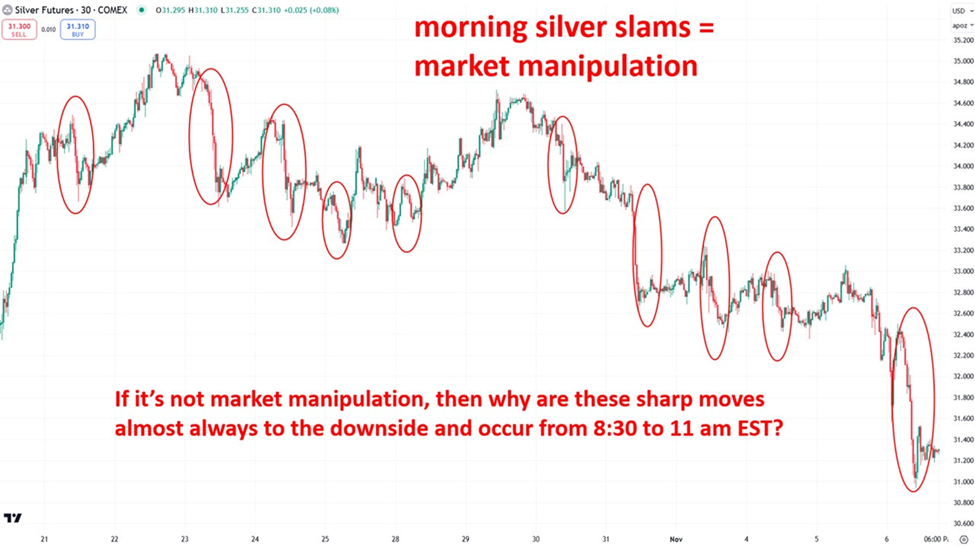

The chart below shows another egregious example of the manipulation slam pattern, captured on the intraday silver futures chart from late October to early November. During this period, silver made a strong breakout attempt, reaching as high as $35 per ounce, only to be aggressively slammed lower nearly every morning between 8:30 AM and 11:00 AM EST. The heavy selling pressure during the U.S. trading session repeatedly drove silver’s price back down, putting the kibosh on the widely watched late October breakout attempt.

These manipulation slams almost exclusively occur in the morning and rarely at any other time of the trading day. To me, these are unmistakable fingerprints of bullion banks deliberately suppressing silver’s price. This is anything but an organic or natural market.

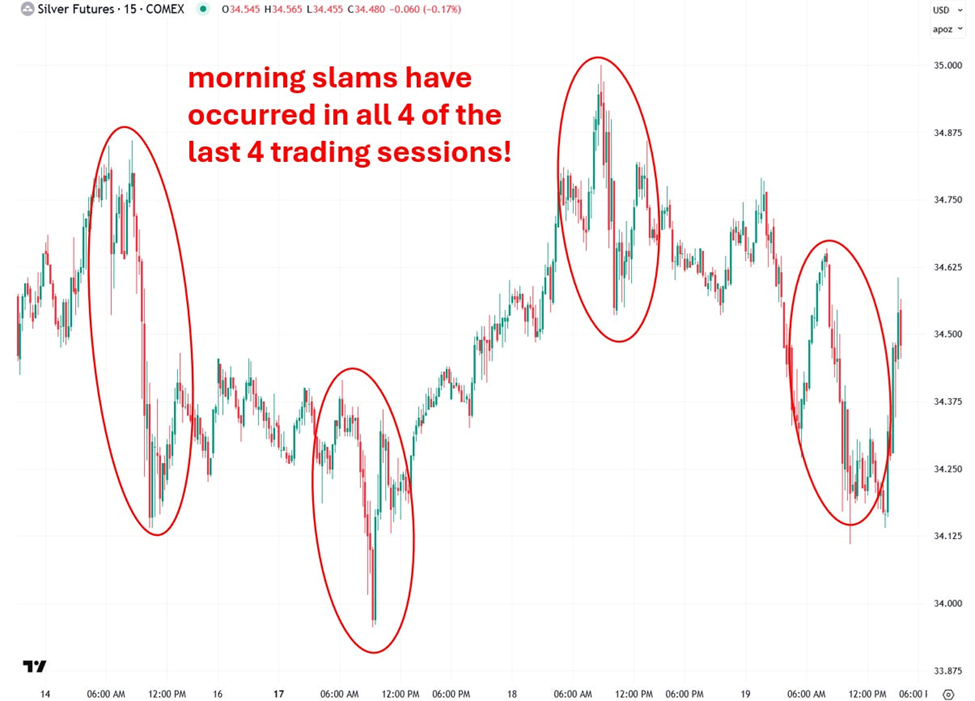

And sure enough, at the time of writing on March 19, 2025, silver has been slammed in all four of the last four trading sessions, proving that this manipulation pattern remains alive and well:

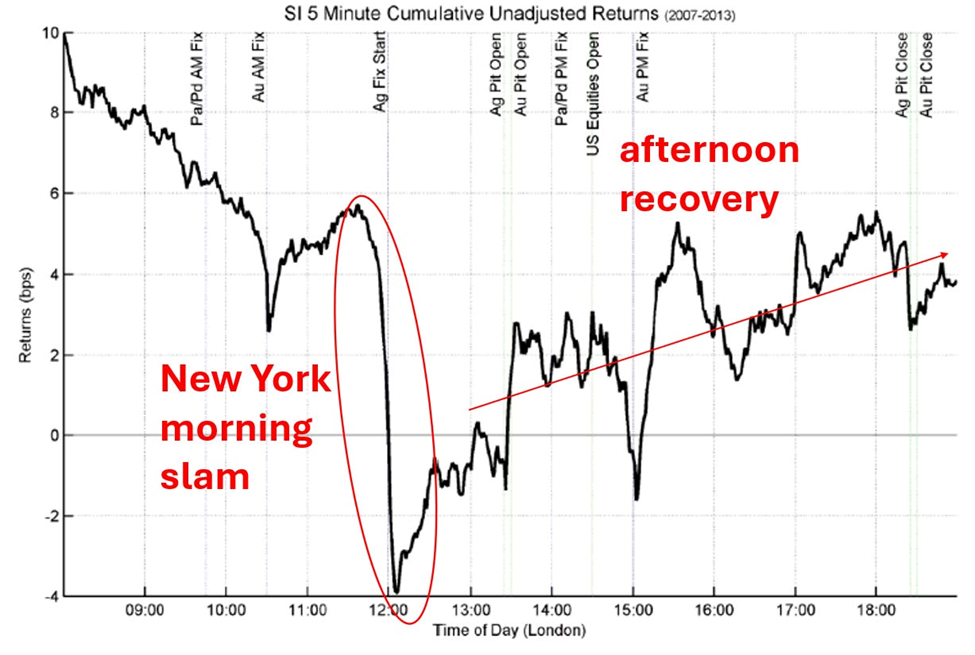

Interestingly, Gold Charts R Us—a leading provider of precious metals data—analyzed and averaged every silver futures trading session from 2007 to 2013. Their findings revealed a clear and consistent pattern: sharp price slams during the New York morning session, followed by recoveries in the afternoon and overnight as the Asian and European markets open. This exact pattern is clearly visible in the chart, and unfortunately, the same phenomenon continues in 2025.

Gold Charts R Us also provided statistical evidence through another model, demonstrating that for literally decades, silver has been consistently slammed during the New York morning trading sessions, only to recover later in the European and Asian sessions.

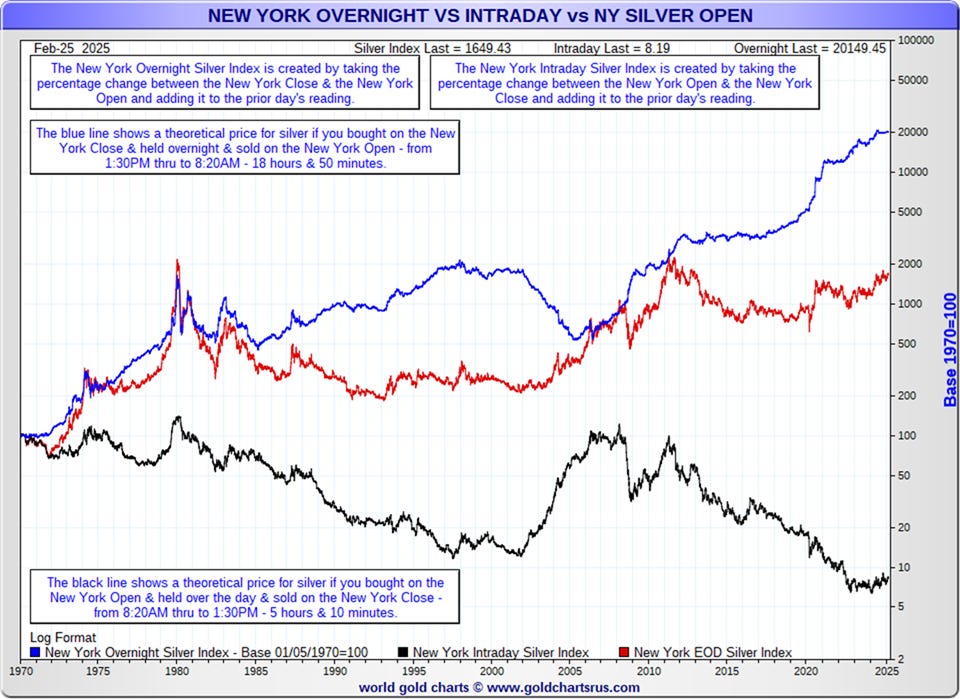

The black line on this chart represents the New York Intraday Silver Index, which tracks the theoretical price of silver if one were to buy at the New York open, hold throughout the trading day, and sell at the New York close. This index further illustrates how silver’s price is regularly pressured downward during U.S. market hours before rebounding in overseas sessions. Starting from a base of 100 in 1970, this index has been relentlessly eroded, plunging to just 8.19 by February 2025—a staggering decline of nearly 92%.

In stark contrast, the New York Overnight Silver Index, represented by the blue line on the chart, tracks the theoretical price of silver if one were to buy at the New York close in the afternoon and sell at the New York open the following morning. Starting from a base of 100 in 1970, this index has skyrocketed to over 20,000 by February 2025—an astonishing gain of 19,900%.

In stark contrast, the New York Overnight Silver Index, represented by the blue line on the chart, tracks the theoretical price of silver if one were to buy at the New York close in the afternoon and sell at the New York open the following morning. Starting from a base of 100 in 1970, this index has skyrocketed to over 20,000 by February 2025—an astonishing gain of 19,900%.

Gold Charts R Us also included the standard price of silver, represented by the red line on the chart, as a baseline for comparison. Since 1970, it has risen a little more than 16-fold, significantly outperforming the New York Intraday Silver Index but falling far short of the explosive gains seen in the New York Overnight Silver Index.

This is clear evidence that normal market forces are not at play. Instead, it points to blatant downward manipulation. Unfortunately, this suppression discourages both existing silver investors and potential newcomers, which is precisely the intended goal. By keeping silver artificially low, the manipulators aim to undermine assets that compete with the U.S. dollar, which itself is no longer backed by anything.

Silver slams, or tamps, have become so normalized and expected that the precious metals community even jokes about a mythical figure known as Mr. Slammy—a fictional character who appears each morning to manipulate the price of gold and silver by slamming them down.

Adding to the humor, there is even a parody account on X impersonating Mr. Slammy, playfully teasing and tormenting precious metals investors whenever gold and silver surge higher. When the metals inevitably get slammed back down, the account takes mock victory laps, celebrating the suppression.

The origin of the term “tamp” or “tamping down” in reference to intentionally slamming silver prices traces back to a statement made in 2021 by Rostin Behnam, who was then chairman of the Commodity Futures Trading Commission (CFTC). Behnam essentially admitted that silver was deliberately slammed by 10% on February 2, 2021, and, in an approving tone, stated that silver futures were able to “tamp down what could have been a much worse situation.”

That “situation” referred to growing fears of a silver shortage and a potential squeeze, which was on the verge of sending prices significantly higher. Instead of preventing market manipulation, as the CFTC is supposed to do, it essentially acknowledged it and gave it tacit approval—which is infuriating. This clearly shows that the agency is protecting the big banks rather than looking out for everyday investors and traders.

Another method bullion banks use to suppress silver prices, aside from flooding the market with massive quantities of paper silver almost daily, is spoofing. This tactic involves placing large sell orders on the futures limit order book to create an artificial price ceiling, reinforcing resistance at key levels.

This form of manipulation isn't just theoretical. In 2023, two former JP Morgan precious metals traders, Michael Nowak and Gregg Smith, were convicted of price manipulation and spoofing as part of a broader market-rigging scheme, resulting in fines and prison sentences. Yet, despite these convictions, similar tactics continue to be used in one form or another.

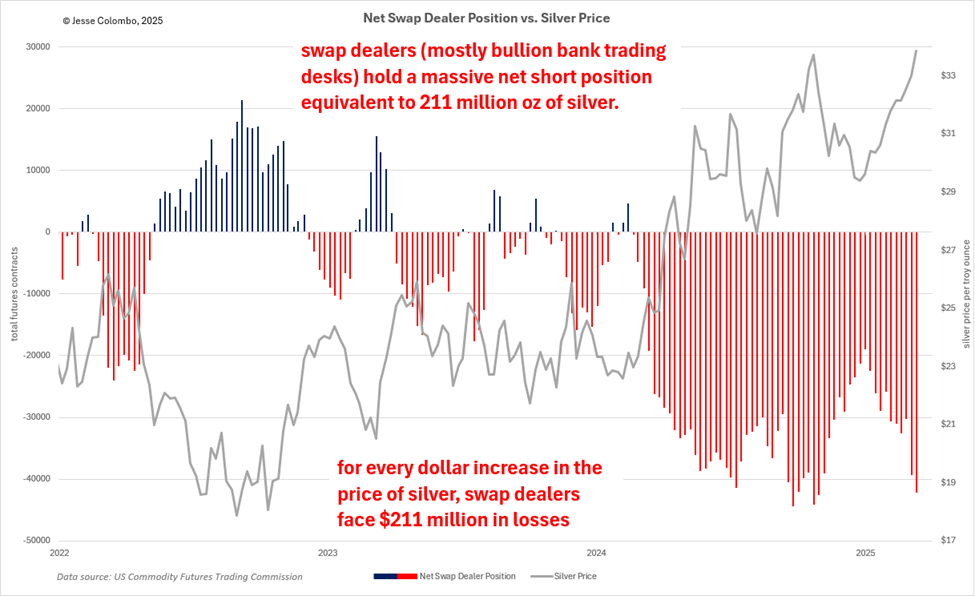

As I’ve been explaining, one of the key factors keeping silver’s price suppressed over the past year has been the heavy short selling of COMEX silver futures by swap dealers—primarily the trading desks of bullion banks such as JP Morgan and UBS. In the process, these entities amassed a massive net short position of 42,116 futures contracts, equivalent to 211 million ounces of silver—or roughly a quarter of the world’s annual silver production. This staggering figure underscores the immense downward pressure being exerted on the silver market.

What’s even more astonishing is how much of this massive short position in silver futures is naked, meaning it isn’t backed by physical silver. Instead, it consists largely of “paper” silver being dumped onto the market to artificially suppress prices. However, once silver finally breaks out, it is likely trigger a wave of short covering, where the banks that bet against silver through naked short selling are forced to buy it back as prices rise to limit their losses.As the price climbs, these banks will become increasingly desperate to close their positions, further fueling the rally.

If the buying pressure is strong enough, it could even lead to a short squeeze, dramatically amplifying silver’s upward momentum. Given the sheer size of their short position, bullion banks stand to lose approximately $211 million for every $1 increase in silver’s price—a setup for a major price surge. Now, imagine what happens if silver climbs by $5, $10, $20, or more from this point.

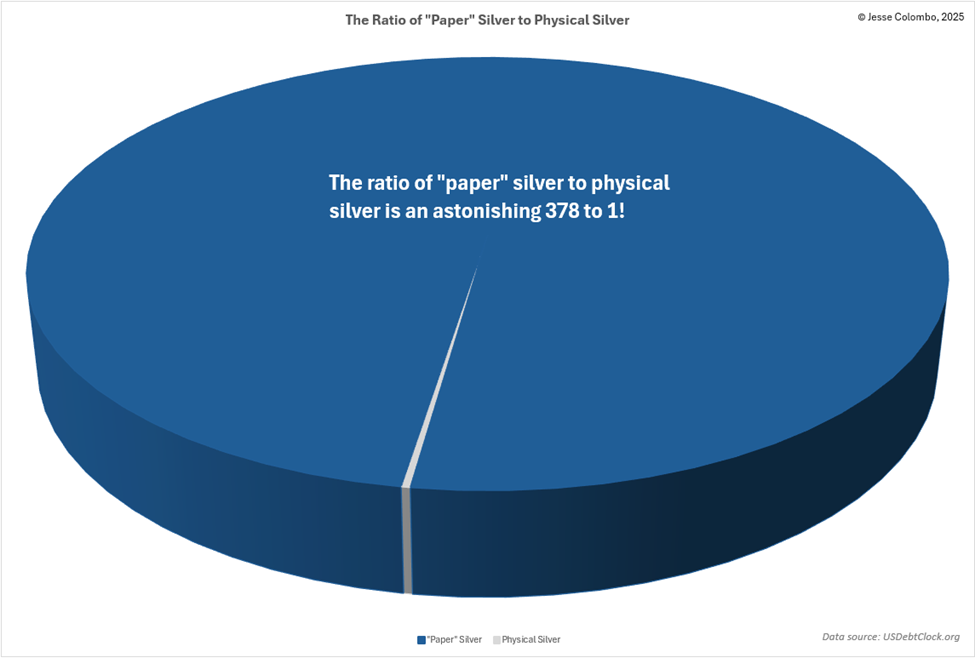

The risk of an explosive silver short squeeze is further amplified by the astonishing ratio of 378 ounces of paper silver—including ETFs, futures, and other derivatives—for every single ounce of physical silver. This extreme imbalance highlights just how overleveraged the paper silver market has become.

In a violent short squeeze, holders of paper silver could be forced to scramble for the extremely scarce physical silver to fulfill their contractual obligations. This would likely cause the price of paper silver products to collapse, while physical silver prices could skyrocket to jaw-dropping levels, potentially reaching several hundred dollars per ounce.

What motivates bullion banks to suppress the price of silver? They do so on behalf of central banks, such as the Federal Reserve, which seek to maintain confidence in paper currencies like the U.S. dollar. A soaring silver price signals weakness in fiat money, raising doubts about its strength and stability. By keeping silver artificially low, bullion banks help preserve the illusion of a strong dollar.

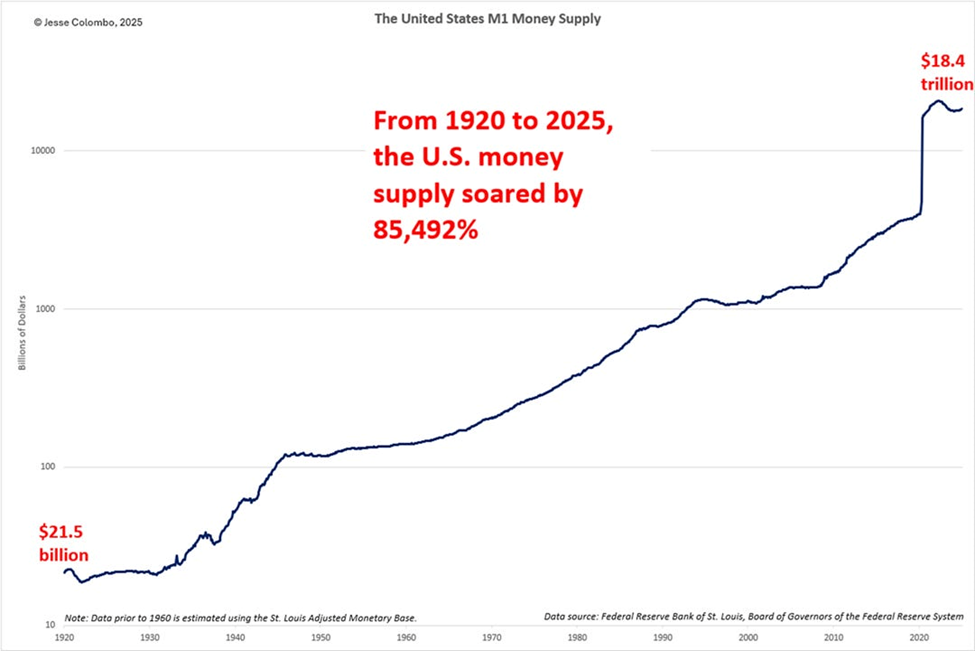

This motivation becomes clear when considering that the U.S. money supply has surged by over 85,000% since 1920, drastically eroding the dollar’s purchasing power. As the dollar declines, the cost of living continues to rise, making a normal middle-class lifestyle increasingly out of reach for most Americans. In contrast, while paper currencies around the world have steadily lost value, silver has retained its purchasing power, serving as a hedge against inflation and currency devaluation.

While the supply of dollars has surged and continues to expand, silver has consistently preserved its purchasing power. The compelling chart below illustrates how the purchasing power of $1,000 in silver ounces has changed over time. In 1960, $1,000 could buy 1,087 ounces of silver, but today, it purchases only 29.74 ounces—a staggering 97% decline in the dollar's purchasing power relative to silver. This means that the same amount of silver in 1960 could buy roughly the same quantity of goods and services then as it does today, whereas the dollar has lost significant value. That’s a powerful reason to consider storing wealth in physical silver.

Though silver is heavily manipulated and suppressed—possibly the most manipulated asset on the planet—I have strong hope that it will soon break free and thrive. I explained this in detail in a recent report, which I highly recommend reading for further insights, as I don’t have space to cover it fully in this already lengthy piece.

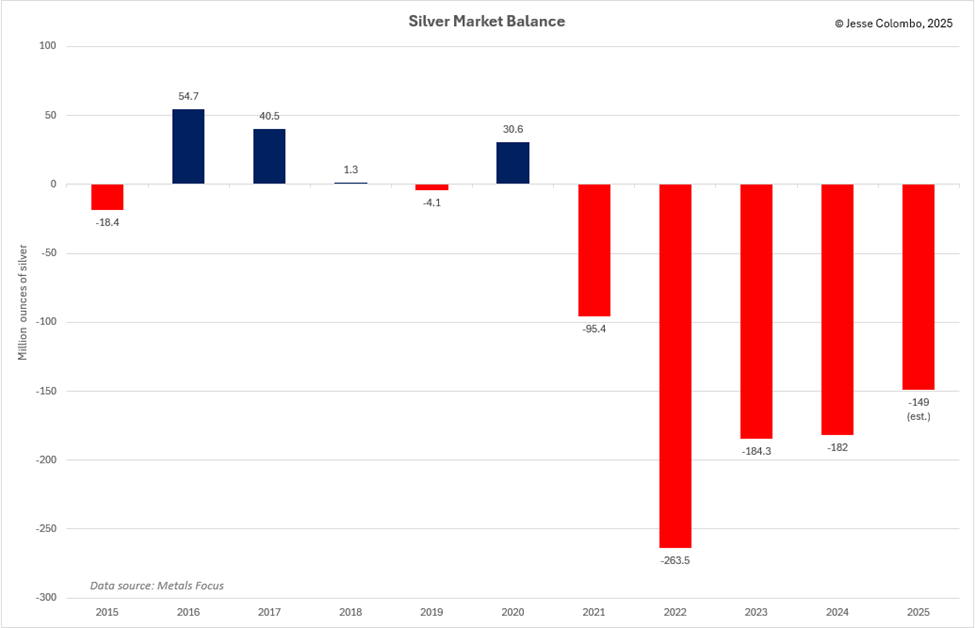

The key reasons for my optimism include the fact that silver has been in a supply deficit for the past five years, with demand consistently outpacing supply. Additionally, silver is extremely undervalued by nearly every measure. I see it as a beach ball being held underwater—it can’t stay suppressed much longer and is bound to pop back up with force.

Also, take a look at the chart below and notice how gold struggled from 2020 to early 2024 to break above the $2,000–$2,100 resistance zone, which acted as a price ceiling for much of that period. Despite multiple attempts, gold was repeatedly pushed back down. However, in March 2024, it finally broke out, igniting the powerful bull market we see today. I see striking parallels with silver’s $32–$33 resistance zone over the past year and believe that once silver manages to close above this level, it will soar just as gold did.

To summarize, silver is heavily manipulated and suppressed by bullion banks like JP Morgan and UBS, acting on behalf of central banks. The price of silver should be significantly higher than its current level. While this is infuriating from a moral standpoint, it also presents a once-in-a-lifetime opportunity for patient silver stackers to acquire the metal at artificially low prices before it breaks free from manipulation and soars—just as gold did one year ago.

At the same time, I am working tirelessly to understand, document, expose, and educate the broader public about silver price manipulation, with the goal of bringing it to an end and ensuring that justice is served. Please help me spread the word by sharing this report with anyone who may be interested.

If you're a silver fan, click here to sign up for my 10 oz Scottsdale Mint Silver Bar giveaway!